I am having trouble with transaction 5 in the 10th edition SUA packet. I included the transaction description, flowchart, and the promissory note.

I confused as to what I'm supposed to do. Do I put this in the ledger or journal? If so which one; cash reciepts, sales journal etc. Please help! I'm not an accounting major so things are a bit confusing for me!

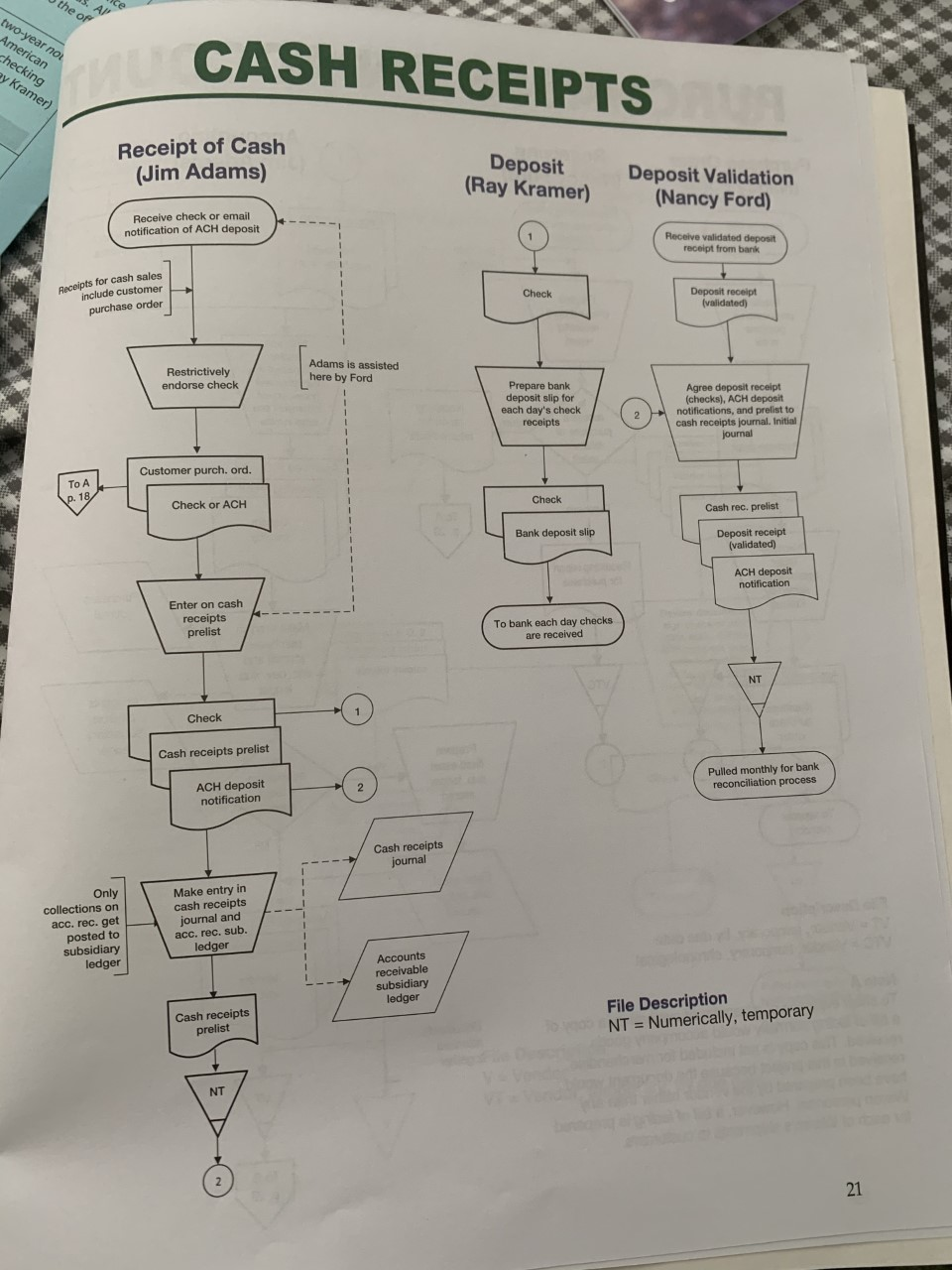

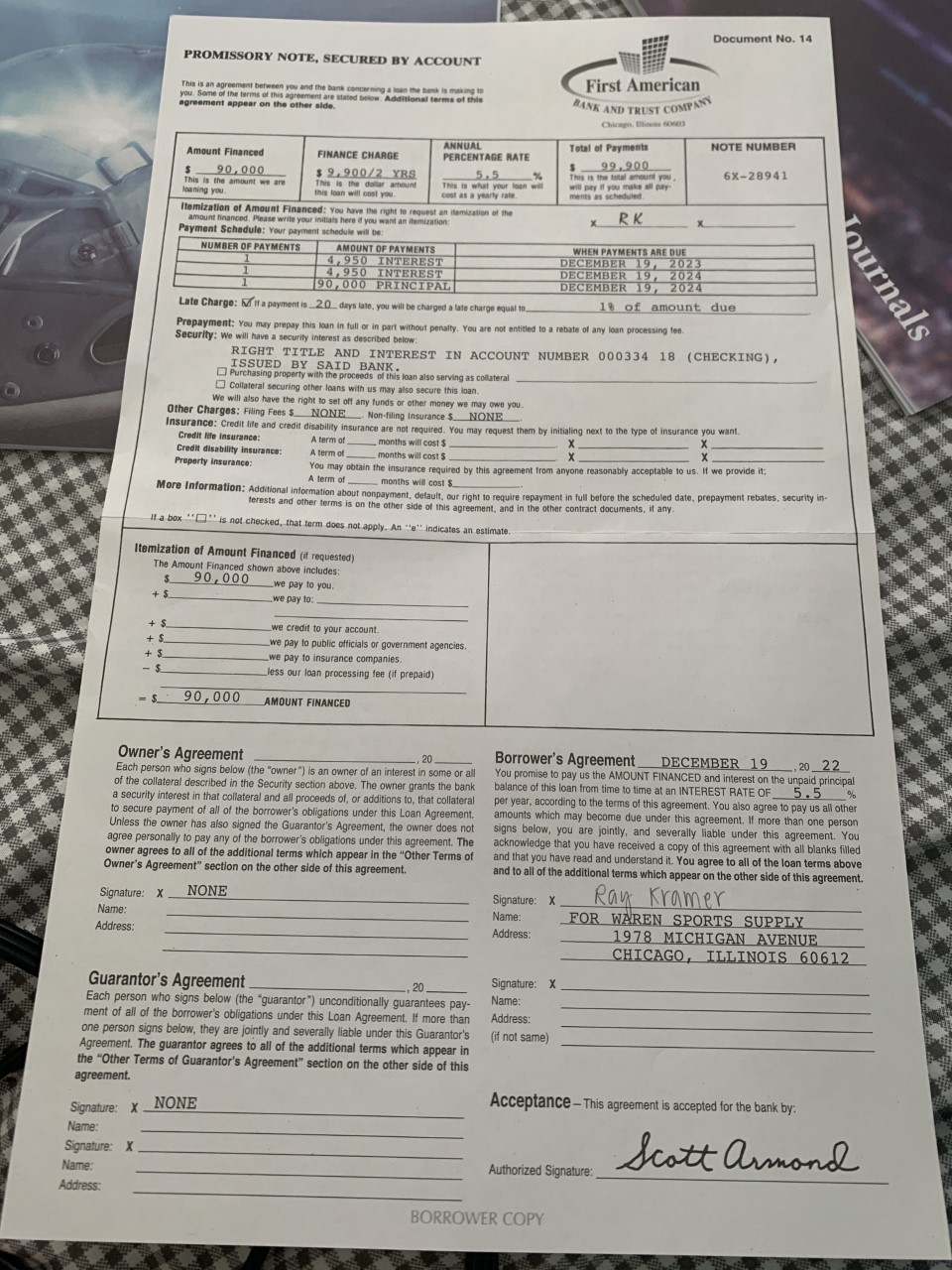

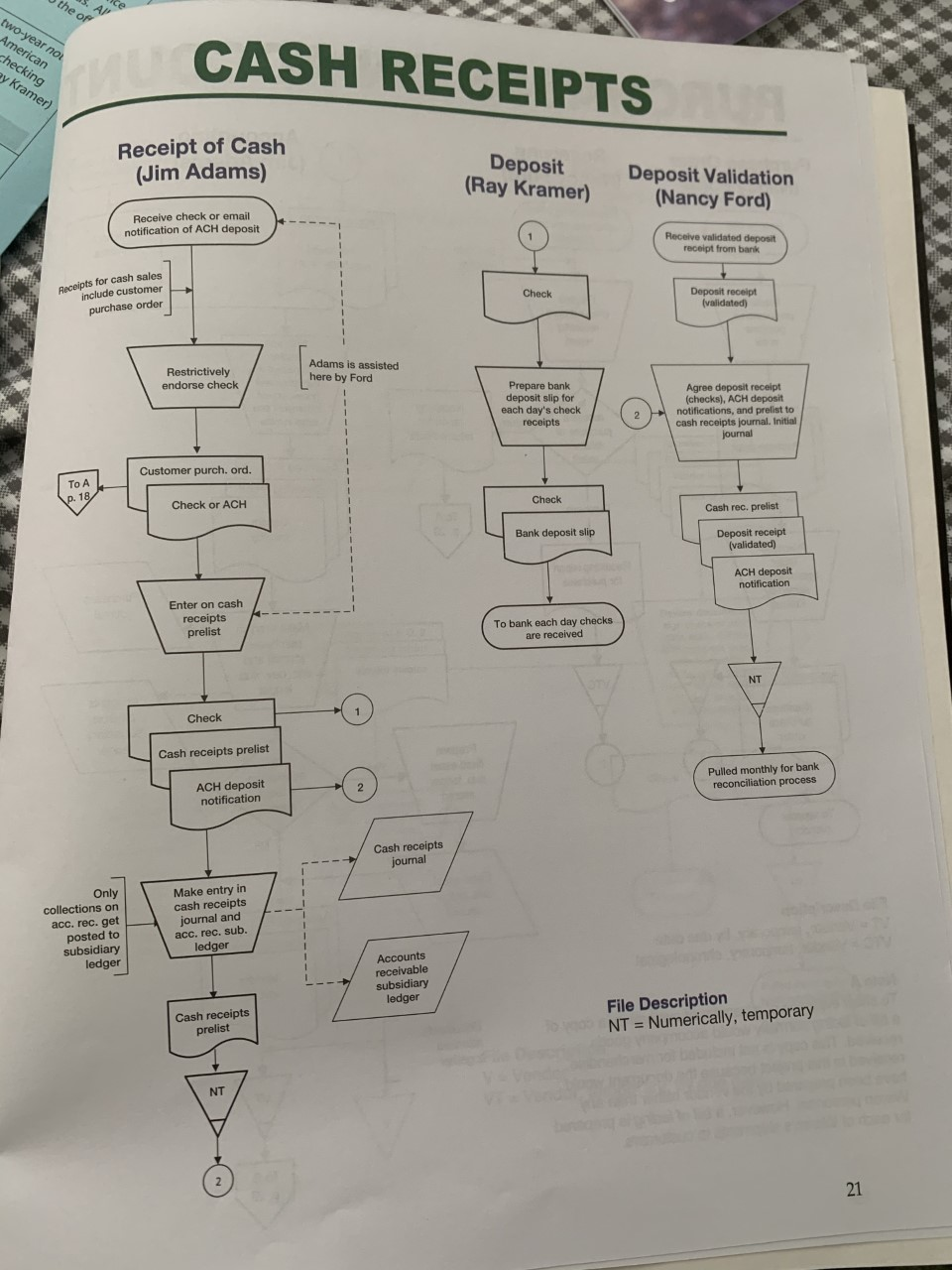

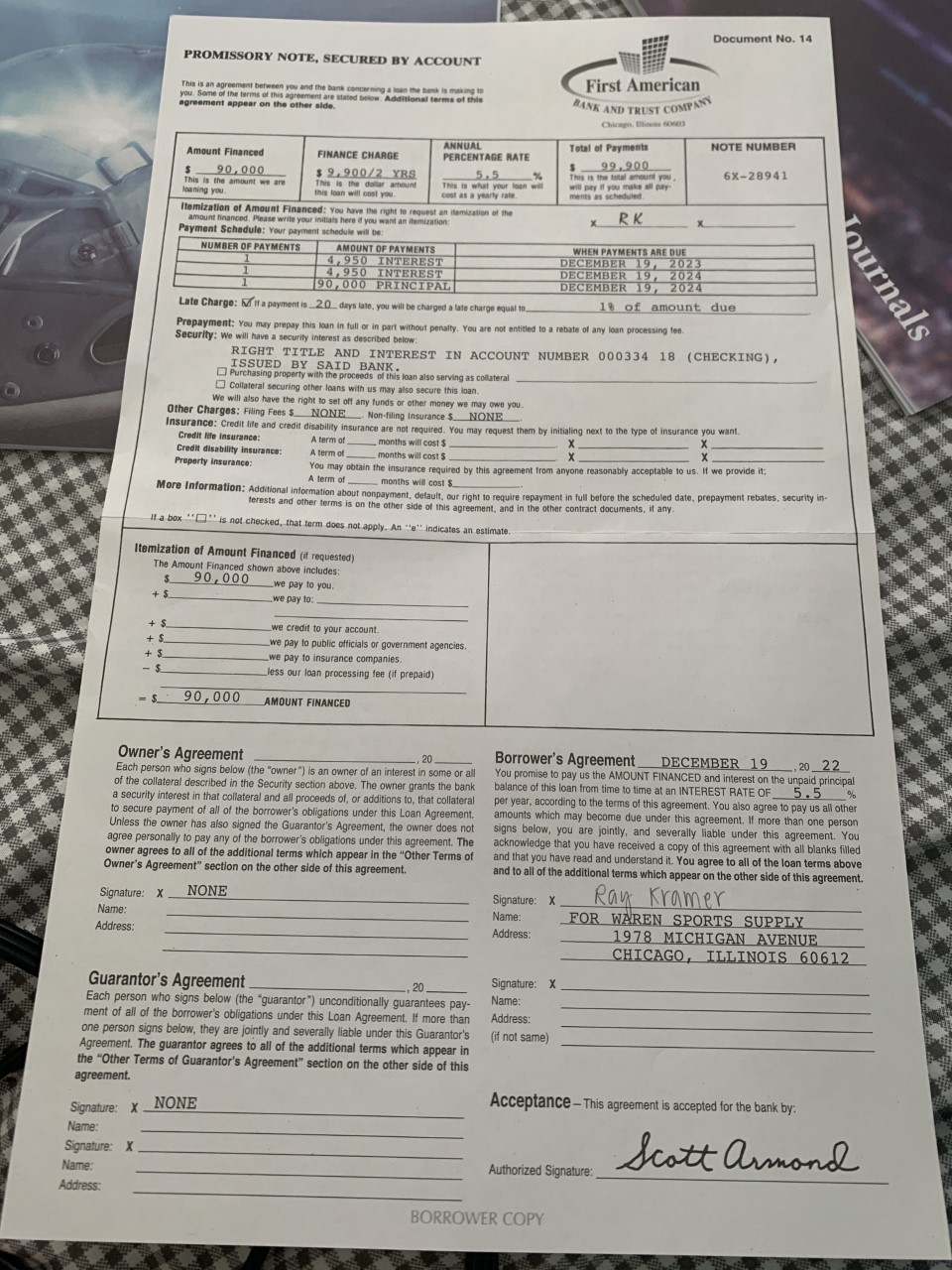

Vendor address: 1285 Colgrove Ave., Pierre, SD 57501 Freight carrier: Interstate Motor Freight Freight charges: FOB shipping point (i.e., will be paid later by Waren) Allowances: None Use purchase order No. 325 (Doc. No. 16) as a guide. Use the price list (Doc. No. 3). No receiving or recording occurs at this point for this transaction. Tear document apart and file, following the flowchart guidance. Received office supplies from Chicago Office Supply as listed on purchase order No. 327 (Doc. No. 16), a copy of which is being held in accounting. Chicago Office Supply's vendor invoice No. 2378 (Doc. No. 18) was received with the goods. All supplies ordered were received in good condition and taken directly to the office, but the invoice was not paid. 19th Yes p.22 5 19th Yes Borrowed $90,000 from First American Bank and Trust by issuing a two-year note pay (Doc. No. 14) with a stated annual interest rate of 5.5% erican electronically deposited the full loan proceeds of $90,000 into Waren's checking account. Reviewed the terms and conditions of the note and signed it (Ray Kramer) as the borrower. p.21 