Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am not sure how to fit the answer provided into the journal entry I was given (Answer provided and journal entry needed are below).

I am not sure how to fit the answer provided into the journal entry I was given (Answer provided and journal entry needed are below).

| Name | Hours Worked | Pay Rate | Federal Income Tax Withheld | Annual Earnings Prior to this check | ||||

| Richards, B. | 40 | $75 per hour | $300 | $138,000 | ||||

| Matthews, M. | 42 | $80 per hour | $320 | $140,000 | ||||

| Ramon, C. | 44 | $82 per hour | $355 | $0 | ||||

| Wong, S. | 46 | $90 per hour | $372 | $151,000 | ||||

| Additional information is as follows: | ||||||||

| The state income tax rate is 4%. Employees' federal income tax withholdings depend on various factors, and the amounts are as indicated in the above table. | ||||||||

| Overtime is paid at 150% (time and a half) of the normal hourly rate. | ||||||||

| Assume that gross pay is subject to social security taxes at a 6.5% rate, on an annual base of $142,800. Assume that Medicare/Medicaid taxes are 1.45% of gross earnings. These taxes are matched by the employer. | ||||||||

| Dish Pan has 100% participation in a $10 per paycheck employee charitable contribution program. These contributions are withheld from weekly pay. | ||||||||

| Dish Pan's payroll is subject to federal (0.6%) and state (1.5%) unemployment taxes on each employee's gross pay, up to $7,000 per year. All employees had earned in excess of $7,000 in the months leading up to November, with the exception of Carlita Ramon. This was Carlita's first week with the company. | ||||||||

| Dish Pan employees are expected to wear company unifroms. Each employee has $15 taken from their paycheck each week to cover the cost of the uniforms. | ||||||||

*** Prepare journal entries for Dish Pan's payroll and the related payroll expenses. The dates and memo entries are already provided.

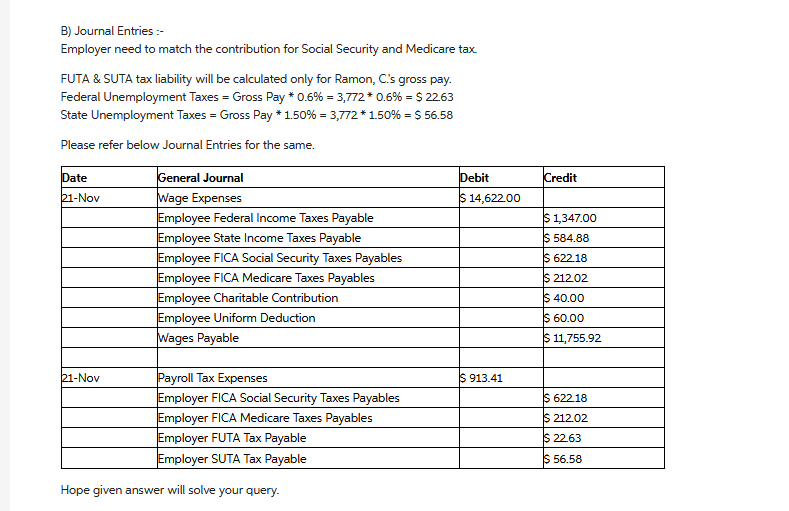

Answer provided

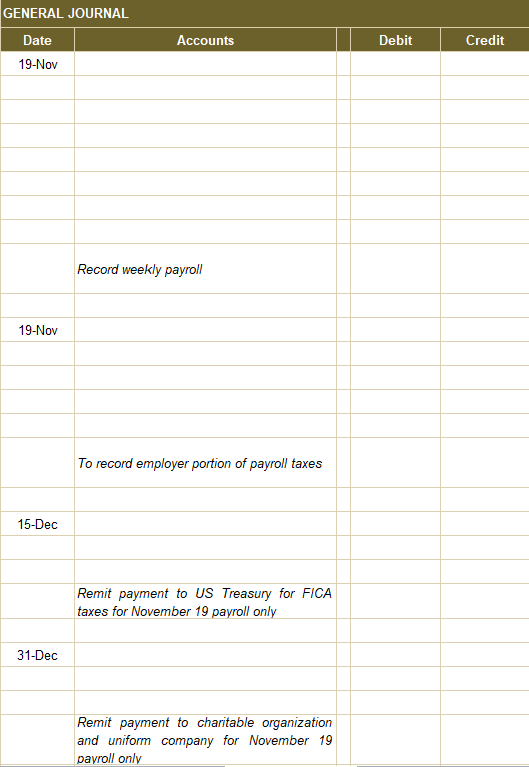

*** Journal entry format I need it in:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started