i am struggling with this. please help!

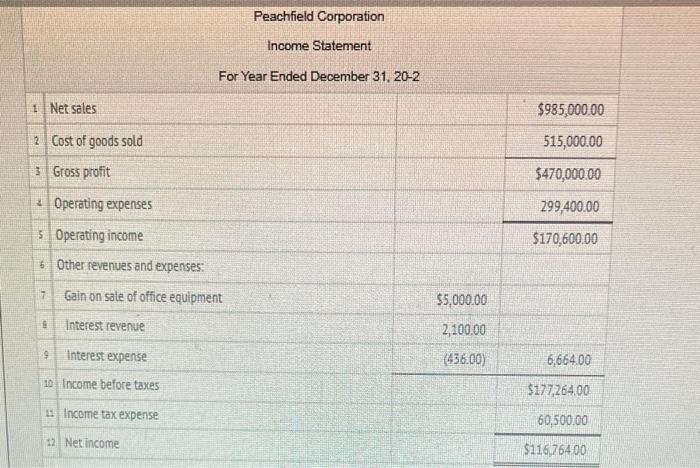

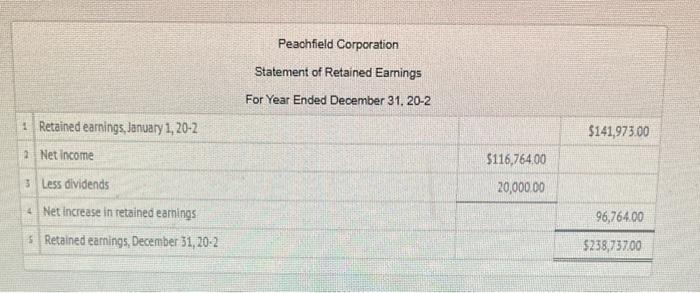

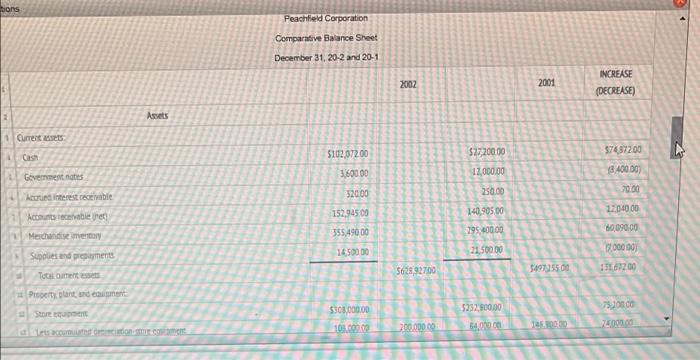

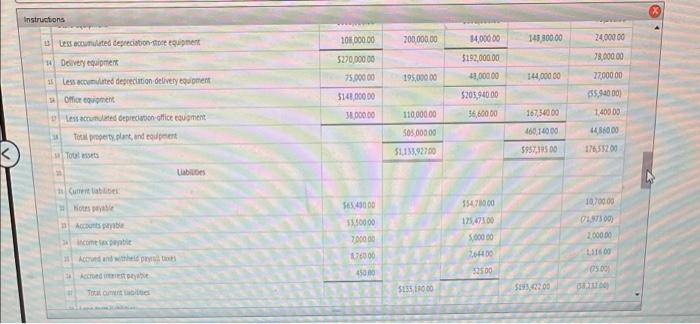

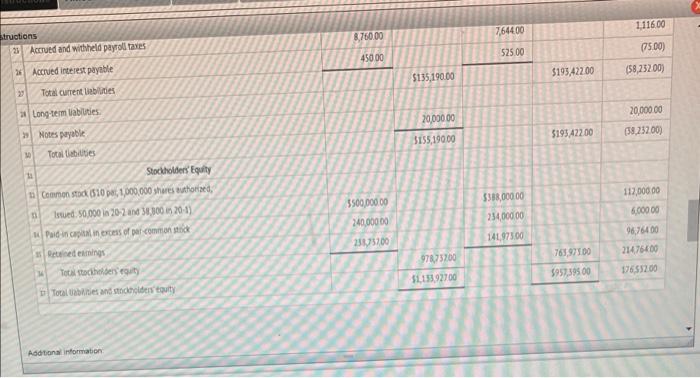

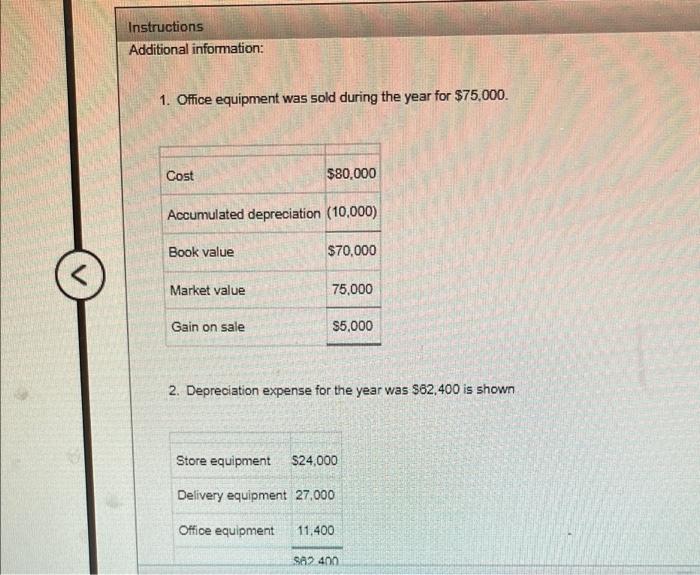

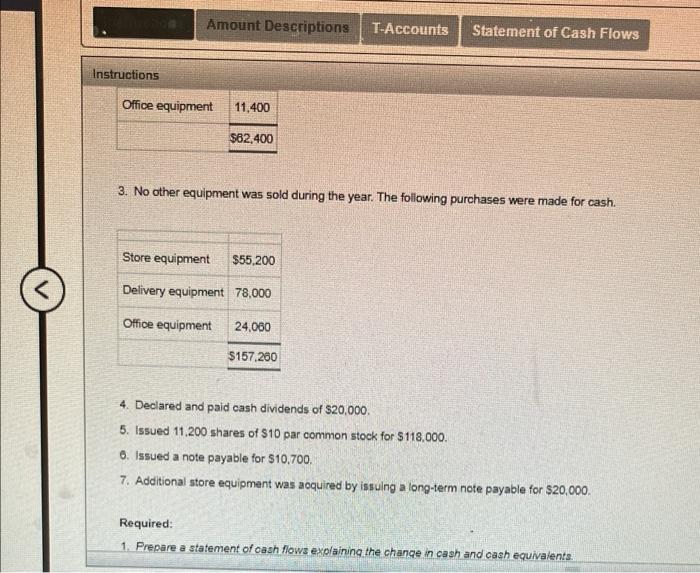

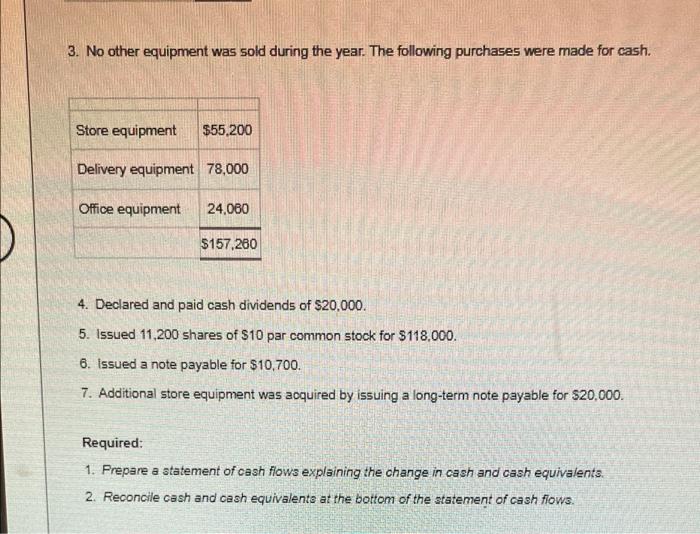

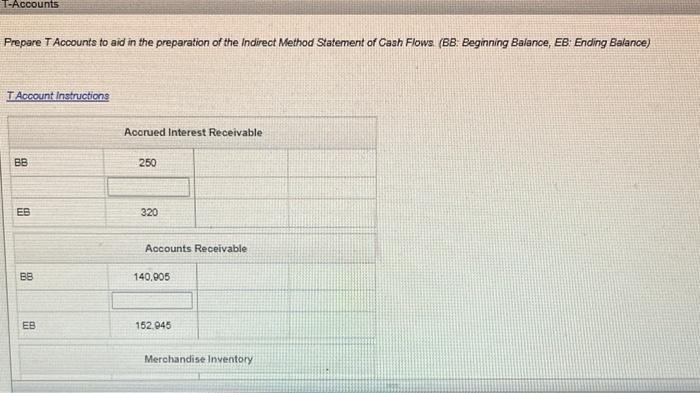

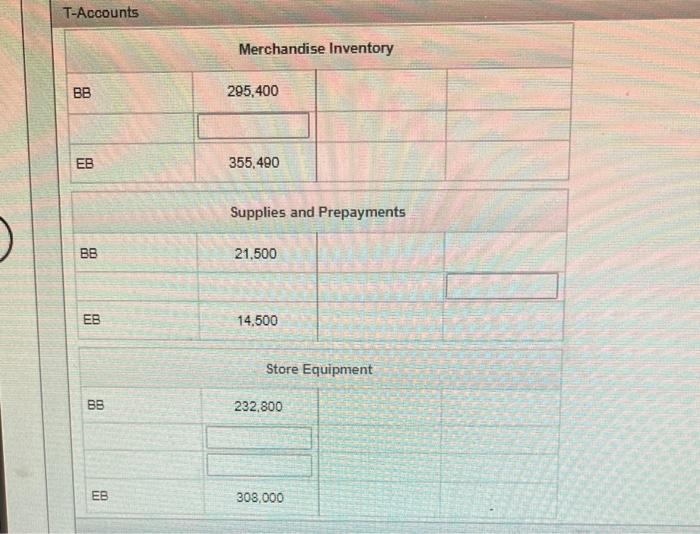

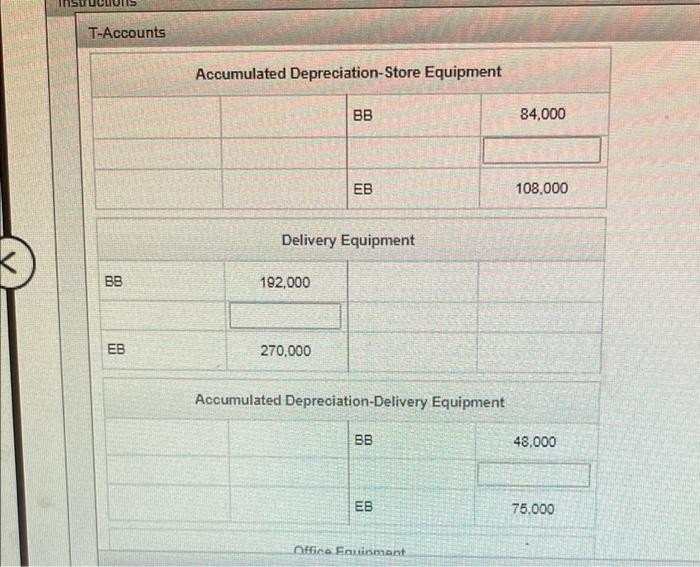

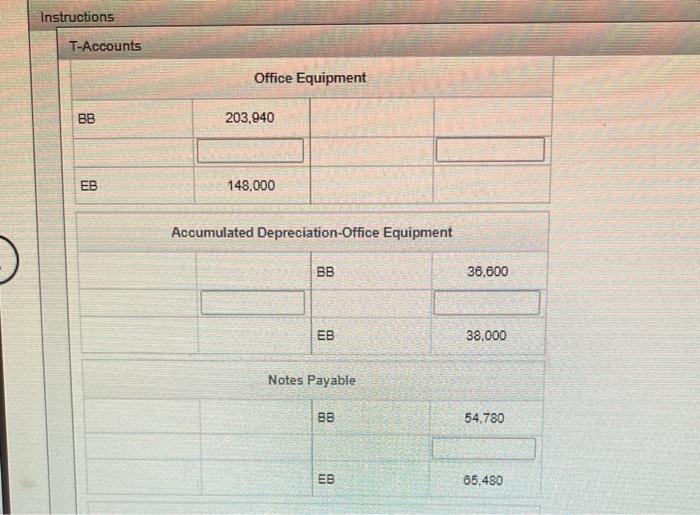

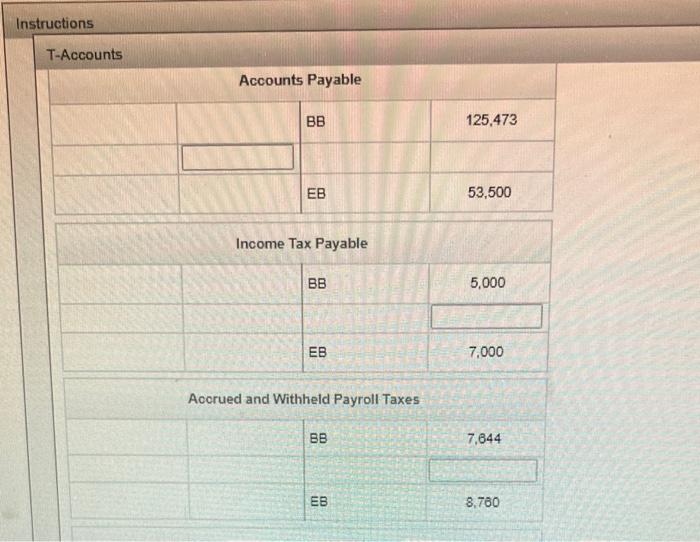

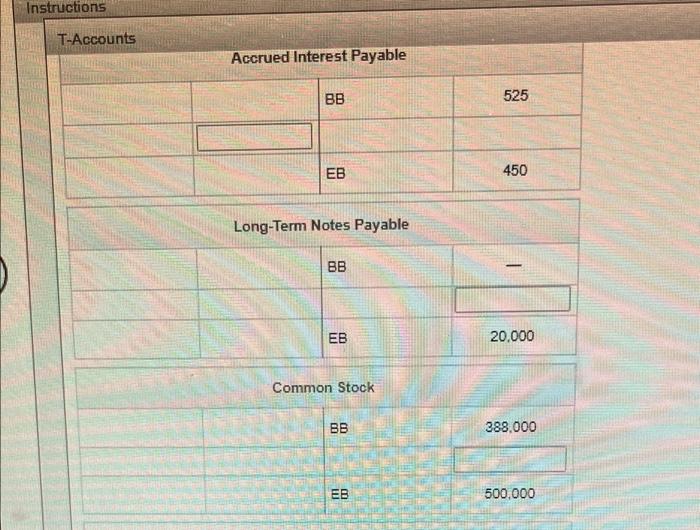

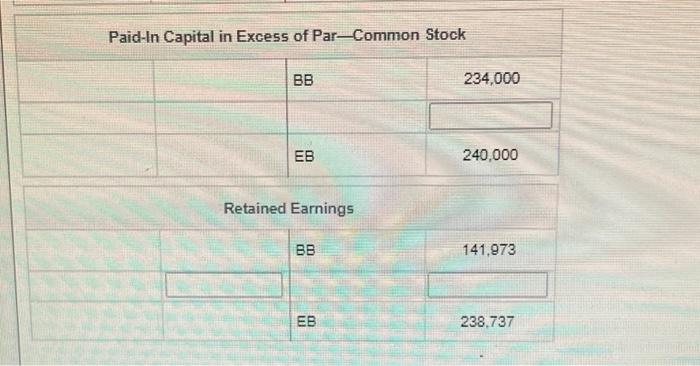

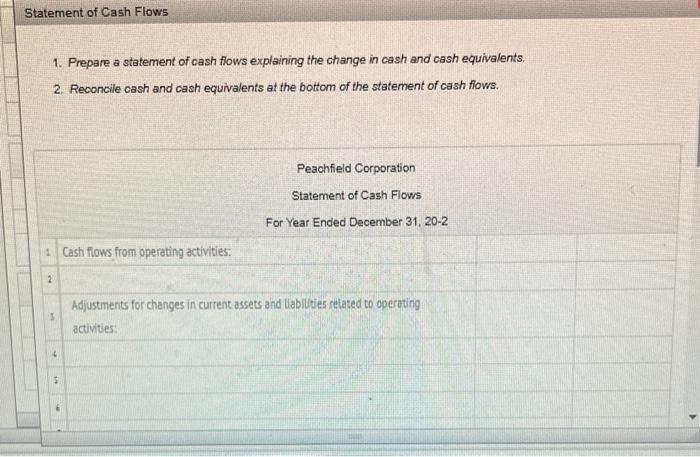

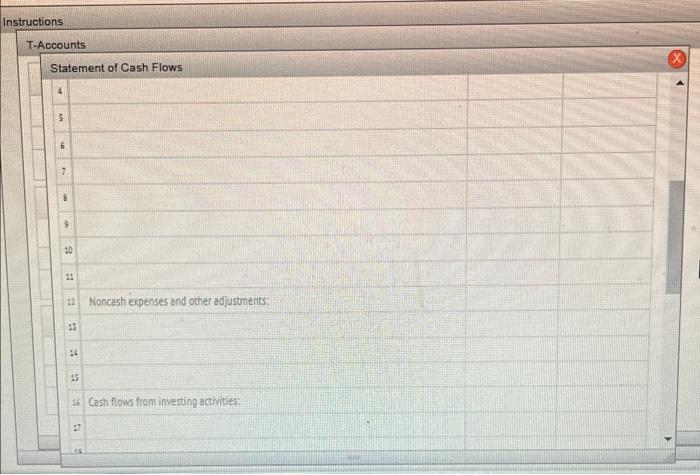

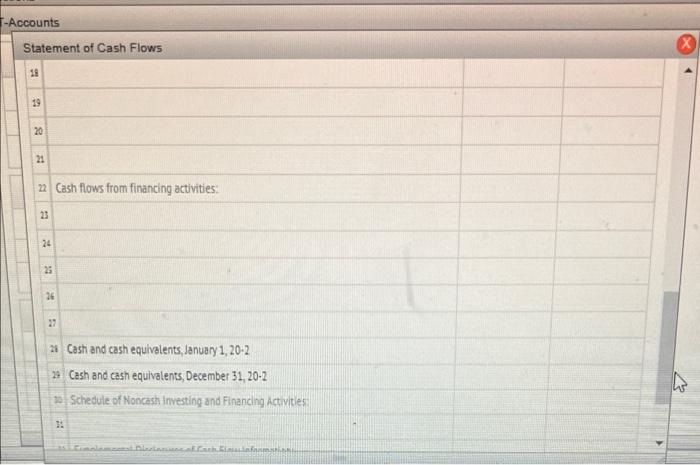

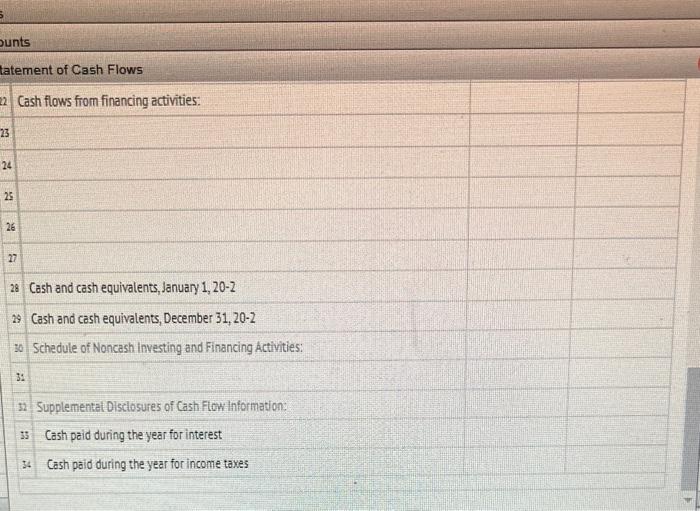

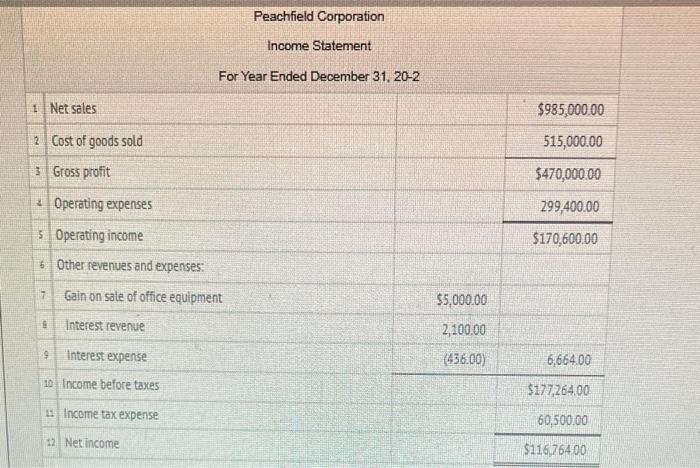

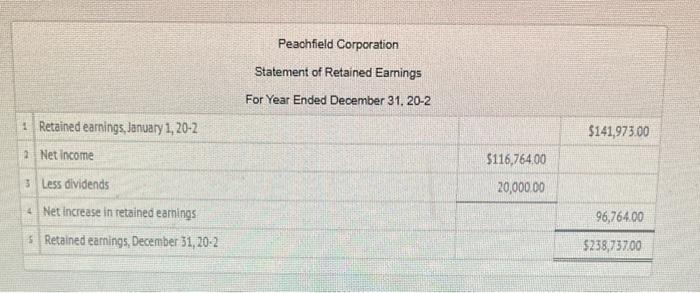

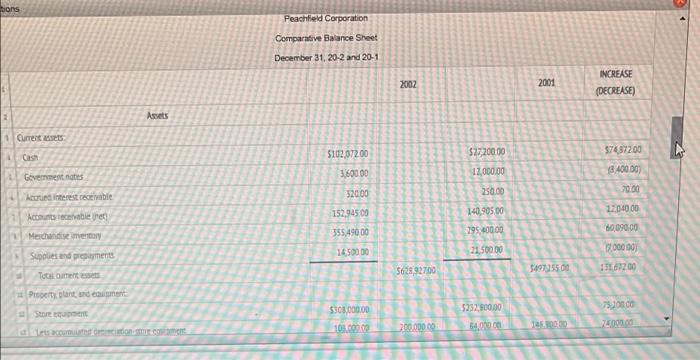

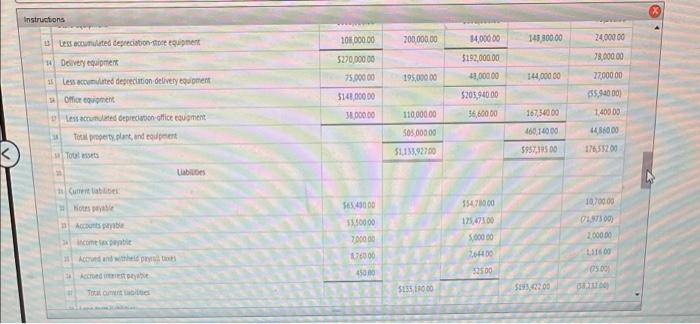

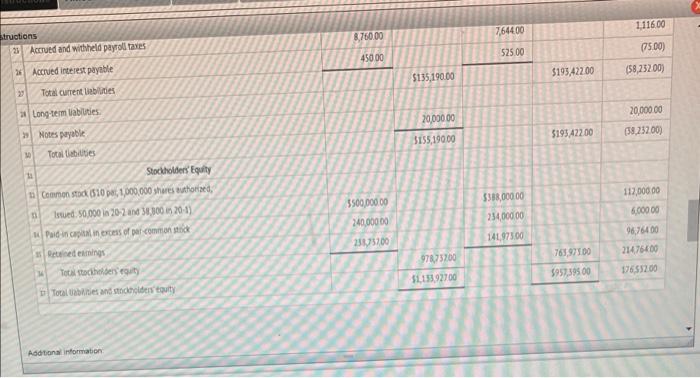

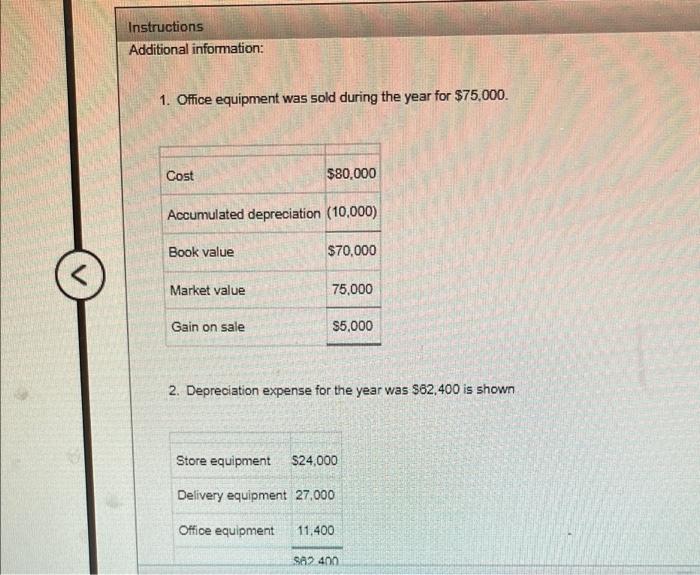

