Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am needing help with question number 4, specifically the statement of retained earnings. As a recently hired accountant for a small business, SMC, Inc.,

I am needing help with question number 4, specifically the statement of retained earnings.

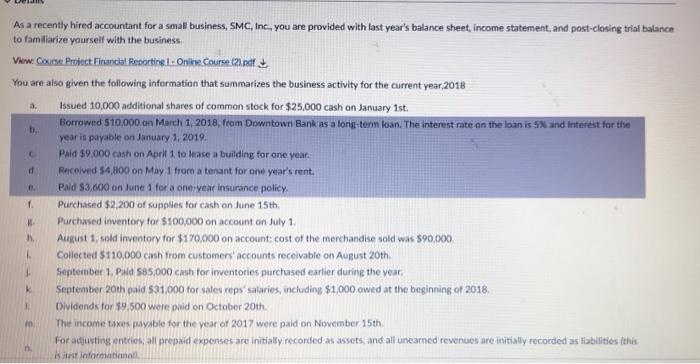

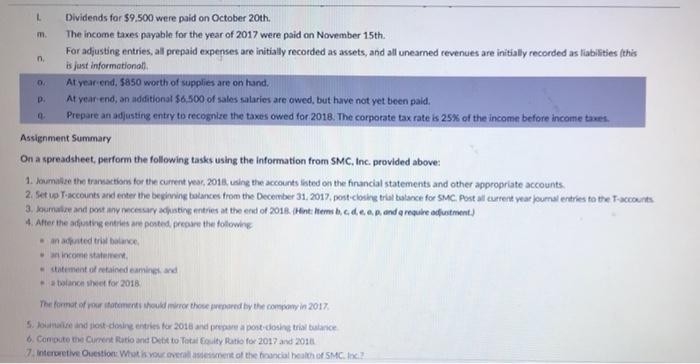

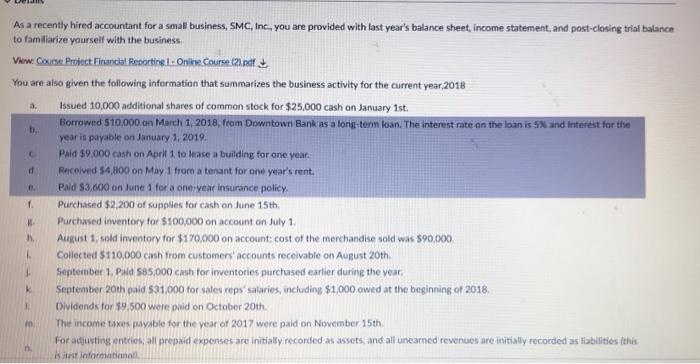

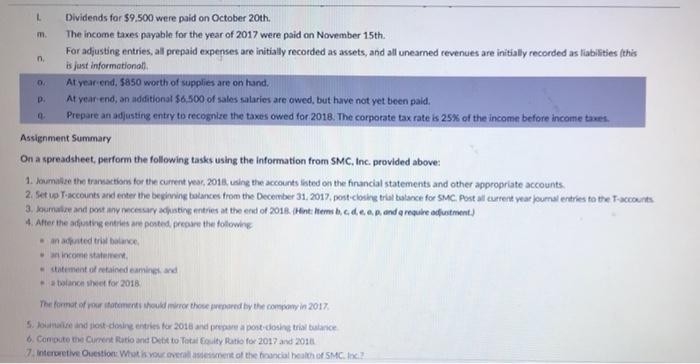

As a recently hired accountant for a small business, SMC, Inc., you are provided with last year's balance sheet, income statement, and post-closing trial balance to familiarize yourself with the business. View: Course Project Financial Reporting 1-Online Course (2).pdf You are also given the following information that summarizes the business activity for the current year 2018 a. Issued 10,000 additional shares of common stock for $25,000 cash on January 1st. b. Borrowed $10,000 on March 1, 2018, from Downtown Bank as a long-term loan. The interest rate on the loan is 5% and interest for the year is payable on January 1, 2019. C. Paid $9,000 cash on April 1 to lease a building for one year. Received $4,800 on May 1 from a tenant for one year's rent. Paid $3.600 on June 1 for a one-year insurance policy. Purchased $2,200 of supplies for cash on June 15th. B Purchased inventory for $100,000 on account on July 1. h. August 1, sold inventory for $170,000 on account; cost of the merchandise sold was $90,000. Collected $110,000 cash from customers' accounts receivable on August 20th. September 1, Paid $85,000 cash for inventories purchased earlier during the year. k September 20th paid $31,000 for sales reps salaries, including $1,000 owed at the beginning of 2018. Dividends for $9,500 were paid on October 20th m. The income taxes payable for the year of 2017 were paid on November 15th. n. For adjusting entries, all prepaid expenses are initially recorded as assets, and all unearned revenues are initially recorded as liabilities (this is just informational, d. 0. f. L Dividends for $9,500 were paid on October 20th. m. The income taxes payable for the year of 2017 were paid on November 15th. n. For adjusting entries, all prepaid expenses are initially recorded as assets, and all unearned revenues are initially recorded as liabilities (this is just informational). 0 At year-end, $850 worth of supplies are on hand. p. At year-end, an additional $6,500 of sales salaries are owed, but have not yet been paid. Prepare an adjusting entry to recognize the taxes owed for 2018. The corporate tax rate is 25% of the income before income taxes. Assignment Summary On a spreadsheet, perform the following tasks using the information from SMC, Inc. provided above: 1. Journalize the transactions for the current year, 2018, using the accounts listed on the financial statements and other appropriate accounts. 2. Set up T-accounts and enter the beginning balances from the December 31, 2017, post-closing trial balance for SMC. Post all current year journal entries to the T-accounts 3. Journalize and post any necessary adjusting entries at the end of 2018. (Hint: Items b, c. d. e. o. p. and a require adjustment) 4. After the adjusting entries are posted, prepare the following an adjusted trial balance, an income statement, statement of retained eamings, and a balance sheet for 2018 The format of your statements should mirror those prepared by the company in 2017. 