I am looking for closing journals and post closing trial balance. Thank you!

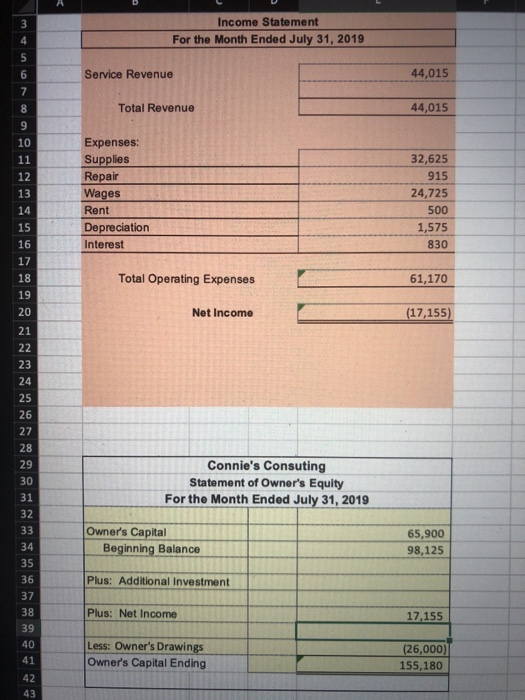

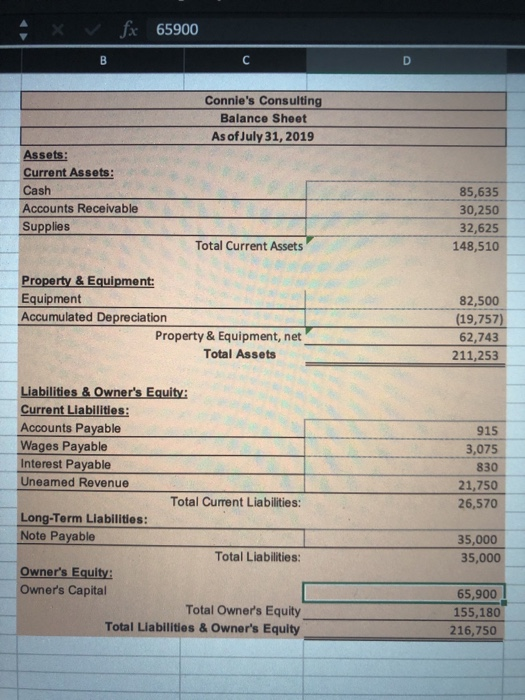

My balance sheet is not in balance. I am trying to figure why. Also I would need help with Closing Journals and Post Closing Trial Balance. Thank you for your help!

