Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am having an issue getting the correct answer on the Cash Budget and Income Statement. I have attached the directions for the question as

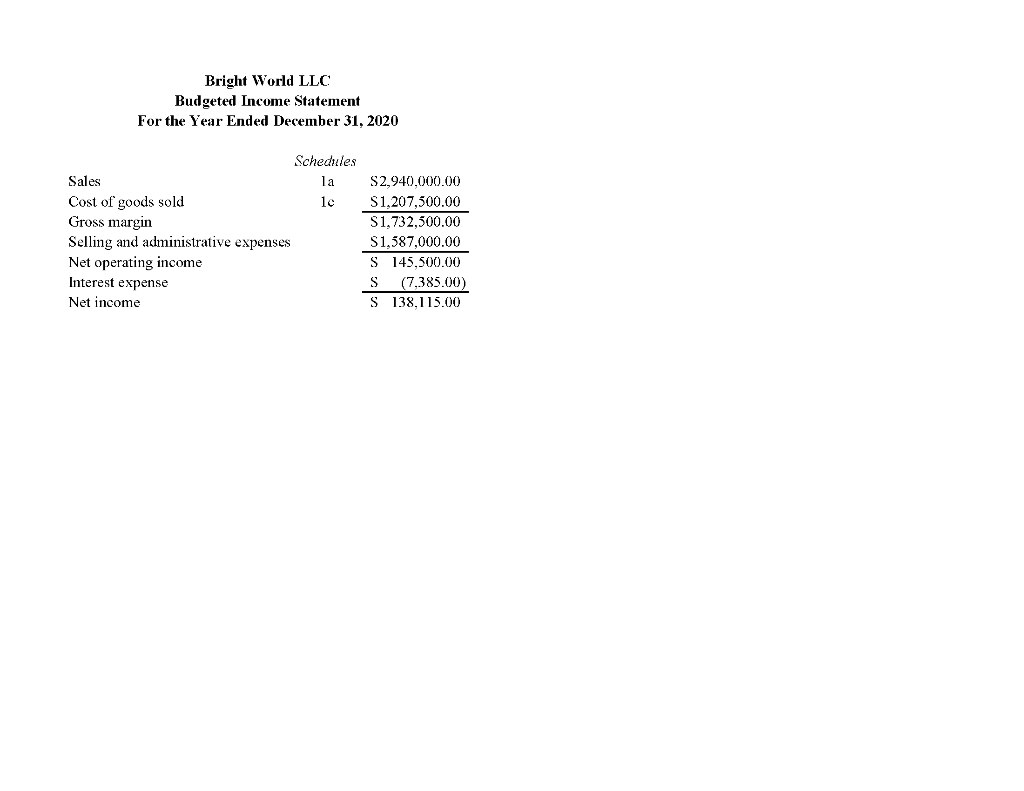

I am having an issue getting the correct answer on the Cash Budget and Income Statement. I have attached the directions for the question as well as what I got for the answers.

