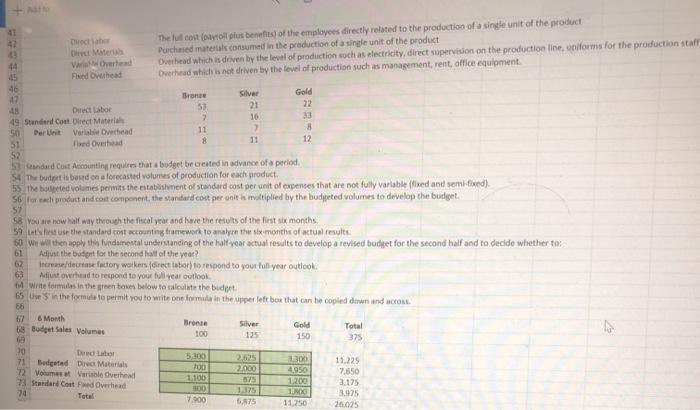

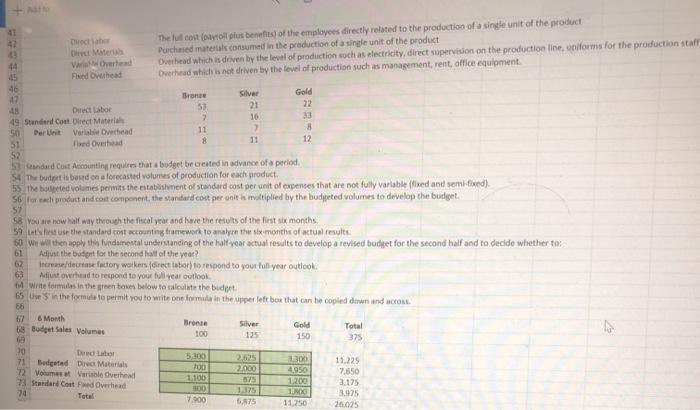

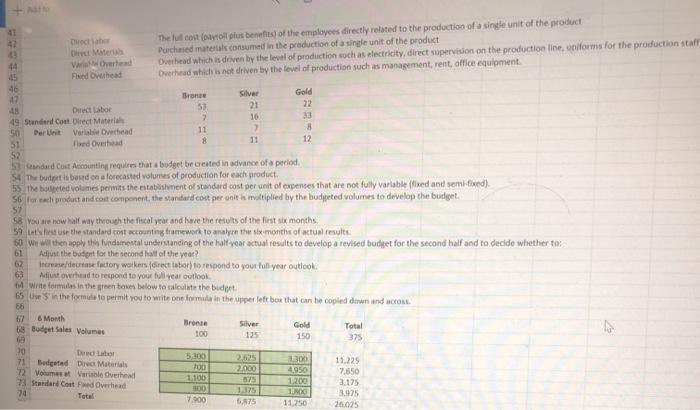

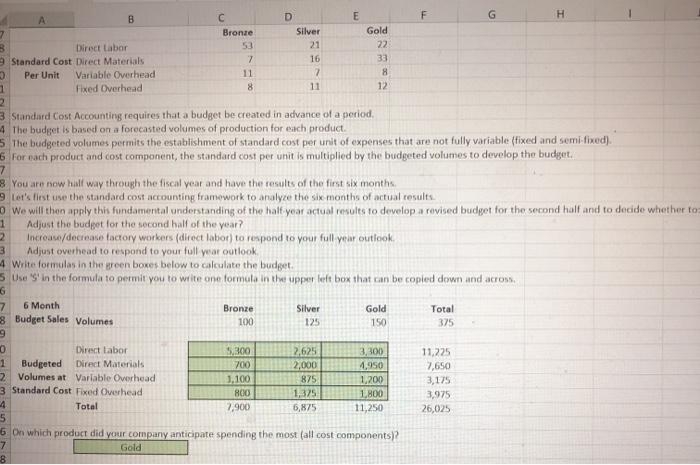

i am posting all infirmation please complete all the green table calculation with formula and first one i did that is right or wrong . if i did wrong first table please do that too.