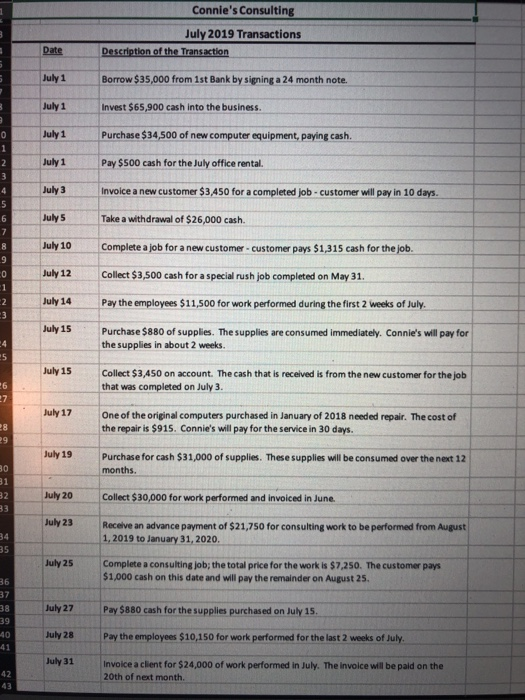

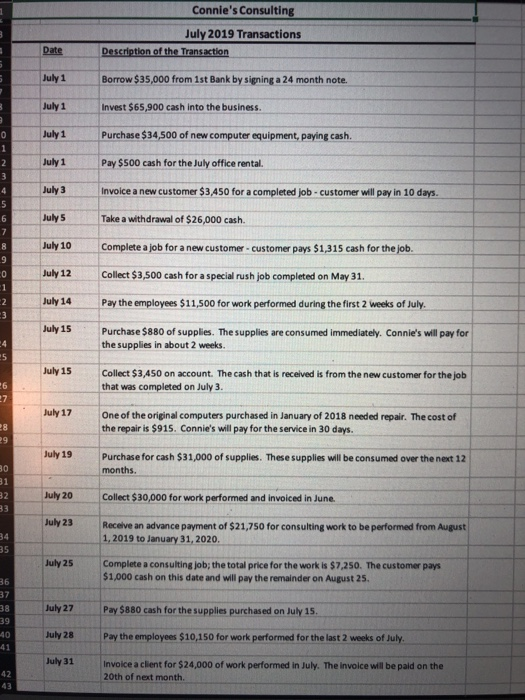

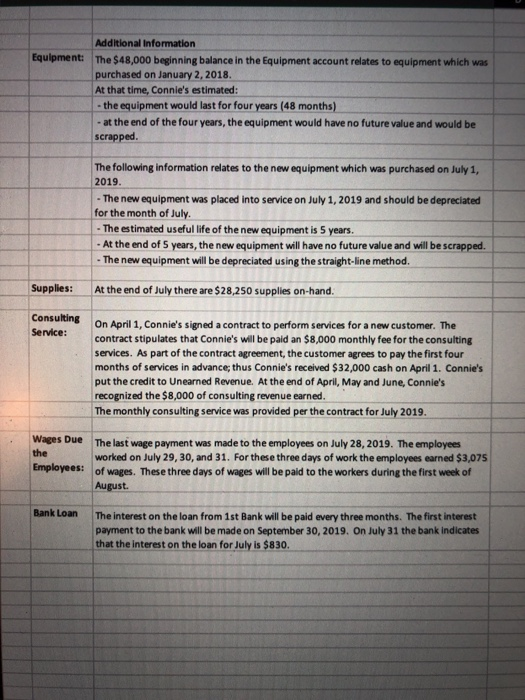

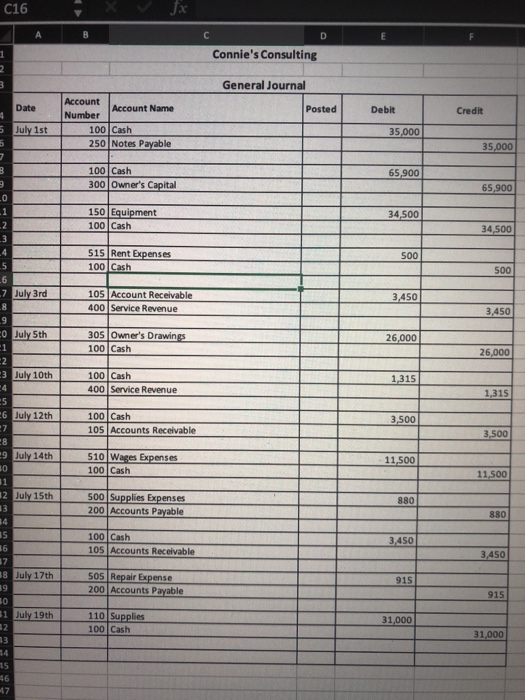

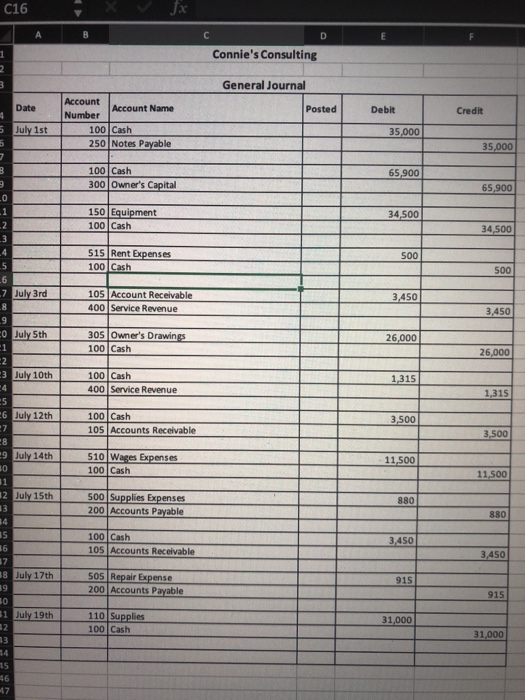

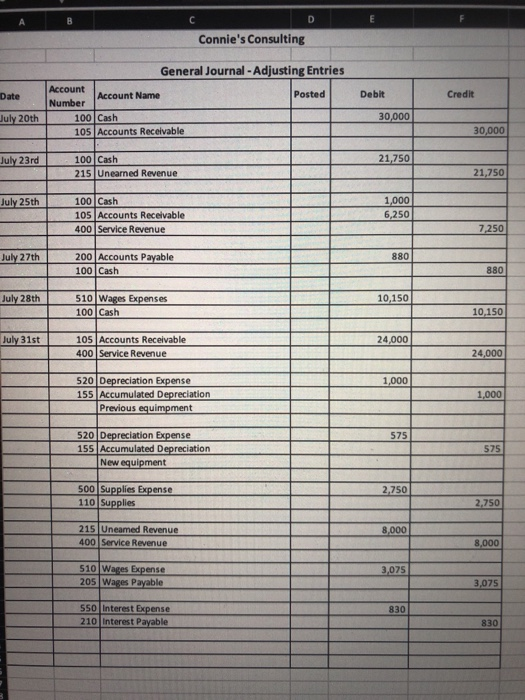

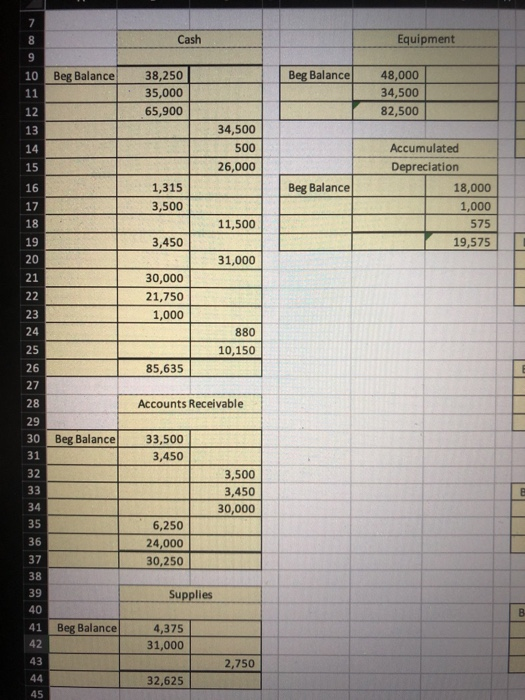

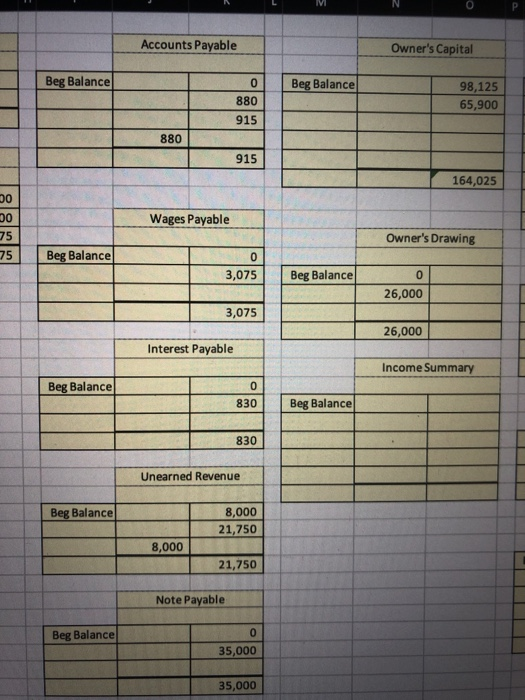

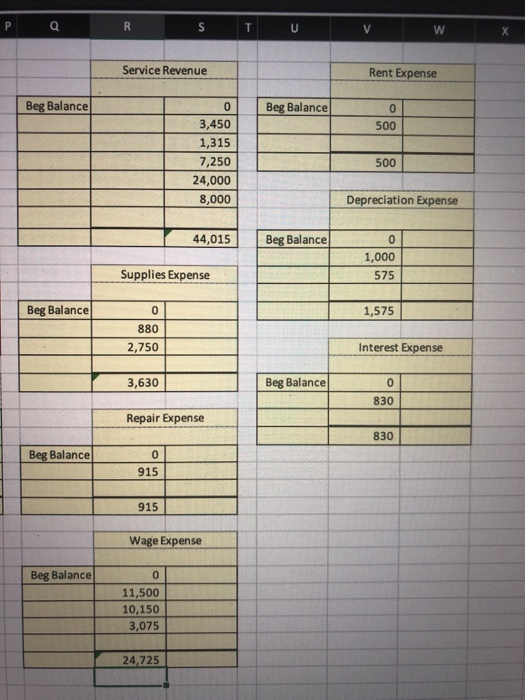

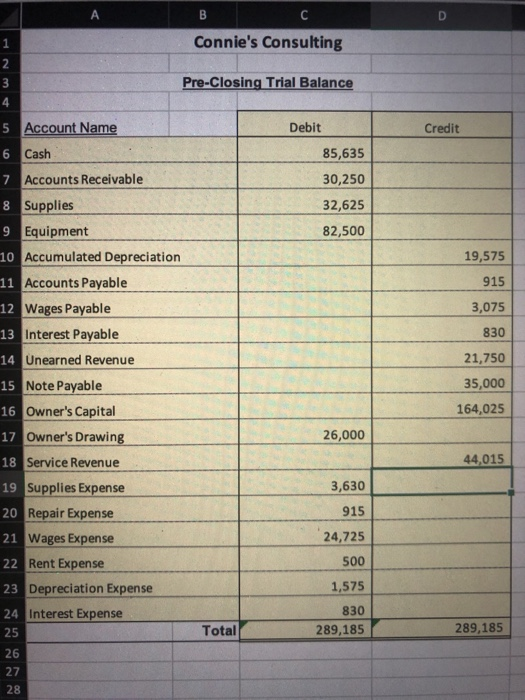

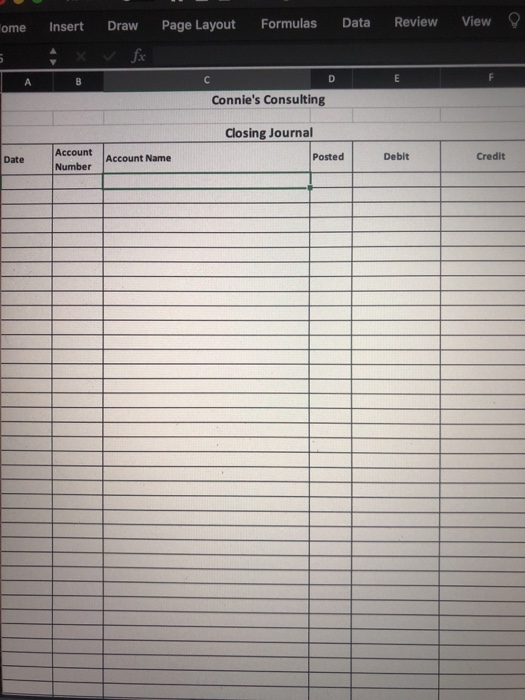

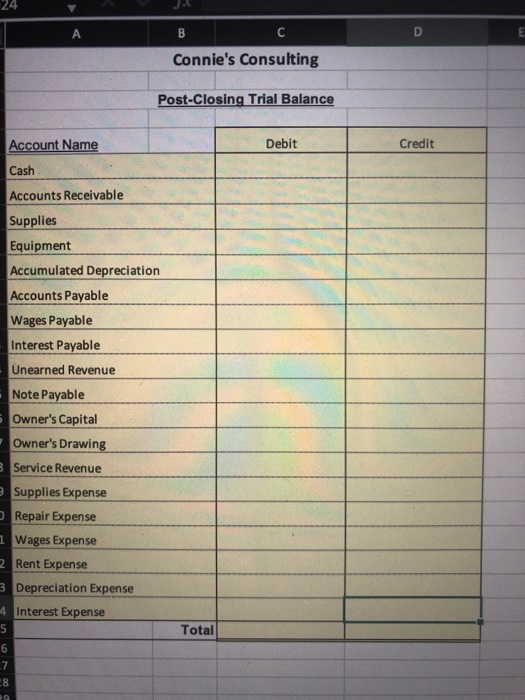

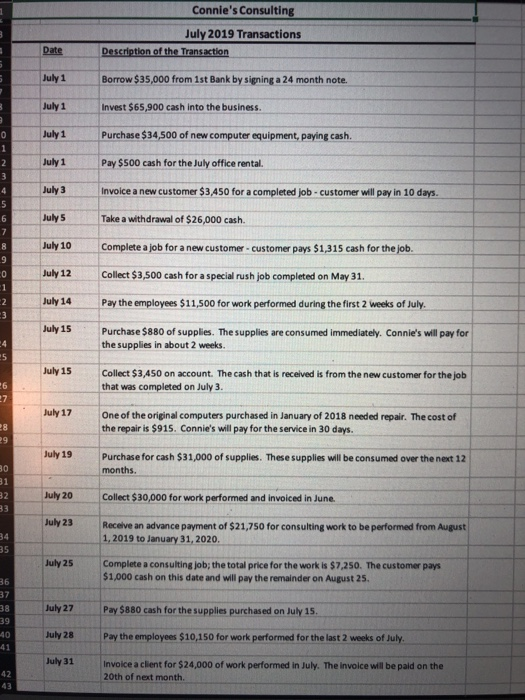

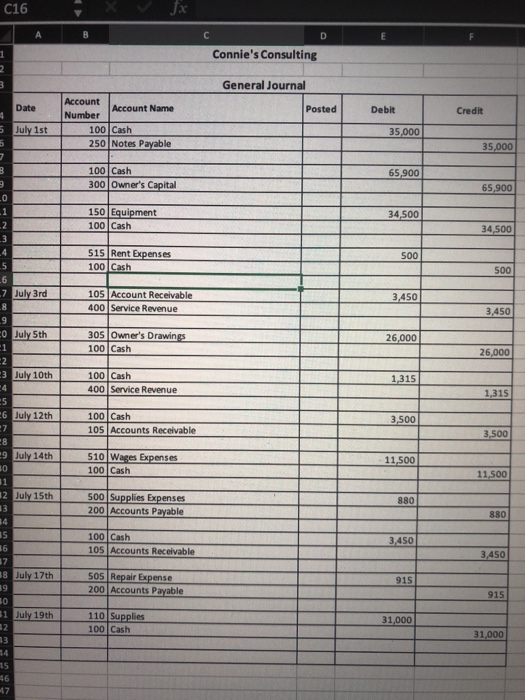

Connie's Consulting July 2019 Transactions Description of the Transaction Date July 1 Borrow $35,000 from 1st Bank by signing a 24 month note. July 1 Invest $65,900 cash into the business July 1 Purchase $34,500 of new computer equipment, paying cash. July 1 Pay $500 cash for the July office rental. July 3 Invoice a new customer $3,450 for a completed job. customer will pay in 10 days. von WN July 5 Take a withdrawal of $26,000 cash. July 10 Complete a job for a new customer-customer pays $1,315 cash for the job. July 12 Collect $3,500 cash for a special rush job completed on May 31. July 14 Pay the employees $11,500 for work performed during the first 2 weeks of July. Purchase $880 of supplies. The supplies are consumed immediately. Connie's will pay for the supplies in about 2 weeks. July 15 Collect $3,450 on account. The cash that is received is from the new customer for the job that was completed on July 3 July 17 One of the original computers purchased in January of 2018 needed repair. The cost of the repair is $915. Connie's will pay for the service in 30 days. July 19 Purchase for cash $31,000 of supplies. These supplies will be consumed over the next 12 months July 20 Collect $30,000 for work performed and invoiced in June July 23 Receive an advance payment of $21,750 for consulting work to be performed from