Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am doing the chapter 7 payroll project and it's asking me for the qtr taxable OASDI earning. can anyone help me de they are

I am doing the chapter 7 payroll project and it's asking me for the qtr taxable OASDI earning. can anyone help me

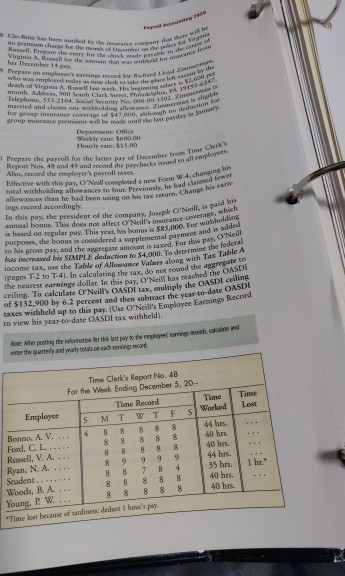

de they are check Panoor Anima A R ask . His begin month. A 1950 n South Chart Street, Philadelphi a Telephone, 5552104. Social Security N 000.00-1 married and claims with dir i mde We a paylay January no destino her from Time Clerk and to all emplom the paychecks Wamewo4.changis Prepare the payroll for the latter pay of December from w Report Nos. 48 and 49 and record the paychecks eek Alves, record the employee's payroll taxes Effective with this pay. O'Neill soral withholding allowances to four previously, he changis plesed a new added allowance than he had been using on his tax return ing record accordingly, In this pay, the president of the cama y las O'Neill. ch annual bonus. This does not affect O'Neill's insurans is based on regular pay. This verbis nusis 85,000. purposes, the bonus coidered a plemental paymena Neill to his gross pay, and the aggregateam is taxed. For federal has increased his SIMPLE deduction to $4,000. Ta determine Tes Table A come tax, use the Table of Allowance Valur along with Tas pages 2 to T.41. In calculating the tax do not own the washed the OASDI the nearest Gaming dollar. In this pay, O'Neill has reached the S Ceiling. To calculate O'Neill OASDI tax, multiply the OASI of $132.900 by 6.2 percent and then subtract the year-to-date on taxes withheld up to this pay. Use O'Neill's Employee Farnings Recoce to view his year-to-date QASDI tax withheld). e s se Wher posting the late for the pay to the employe to the rely and yet to ona ning or Time Time Clerk's Report No. AB For the Week Ending December 5, 20-- Time Record Employee S M T W T F S World Bonno, A V... 14 8 8 8 8 8 Ford, C.L ... Russell. V. A... 8 8 8 8 8 40 hes Ryan, N. A... 8 9 9 9 9 Student ...... 35 hrs. Woods, BA.. 40 hrs Young, P. W.... 8 8 8 8 8 40 hrs. "Time lost because of cardines deduct I hopay de they are check Panoor Anima A R ask . His begin month. A 1950 n South Chart Street, Philadelphi a Telephone, 5552104. Social Security N 000.00-1 married and claims with dir i mde We a paylay January no destino her from Time Clerk and to all emplom the paychecks Wamewo4.changis Prepare the payroll for the latter pay of December from w Report Nos. 48 and 49 and record the paychecks eek Alves, record the employee's payroll taxes Effective with this pay. O'Neill soral withholding allowances to four previously, he changis plesed a new added allowance than he had been using on his tax return ing record accordingly, In this pay, the president of the cama y las O'Neill. ch annual bonus. This does not affect O'Neill's insurans is based on regular pay. This verbis nusis 85,000. purposes, the bonus coidered a plemental paymena Neill to his gross pay, and the aggregateam is taxed. For federal has increased his SIMPLE deduction to $4,000. Ta determine Tes Table A come tax, use the Table of Allowance Valur along with Tas pages 2 to T.41. In calculating the tax do not own the washed the OASDI the nearest Gaming dollar. In this pay, O'Neill has reached the S Ceiling. To calculate O'Neill OASDI tax, multiply the OASI of $132.900 by 6.2 percent and then subtract the year-to-date on taxes withheld up to this pay. Use O'Neill's Employee Farnings Recoce to view his year-to-date QASDI tax withheld). e s se Wher posting the late for the pay to the employe to the rely and yet to ona ning or Time Time Clerk's Report No. AB For the Week Ending December 5, 20-- Time Record Employee S M T W T F S World Bonno, A V... 14 8 8 8 8 8 Ford, C.L ... Russell. V. A... 8 8 8 8 8 40 hes Ryan, N. A... 8 9 9 9 9 Student ...... 35 hrs. Woods, BA.. 40 hrs Young, P. W.... 8 8 8 8 8 40 hrs. "Time lost because of cardines deduct I hopay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started