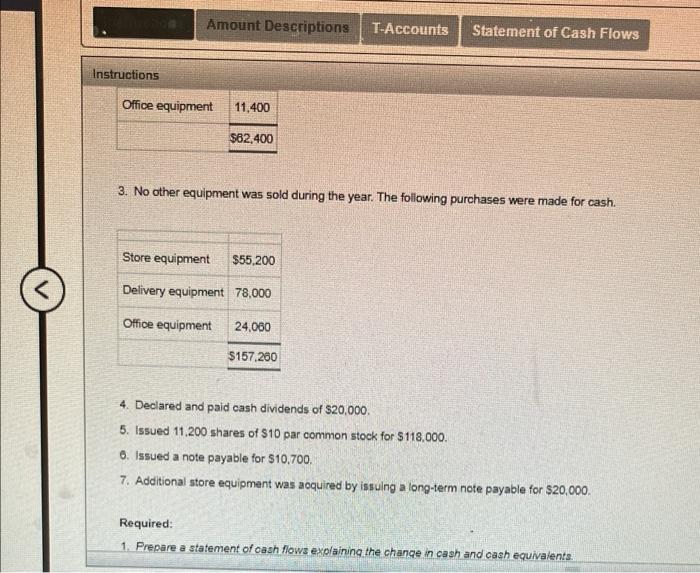

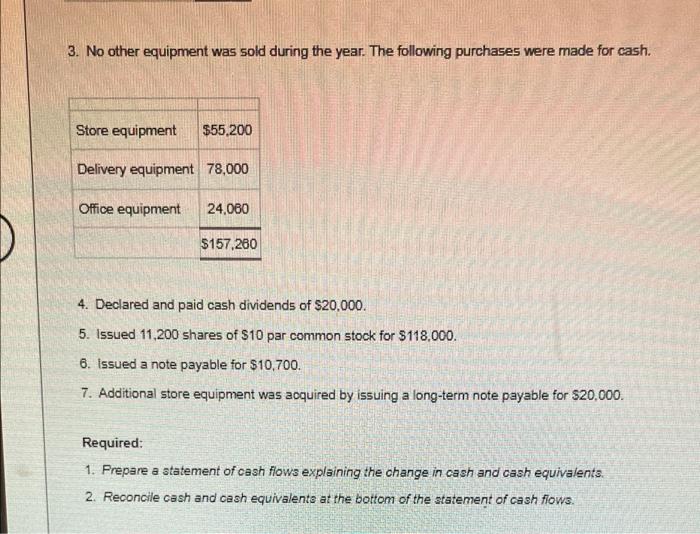

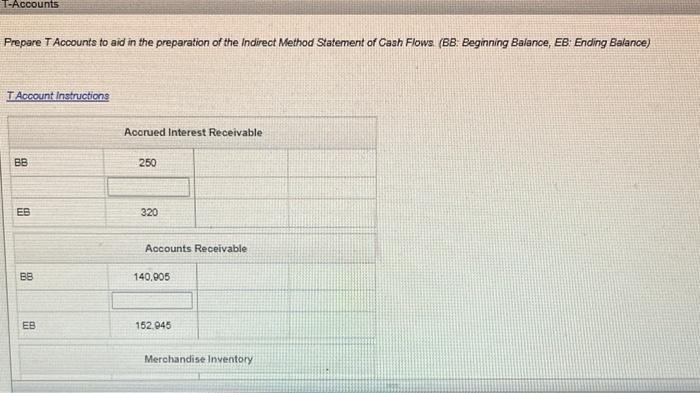

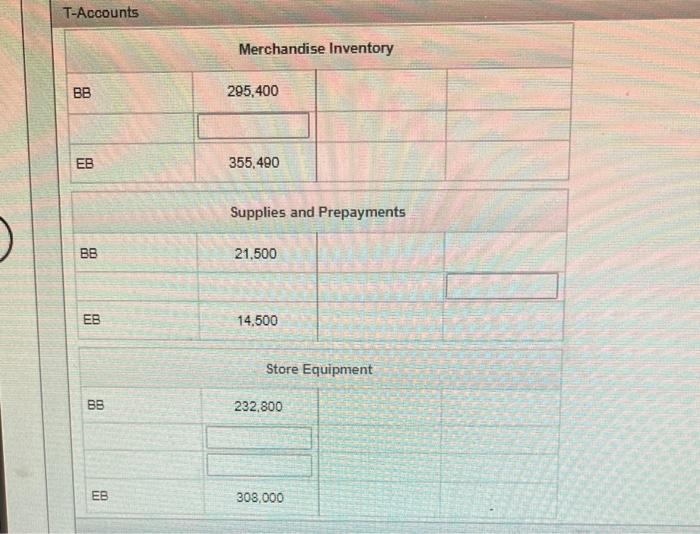

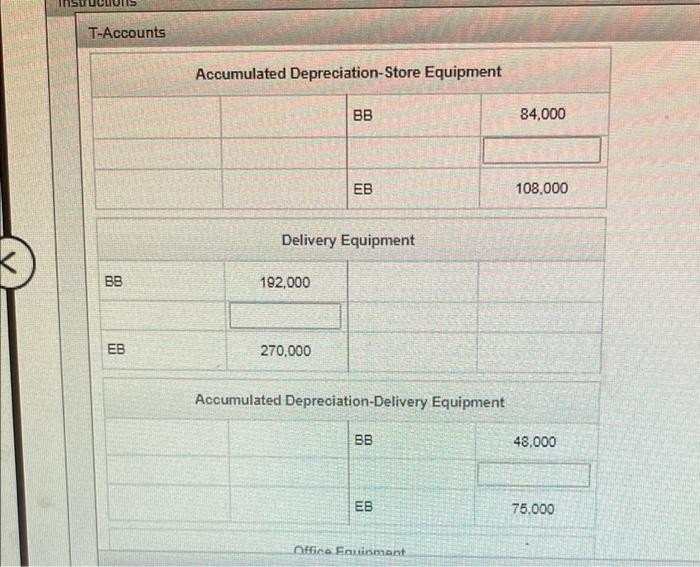

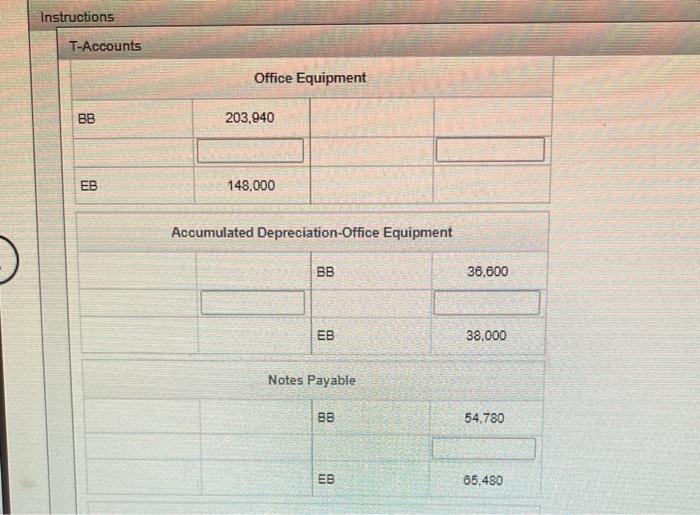

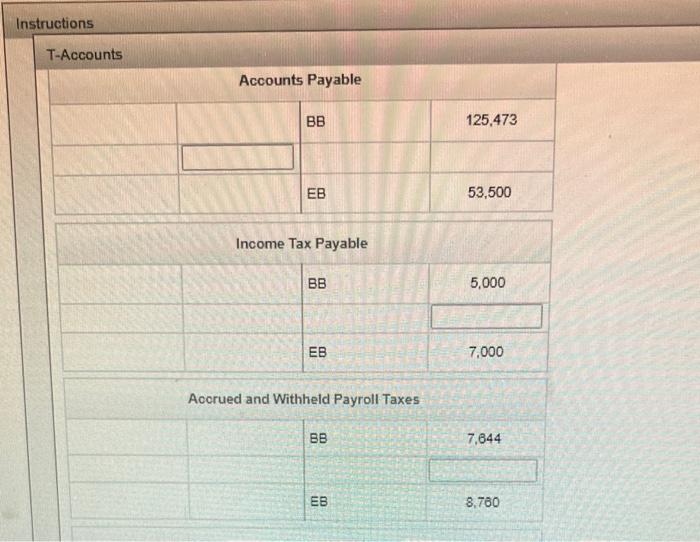

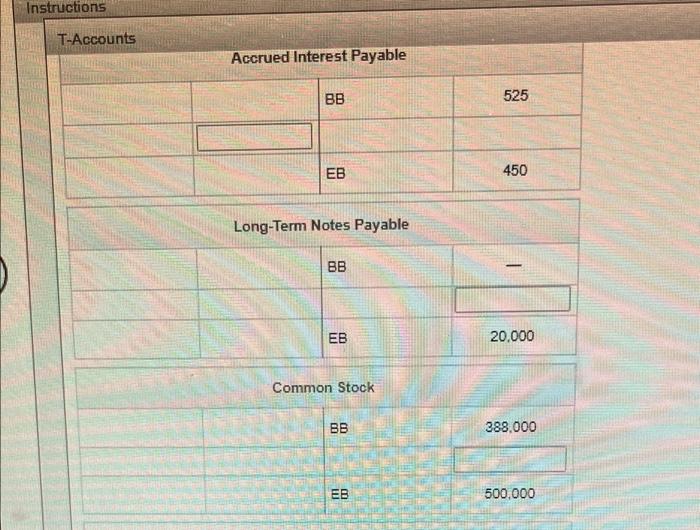

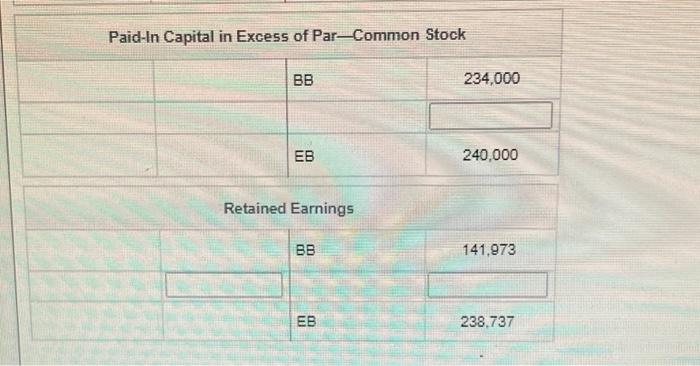

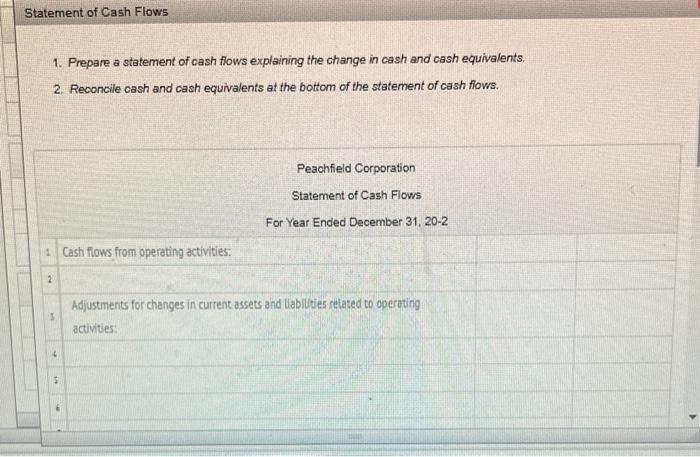

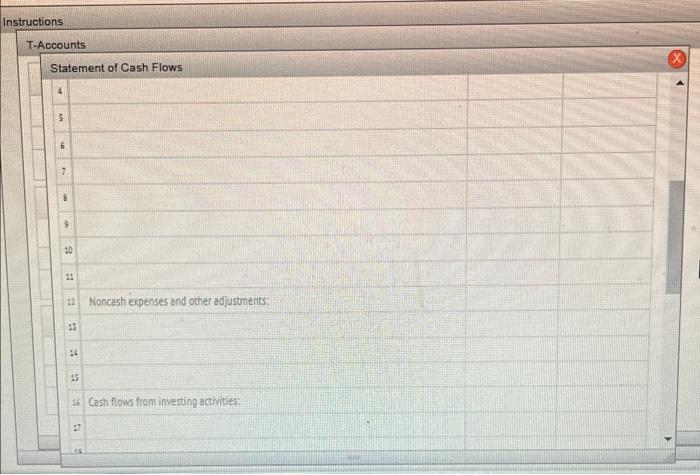

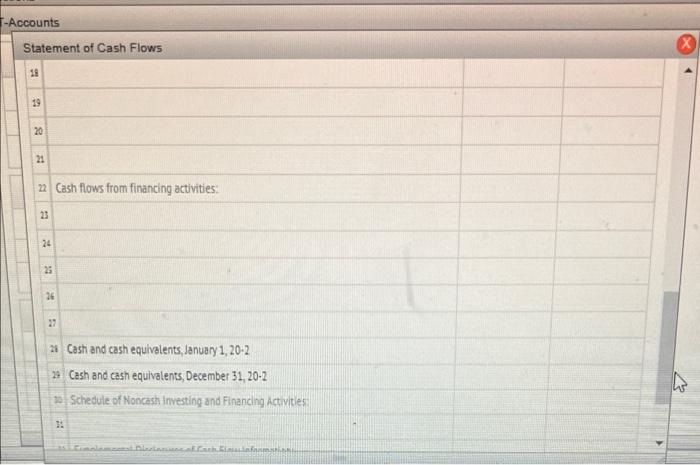

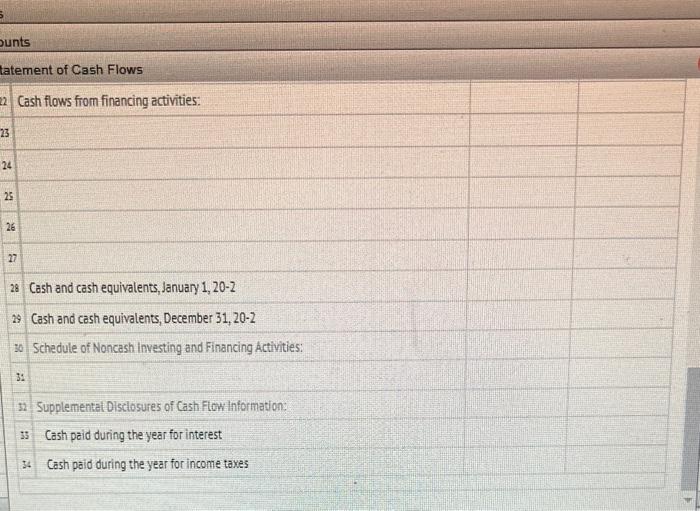

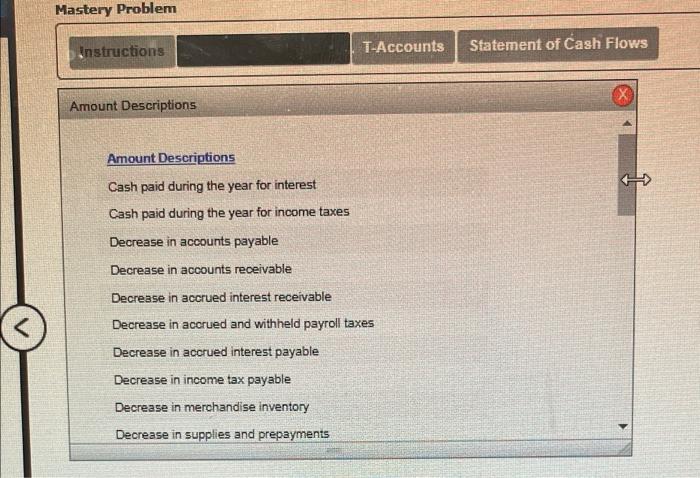

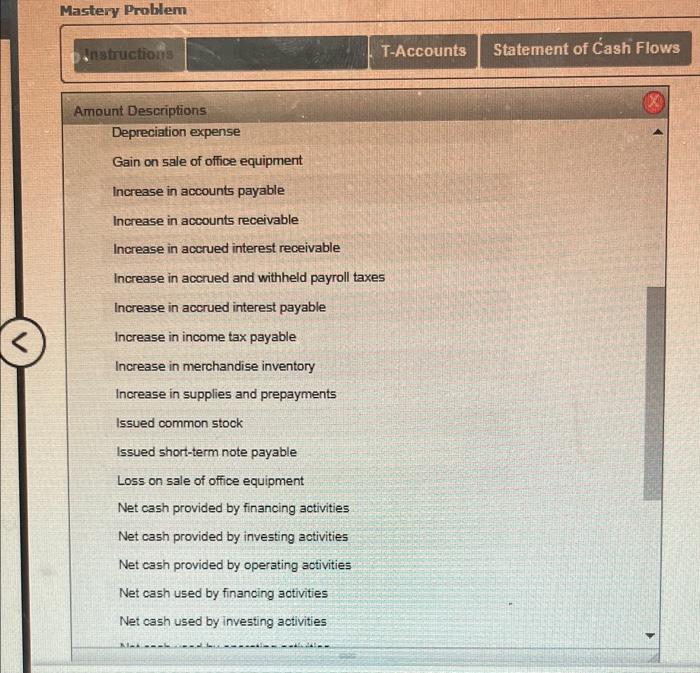

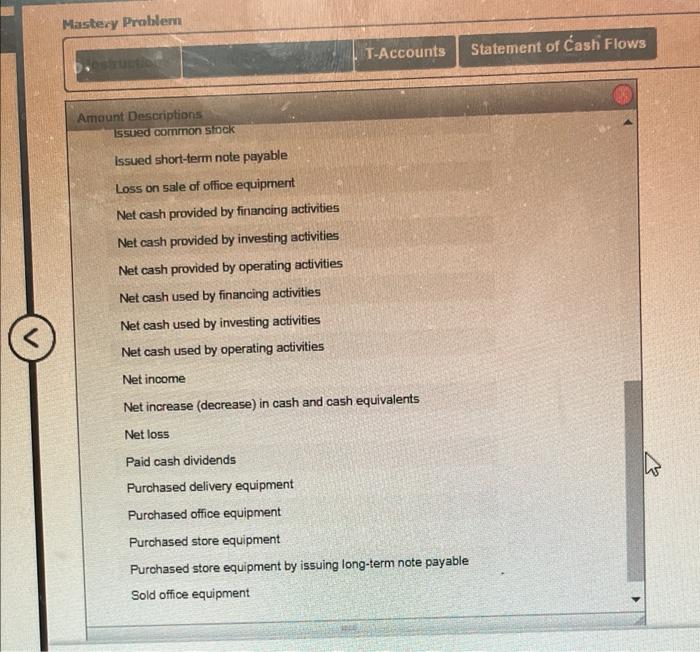

1 Net sales 2 Cost of goods sold 3Gross profit 4 Operating expenses 5 Operating income Peachfield Corporation Income Statement For Year Ended December 31, 20-2 Other revenues and expenses: Gain on sale of office equipment Interest revenue 9 Interest expense 10 Income before taxes 11 Income tax expense 12 Net income 7 S $5,000.00 2,100.00 (436.00) $985,000.00 515,000.00 $470,000.00 299,400.00 $170,600.00 6,664.00 $177,264.00 