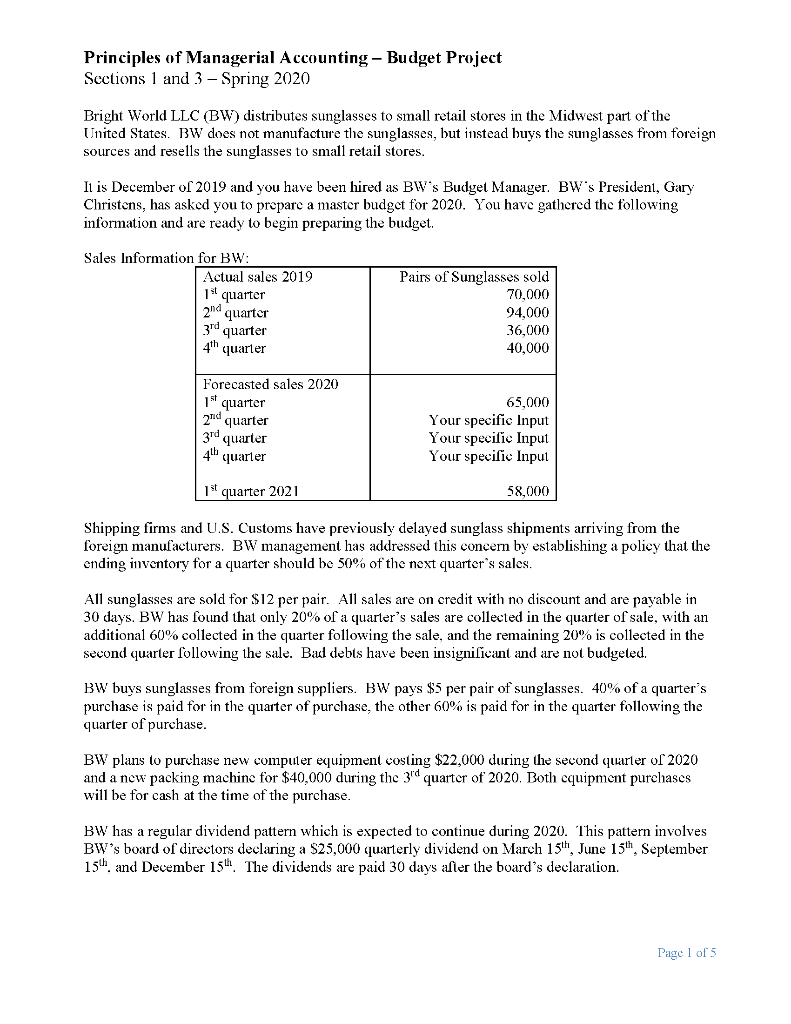

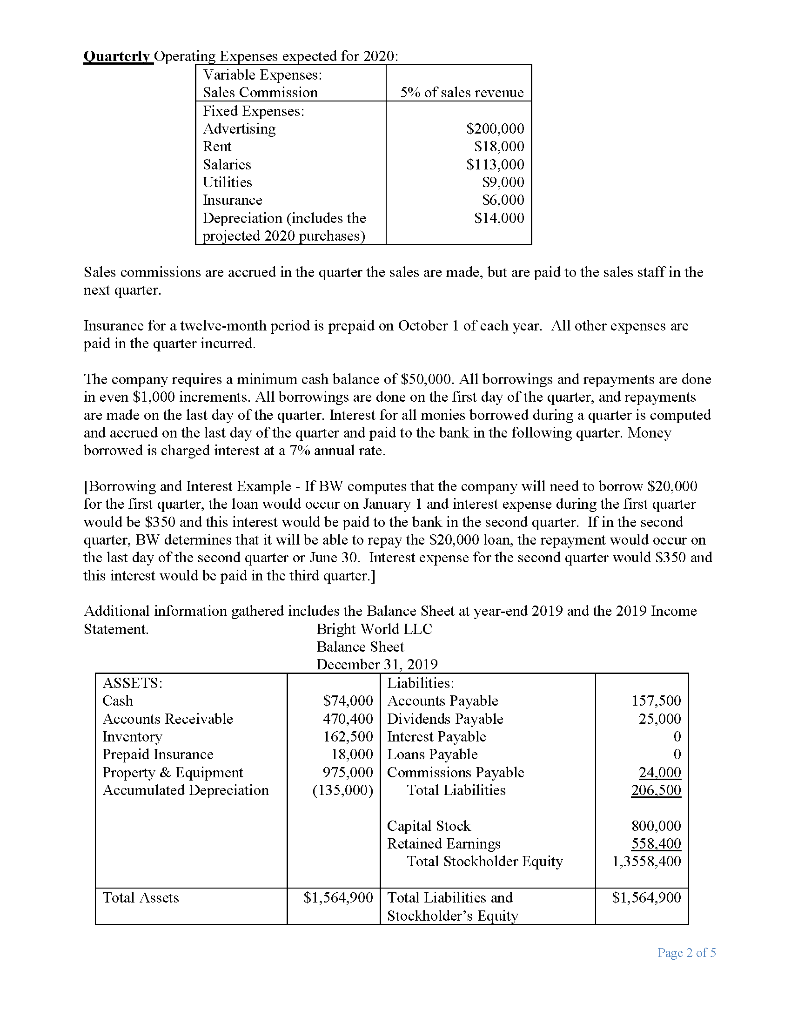

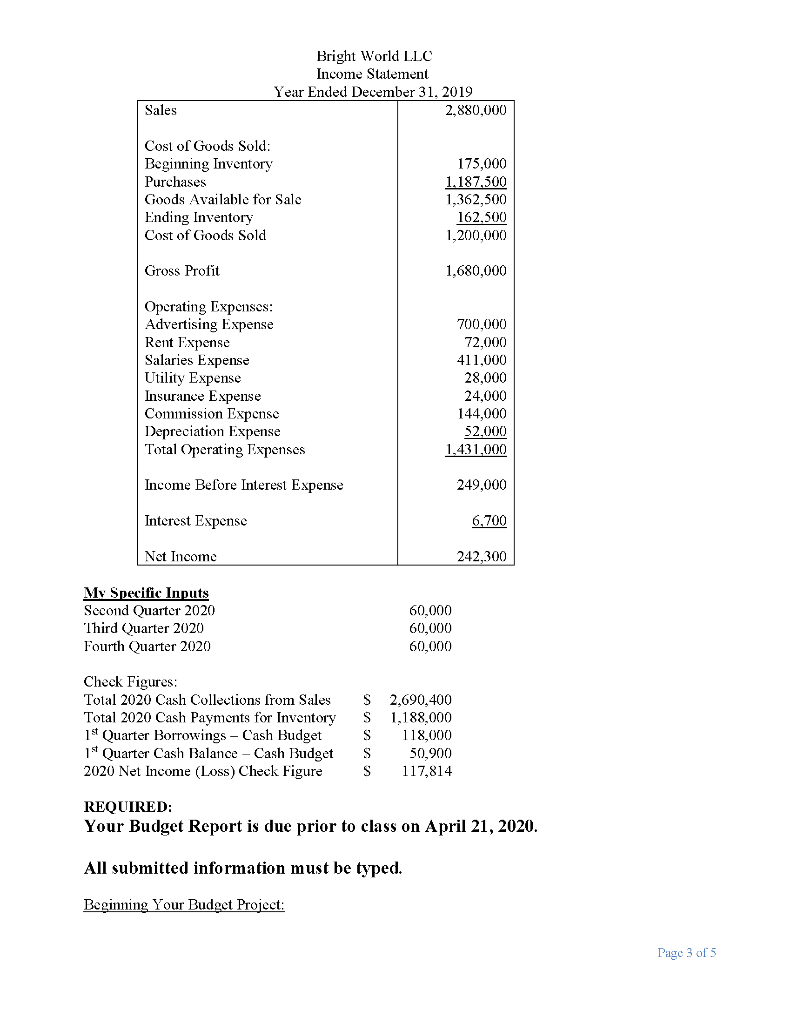

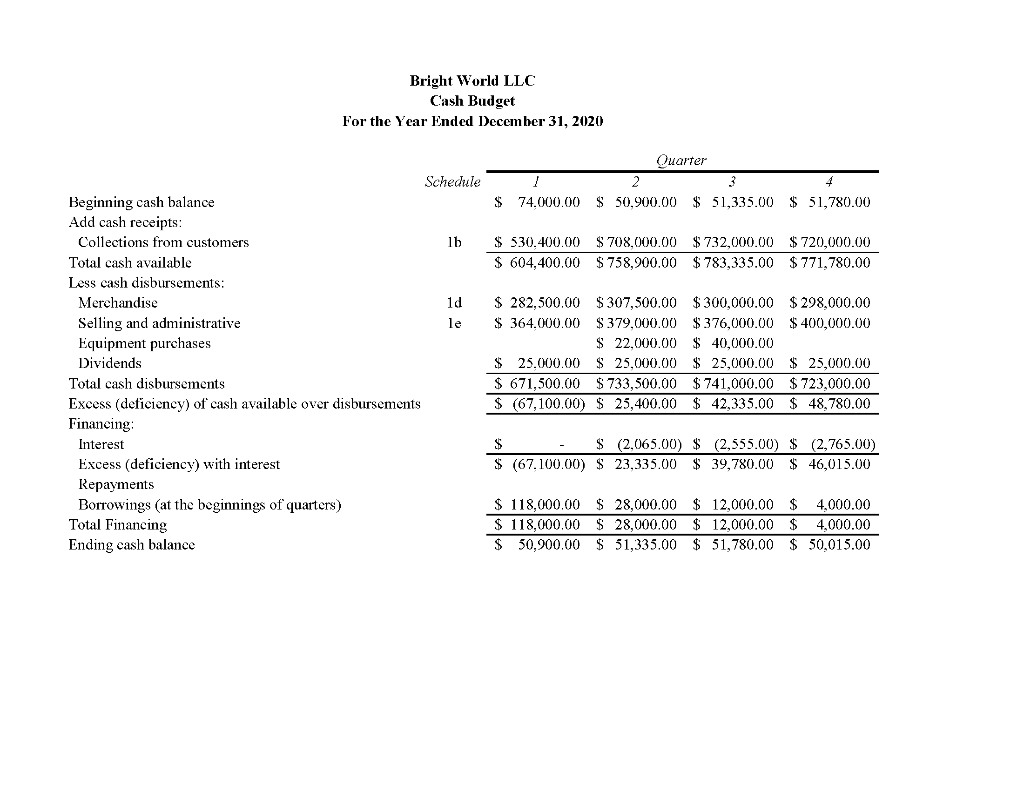

Principles of Managerial Accounting - Budget Project Sections 1 and 3 - Spring 2020 Bright World LLC (BW) distributes sunglasses to small retail stores in the Midwest part of the United States. BW does not manufacture the sunglasses, but instead buys the sunglasses from foreign sources and resells the sunglasses to small retail stores. It is December of 2019 and you have been hired as BW's Budget Manager. BW's President, Gary Christens, has asked you to prepare a master budget for 2020. You have gathered the following information and are ready to begin preparing the budget. Sales Information for BW: Actual sales 2019 1 quarter 2nd quarter 3rd quarter 4th quarter Pairs of Sunglasses sold 70,000 94,000 36,000 40,000 Forecasted sales 2020 1" quarter 2 quarter 3rd quarter 4 quarter 65,000 Your specific Input Your specific Input Your specific Input 1 quarter 2021 58,000 Shipping firms and U.S. Customs have previously delayed sunglass shipments arriving from the foreign manufacturers. BW management has addressed this concern by establishing a policy that the onding inventory for a quarter should be 50% of the next quarter's sales. All sunglasses are sold for $12 per pair. All sales are on credit with no discount and are payable in 30 days. BW has found that only 20% of a quarter's sales are collected in the quarter of sale, with an additional 60% collected in the quarter following the sale, and the remaining 20% is collected in the second quarter following the sale. Bad debts have been insignificant and are not budgeted. BW buys sunglasses from foreign suppliers. BW pays $5 per pair of sunglasses. 40% of a quarter's purchase is paid for in the quarter of purchase, the other 60% is paid for in the quarter following the quarter of purchase. BW plans to purchase new computer equipment costing $22,000 during the second quarter of 2020 and a new packing machine for $40,000 during the 3 quarter of 2020. Both equipment purchases will be for cash at the time of the purchase. BW has a regular dividend pattern which is expected to continue during 2020. This pattern involves BW's board of directors declaring a $25,000 quarterly dividend on March 15th, June 15th September 154. and December 154. The dividends are paid 30 days after the board's declaration. Page 1 of 5 Quarterly Operating Expenses expected for 2020: Variable Expenses: Sales Commission 5% of sales revenue Fixed Expenses: Advertising $200,000 Rent $18,000 Salaries $113,000 Ctilities $9.000 Insurance S6.000 Depreciation (includes the $14.000 projected 2020 purchases) Sales