August 1, 2019 to January 31, 2020. July 25 Complete a consulting job; the total price for the work is 57,250. The customer pays 51,000 cash on this date and will pay the remainder on August 25. July 27 Pay $880 cash for the supplies purchased on July 15. July 28 Pay the employees $10,150 for work performed for the last 2 weeks of July. July 31 Invoice a client for $24,000 of work performed in July. The invoice will be paid on the 20th of next month Additional Information Equipment: The $48,000 beginning balance in the Equipment account relates to equipment which was purchased on January 2, 2018. At that time, Connie's estimated: - the equipment would last for four years (48 months) - at the end of the four years, the equipment would have no future value and would be scrapped. The following information relates to the new equipment which was purchased on July 1. 2019. - The new equipment was placed into service on July 1, 2019 and should be depreciated for the month of July. - The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped. - The new equipment will be depreciated using the straight-line method. Supplies: At the end of July there are $28,250 supplies on-hand. Consulting Service: On April 1, Connie's signed a contract to perform services for a new customer. The contract stipulates that Connie's will be paid an $8,000 monthly fee for the consulting services. As part of the contract agreement, the customer agrees to pay the first four months of services in advance; thus Connie's received $32,000 cash on April 1. Connie's put the credit to Unearned Revenue. At the end of April, May and June, Connie's recognized the $8,000 of consulting revenue earned. The monthly consulting service was provided per the contract for July 2019. Wages Due the Employees The last wage payment was made to the employees on July 28, 2019. The employees worked on July 29, 30, and 31. For these three days of