Answered step by step

Verified Expert Solution

Question

1 Approved Answer

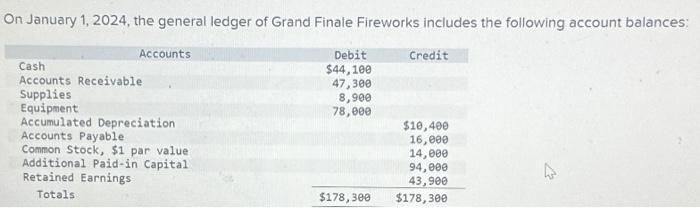

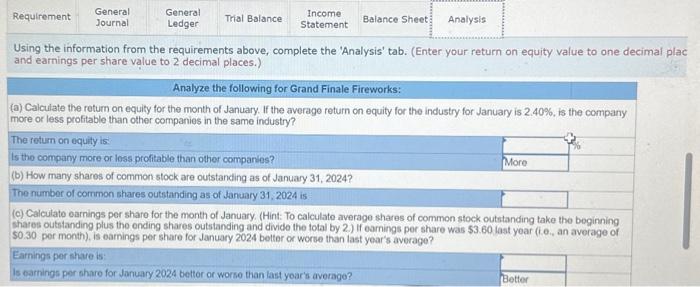

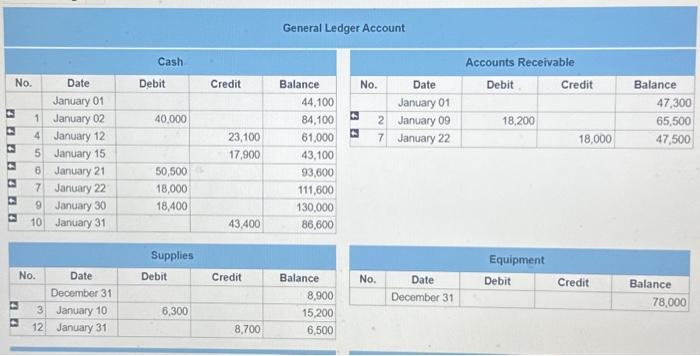

I am having trouble with the analysis at the end. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account

I am having trouble with the analysis at the end.