commissions are accrued in the quarter the sales are made, but are paid to the sales staff in the next quarter. Insurance for a twelve-month period is prepaid on October 1 of cach year. All other expenses are paid in the quarter incurred. The company requires a minimum cash balance of $50,000. All borrowings and repayments are done in even $1,000 increments. All borrowings are done on the first day of the quarter, and repayments are made on the last day of the quarter. Interest for all monies borrowed during a quarter is computed and accrued on the last day of the quarter and paid to the bank in the following quarter. Money borrowed is charged interest at a 7% annual rate. Borrowing and Interest Example - If BW computes that the company will need to borrow $20.000 for the first quarter, the loan would occur on January 1 and interest expense during the first quarter would be $350 and this interest would be paid to the bank in the second quarter. If in the second quarter, BW determines that it will be able to repay the S20,000 loan, the repayment would occur on the last day of the second quarter or June 30. Interest expense for the second quarter would $350 and this interest would be paid in the third quarter.] Additional information gathered includes the Balance Sheet at year-end 2019 and the 2019 Income Statement Bright World LLC Balance Sheet December 31, 2019 ASSETS: Liabilities: Cash $74,000 Accounts Payable 157.500 Accounts Receivable 470,400 Dividends Payable 25,000 Inventory 162,500 Interest Pavable Prepaid Insurance 18,000 Loans Payable Property & Equipment 975,000 Commissions Payablo 24,000 Accumulated Depreciation (135,000) Total Liabilities 206,500 Capital Stock Retained Earnings Total Stockholder Equity 800,000 558.400 1,3558,400 Total Assets $1,564,900 $1,564,900 Total Liabilities and Stockholder's Equity Page 2 of 5 Bright World LLC Income Statement Year Ended December 31, 2019 2,880,000 Sales Cost of Goods Sold: Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold 175,000 1,187,500 1,362,500 162,500 1,200,000 Gross Profit 1,680,000 Operating Expenses: Advertising Expense Rent Expense Salaries Expense Utility Expense Insurance Expense Commission Expenso Depreciation Expense Total Operating Expenses 700,000 72,000 411,000 28,000 24,000 144,000 52.000 1,431,000 Income Before Interest Expense 249,000 Interest Expense 6,700 Net Income 242,300 My Specific Inputs Second Quarter 2020 Third Quarter 2020 Fourth Quarter 2020 60,000 60,000 60,000 Check Figures: Total 2020 Cash Collections from Sales Total 2020 Cash Payments for Inventory 1st Quarter Borrowings - Cash Budget 1* Quarter Cash Balance - Cash Budget 2020 Net Income (Loss) Check Figure S S S S S 2.690,400 1,188,000 118,000 