Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am looking for a reply to the questions 2 and 3. I have found already reply for number 2 but has 4 negative feedbacks

I am looking for a reply to the questions 2 and 3. I have found already reply for number 2 but has 4 negative feedbacks and even me i dont find it correct. Thanks

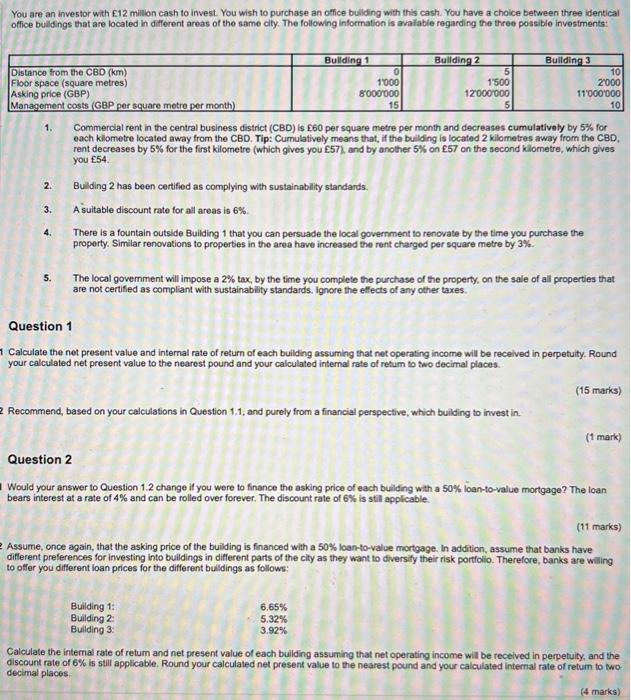

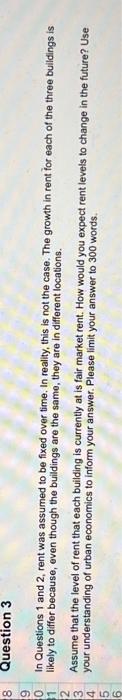

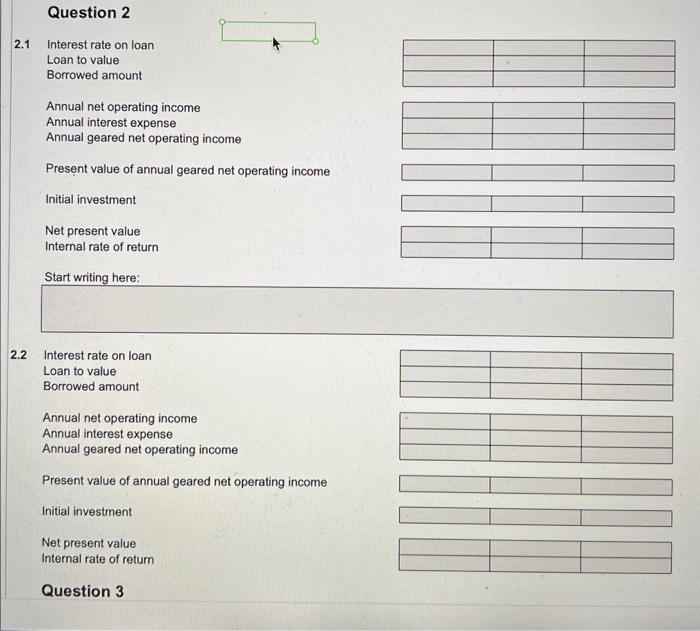

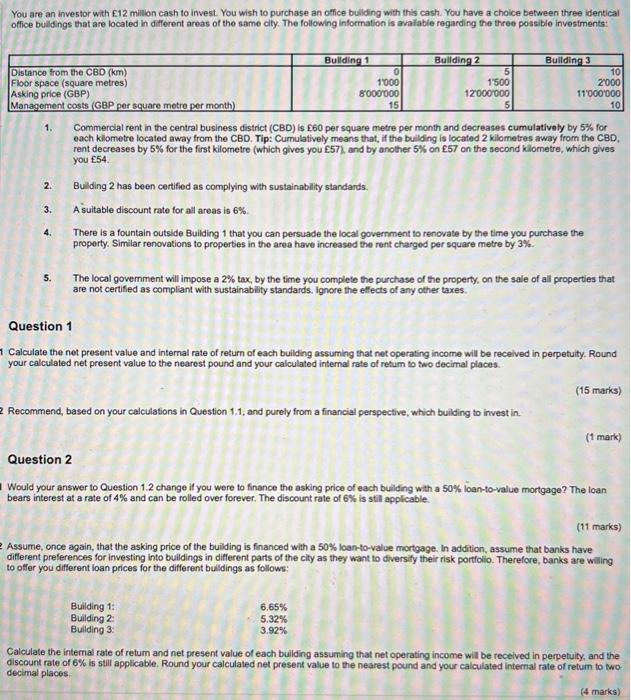

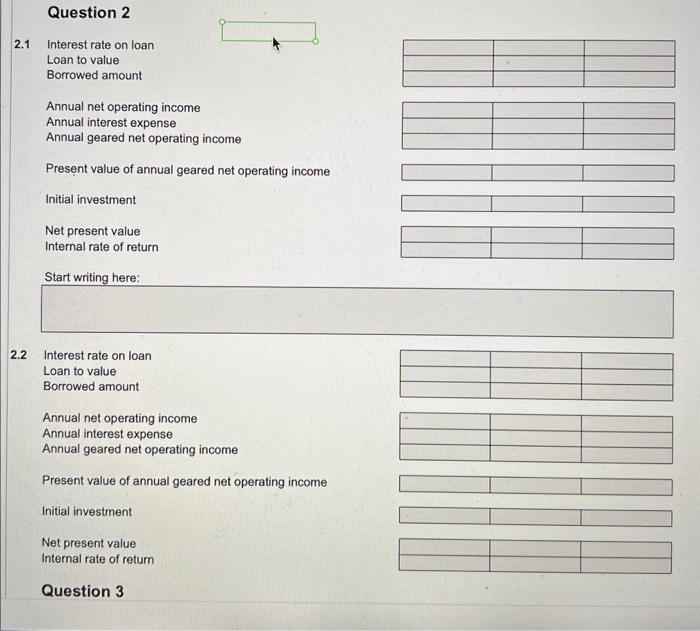

You are an investor with 12 million cash to invest. You wish to purchase an office bullding with this cash. You have a choice between three identical office bulidings that are located in different areas of the same city. The following information is avalable regarding the three possible investments: 1. Commercial rent in the central business district (CBD) is 60 per square metre per month and decreases cumulatively by 5% for each kilometre located away from the CBD. Tip: Cumulatively means that, if the building is located 2 kilometres away from the CBD, rent decreases by 5% for the first kilometre (which gives you 57 ), and by another 5% on 57 on the second kilometre, which gives you 54. 2. Bulding 2 has been certified as complying with sustainability standards. 3. A suitable discount rate for all areas is 6%. 4. There is a fountain outside Building 1 that you can persuade the local government to renovate by the time you purchase the property. Similar renovations to properties in the area have increased the rent charged per square metre by 3%. 5. The local govemment will impose a 2% tax, by the time you complete the purchase of the property, on the sale of all properties that are not certified as compliant with sustainability standards. Ignore the effects of any other taxes. Question 1 Calculate the net present value and internal rate of return of each building assuming that net operating income will be received in perpetuity. Round your calculated net present value to the nearest pound and your calculated internal rate of retum to two decimal places. (15 marks) Recommend, based on your calculations