Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am looking to fill out this form given the information above. Problem 10-43 (LO. 7, 8, 9, 10, 11 Amy and Mitchell share equally

I am looking to fill out this form given the information above.

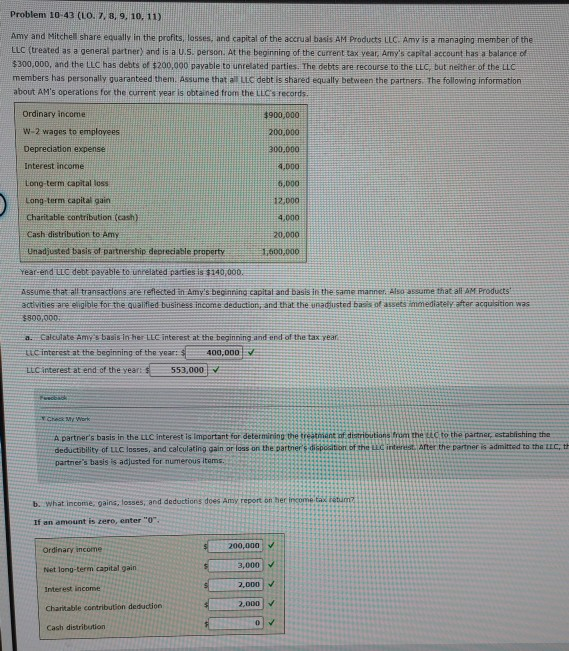

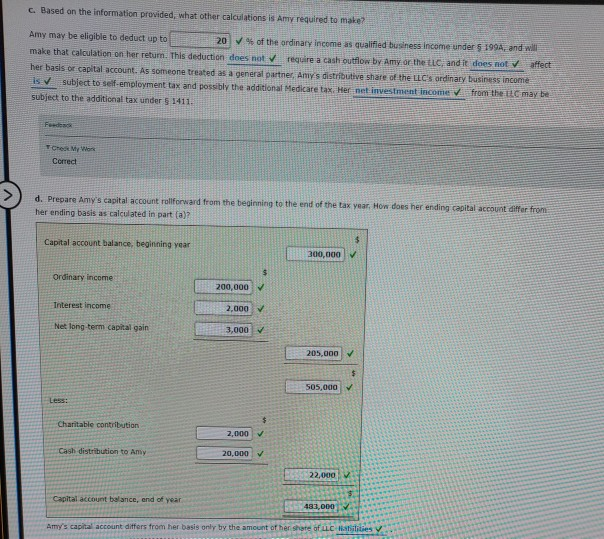

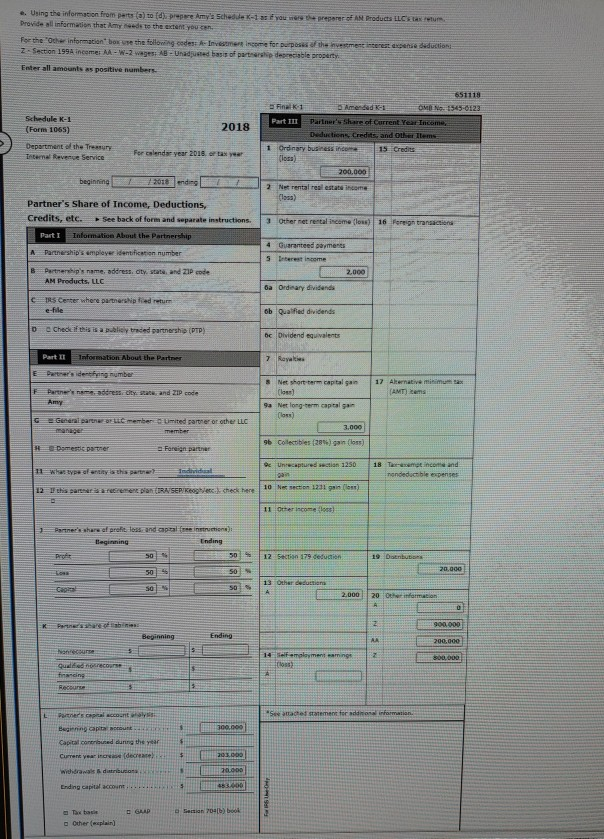

Problem 10-43 (LO. 7, 8, 9, 10, 11 Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $300,000, and the LLC has debts of $200,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that a c debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records. Ordinary income $900.000 W-2 wages to employees 200,000 Depreciation expense 300.000 Interest income 4.000 Long-term capital loss 16,000 Long-term capital gain 12,000 4.000 Charitable contribution (cash) Cash distribution to Amy Unadjusted basis of partnership depreciable property 20,000 1,500,000 Year-end LLC debt payable to unrelated parties is $140,000 Assume that all transactions are reflected in Amy's beginning capital and basis in the same manner. Also assume that all AM Products activities are eligible for the qualified business income deduction, and that the unadjusted basis of assets immediately after acquisition was $800,000 a. Calculate my basis in her LLC interest at the beginning and end of the tax LLC interest at the beginning of the year: 400,000 LLC interest at end of the year: 553,000 A partner's basis in the LLC interest is important for determining the treatment of distributions from the Llc to the partner, establishing the deductibility of losses, and calculating gain or loss on the partner's disposition of the interest. After the partner is admitted to the EC, partner's basis is adjusted for numerous items. b. What income, gains, losses, and deductions does Amy report on her in If an amount is zero, enter "0". Ordinary income 200,000 Net long-term capital gain Interest income Charitable contribution deduction Cash distribution C. Based on the information provided, what other calculations is Amy required to make Amy may be eligible to deduct up to 20 % of the ordinary income as qualified business income under 5 1994, and will make that calculation on her return. This deduction does not require a cash outflow by Amy or the cand it does not affect her basis of capital account. As someone treated as a general partner. Any's distributive share of the u s ordinary business income is subject to self-employment tax and possibly the additional Medicare tax. Her net investment income from the il may be subject to the additional tax under $1411 TC My Won Comed d. Prepare Amy's capital account rolforward from the beginning to the end of the tax year, How does her ending capital account differ from her ending basis as calculated in part (a)? Capital account balance beginning year 300,000 Ordinary income Interest Income Net long-term capital gain 205,000 505,000 Charitable contribution Cash distribution to Amy Capital account balance, end of year Amy's capital count differs from her basis only by the amount of her state of .. Using the information from parts (a) to prepare Amy's Schede - you were preparer