50,900 117,814 REQUIRED: Your Budget Report is due prior to class on April 21, 2020. All submitted information must be typed. Beginning Your Budget Project: Page 3 of 5 Unique unit sale information for the second, third, and fourth quarter of 2020 has been provided to you. Insert your unique unit sale information into the sales forecast on page 1 of this document. Please be aware that because of the unique 2020 sale information, the results in your Budget Project will be different from other students. For any questions you have on your Budget Project, please include your unique Budget Project Number listed on the top of your unique INPUT page. Your input sheet includes the following Check Figures Total 2020 Cash Collections from Sales Total 2020 Cash Payments for Purchased Inventory First Quarter 2020 Borrowing on the Cash Budget First Quarter 2020 Ending Cash Balance on the Cash Budget Total 2020 Net Income Page 4 of 5 Begin Your Budget Project by preparing the following Budget Schedules: All schedules listed below in Number 1, must be prepared by quarter and include an annual total column. For all schedules in number 1 below round amounts to the nearest dollar. For all calculations in number 2 calculations should be to 3 decimal places. The pages referencing examples are just that, EXAMPLES. You need to use the assumptions given to prepare a schedule that fits the facts of the Budget you are preparing 1) Prepare the following budget schedules for 2020. a) A sales budget. See page 372 b) A schedule of expected cash collections from sales. See page 372 c) A merchandise purchases budget in units and in dollars. See page 374. The book mentions that a purchases budget can be prepared in dollars and in units. I would suggest preparing your merchandise purchase in units and when the units have been determined, multiple the units time the purchase price. d) A schedule of expected cash disbursements for merchandise purchases. e) A selling and administrative expense budget. See page 380. 1) A cash budget including borrowings and loan repayments. See page 382. g) A budgeted Income Statement by quarter and total for 2020. h) A budgeted Balance Sheet by quarter. There is no total column for the Balance Sheet. 2) Additional analysis information including (show computations): a) Break Even in units and revenue dollars for budget year 2020. b) Margin of Safety for 2020 in total dollar amount and percentage. c) Contribution Margin for 2020. d) Any additional analysis that you have calculated (Optional). Page 5 of 5 Bright World LLC Cash Budget For the Year Ended December 31, 2020 Quarter $ 74,000.00 $ 50,900.00 $ 51,335.00 $ 51,780.00 $ 530.400.00 $ 708,000.00 $ 732,000.00 $ 720,000.00 $ 604,400.00 $ 758.900.00 $ 783,335.00 $771.780.00 Schedule Beginning cash balance Add cash receipts: Collections from customers lb Total cash available Less cash disbursements: Merchandise 1d Selling and administrative le Equipment purchases Dividends Total cash disbursements Excess (deficiency) of cash available over disbursements Financing Interest Excess (deficiency) with interest Repayments Borrowings (at the beginnings of quarters) Total Financing Ending cash balance $ 282,500.00 $ 307,500.00 $300,000.00 $298.000.00 $ 364.000.00 $379,000.00 $376,000.00 $ 400,000.00 $ 22,000.00 $ 40,000.00 $ 25.000.00 $ 25,000.00 $ 25,000.00 $ 25,000.00 $ 671,500.00 $ 733,500.00 $ 741,000.00 $ 723,000.00 $ (67,100.00) $ 25,400.00 $ 42,335.00 $ 48,780.00 $ - $ (2.065.00) $ (2,555.00) $ (2,765.00) $ (67, 100.00) $ 23,335.00 $ 39,780.00 $ 46,015.00 $ 118,000.00 $ 28,000.00 $ 12,000.00 $ 4,000.00 $ 118,000.00 $ 28,000.00 $ 12,000.00 $ 4,000.00 $ 50,900.00 $ 51,335.00 $ 51,780.00 $ 50,015.00 Year 74,000.00 $ $ 2,690,400.00 $ 2.764,400.00 $ 1,188,000.00 $1,519,000.00 $ 62,000.00 $ 25,000.00 $ 2,794,000.00 $ 49,415.00 $ $ (7,385.00) 42,030.00 $ $ $ 162,000.00 162,000.00 204,030.00 Bright World LLC Budgeted Income Statement For the Year Ended December 31, 2020 la Schedules Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net income S2,940,000.00 S1,207,500.00 S1,732,500.00 S1,587,000.00 S 145,500.00 S (7,385.00) S 138,115.00 Principles of Managerial Accounting - Budget Project Sections 1 and 3 - Spring 2020 Bright World LLC (BW) distributes sunglasses to small retail stores in the Midwest part of the United States. BW does not manufacture the sunglasses, but instead buys the sunglasses from foreign sources and resells the sunglasses to small retail stores. It is December of 2019 and you have been hired as BW's Budget Manager. BW's President, Gary Christens, has asked you to prepare a master budget for 2020. You have gathered the following information and are ready to begin preparing the budget. Sales Information for BW: Actual sales 2019 1 quarter 2nd quarter 3rd quarter 4th quarter Pairs of Sunglasses sold 70,000 94,000 36,000 40,000 Forecasted sales 2020 1" quarter 2 quarter 3rd quarter 4 quarter 65,000 Your specific Input Your specific Input Your specific Input 1 quarter 2021 58,000 Shipping firms and U.S. Customs have previously delayed sunglass shipments arriving from the foreign manufacturers. BW management has addressed this concern by establishing a policy that the onding inventory for a quarter should be 50% of the next quarter's sales. All sunglasses are sold for $12 per pair. All sales are on credit with no discount and are payable in 30 days. BW has found that only 20% of a quarter's sales are collected in the quarter of sale, with an additional 60% collected in the quarter following the sale, and the remaining 20% is collected in the second quarter following the sale. Bad debts have been insignificant and are not budgeted. BW buys sunglasses from foreign suppliers. BW pays $5 per pair of sunglasses. 