in Question 1.1, and purely from a financial perspective, which building to invest in. (1mark) Question 2 Would your answer to Question 1.2 change if you were to finance the asking price of each bullding with a 50% loan-to-value mortgage? The loan bears interest at a rate of 4% and can be rolled over forever. The discount rate of 6% is still applicable. (11 marks) Assume, once again, that the asking price of the building is financed with a 50% loan-to-value mortgage. In addition, assume that banks have different preferences for investing into buildings in different parts of the city as they want to diversity their risk portiolio. Therefore, banks are willing to offer you different loan prices for the different bulldings as follows: Calculate the intemal rate of retum and net present value of each building assuming that net operating income will be received in perpetuity, and the discount rate of 6% is still applicable. Round your calculated net present value to the nearest pound and your calculated internal rate of retum to two decimal places. In Questions 1 and 2, rent was assumed to be fixed over time. In reality, this is not the case. The growth in rent for each of the three buildings is likely to differ because, even though the buildings are the same, they are in different locations. Assume that the level of rent that each building is currently at is fair market rent. How would you expect rent levels to change in the future? Use your understanding of urban economics to inform your answer. Please limit your answer to 300 words. Question 2 2.1 Interest rate on loan Loan to value Borrowed amount Annual net operating income Annual interest expense Annual geared net operating income Present value of annual geared net operating income Initial investment Net present value Internal rate of return Start writing here: 2.2 Interest rate on loan Loan to value Borrowed amount Annual net operating income Annual interest expense Annual geared net operating income Present value of annual geared net operating income Initial investment Net present value Internal rate of return Question 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started