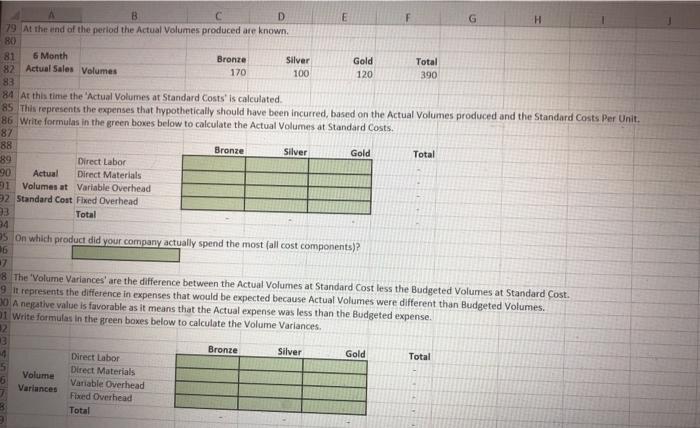

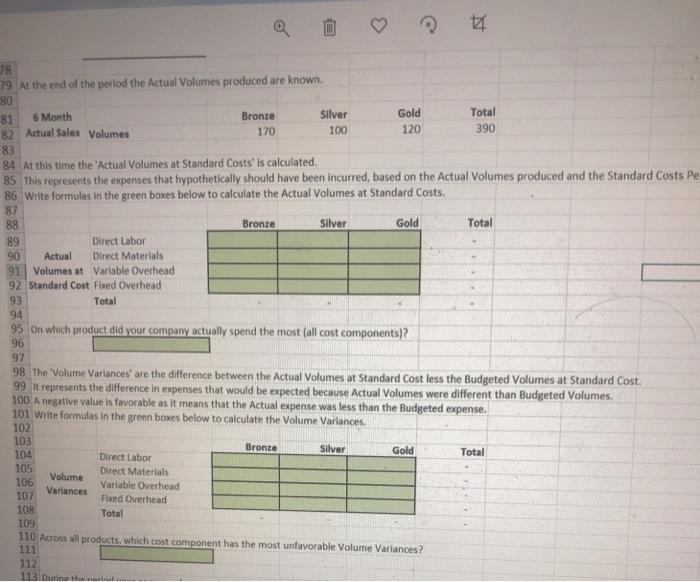

please use this last picture to provide the first picture answer.

Thus the information i got from my homework to solve that problem this one i did. is it right or wrong check please?

