Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i am strugling solving this problem. need help please Compute and interpret Liquidity, Solvency and Coverage Ratios Selected balance sheet and income statement information for

i am strugling solving this problem. need help please

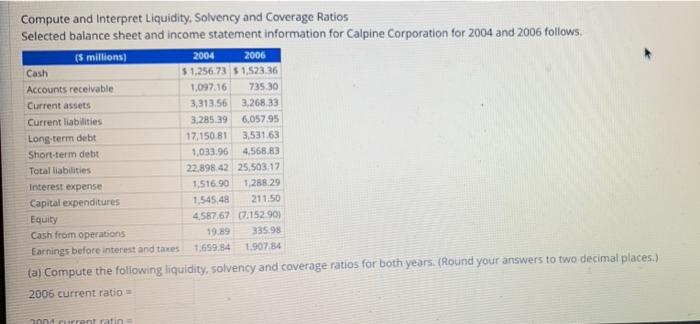

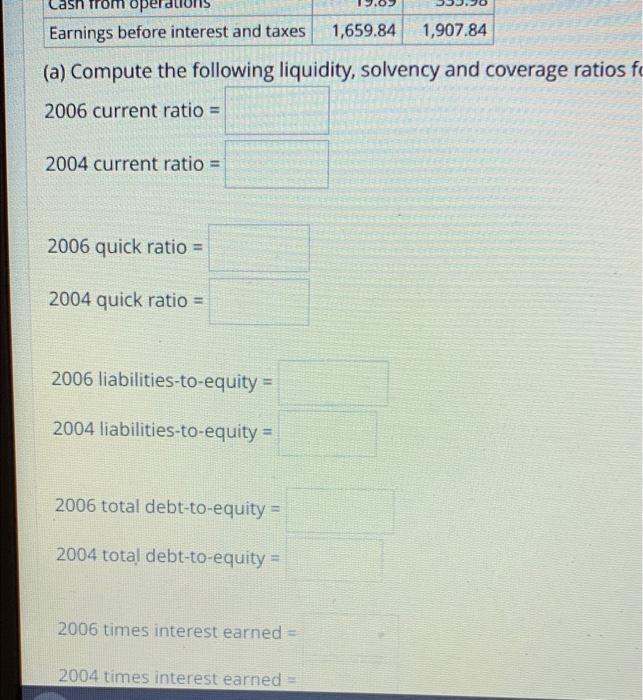

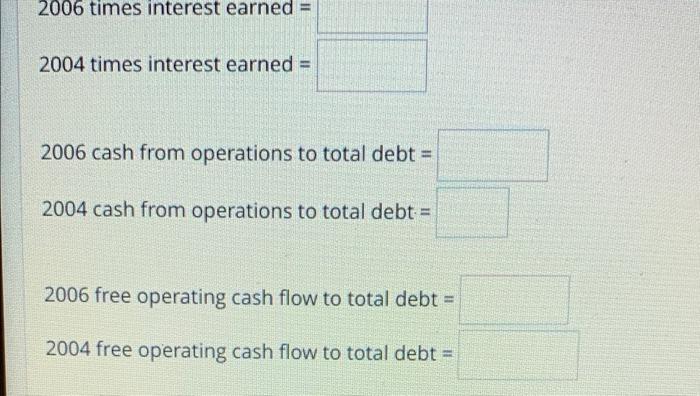

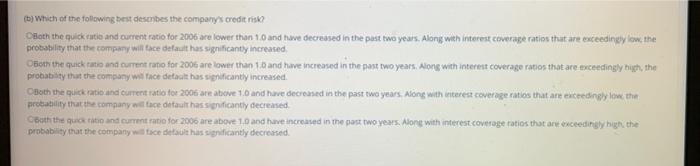

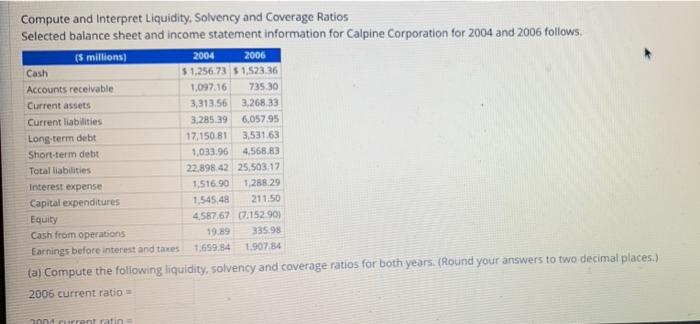

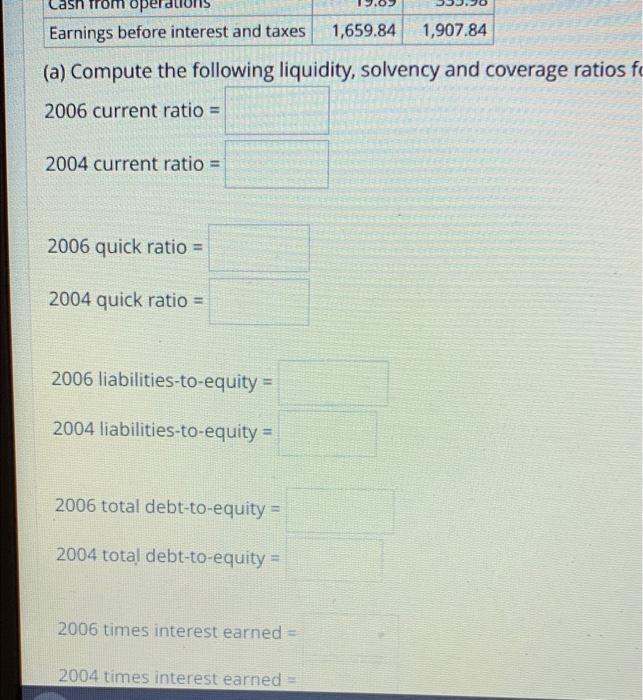

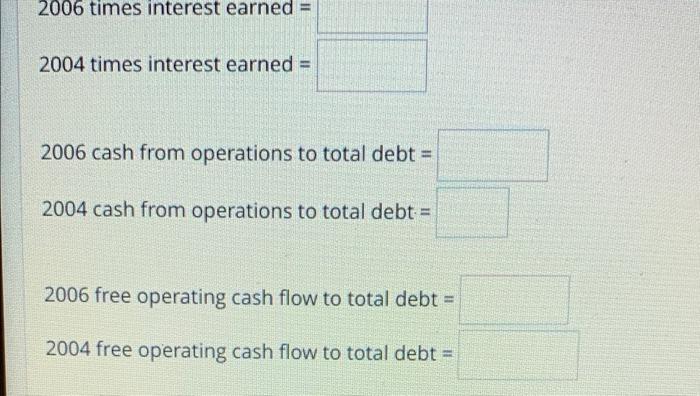

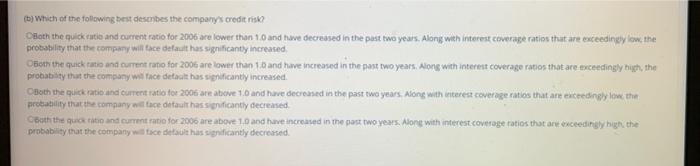

Compute and interpret Liquidity, Solvency and Coverage Ratios Selected balance sheet and income statement information for Calpine Corporation for 2004 and 2006 follows. (5 millions) 2004 2006 Cash $1.256.73 $ 1.523.36 Accounts receivable 1.097.16 735 30 Current assets 3,313.56 3.268.33 Current liabilities 3.285.39 6,057.95 Long-term debt 17.150.81 3.53163 Short-term debt 1,033.96 4.568.83 Total liabilities 22.898 42 25,503.17 Interest expense 1.516,90 1.28 29 Capital expenditures 1,54545 211.50 Equity 4587.677.152 901 Cash from operations 19.89 335.98 Earnings before interest and taxes 1,699.84 1907 84 (a) Compute the following liquidity, solvency and coverage ratios for both years. (Round your answers to two decimal places.) 