File the note in the Shipping/Banking file tab. Received sales return request No. R8034 (Doc. No. 12) from Eastern Wisconsin University (EWU). The request was approved, and the acknowledgment copy mailed to EWU. 6 19th Yes p.20 You can't record the sales return yet because the goods have not yet been received from Eastern Wisconsin University. Received vendor invoice No. 105963 (D No. 18) from First Security Insurance for the fourth quarter's health insurance coverage for employees and immediately issued a check (Doc. No. 20) for payment in full. 7 20th Yes the of two-year nou American checking ey Kramer) CASH RECEIPTS Receipt of Cash (Jim Adams) Deposit (Ray Kramer) Deposit Validation (Nancy Ford) Receive check or email notification of ACH deposit Receive validated deposit receipt from bank Aeceipts for cash sales include customer purchase order Check Deposit receipt (validated) Restrictively endorse check Adams is assisted here by Ford Prepare bank deposit slip for each day's check receipts Agree deposit receipt (checks), ACH deposit notifications, and prelist to cash receipts journal. Initial journal Customer purch. ord. .18 Check Check or ACH Cash rec, prelist Bank deposit slip Deposit receipt (validated) ACH deposit notification Enter on cash receipts prelist To bank each day checks are received NT Check Cash receipts prelist Pulled monthly for bank reconciliation process ACH deposit notification Cash receipts journal Only collections on acc. rec. get posted to subsidiary ledger Make entry in cash receipts journal and acc. rec. sub ledger Accounts receivable subsidiary ledger Cash receipts File