work the employees earned $3,075 of wages. These three days of wages will be paid to the workers during the first week of of August. Bank Loan The interest on the loan from 1st Bank will be paid every three months. The first interest payment to the bank will be made on September 30, 2019. On July 31 the bank indicates that the interest on the loan for July is $830. Connie's Consulting July 2019 Transactions Description of the Transaction Date July 1 Borrow $35,000 from 1st Bank by signing a 24 month note. July 1 Invest $65,900 cash into the business July 1 Purchase $34,500 of new computer equipment, paying cash. July 1 Pay $500 cash for the July office rental. July 3 Invoice a new customer $3,450 for a completed job. customer will pay in 10 days. von WN July 5 Take a withdrawal of $26,000 cash. July 10 Complete a job for a new customer-customer pays $1,315 cash for the job. July 12 Collect $3,500 cash for a special rush job completed on May 31. July 14 Pay the employees $11,500 for work performed during the first 2 weeks of July. Purchase $880 of supplies. The supplies are consumed immediately. Connie's will pay for the supplies in about 2 weeks. July 15 Collect $3,450 on account. The cash that is received is from the new customer for the job that was completed on July 3 July 17 One of the original computers purchased in January of 2018 needed repair. The cost of the repair is $915. Connie's will pay for the service in 30 days. July 19 Purchase for cash $31,000 of supplies. These supplies will be consumed over the next 12 months July 20 Collect $30,000 for work performed and invoiced in June July 23 Receive an advance payment of $21,750 for consulting work to be performed from August 1, 2019 to January 31, 2020. July 25 Complete a consulting job; the total price for the work is 57,250. The customer pays 51,000 cash on this date and will pay the remainder on August 25. July 27 Pay $880 cash for