Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am having trouble calculating the correct NPV for the following investment project (image at bottom). The correct value is $1.936M, which I am unable

I am having trouble calculating the correct NPV for the following investment project (image at bottom). The correct value is $1.936M, which I am unable to obtain. My cash flows are as following:

| Investment | Year0 | 1 | 2 | 3 | 4 |

| Opportunity cost | -0.2 | -0.2 | -0.2 | ||

| Initial Outlay | -1.5 | ||||

| Carrying Value | -1.5 | -1 | -0.5 | 0 | |

| Depr. | 0 | -0.5 | -0.5 | -0.5 | |

| Sales of fixed asset | 0.3 | ||||

| Capital gains tax | -0.09 | ||||

| After-tax salvage value | 0.21 | ||||

| cash Flow | -1.5 | -0.2 | -0.5 | 0.01 | |

| Operating | |||||

| Revenue | 3 | 3 | 3 | ||

| COGS | 0.8 | 0.8 | 0.8 | ||

| Fixed Costs | 0.3 | 0.3 | 0.3 | ||

| Depr. | 0.5 | 0.5 | 0.5 | ||

| Prof before tax | 1.4 | 1.4 | 1.4 | ||

| Tax | 0.42 | 0.42 | 0.42 | ||

| Profit | 0.98 | 0.98 | 0.98 | ||

| Profit plus Depr. | 1.48 | 1.48 | 1.48 | ||

| Working Cap | |||||

| Inventories | 0.5 | 0.5 | 0.5 | ||

| A/C receivables | 0.3 | 0.3 | 0.3 | ||

| A/C payables | 0.16 | 0.16 | 0.16 | ||

| Working cap | 0.64 | 0.64 | 0.64 | ||

| Change in Working cap | 0.64 | -0.64 | |||

| Cash flow | -0.64 | 0.64 | |||

| Project Val | |||||

| Total cash flow | -1.5 | 0.64 | 1.28 | 1.49 | 0.64 |

| Cost of Cap | 8.8% | ||||

| NPV | 1.7832 |

I have a feeling I am calculating the working capital wrong for each year, and was wondering if my error lies here. If so, I wish to understand how to interpret the working capital of a project.

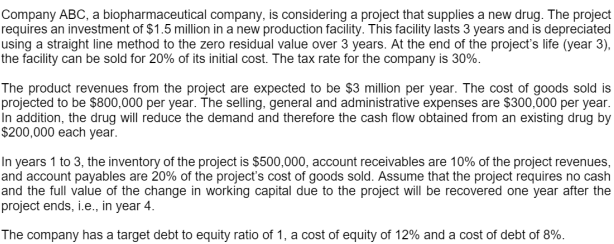

Company ABC, a biopharmaceutical company, is considering a project that supplies a new drug. The project requires an investment of $1.5 million in a new production facility. This facility lasts 3 years and is depreciated using a straight line method to the zero residual value over 3 years. At the end of the project's life (year 3), the facility can be sold for 20% of its initial cost. The tax rate for the company is 30%. The product revenues from the project are expected to be $3 million per year. The cost of goods sold is projected to be $800,000 per year. The selling, general and administrative expenses are $300,000 per year. In addition, the drug will reduce the demand and therefore the cash flow obtained from an existing drug by $200,000 each year. In years 1 to 3 , the inventory of the project is $500,000, account receivables are 10% of the project revenues, and account payables are 20% of the project's cost of goods sold. Assume that the project requires no cash and the full value of the change in working capital due to the project will be recovered one year after the project ends, i.e., in year 4 . The company has a target debt to equity ratio of 1 , a cost of equity of 12% and a cost of debt of 8%

Company ABC, a biopharmaceutical company, is considering a project that supplies a new drug. The project requires an investment of $1.5 million in a new production facility. This facility lasts 3 years and is depreciated using a straight line method to the zero residual value over 3 years. At the end of the project's life (year 3), the facility can be sold for 20% of its initial cost. The tax rate for the company is 30%. The product revenues from the project are expected to be $3 million per year. The cost of goods sold is projected to be $800,000 per year. The selling, general and administrative expenses are $300,000 per year. In addition, the drug will reduce the demand and therefore the cash flow obtained from an existing drug by $200,000 each year. In years 1 to 3 , the inventory of the project is $500,000, account receivables are 10% of the project revenues, and account payables are 20% of the project's cost of goods sold. Assume that the project requires no cash and the full value of the change in working capital due to the project will be recovered one year after the project ends, i.e., in year 4 . The company has a target debt to equity ratio of 1 , a cost of equity of 12% and a cost of debt of 8% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started