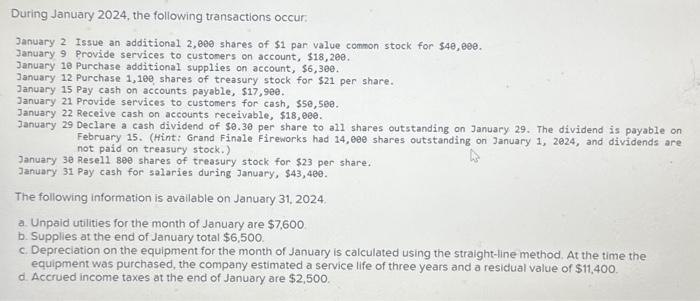

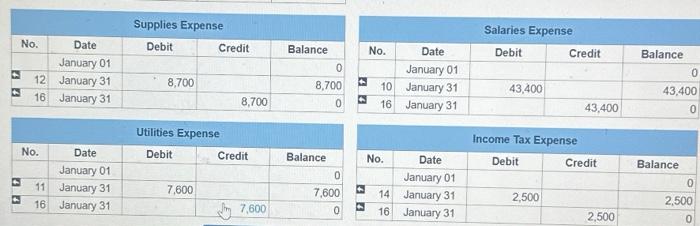

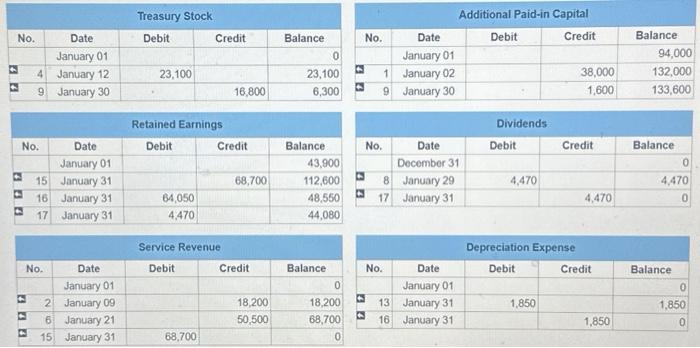

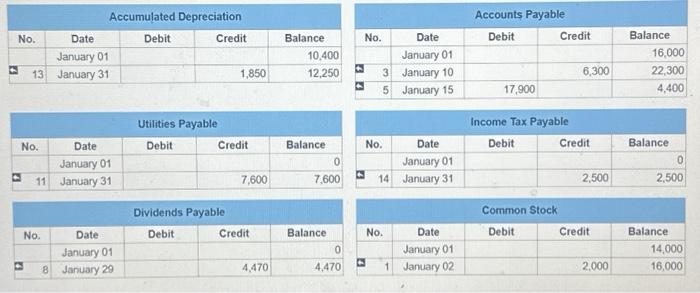

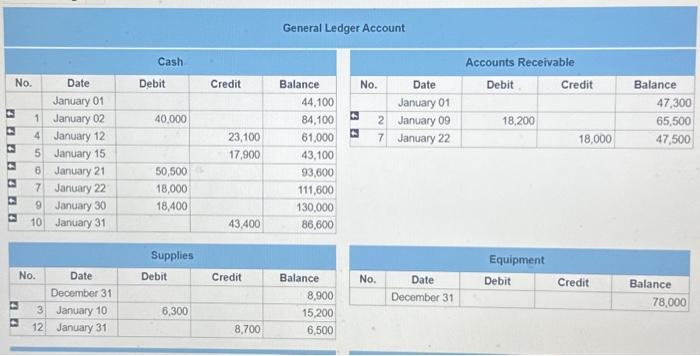

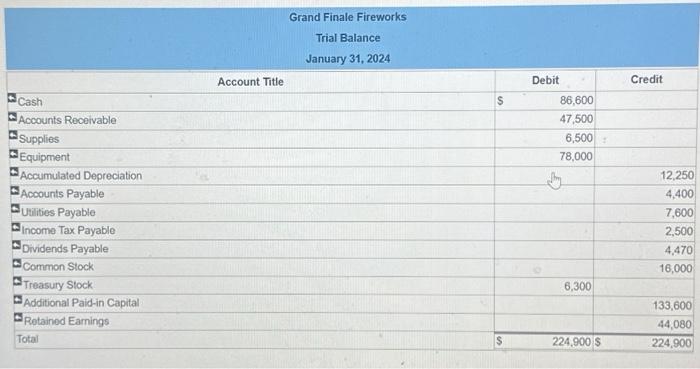

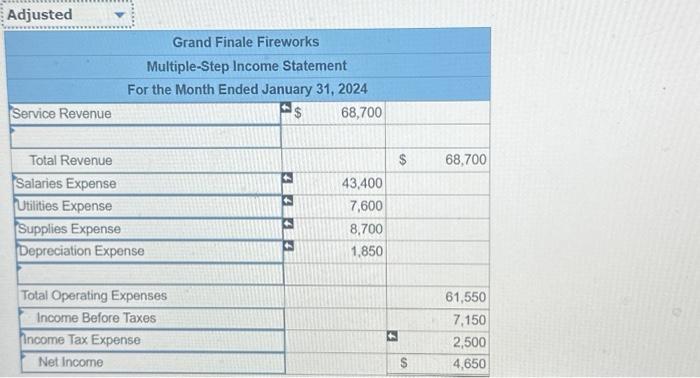

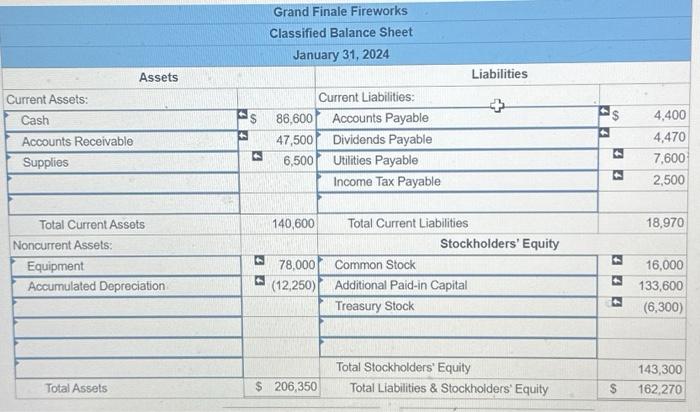

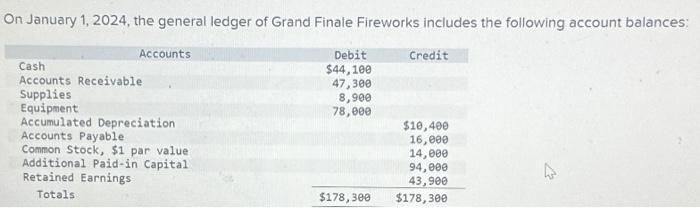

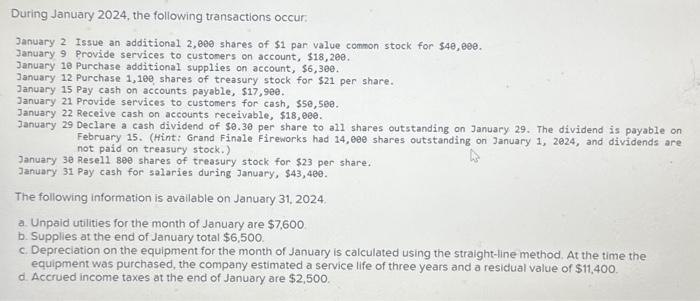

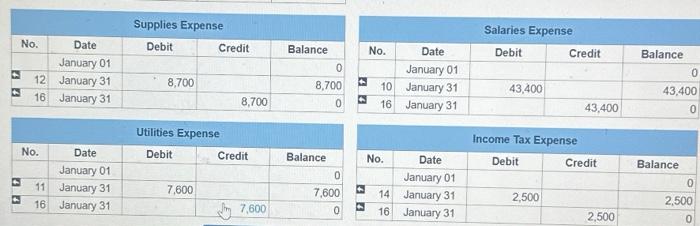

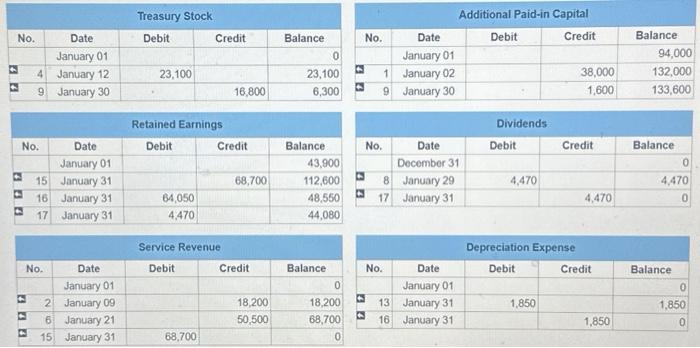

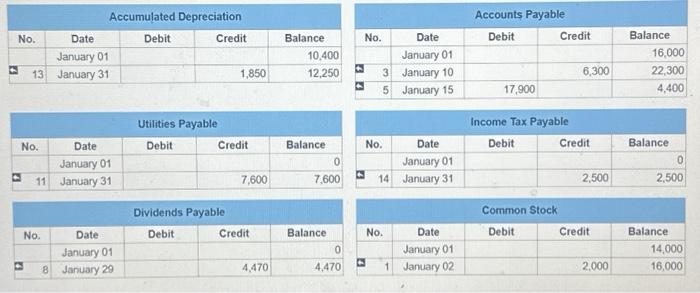

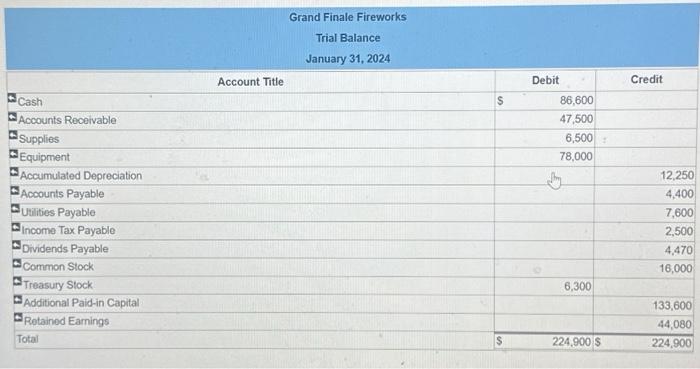

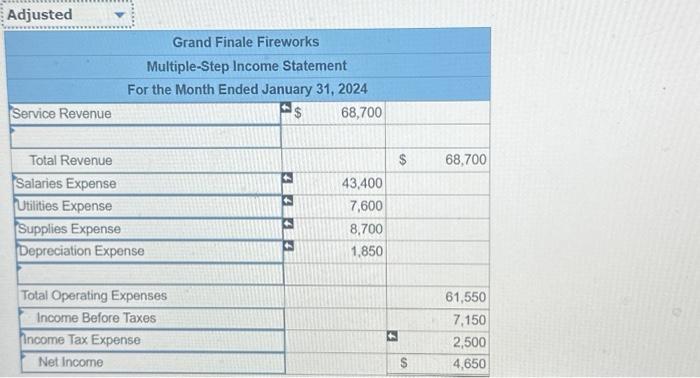

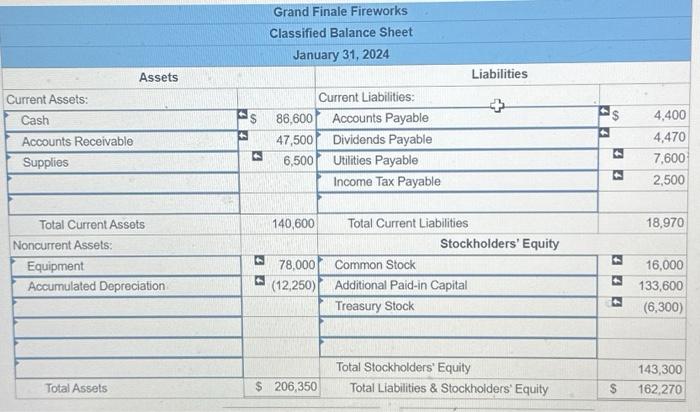

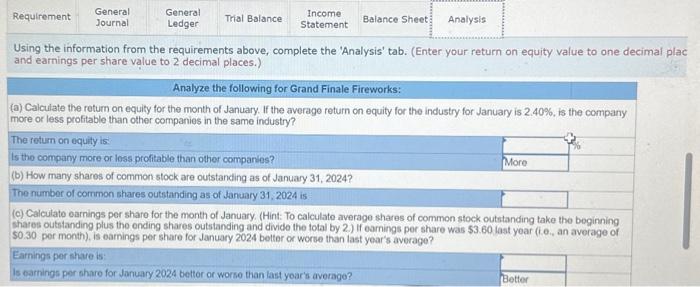

On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024 , the following transactions occur: January 2 Issue an additional 2, 600 shares of $1 par value common stock for $4,00. January 9 Provide services to customers on account, $18,200. January 10 Purchase additional supplies on account, $6,3e0. January 12 Purchase 1,100 shares of treasury stock for $21 per share. January 15 Pay cash on accounts payable, $17,900. January 21 Provide services to customers for cash, $50,560. January 22 Receive cash on accounts receivable, $18,000. January 29 Declare a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 14, 60 e shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) January 30 Resel1 800 shares of treasury stock for $23 per share. January 31 Pay cash for salaries during January, $43,460. The following information is avallable on January 31, 2024. a. Unpaid utilities for the month of January are $7,600 b. Supplies at the end of January total $6,500. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,400 d. Accrued income taxes at the end of January are $2,500. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Supplies Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & - & 0 \\ \hline (N) 12 & January 31 & 8,700 & & 8,700 \\ \hline (4) 16 & January 31 & & 8,700 & 0 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|r|} \hline \multicolumn{7}{|c|}{ Salaries Expense } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Debit } & Credit & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 01 & & & 0 \\ \hline 10 & January 31 & 43,400 & & 43,400 \\ \hline 16 & January 31 & & 43,400 & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Utilities Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 0 \\ \hline (B) 11 & January 31 & 7,600 & & 7.600 \\ \hline (5) 16 & January 31 & \pm & Stry 7,600 & 0 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|r|} \hline \multicolumn{6}{|c|}{ Income Tax Expense } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 01 & & & 0 \\ \hline 14 & January 31 & 2,500 & & 2,500 \\ \hline 16 & January 31 & & 2,500 & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Treasury Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 0 \\ \hline (1) 4 & January 12 & 23,100 &.+ & 23,100 \\ \hline D 9 & January 30 & . & 16,800 & 6,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Additional Paid-in Capital } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 94,000 \\ \hline (1) 1 & January 02 & & 38,000 & 132,000 \\ \hline A 9 & January 30 & . & 1,600 & 133,600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 43,900 \\ \hline (2) 15 & January 31 & & 68,700 & 112,600 \\ \hline 16 & January 31 & 64,050 & & 48.550 \\ \hline [ 17 & January 31 & 4,470 & & 44,080 \\ \hline \end{tabular} \begin{tabular}{|r|c|r|r|r|} \hline \multicolumn{6}{|c|}{ Dividends } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & December 31 & & & 0 \\ \hline 8 & January 29 & 4,470 & & 4,470 \\ \hline 17 & January 31 & & 4,470 & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 0 \\ \hline (a) & January 09 & 1 & 18,200 & 18,200 \\ \hline ( 6 & January 21 & & 50,500 & 68,700 \\ \hline [c) 15 & January 31 & 68,700 & & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Depreciation Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 0 \\ \hline a 13 & January 31 & 1,850 & & 1,850 \\ \hline a 16 & January 31 & & 1,850 & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accumulated Depreciation } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 10,400 \\ \hline13 & January 31 & & 1,850 & 12,250 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Utilities Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 0 \\ \hline (1) 11 & January 31 & 28 & 7,600 & 7,600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 0 \\ \hline (D) 14 & January 31 & & 2,500 & 2,500 \\ \hline \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 14,000 \\ \hline [ 1 & January 02 & & 2,000 & 16,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|r|r|} \hline No. & Date & Debit & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 01 & & & 0 \\ \hline 8 & January 29 & & 4,470 & 4,470 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 16,000 \\ \hline (1) 3 & January 10 & & 6,300 & 22,300 \\ \hline & January 15 & 17,900 & & 4,400 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|r|r|} \hline \multicolumn{8}{|c||}{ Dividends Pryabic } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline D & January 01 & & & 0 \\ \hline & January 29 & & 4,470 & 4,470 \\ \hline \end{tabular} General Ledger Account Adjusted \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Grand Finale Fireworks } \\ \hline \multicolumn{5}{|c|}{ Multiple-Step Income Statement } \\ \hline \multicolumn{5}{|c|}{ For the Month Ended January 31, 2024} \\ \hline Service Revenue & N$ & 68,700 & & \\ \hline Total Revenue & & & s & 68,700 \\ \hline Salaries Expense & \$ & 43,400 & & \\ \hline Utilities Expense & & 7,600 & & \\ \hline Supplies Expense & & 8,700 & & \\ \hline Depreciation Expense & a & 1,850 & & \\ \hline Total Operating Expenses & & & & 61,550 \\ \hline Income Before Taxes & & & & 7,150 \\ \hline Income Tax Expense & & & $ & 2,500 \\ \hline Net Income & & & $ & 4,650 \\ \hline \end{tabular} Using the information from the requirements above, complete the 'Analysis' tab. (Enter your return on equity value to one dec and earnings per share value to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started