Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am looking for solution on Q2 Report: Use any font type of your choice with 1.5 line spacing and 12 point size. Cite and

I am looking for solution on Q2

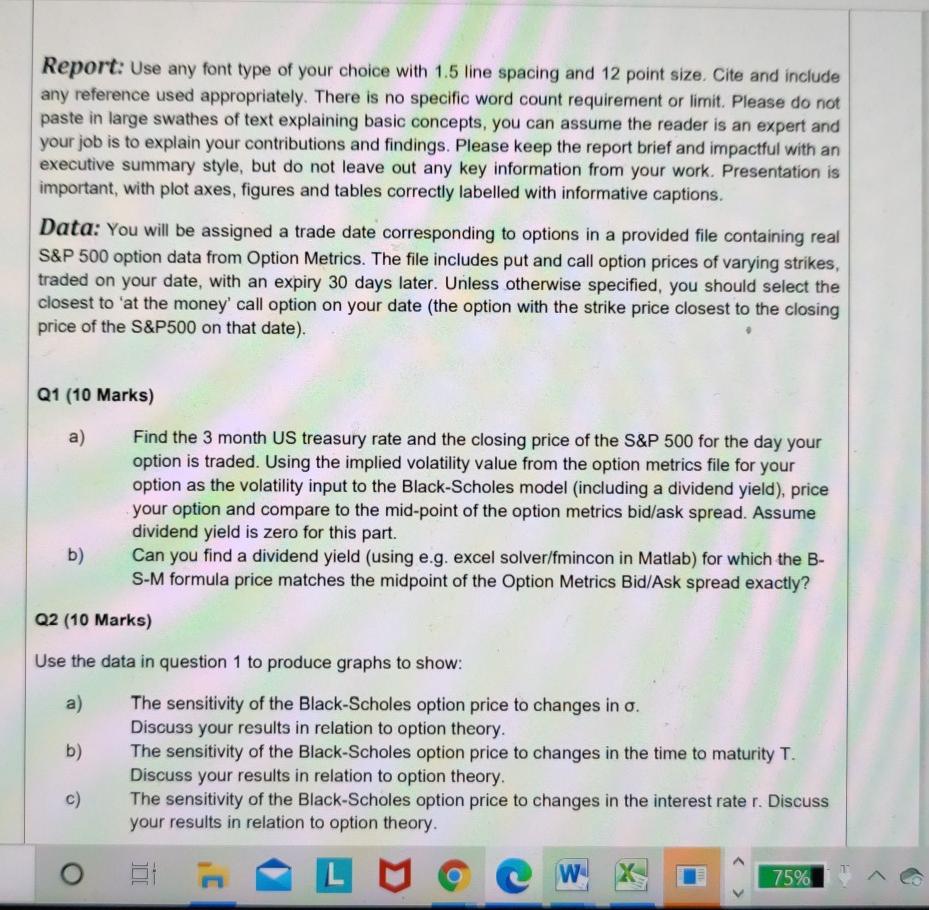

Report: Use any font type of your choice with 1.5 line spacing and 12 point size. Cite and include any reference used appropriately. There is no specific word count requirement or limit. Please do not paste in large swathes of text explaining basic concepts, you can assume the reader is an expert and your job is to explain your contributions and findings. Please keep the report brief and impactful with an executive summary style, but do not leave out any key information from your work. Presentation is important, with plot axes, figures and tables correctly labelled with informative captions. Data: You will be assigned a trade date corresponding to options in a provided file containing real S&P 500 option data from Option Metrics. The file includes put and call option prices of varying strikes, traded on your date, with an expiry 30 days later. Unless otherwise specified, you should select the closest to 'at the money call option on your date (the option with the strike price closest to the closing price of the S&P500 on that date). Q1 (10 Marks) a) Find the 3 month US treasury rate and the closing price of the S&P 500 for the day your option is traded. Using the implied volatility value from the option metrics file for your option as the volatility input to the Black-Scholes model (including a dividend yield), price your option and compare to the mid-point of the option metrics bid/ask spread. Assume dividend yield is zero for this part. Can you find a dividend yield (using e.g. excel solver/fmincon in Matlab) for which the B- S-M formula price matches the midpoint of the Option Metrics Bid/Ask spread exactly? b) Q2 (10 Marks) Use the data in question 1 to produce graphs to show: a) b) The sensitivity of the Black-Scholes option price to changes in o. Discuss your results in relation to option theory. The sensitivity of the Black-Scholes option price to changes in the time to maturity T. Discuss your results in relation to option theory. The sensitivity of the Black-Scholes option price to changes in the interest rater. Discuss your results in relation to option theory. c) w x 75% Report: Use any font type of your choice with 1.5 line spacing and 12 point size. Cite and include any reference used appropriately. There is no specific word count requirement or limit. Please do not paste in large swathes of text explaining basic concepts, you can assume the reader is an expert and your job is to explain your contributions and findings. Please keep the report brief and impactful with an executive summary style, but do not leave out any key information from your work. Presentation is important, with plot axes, figures and tables correctly labelled with informative captions. Data: You will be assigned a trade date corresponding to options in a provided file containing real S&P 500 option data from Option Metrics. The file includes put and call option prices of varying strikes, traded on your date, with an expiry 30 days later. Unless otherwise specified, you should select the closest to 'at the money call option on your date (the option with the strike price closest to the closing price of the S&P500 on that date). Q1 (10 Marks) a) Find the 3 month US treasury rate and the closing price of the S&P 500 for the day your option is traded. Using the implied volatility value from the option metrics file for your option as the volatility input to the Black-Scholes model (including a dividend yield), price your option and compare to the mid-point of the option metrics bid/ask spread. Assume dividend yield is zero for this part. Can you find a dividend yield (using e.g. excel solver/fmincon in Matlab) for which the B- S-M formula price matches the midpoint of the Option Metrics Bid/Ask spread exactly? b) Q2 (10 Marks) Use the data in question 1 to produce graphs to show: a) b) The sensitivity of the Black-Scholes option price to changes in o. Discuss your results in relation to option theory. The sensitivity of the Black-Scholes option price to changes in the time to maturity T. Discuss your results in relation to option theory. The sensitivity of the Black-Scholes option price to changes in the interest rater. Discuss your results in relation to option theory. c) w x 75%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started