60,500.00 $116,764.00 1 Retained earnings, January 1, 20-2 2 Net Income 3 Less dividends 4 Net increase in retained earnings $Retained earnings, December 31, 20-2 Peachfield Corporation Statement of Retained Earnings For Year Ended December 31, 20-2 $116,764.00 20,000.00 $141,973.00 96,764.00 $238,737.00 bons 1 1 Current ad Cash Government nates Accrued interest receivable Accounts receivable ret Merchandise inventory Supplies and prepayments Totalcument essets Property, plant, and equipment Store equipment CODOL Assets Peachfield Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 $102,072.00 3,600.00 320.00 152,945.00 355,49000 14.500.00 $308,000.00 10.000.00 2002 5628 92700 200.000 00 $27,200.00 12,000.00 250.00 140,905.00 195.400.00 21,500.00 $232,800.00 64,000.00 2001 $497,155.00 INCREASE (DECREASE) $74,872.00 (3,400.00) 70.00 12.040.00 60,090.00 7,000 00 131,672.00 75,200.00 74.000.00 Instructions Less eccumulated depreciation-store equipment Delivery equipment Less accumulated depreciation delivery equipment Office equipment Less accumulated depreciation office equipment 34 Total property, plant, and equipment Total assets Liabilirs Cument liabilities: Hotes payable Accounts payable 34income tax payable Accrued and withheld pay taxes Accredit payable Totalcument tables 108,000.00 $270,000.00 75,000.00 $148,000,00 38,000.00 $65,43000 $3,500.00 7,000.00 1.76000 45000 200,000,00 195,000.00 110,000.00 505,000.00 $1,133,92700 $135,1R000 $4,000.00 $192,000.00 48,000.00 $203,940 00 56,600 00 154,700.00 125,471.00 5,000 00 264400 325.00 145,800.00 144,000.00 167,340.00 460,140.00 $957,195 00 $493,422.00 24,000.00 78,000.00 27,000 00 (55,94000) 1,400.00 44,860.00 176,332.00 10,700.00 01,97500) 2,000.00 1116 00 05.00 38.231.000 structions 23 Accrued and withheld payroll taxes 24 Accrued interest payable Total current liabilities Long-term liabilities 29Notes payable 30 11 ADDE Total liabilities Stockholders' Equity Common stock (510 pa, 1,000,000 shares authorized, Issued 50,000 in 20-2 and 38,800 in 20-1) Paid-in capital in excess of par common stick Retained eamings Total stockholders' equity Total abilities and stockholders equity 34 Additional