the supplies purchased on July 15. July 28 Pay the employees $10,150 for work performed for the last 2 weeks of July. July 31 Invoice a client for $24,000 of work performed in July. The invoice will be paid on the 20th of next month Additional Information Equipment: The $48,000 beginning balance in the Equipment account relates to equipment which was purchased on January 2, 2018. At that time, Connie's estimated: - the equipment would last for four years (48 months) - at the end of the four years, the equipment would have no future value and would be scrapped. The following information relates to the new equipment which was purchased on July 1. 2019. - The new equipment was placed into service on July 1, 2019 and should be depreciated for the month of July. - The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped. - The new equipment will be depreciated using the straight-line method. Supplies: At the end of July there are $28,250 supplies on-hand. Consulting Service: On April 1, Connie's signed a contract to perform services for a new customer. The contract stipulates that Connie's will be paid an $8,000 monthly fee for the consulting services. As part of the contract agreement, the customer agrees to pay the first four months of services in advance; thus Connie's received $32,000 cash on April 1. Connie's put the credit to Unearned Revenue. At the end of April, May and June, Connie's recognized the $8,000 of consulting revenue earned. The monthly consulting service was provided per the contract for July 2019. Wages Due the Employees The last wage payment was made to the employees on July 28, 2019. The employees worked on July 29, 30, and 31. For these three days of work the employees earned $3,075 of wages. These three days of wages will be paid to the workers during the first week of of August. Bank Loan The interest on the loan from 1st Bank will be paid every three months. The first interest payment to the bank will be made on September 30, 2019. On July 31 the bank indicates that the interest on the loan for July is $830. Cash Equipment 10 Beg Balance Beg Balance 1 38,250 35,000 65,900 48,000 34,500 82,500 34,500 500 2. 