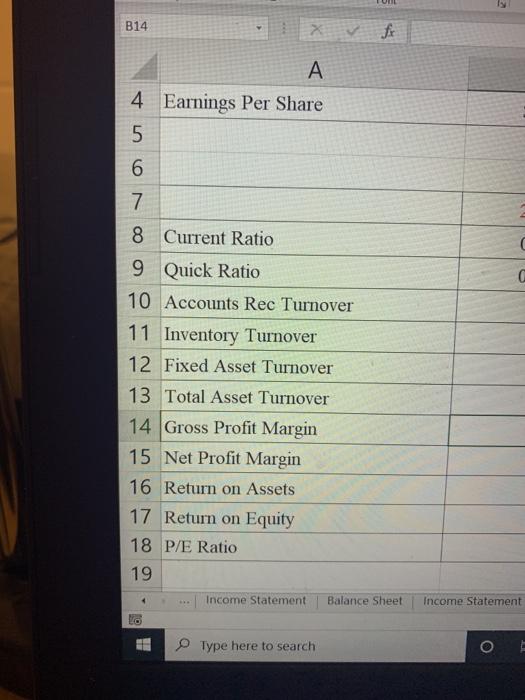

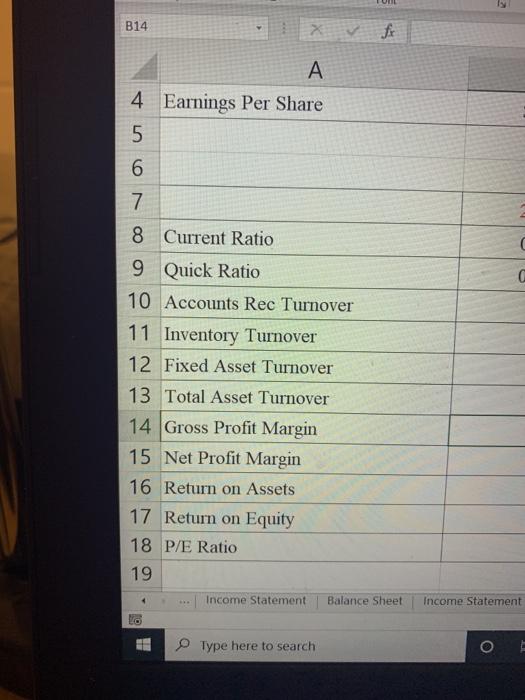

i am looming for these ratios using the income statements and balancd sheets from 2019 2018 2017 but i the names are all different comlared to the normal balance sheets. help?