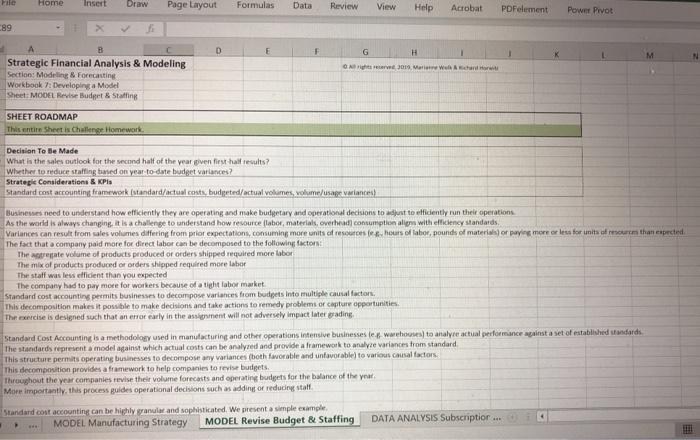

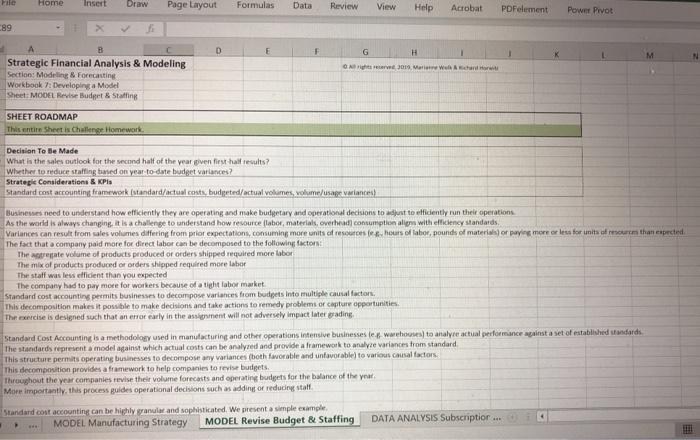

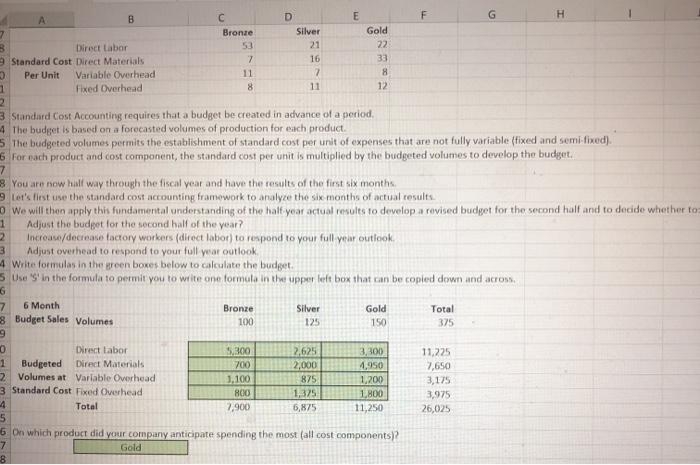

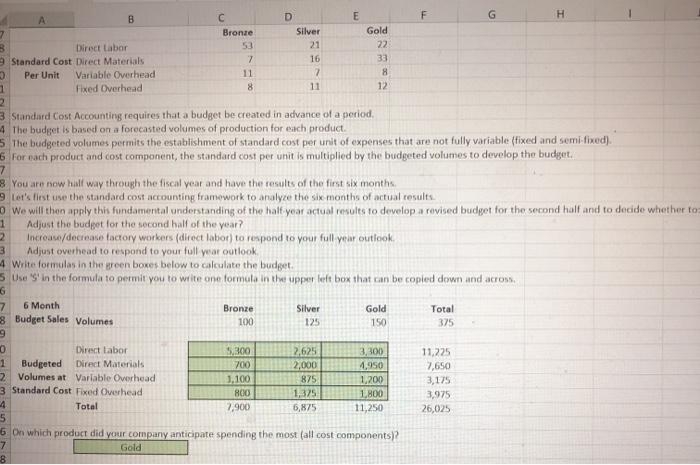

B C D E F G H 79 At the end of the period the Actual Volumes produced are known 80 81 6 Month Bronze Silver Gold Total 82 Actual Sales Volumes 170 100 120 390 83 84 At this time the 'Actual Volumes at Standard Costs' is calculated 85. This represents the expenses that hypothetically should have been incurred, based on the actual Volumes produced and the Standard Costs Per Unit. 86 Write formulas in the green boxes below to calculate the actual Volumes at Standard Costs. 87 88 Bronze Silver Gold Total 89 Direct Labor 90 Actual Direct Materials 91 Volumes at Variable Overhead 2 Standard Cost Fixed Overhead 23 Total 34 5 On which product did your company actually spend the most (all cost components)? 16 7 8 The 'Volume Variances are the difference between the actual Volumes at Standard Cost less the Budgeted Volumes at Standard Cost. 9 it represents the difference in expenses that would be expected because Actual Volumes were different than Budgeted Volumes. 30 A negative value is favorable as it means that the Actual expense was less than the Budgeted expense. 01 Write formulas in the green boxes below to calculate the Volume Variances, 2. 3 Bronze Silver Gold Total Direct Labor Direct Materials Volume Variable Overhead Variances Fixed Overhead Total File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat PDFelement Power Pivot -89 D G O, 3011, Marie Welcando Strategic Financial Analysis & Modeling Section: Modeling & Forecasting Workbook 7. Developing a Model Sheet: MODEL Revise Budget & Staffing SHEET ROADMAP This entire Sheet is Challenge Homework Decision To Be Made What is the sales outlook for the second half of the year given first half results? Whether to reduce staffing tuned on year to date budget varlances? Strategie Considerations & KP Standard cost accounting framework (standard/actual consta, budgeted/actual volumes, volume/usage variantes Businesses need to understand how efficiently they are operating and make budgetary and operational decisions to adjust to idently run their operations As the world is always changing. It is a challenge to understand how resource (labor materials, overhead consumption align with efficiency standards Variances can result from sales volumes differing from prior expectations, consuming more units of resources hours of labor, pounds of materials) or paying more or less for units our than expected The fact that a company paid more for direct labor can be decomposed to the following factors The agregate volume of products produced or orders shipped required more labor The mix of products produced or orders shipped required more labor The staff was less efficient than you expected The company had to pay more for workers because of a tight labor market Standard cost accounting permits businesses to decompose variances from budgets into multiple causal factors This decomposition makes it possible to make decisions and take actions to remedy problems or capture opportunities The exercise is designed such that an error early in the assignment will not adversely impact later grading Standard Cost Accounting is a methodology used in manufacturing and other operations intensive businesses te wwehouses) to analyre actual performance against a set of established standards The standards represent a model against which actual costs can be analyzed and provide a framework to analyze variances from standard This structure permits operating businesses to decompose any variances (both favorable and unfavorable to various causal factors This decomposition provides a framework to help companies to revise budgets Throughout the year companies revise their volume forecasts and operating budgets for the balance of the year More importantly, this process guides operational decisions such as adding or reducing staff Standard cost accounting can be highly granular and sophisticated. We present simple example MODEL. Manufacturing Strategy MODEL Revise Budget & Staffing DATA ANALYSIS Subscriptior... ta 78 79 At the end of the period the Actual Volumes produced are known. SO 81 6 Month Bronze Silver Gold Total 82 Actual Sales Volumes 170 100 120 390 83 84 At this time the 'Actual Volumes at Standard Costs' is calculated 85 This represents the expenses that hypothetically should have been incurred, based on the Actual Volumes produced and the Standard Costs Pe 86 Write formulas in the green boxes below to calculate the actual Volumes at Standard Costs. 