26,000 Beg Balance 1,315 3,500 Accumulated Depreciation 18,000 1,000 575 19,575 11,500 3,450 31,000 30,000 21,750 1,000 880 10,150 85,635 Accounts Receivable Beg Balance 33,500 3,450 3,500 3,450 30,000 6,250 24,000 30,250 Supplies 41 Beg Balance 4,375 31,000 43 2,750 32,625 C16 Connie's Consulting General Journal Date Posted Credit Account Account Name Number 100 Cash 250 Notes Payable Debit 35,000 July 1st 35,000 65,900 T 100 Cash 300 Owner's Capital 65,900 150 Equipment 100 Cash 34 500 T 500 S15 Rent Expenses 100 Cash 5 1 6 7 July 3rd 3,450 105 Account Receivable 400 Service Revenue 3.450 Co July 5th 305 Owner's Drawings 100 cash 26,000 26.000 July 10th 1,315 100 Cash 400 Service Revenue I T 1315 6 July 12th 3,500 100 l Cash 105 Accounts Receivable 3,500 9 July 14th 11,500 510 Wages Expenses 100 Cash 11,500 2 July 15th 500 l Supplies Expenses 200 Accounts Payable 880 5 3.450 100 Cash 105 Accounts Receivable 3,450 16 7 8 July 17th 915 505 Repair Expense 200 Accounts Payable 915 O Juhy 19th 31.000 1101 Supplies 100 Cash 31,000 P Q R S T U V W Service Revenue Rent Expense Beg Balance Beg Balance 0 500 TO 3,450 1,315 7,250 24,000 8,000 1 500 Depreciation Expense 44,015 Beg Balance 0 1,000 575 Supplies Expense L T 1,575 Beg Balance 0 880 12,750 Interest Expense 3,630 Beg Balance 0 830 Repair Expense 830 Beg Balance 0 915 915 Wage Expense Beg Balance 11,500 10,150 3,075 24,725 Accounts Payable Owner's Capital Beg Balance Beg Balance 0 880 915 98,125 65,900 880 915 164,025 Wages Payable Owner's Drawing Beg Balance 0 3,075 Beg Balance 0 26,000 3,075 26,000 Interest Payable Income Summary Beg Balance 0 830 Beg Balance 830 Unearned Revenue Beg Balance 8,000 