Question

I am only having trouble to determine the liability here. If you can please review the question, T account, and then please answer the liability

I am only having trouble to determine the liability here. If you can please review the question, T account, and then please answer the liability question:

"What liabilities does the business have after all transactions have been recorded?"

Question:

The accountant for the firm owned by Randy Guttery prepares financial statements at the end of each month. The following transactions for Randy Guttery, Landscape Consultant took place during the month ended June 30, 2019. The following transactions are for Randy Guttery, Landscape Consultant.

I just need assistance with the second part of the question, which is:

Also, if you can please provide to me how you came up with the answer?

Thanks

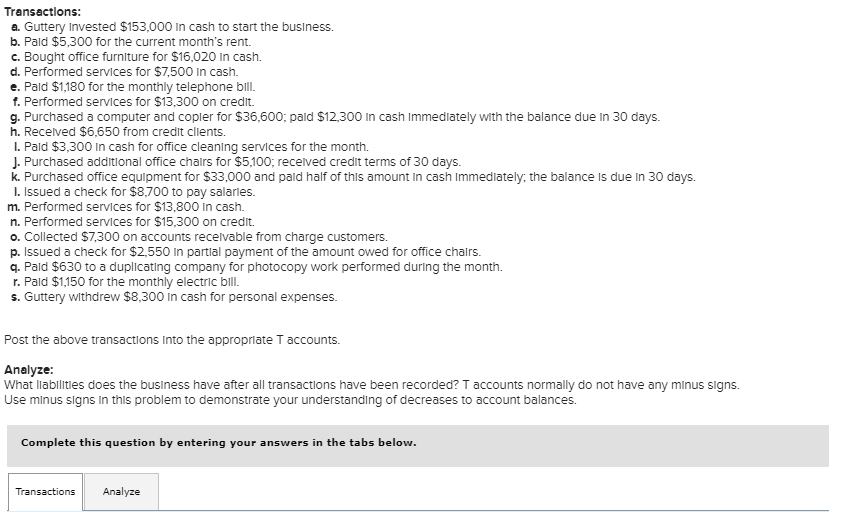

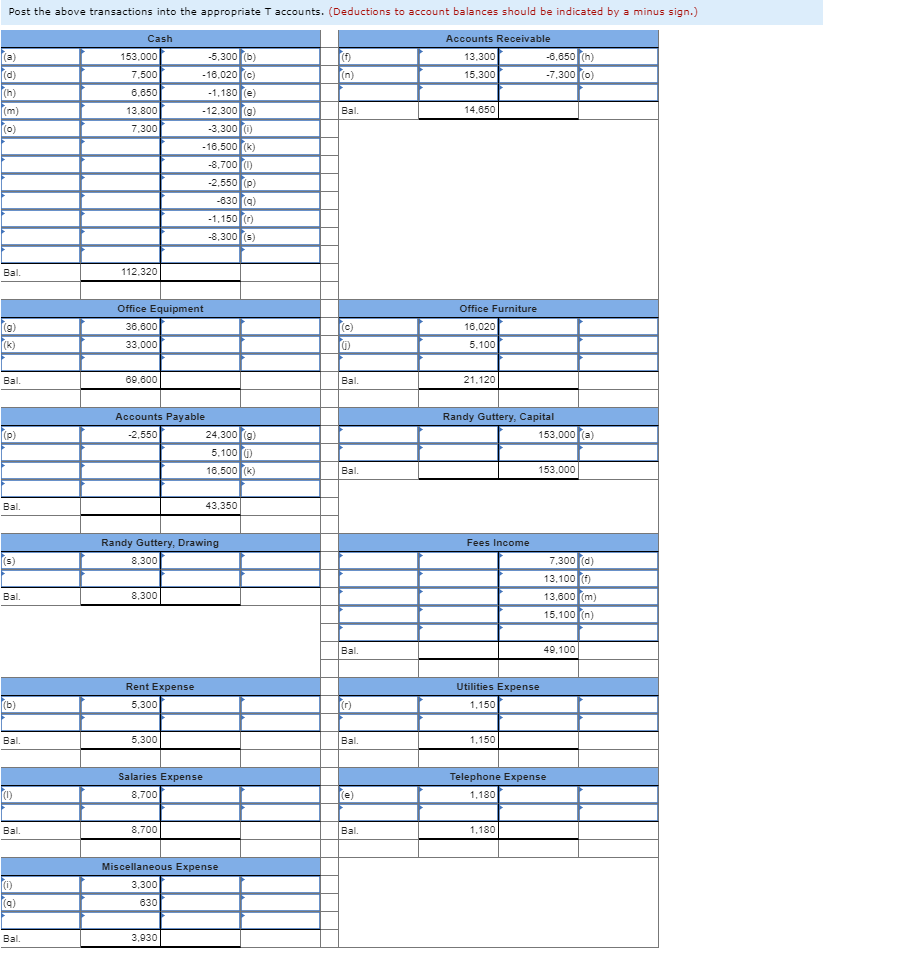

Transactlons: a. Guttery Invested $153,000 In cash to start the business. b. Pald $5,300 for the current month's rent. c. Bought office furniture for $16,020 In cash. d. Performed services for $7,500 In cash. e. Pald $1,180 for the monthly telephone bill. f. Performed services for $13,300 on credit. g. Purchased a computer and copler for $36,600; pald $12,300 In cash Immedlately with the balance due In 30 days. h. Recelved $6,650 from credit clients. l. Pald $3,300 In cash for office cleaning services for the month. J. Purchased additional office chairs for $5,100; recelved credit terms of 30 days. k. Purchased office equipment for $33,000 and pald half of thls amount In cash Immediately, the balance is due In 30 days. I. Issued a check for $8,700 to pay salaries. m. Performed services for $13,800 In cash. n. Performed services for $15,300 on credit. o. Collected $7,300 on accounts recelvable from charge customers. p. Issued a check for $2,550 In partial payment of the amount owed for office chalrs. q. Pald $630 to a duplicating company for photocopy work performed during the month. r. Pald $1,150 for the monthly electric bill. s. Guttery withdrew $8,300 In cash for personal expenses. Post the above transactions Into the appropriate T accounts. Analyze What liabilities does the business have after all transactions have been recorded? T accounts normally do not have any minus signs. Use minus signs In this problem to demonstrate your understanding of decreases to account balances. Complete this question by entering your answers in the tabs below Transactions AnalyzeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started