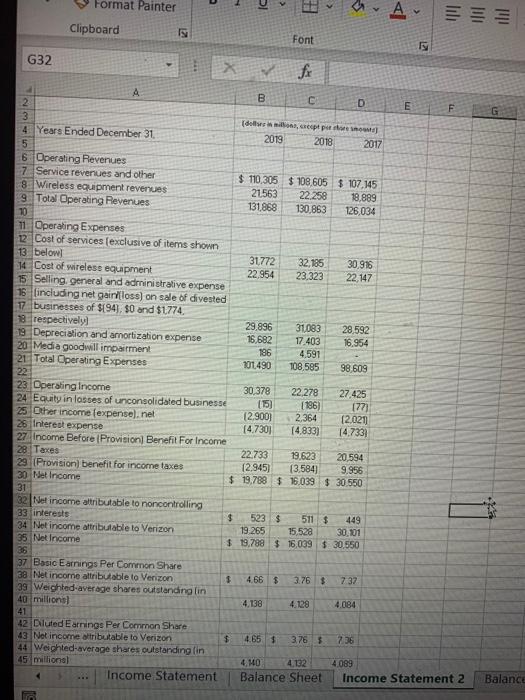

2 B14 4 Earnings Per Share 5 6 c 7 8 Current Ratio 9 Quick Ratio 10 Accounts Rec Turnover 11 Inventory Turnover 12 Fixed Asset Turnover 13 Total Asset Turnover 14 Gross Profit Margin 15 Net Profit Margin 16 Return on Assets 17 Return on Equity 18 P/E Ratio 19 Income Statement Balance Sheet Income Statement Type here to search o Format Painter 2 U A === Clipboard Font G32 fx E F G B C D 2 3 (doli, pepe 4 Years Ended December 31 2019 2018 2017 5 6 Operating Revenues 7 Service revenues and other $ 110,305 $ 108,605 $ 107.145 8. Wireless equipment revenues 21563 22.258 19,889 9 Total Operating Revenues 131.868 130,863 126,034 10 11. Operating Expenses 22 Cost of services (exclusive of items shown 13 below) 31772 32,185 30,916 14 Cost of wireless equipment 22,954 23.323 22,147 15 Selling general and administrative expense 16 lincluding net gain loss) on sale of divested 17 businesses of ${94). $0 and $1774. 18 respectively 29,896 31083 28,592 19 Depreciation and amortization expense 16,682 17.403 16.954 20 Media goodwill impairment 186 4,591 21 Total Operating Expenses 101.490 108.585 98 609 22 23 Operating Income 30 378 22,278 27.425 24 Equity in losses of unconsolidated businesse (15) (186) 177 25 Other income (expensel.net 12.900 2,364 (2,021 26 Interest expense [4.730) [4.833) 14.733) 27 ome Before Provision Benefit For Income 28. Taxes 22.733 19.623 20.594 29 (Provision) benefit for income taxes 12,945) (3,584) 9.956 30 Net Income $19,788 $ 16.039 $ 30.550 31 32 | Net income attributable to noncontrolling 33 interests $ 523 $ 511 $ 34 Net income attributable to Verizon 19.265 15,528 30.101 35 Net Income $ 19,788 $ 16,039 $ 30.550 449 4.66 $ 3.76 $ 737 4.138 4.128 4.084 37. Basic Earnings Per Common Share 38 Net income attributable to Verizon $ 39 Weighted average shares outstandina lin 40 millions) 41 42 Diluted Earrings Per Common Share 43 Net income attributable to Verizon $ 44 Weighted-average shares outstanding in 45 millional Income Statement 4.655 3.76 $ 736 4.MD 4.132 Balance Sheet 4089 Income Statement 2 Balance 2 B14 4 Earnings Per Share 5 6 c 7 8 Current Ratio 9 Quick Ratio 10 Accounts Rec Turnover 11 Inventory Turnover 12 Fixed Asset Turnover 13 Total Asset Turnover 14 Gross Profit Margin 15 Net Profit Margin 16 Return on Assets 17 Return on Equity 18 P/E Ratio 19 Income Statement Balance Sheet Income Statement Type here to search o Format Painter 2 U A === Clipboard Font G32 fx E F G B C D 2 3 (doli, pepe 4 Years Ended December 31 2019 2018 2017 5 6 Operating Revenues 7 Service revenues and other $ 110,305 $ 108,605 $ 107.145 8. Wireless equipment revenues 21563 22.258 19,889 9 Total Operating Revenues 131.868 130,863 126,034 10 11. Operating Expenses 22 Cost of services (exclusive of items shown 13 below) 31772 32,185 30,916 14 Cost of wireless equipment 22,954 23.323 22,147 15 Selling general and administrative expense 16 lincluding net gain loss) on sale of divested 17 businesses of ${94). $0 and $1774. 18 respectively 29,896 31083 28,592 19 Depreciation and amortization expense 16,682 17.403 16.954 20 Media goodwill impairment 186 4,591 21 Total Operating Expenses 101.490 108.585 98 609 22 23 Operating Income 30 378 22,278 27.425 24 Equity in losses of unconsolidated businesse (15) (186) 177 25 Other income (expensel.net 12.900 2,364 (2,021 26 Interest expense [4.730) [4.833) 14.733) 27 ome Before Provision Benefit For Income 28. Taxes 22.733 19.623 20.594 29 (Provision) benefit for income taxes 12,945) (3,584) 9.956 30 Net Income $19,788 $ 16.039 $ 30.550 31 32 | Net income attributable to noncontrolling 33 interests $ 523 $ 511 $ 34 Net income attributable to Verizon 19.265 15,528 30.101 35 Net Income $ 19,788 $ 16,039 $ 30.550 449 4.66 $ 3.76 $ 737 4.138 4.128 4.084 37. Basic Earnings Per Common Share 38 Net income attributable to Verizon $ 39 Weighted average shares outstandina lin 40 millions) 41 42 Diluted Earrings Per Common Share 43 Net income attributable to Verizon $ 44 Weighted-average shares outstanding in 45 millional Income Statement 4.655 3.76 $ 736 4.MD 4.132 Balance Sheet 4089 Income Statement 2 Balance