21,750 8,000 21,750 Note Payable Beg Balance 35,000 35,000 24 Connie's Consulting Post-Closing Trial Balance Debit Credit Account Name Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Unearned Revenue Note Payable Owner's Capital Owner's Drawing Service Revenue Supplies Expense Repair Expense 1 Wages Expense 2 Rent Expense 3 Depreciation Expense 4 Interest Expense Total 000 voi Tome Insert Draw Page Layout Formulas Data Review View O AB Connie's Consulting Closing Journal Date Account Number Account Name Posted Debit I Credit Connie's Consulting Pre-Closing Trial Balance Debit Credit 85,635 30,250 32,625 82,500 19,575 915 3,075 830 21,750 5 Account Name 6 Cash 7 Accounts Receivable 8 Supplies 9 Equipment 10 Accumulated Depreciation 11 Accounts Payable 12 Wages Payable 13 Interest Payable 14 Unearned Revenue 15 Note Payable 16 Owner's Capital 17 Owner's Drawing 18 Service Revenue 19 Supplies Expense 20 Repair Expense 21 Wages Expense 22 Rent Expense 23 Depreciation Expense 24 Interest Expense T 35,000 164,025 26,000 44,015 3,630 915 24,725 500 1,575 830 289,185 Total 289,185 Connie's Consulting Date General Journal - Adjusting Entries Account Account Name Posted Number 100 Cash 105 Accounts Receivable Debit Credit July 20th 30,000 30,000 July 23rd 21,750 100 Cash 215 lunearned Revenue 21,750 July 25th | 100 Cash 105 | Accounts Receivable 400 Service Revenue 6,250 7.250 July 27th T T 8 80 200 Accounts Payable 100 Cash - 880 July 28th 10,150 510 Wages Expenses 100 Cash 10,150 July 31st 24,000 105 Accounts Receivable 400 Service Revenue 24,000 1,000 520 Depreciation Expense 155 Accumulated Depreciation Previous equimpment 1,000 575 520 Depreciation Expense 155 Accumulated Depreciation New equipment 575 : 2.750 500 Supplies Expense 110 Supplies 2,750 8,000 215 Uneamed Revenue 400 Service Revenue 8,000 3,075 510 Wages Expense 205 Wages Payable 3,075 550 Interest Expense 210 Interest Payable 830 830