40% of a quarter's purchase is paid for in the quarter of purchase, the other 60% is paid for in the quarter following the quarter of purchase. BW plans to purchase new computer equipment costing $22,000 during the second quarter of 2020 and a new packing machine for $40,000 during the 3 quarter of 2020. Both equipment purchases will be for cash at the time of the purchase. BW has a regular dividend pattern which is expected to continue during 2020. This pattern involves BW's board of directors declaring a $25,000 quarterly dividend on March 15th, June 15th September 154. and December 154. The dividends are paid 30 days after the board's declaration. Page 1 of 5 Quarterly Operating Expenses expected for 2020: Variable Expenses: Sales Commission 5% of sales revenue Fixed Expenses: Advertising $200,000 Rent $18,000 Salaries $113,000 Ctilities $9.000 Insurance S6.000 Depreciation (includes the $14.000 projected 2020 purchases) Sales commissions are accrued in the quarter the sales are made, but are paid to the sales staff in the next quarter. Insurance for a twelve-month period is prepaid on October 1 of cach year. All other expenses are paid in the quarter incurred. The company requires a minimum cash balance of $50,000. All borrowings and repayments are done in even $1,000 increments. All borrowings are done on the first day of the quarter, and repayments are made on the last day of the quarter. Interest for all monies borrowed during a quarter is computed and accrued on the last day of the quarter and paid to the bank in the following quarter. Money borrowed is charged interest at a 7% annual rate. Borrowing and Interest Example - If BW computes that the company will need to borrow $20.000 for the first quarter, the loan would occur on January 1 and interest expense during the first quarter would be $350 and this interest would be paid to the bank in the second quarter. If in the second quarter, BW determines that it will be able to repay the S20,000 loan, the repayment would occur on the last day of the second quarter or June 30. Interest expense for the second quarter would $350 and this interest would be paid in the third quarter.] Additional information gathered includes the Balance Sheet at year-end 2019 and the 2019 Income Statement Bright World LLC Balance Sheet December 31, 2019 ASSETS: Liabilities: Cash $74,000 Accounts Payable 157.500 Accounts Receivable 470,400 Dividends