2006 current ratio zonnent ratin operation Earnings before interest and taxes 1,659.84 1,907.84 (a) Compute the following liquidity, solvency and coverage ratios fo 2006 current ratio = 2004 current ratio = 2006 quick ratio = 2004 quick ratio = 2006 liabilities-to-equity = 2004 liabilities-to-equity = 2006 total debt-to-equity = 2004 total debt-to-equity = 2006 times interest earned = 2004 times interest earned = 2006 times interest earned = 2004 times interest earned = 2006 cash from operations to total debt = 2004 cash from operations to total debt = 2006 free operating cash flow to total debt = 2004 free operating cash flow to total debt = (b) Which of the following best desnibes the company's credit risk Both the quick title and current ratio for 2006 are lower than 10 and have decreased in the past two years. Along with interest coverage ratios that are exceeding tow the probability that the company will tace default has significantly increased Both the quick rate and current rano for 2006 are lower than 10 and have increased in the past two years. Along with interest coverage ratios that are exceedingly high, the probability that the company wie face detaalt has significantly increased CBoth the quick rates and current ratio for 2006 are above 1.0 anid have decreased in the past two years. Along with interest coverage ratios that are exceeding to the probability that the company w tace default has significantly decreased both the quanto and current ratio for 2006 are above 10 and have increased in the past two years. Along with interest.coverage ratios that an exceedingly high the probability that the company wiedet has significantly decreased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started