Question

I am interested in constructing the best possible portfolio from a set of securities, S1, S2, and S3, each of which has an expected return

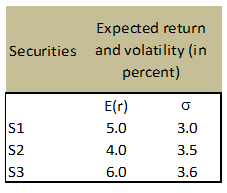

I am interested in constructing the best possible portfolio from a set of securities, S1, S2, and S3, each of which has an expected return E(r) and volatility or risk . Below I see their risk-return characteristics:

A.I will choose S3 only, since it has the highest expected return.

B.I will always choose a portfolio that contains some amount of all three securities.

C.I will discard S2, because it has lower return and higher risk than S1.

D.I will choose S1 only, because it has high return with low risk.

E.I cannot discard any of the above securities without more information.

Securities Expected return and volatility (in percent) 0 S1 S2 Elr) 5.0 4.0 6.0 3.0 3.5 S3 3.6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started