Payable 25,000 Inventory 162,500 Interest Pavable Prepaid Insurance 18,000 Loans Payable Property & Equipment 975,000 Commissions Payablo 24,000 Accumulated Depreciation (135,000) Total Liabilities 206,500 Capital Stock Retained Earnings Total Stockholder Equity 800,000 558.400 1,3558,400 Total Assets $1,564,900 $1,564,900 Total Liabilities and Stockholder's Equity Page 2 of 5 Bright World LLC Income Statement Year Ended December 31, 2019 2,880,000 Sales Cost of Goods Sold: Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold 175,000 1,187,500 1,362,500 162,500 1,200,000 Gross Profit 1,680,000 Operating Expenses: Advertising Expense Rent Expense Salaries Expense Utility Expense Insurance Expense Commission Expenso Depreciation Expense Total Operating Expenses 700,000 72,000 411,000 28,000 24,000 144,000 52.000 1,431,000 Income Before Interest Expense 249,000 Interest Expense 6,700 Net Income 242,300 My Specific Inputs Second Quarter 2020 Third Quarter 2020 Fourth Quarter 2020 60,000 60,000 60,000 Check Figures: Total 2020 Cash Collections from Sales Total 2020 Cash Payments for Inventory 1st Quarter Borrowings - Cash Budget 1* Quarter Cash Balance - Cash Budget 2020 Net Income (Loss) Check Figure S S S S S 2.690,400 1,188,000 118,000 50,900 117,814 REQUIRED: Your Budget Report is due prior to class on April 21, 2020. All submitted information must be typed. Beginning Your Budget Project: Page 3 of 5 Unique unit sale information for the second, third, and fourth quarter of 2020 has been provided to you. Insert your unique unit sale information into the sales forecast on page 1 of this document. Please be aware that because of the unique 2020 sale information, the results in your Budget Project will be different from other students. For any questions you have on your Budget Project, please include your unique Budget Project Number listed on the top of your unique INPUT page. Your input sheet includes the following Check Figures Total 2020 Cash Collections from Sales Total 2020 Cash Payments for Purchased Inventory First Quarter 2020 Borrowing on the Cash Budget First Quarter 2020 Ending Cash Balance on the Cash Budget Total 2020 Net Income Page 4 of 5 Begin Your Budget Project by preparing the following Budget Schedules: All schedules listed below in Number 1, must be prepared by quarter and include an annual total column. For all schedules in number 1 below round amounts to the nearest dollar. For all calculations in number 2 calculations should be to 3 decimal places. The pages referencing examples are just that, EXAMPLES. You need to use the assumptions given to prepare a schedule that fits the facts of the Budget you are preparing 1) Prepare the following budget schedules for 