87 88 Bronze Silver Gold Total 89 Direct Labor 90 Actual Direct Materials 91 Volumes at Variable Overhead 92 Standard Cost Fixed Overhead 93 Total 94 95 on which product did your company actually spend the most (all cost components)? 96 97 105 98 The 'Volume Variances are the difference between the Actual Volumes at Standard Cost less the Budgeted Volumes at Standard Cost 99 lt represents the difference in expenses that would be expected because Actual Volumes were different than Budgeted Volumes. 100 A negative value is favorable as it means that the Actual expense was less than the Budgeted expense. 101 Write formulas in the green boxes below to calculate the Volume Variances. 102 103 Bronte Silver Gold Total 104 Direct Labor Direct Materials Volume 106 Variable Overhead Variances 107 Fixed Overhead 108 Total 109 110 Across all products, which cost component has the most unfavorable Volume Variances? 111 112 113 in the 42 The full cost faytoll plus benefits of the employees directly related to the production of a single unit of the product Purchased materials consumed in the production of a single unit of the product Overhead which is driven by the level of production soichas electricity, direct supervision on the production line, on forms for the production staff Overhead which is not driven by the level of production such as management, rent, office equipment Overhead Fund Othead Silver Gold 17 53 21 Direct Labor 22 ? 16 33 49 Standard Cont Direct Material Der Unit 11 8 Variable Overhead 7 12 51 Tood Overhead 52 51 dard Cost Accounting requires that a budget be created in advance of a period 54 The budget is based on a forecasted volumes of production for each product. 55 The botted volumes permits the establishment of standard cost per unit of expenses that are not fully variable(fixed and semified) S6 for and product and cost component, the standard cost per unit le viltiplied by the budgeted volumes to develop the budget. 57 58 You are now half way through the fiscal year and are the results of the first six months Laiuse the standard cost accounting framework to analyze the six months of actual results 60 We will then apply the fundamental understanding of the half year actual results to develop a revised budget for the second half and to decide whether to: 61 Adjust the budget for the second half of the year? 62 Increase/decreme factory workers (direct labor) to respond to your full year outlook 63 Adjust overhead to respond to your full year outlook write formules in the green boxes below to calculate the budget 65 Use the formule to permit you to write one formula in the upper left box that can be copied down and across 66 67 6 Month Silver Gold Budget Sales Volume Total 100 150 375 70 Ducator 5300 2,525 71 Budget Direct Materials 11.225 700 72 Volumes Variable Overhead 2.000 4,950 7.650 73 Standard Couted Overhead 1.100 375 1.200 2.125 74 300 Total 1.30 3.925 7.900 675 11.250 20.025 Bronze 1300 D E F B G 7 3 F Bronze Silver Gold Direct Labor 53 21 22 Standard Cost Direct Materials 7 16 33 Per Unit Variable Overhead 11 7 8 1 Fixed Overhead 8 11 12 2 3 Standard Cost Accounting requires that a budget be created in advance of a period 4 The budget is based on a forecasted volumes of production for each product 5 The budgeted volumes permits the establishment of standard cost per unit of expenses that are not fully variable (fixed and semi-fixed). 6 For each product and cost component, the standard cost per unit is multiplied by the budgeted volumes to develop the budget. 7 You are now hall way through the fiscal year and have the results of the first six months. 9 Let's first use the standard cost accounting framework to analyze the six months of actual results We will then apply this fundamental understanding of the half year actual results to develop a revised budget for the second half and to decide whether to 1 Adjust the budget for the second half of the year? 2 Incroa/decrease factory workers (direct labor) to respond to your full year outlook. 3 Adjust overhead to respond to your full year outlook 4 Write formulas in the green boxes below to calculate the budget 5 User 'S' in the formula to permit you to write one formula in the upper left box that can be copied down and across G 7 6 Month Bronze Silver Gold Total 3 Budget Sales Volumes 100 125 150 375 0 Direct labor 5,300 2.625 3,300 1 Budgeted Direct Materials 700 2,000 4,950 2 Volumes at Variable Overhead 3.100 875 1,200 3 Standard Cost Fixed Overhead 800 1,375 1,800 4 Total 7,900 6,875 11,250 5 6 On which product did your company anticipate spending the most (all cost components) 7 Gold 8 11.225 7,650 3,175 3,975 26,025