Answered step by step

Verified Expert Solution

Question

1 Approved Answer

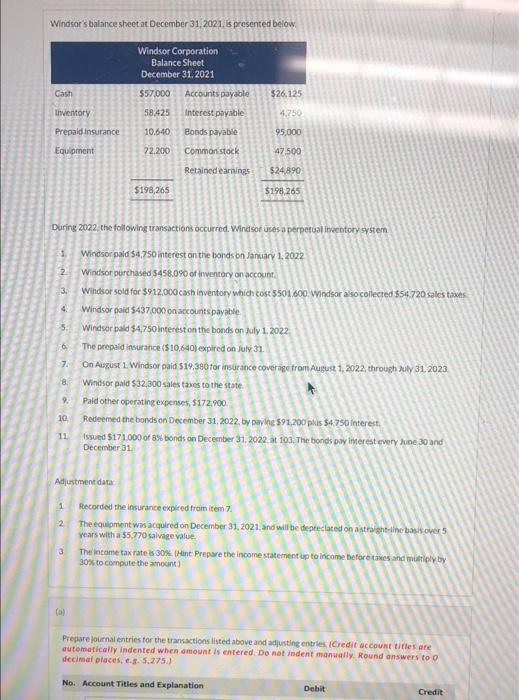

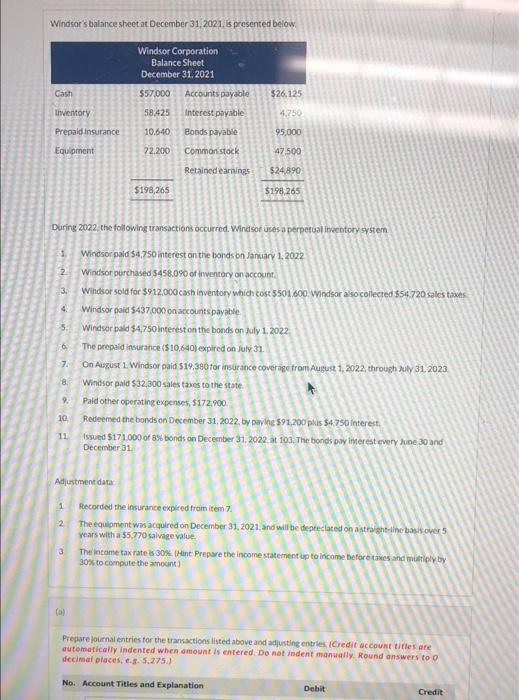

I am only missing the adjusting entries, so from 12 to 14 Windsor balance sheet at December 31, 2021. is presented below Windsor Corporation Balance

I am only missing the adjusting entries, so from 12 to 14

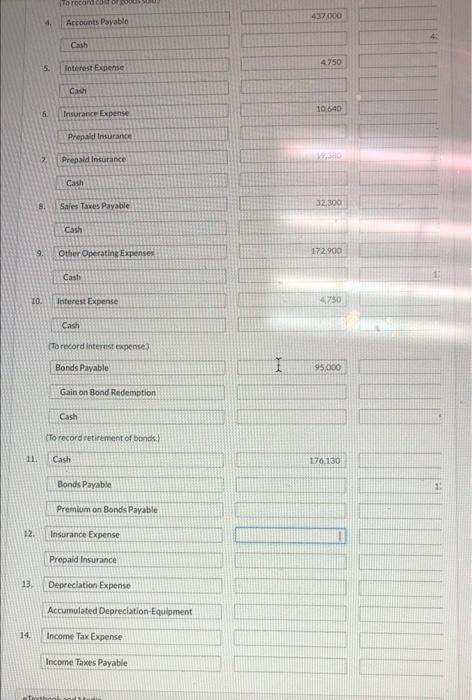

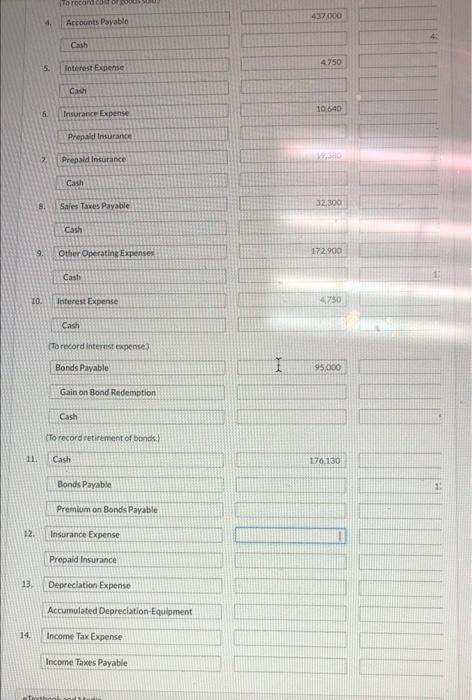

Windsor balance sheet at December 31, 2021. is presented below Windsor Corporation Balance Sheet December 31, 2021 Cash $57.000 $26.125 Accounts payable Interest payable Inventory 58.425 4.750 Prepaid insurance 10.640 Boods payable 95,000 Equipment 72.200 Common stock 47.500 Retained earnings $24.890 $198,265 $198.265 During 2022, the following transactions occurred. Windsor uses a perpetual inventory system 1 2 3. 4. 5 6 Windsor paid $4,750 interest on the bonds on January 1, 2022 Windsor purchased $458.0% of inventory on account Windsor sold for $912.000 cash inventory which cost 3501.600 Windsor also collected $54.720 sales taxes Windsor paid $437,000 on accounts payable Windsor paid $4.750 interest on the bonds on July 1, 2022 The prepaid insurance ($10.640) expired on July 31 On August 1, Windsor said 519.380 for insurance coverage from August 1, 2022, through July 31, 2023. Windsor paid $32,300 sales taxes to the state Pald other operating expenses, 5172.900 Redeemed the bonds on December 31, 2022, by wine 591.200 plus $4.750 Interest, Issued $171.000 of 8% bonds on December 31, 2022 at 103. The bonds pay interest every June 30 and December 31 7 8 . 10. 11 Adjustment data 1 2 Recorded the insurance expired from item 7. The equipment was acquired on December 31, 2021, and will be deprecated on a straight-line basis over 5 years with a $5.770 salvage value The income tax rate is 30%. (Hint Prepare the income statement up to income before times and multiply by 30% to compute the amount 3 Prepare journal entries for the transactions listed above and adjusting entries (Credit account tities are automatically indented when amount is entered. Do not indent manually. Round answers to o decimal places, s. 5.275.) No. Account Titles and Explanation Debit Credit Troca SOS 437,000 Accounts Payable Cash 4.750 5. Interest Expense Casi 10.640 5. Insurance Expense Prepaid Insurance Prenald Insurance Cash 32,300 Sales Taxes Payable Cash 9. Other Operating Expenses 172.900 Cash TO Interest Expense 4750 Cash To record interest expense) Bonds Payable 1 95,000 Gain on Bond Redemption Cash To record retirement of bonds) 11 Cash 176.130 Bonds Payable 1 Premium on Bonds Payable 12 Insurance Expense Prepaid Insurance 13 Depreciation Expense Accumulated Depreciation Equipment 14. Income Tax Expense Income Taxes Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started