Description NT = Numerically, temporary prelist NT 21 Document No. 14 BANK AND TRUST COMPANY PROMISSORY NOTE, SECURED BY ACCOUNT This is an agreement between you and the bank concerning on the banking First American you. Some of the terms of this Agreement are stated below. Additional terms of the agreement appear on the other side. ANNUAL Total of Payments NOTE NUMBER Amount Financed FINANCE CHARGE PERCENTAGE RATE $ 99.900 $ 90,000 $9.900/2 YRS 5.5 % 6X-28941 This is the amount we are This is the dollar amount This is what your loan will will pay you may loaning you this loan will cost you costas a yearly rate ments as scheduled itemization of Amount Financed: You have the right to request an itemization of the RK amount financed. Please write your initial here if you want an itemization X X Payment Schedule: Your payment schedule will be NUMBER OF PAYMENTS AMOUNT OF PAYMENTS WHEN PAYMENTS ARE DUE 4,950 INTEREST DECEMBER 19, 2023 4,950 INTEREST DECEMBER 19, 2024 1 90,000 PRINCIPAL DECEMBER 19, 2024 Late Charge: ita payment is 20 days late, you will be charged a late charge equal to 1% of amount due Prepayment: You may prepay this loan in full or in part without penalty. You are not entitled to a rebate of any loan processing fee. Security: We will have a security interest as described below: RIGHT TITLE AND INTEREST IN ACCOUNT NUMBER 000334 18 (CHECKING), ISSUED BY SAID BANK. Purchasing property with the proceeds of this loan also serving as collateral Collateral securing other loans with us may also secure this loan. We will also have the right to set off any funds or other money we may owe you. Other Charges: Filing Fees $_NONE Non-filing Insurance $_NONE Insurance: Credit life and credit disability insurance are not required. You may request them by initialing next to the type of insurance you want. Credit life insurance: A term of months will cost $ X Credit disability insurance A term of months will costs Property Insurance You may obtain the insurance required by this agreement from anyone reasonably acceptable to us. If we provide it; A term of months will cost $ More Information: Additional information about nonpayment, detault, our right to require repayment in full before the scheduled date, prepayment rebates, security in terests and other terms is on the other side of this agreement, and in the other contract documents, if any. If a box is not checked, that term does not apply. An "e" indicates an estimate Itemization of Amount Financed (if requested) The Amount Financed shown above includes: $ 90,000 we pay to you + $ we pay to: Tournals + $ + S + $ - $ we credit to your account. we pay to public officials or government agencies, we pay to insurance companies. less our loan processing fee (if prepaid) $ 90,000 AMOUNT FINANCED 20_22 Owner's Agreement , 20 Each person who signs below (the "owner") is an owner of an interest in some or all of the collateral described in the Security section above. The owner grants the bank a security interest in that collateral and all proceeds of, or additions to that collateral to secure payment of all of the borrower's obligations under this Loan Agreement. Unless the owner has also signed the Guarantor's Agreement, the owner does not agree personally to pay any of the