information 8,760.00 450.00 $500,000.00 240,000 00 258,737,00 $135,190.00 20,000.00 3155,190.00 978,73200 $1.153.92700 7,644.00 525.00 $388,000.00 234,000.00 141,975.00 $195,422.00 $193,422.00 763,975.00 $957,395.00 1,116.00 (75.00) (58,252.00) 20,000.00 (38,252.00) 112,000.00 6,000.00 96,764.00 21476400 176552.00 Instructions Additional information: 1. Office equipment was sold during the year for $75,000. Cost $80,000 Accumulated depreciation (10,000) Book value $70,000 Market value 75,000 Gain on sale $5,000 2. Depreciation expense for the year was $62,400 is shown Store equipment $24,000 Delivery equipment 27.000 Office equipment 11,400 $82 400 Amount Descriptions T-Accounts Statement of Cash Flows Office equipment 11,400 $62,400 3. No other equipment was sold during the year. The following purchases were made for cash. Store equipment $55,200 Delivery equipment 78,000 Office equipment 24,060 $157,260 4. Declared and paid cash dividends of $20,000. 5. Issued 11,200 shares of $10 par common stock for $118.000. 6. Issued a note payable for $10.700. 7. Additional store equipment was acquired by issuing a long-term note payable for $20,000. Required: 1. Prepare a statement of cash flows explaining the change in cash and cash equivalents Instructions 3. No other equipment was sold during the year. The following purchases were made for cash. Store equipment $55,200 Delivery equipment 78,000 Office equipment 24,060 $157,260 4. Declared and paid cash dividends of $20,000. 5. Issued 11,200 shares of $10 par common stock for $118.000. 6. Issued a note payable for $10,700. 7. Additional store equipment was acquired by issuing a long-term note payable for $20,000. Required: 1. Prepare a statement of cash flows explaining the change in cash and cash equivalents. 2. Reconcile cash and cash equivalents at the bottom of the statement of cash flows. T-Accounts Prepare T Accounts to aid in the preparation of the Indirect Method Statement of Cash Flows (BB. Beginning Balance, EB: Ending Balance) TAccount Instructions Accrued Interest Receivable BB 250 320 Accounts Receivable 140,905 152.945 Merchandise Inventory EB BB EB T-Accounts 8888 BB EB BB EB BB EB