2020. a) A sales budget. See page 372 b) A schedule of expected cash collections from sales. See page 372 c) A merchandise purchases budget in units and in dollars. See page 374. The book mentions that a purchases budget can be prepared in dollars and in units. I would suggest preparing your merchandise purchase in units and when the units have been determined, multiple the units time the purchase price. d) A schedule of expected cash disbursements for merchandise purchases. e) A selling and administrative expense budget. See page 380. 1) A cash budget including borrowings and loan repayments. See page 382. g) A budgeted Income Statement by quarter and total for 2020. h) A budgeted Balance Sheet by quarter. There is no total column for the Balance Sheet. 2) Additional analysis information including (show computations): a) Break Even in units and revenue dollars for budget year 2020. b) Margin of Safety for 2020 in total dollar amount and percentage. c) Contribution Margin for 2020. d) Any additional analysis that you have calculated (Optional). Page 5 of 5 Bright World LLC Cash Budget For the Year Ended December 31, 2020 Quarter $ 74,000.00 $ 50,900.00 $ 51,335.00 $ 51,780.00 $ 530.400.00 $ 708,000.00 $ 732,000.00 $ 720,000.00 $ 604,400.00 $ 758.900.00 $ 783,335.00 $771.780.00 Schedule Beginning cash balance Add cash receipts: Collections from customers lb Total cash available Less cash disbursements: Merchandise 1d Selling and administrative le Equipment purchases Dividends Total cash disbursements Excess (deficiency) of cash available over disbursements Financing Interest Excess (deficiency) with interest Repayments Borrowings (at the beginnings of quarters) Total Financing Ending cash balance $ 282,500.00 $ 307,500.00 $300,000.00 $298.000.00 $ 364.000.00 $379,000.00 $376,000.00 $ 400,000.00 $ 22,000.00 $ 40,000.00 $ 25.000.00 $ 25,000.00 $ 25,000.00 $ 25,000.00 $ 671,500.00 $ 733,500.00 $ 741,000.00 $ 723,000.00 $ (67,100.00) $ 25,400.00 $ 42,335.00 $ 48,780.00 $ - $ (2.065.00) $ (2,555.00) $ (2,765.00) $ (67, 100.00) $ 23,335.00 $ 39,780.00 $ 46,015.00 $ 118,000.00 $ 28,000.00 $ 12,000.00 $ 4,000.00 $ 118,000.00 $ 28,000.00 $ 12,000.00 $ 4,000.00 $ 50,900.00 $ 51,335.00 $ 51,780.00 $ 50,015.00 Year 74,000.00 $ $ 2,690,400.00 $ 2.764,400.00 $ 1,188,000.00 $1,519,000.00 $ 62,000.00 $ 25,000.00 $ 2,794,000.00 $ 49,415.00 $ $ (7,385.00) 42,030.00 $ $ $ 162,000.00 162,000.00 204,030.00 Bright World LLC Budgeted Income Statement For the Year Ended December 31, 2020 la Schedules Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net income S2,940,000.00 S1,207,500.00 S1,732,500.00 S1,587,000.00 S 145,500.00 S (7,385.00) S 138,115.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started