borrower's obligations under this agreement. The owner agrees to all of the additional terms which appear in the "Other Terms of Owner's Agreement" section on the other side of this agreement Signature: X NONE Name: Address: Borrower's Agreement DECEMBER 19 You promise to pay us the AMOUNT FINANCED and interest on the unpaid principal balance of this loan from time to time at an INTEREST RATE OF 5.5 % per year, according to the terms of this agreement. You also agree to pay us all other amounts which may become due under this agreement. If more than one person signs below, you are jointly, and severally liable under this agreement. You acknowledge that you have received a copy of this agreement with all blanks filled and that you have read and understand it. You agree to all of the loan terms above and to all of the additional terms which appear on the other side of this agreement. Ray Kramer Signature: X Name: Address: FOR WAREN SPORTS SUPPLY 1978 MICHIGAN AVENUE CHICAGO, ILLINOIS 60612 Signature: X Name: Address: (if not same) Guarantor's Agreement 20 Each person who signs below (the "guarantor") unconditionally guarantees pay- ment of all of the borrower's obligations under this Loan Agreement. If more than one person signs below, they are jointly and severally liable under this Guarantor's Agreement. The guarantor agrees to all of the additional terms which appear in the "Other Terms of Guarantor's Agreement" section on the other side of this agreement. Signature: x NONE Name: : Signature: X Name: : Acceptance - This agreement is accepted for the bank by: Scott Armond Authorized Signature: Address: BORROWER COPY