of Ant Products LLC eur Drovide all information that my weds to the action you can For the Other information box use the following code Investment income for purpose of the investment interest expense deduction z. Section 199income: = W-2 wages: Unadused basis of parte des cible property Enter all amounts as positive numbers Schedule K- (Form 1065) 2018 651118 Final 1 CM 1545-0123 Part 11 Partner'share of Current Year Income Deduction credit and Items 1 Ordinary business income (los) Department of the Treasury Internal Revenue Service For calendar year 2016 beginning 2016 ending 2 Net rental real estate income Othernet rental income flow) 16 Poron transaction Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions. Part I Information About the Partnership A Partnership's employer identification number & Partnership's name, address, aty, state and ZIP code AM Products, LLC Guaranteed payments 4 5 nerest income 2.000 a Ordinary dividende IRS Center where partnership ied return e-file ob Qualified dividends 0 Chede if this is a publicly traded partnership (DTP) or Dividend equivalents Part II Information About the Partner 7 Royale Purtresidenteng number Partner address, city, state and ZIP code * Net short-term capital gain (los) 9a Netlong-term captalan Class) Geral part LLC member mited partner or the LLC 3.000 9b Collectibles (20) gain (los) E esti partner Foreign partner Unrecaptured section 1250 1 8 T what type of this part da If this partner en plan (RASEKO checka 10 Nes section 1231 in 11 Orincome Partners share of profit loss and captal fra intro ) 50 N 5 012 Section 179 detiene 19 S0 5 0 Other deduction 2.00020 14 s emalamentaminen stades sement for sine informat Ending capital account. GADS ) Other explain) Problem 10-43 (LO. 7, 8, 9, 10, 11 Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $300,000, and the LLC has debts of $200,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that a c debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records. Ordinary income $900.000 W-2 wages to employees 200,000 Depreciation expense 300.000 Interest income 4.000 Long-term capital loss 16,000 Long-term capital gain 12,000 4.000 Charitable contribution (cash) Cash distribution to Amy Unadjusted basis of partnership depreciable property 20,000 1,500,000 Year-end LLC debt payable to unrelated parties is $140,000 Assume that all transactions are reflected in Amy's beginning capital and basis in the same manner. Also assume that all AM Products activities are eligible for the qualified business income deduction, and that the unadjusted basis of assets immediately after acquisition was $800,000 a. Calculate my basis in her LLC interest at the beginning and end of the tax LLC interest at the beginning of the year: 400,000 LLC interest at end of the year: 553,000 A partner's basis in the LLC interest is important for determining the treatment of distributions from the Llc to the partner, establishing the deductibility of losses, and calculating gain or loss on the partner's disposition of the interest. After the partner is admitted to the EC, partner's basis is adjusted for numerous items. b. What income, gains, losses, and