5. Joumalize and post-closing entries for 2018 and prepare a post-closing trial balance 6. Compute the Current Ratio and Debt to Total Equity Ratio for 2017 and 2018 7. Interpretive Question: What is your overall assessment of the financial health of SMC. Inc.? As a recently hired accountant for a small business, SMC, Inc., you are provided with last year's balance sheet, income statement, and post-closing trial balance to familiarize yourself with the business. View: Course Project Financial Reporting 1-Online Course (2).pdf You are also given the following information that summarizes the business activity for the current year 2018 a. Issued 10,000 additional shares of common stock for $25,000 cash on January 1st. b. Borrowed $10,000 on March 1, 2018, from Downtown Bank as a long-term loan. The interest rate on the loan is 5% and interest for the year is payable on January 1, 2019. C. Paid $9,000 cash on April 1 to lease a building for one year. Received $4,800 on May 1 from a tenant for one year's rent. Paid $3.600 on June 1 for a one-year insurance policy. Purchased $2,200 of supplies for cash on June 15th. B Purchased inventory for $100,000 on account on July 1. h. August 1, sold inventory for $170,000 on account; cost of the merchandise sold was $90,000. Collected $110,000 cash from customers' accounts receivable on August 20th. September 1, Paid $85,000 cash for inventories purchased earlier during the year. k September 20th paid $31,000 for sales reps salaries, including $1,000 owed at the beginning of 2018. Dividends for $9,500 were paid on October 20th m. The income taxes payable for the year of 2017 were paid on November 15th. n. For adjusting entries, all prepaid expenses are initially recorded as assets, and all unearned revenues are initially recorded as liabilities (this is just informational, d. 0. f. L Dividends for $9,500 were paid on October 20th. m. The income taxes payable for the year of 2017 were paid on November 15th. n. For adjusting entries, all prepaid expenses are initially recorded as assets, and all unearned revenues are initially recorded as liabilities (this is just informational). 0 At year-end, $850 worth of supplies are on hand. p. At year-end, an additional $6,500 of sales salaries are owed, but have not yet been paid. Prepare an adjusting entry to recognize the taxes owed for 2018. The corporate tax rate is 25% of the income before income taxes. Assignment Summary On a spreadsheet, perform the following tasks using the information from SMC, Inc. provided above: 1. Journalize the transactions for the current year, 2018, using the accounts listed on the financial statements and other appropriate accounts. 2. Set up T-accounts and enter the beginning balances from the December 31, 2017, post-closing trial balance for SMC. Post all current year journal entries to the T-accounts 3. Journalize and post any necessary adjusting entries at the end of 2018. (Hint: Items b, c. d. e. o. p. and a require adjustment) 4. After the adjusting entries are posted, prepare the following an adjusted trial balance, an income statement, statement of retained eamings, and a balance sheet for 2018 The format of your statements should mirror those prepared by the company in 2017. 5. Joumalize and post-closing entries for 2018 and prepare a post-closing trial balance 6. Compute the Current Ratio and Debt to Total Equity Ratio for 2017 and 2018 7. Interpretive Question: What is your overall assessment of the financial health of SMC. Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started