Merchandise Inventory 295,400 355,490 Supplies and Prepayments 21,500 14.500 Store Equipment 232,800 308,000 T-Accounts BB EB Accumulated Depreciation-Store Equipment BB EB Delivery Equipment 192,000 270,000 Accumulated Depreciation-Delivery Equipment BB EB Office Equinmant 84,000 108,000 48.000 75,000 Instructions T-Accounts BB EB Office Equipment 203,940 148,000 Accumulated Depreciation-Office Equipment BB EB Notes Payable 88 EB 36.600 38,000 54,780 65,480 Instructions T-Accounts Accounts Payable BB EB Income Tax Payable BB EB Accrued and Withheld Payroll Taxes BB EB 125,473 53,500 5,000 7,000 7,644 8,760 Instructions HOGAN waww T-Accounts Accrued Interest Payable BB EB Long-Term Notes Payable BB EB Common Stock BB EB 525 450 - 20,000 388,000 500,000 Paid-In Capital in Excess of Par-Common Stock BB EB Retained Earnings BB EB 234,000 240,000 141,973 238,737 Statement of Cash Flows 1. Prepare a statement of cash flows explaining the change in cash and cash equivalents. 2. Reconcile cash and cash equivalents at the bottom of the statement of cash flows. Peachfield Corporation Statement of Cash Flows For Year Ended December 31, 20-2 1 Cash flows from operating activities: 2 Adjustments for changes in current assets and liabilities related to operating activities: Instructions T-Accounts Statement of Cash Flows 5 12 Noncash expenses and other adjustments: 13 14 15 16 Cash flows from investing activities: 6 9 10 # ta X -Accounts Statement of Cash Flows 18 21 22 Cash flows from financing activities: 23 27 26 Cash and cash equivalents, January 1, 20-2 29 Cash and cash equivalents, December 31, 20-2 30 Schedule of Noncash Investing and Financing Activities: Disclaun of Cath Klas 19 20 24 25 26 X 4 punts tatement of Cash Flows 22 Cash flows from financing activities: 23 27 28 Cash and cash equivalents, January 1, 20-2 29 Cash and cash equivalents, December 31, 20-2 30 Schedule of Noncash Investing and Financing Activities: 31 32 Supplemental Disclosures of Cash Flow Information: 35 Cash paid during the year for interest 34 Cash paid during the year for income taxes 24 25 26 Mastery Problem Instructions T-Accounts Statement of Cash Flows X Amount Descriptions