deductions does Amy report on her in If an amount is zero, enter "0". Ordinary income 200,000 Net long-term capital gain Interest income Charitable contribution deduction Cash distribution C. Based on the information provided, what other calculations is Amy required to make Amy may be eligible to deduct up to 20 % of the ordinary income as qualified business income under 5 1994, and will make that calculation on her return. This deduction does not require a cash outflow by Amy or the cand it does not affect her basis of capital account. As someone treated as a general partner. Any's distributive share of the u s ordinary business income is subject to self-employment tax and possibly the additional Medicare tax. Her net investment income from the il may be subject to the additional tax under $1411 TC My Won Comed d. Prepare Amy's capital account rolforward from the beginning to the end of the tax year, How does her ending capital account differ from her ending basis as calculated in part (a)? Capital account balance beginning year 300,000 Ordinary income Interest Income Net long-term capital gain 205,000 505,000 Charitable contribution Cash distribution to Amy Capital account balance, end of year Amy's capital count differs from her basis only by the amount of her state of .. Using the information from parts (a) to prepare Amy's Schede - you were preparer of Ant Products LLC eur Drovide all information that my weds to the action you can For the Other information box use the following code Investment income for purpose of the investment interest expense deduction z. Section 199income: = W-2 wages: Unadused basis of parte des cible property Enter all amounts as positive numbers Schedule K- (Form 1065) 2018 651118 Final 1 CM 1545-0123 Part 11 Partner'share of Current Year Income Deduction credit and Items 1 Ordinary business income (los) Department of the Treasury Internal Revenue Service For calendar year 2016 beginning 2016 ending 2 Net rental real estate income Othernet rental income flow) 16 Poron transaction Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions. Part I Information About the Partnership A Partnership's employer identification number & Partnership's name, address, aty, state and ZIP code AM Products, LLC Guaranteed payments 4 5 nerest income 2.000 a Ordinary dividende IRS Center where partnership ied return e-file ob Qualified dividends 0 Chede if this is a publicly traded partnership (DTP) or Dividend equivalents Part II Information About the Partner 7 Royale Purtresidenteng number Partner address, city, state and ZIP code * Net short-term capital gain (los) 9a Netlong-term captalan Class) Geral part LLC member mited partner or the LLC 3.000 9b Collectibles (20) gain (los) E esti partner Foreign partner Unrecaptured section 1250 1 8 T what type of this part da If this partner en plan (RASEKO checka 10 Nes section 1231 in 11 Orincome Partners share of profit loss and captal fra intro ) 50 N 5 012 Section 179 detiene 19 S0 5 0 Other deduction 2.00020 14 s emalamentaminen stades sement for sine informat Ending capital account. GADS ) Other explain)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started