i am stuck help to solve the question

solve the question

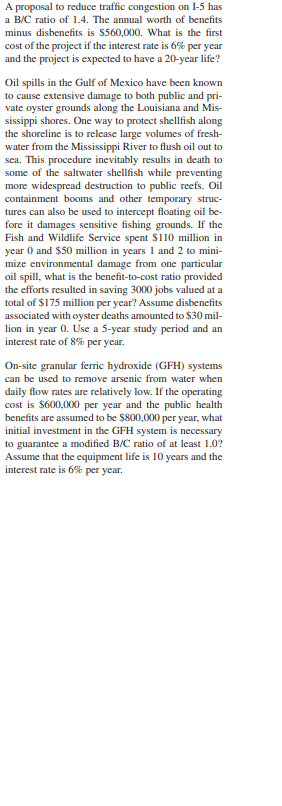

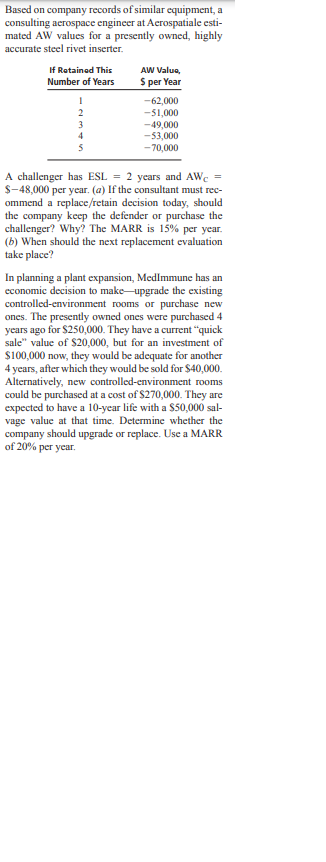

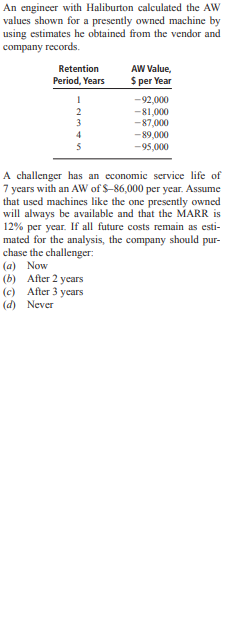

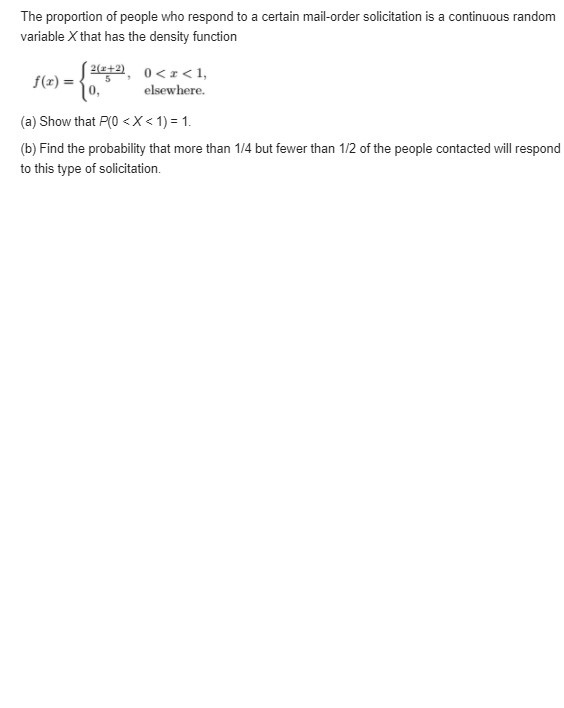

A proposal to reduce traffic congestion on 1-5 has a B/C ratio of 1.4. The annual worth of benefits minus disbenefits is $560,000. What is the first cost of the project if the interest rate is 6% per year and the project is expected to have a 20-year life? Oil spills in the Gulf of Mexico have been known to cause extensive damage to both public and pri- vate oyster grounds along the Louisiana and Mis- sissippi shores. One way to protect shellfish along the shoreline is to release large volumes of fresh- water from the Mississippi River to flush oil out to sea. This procedure inevitably results in death to some of the saltwater shellfish while preventing more widespread destruction to public reefs. Oil containment booms and other temporary struc tures can also be used to intercept floating oil be- fore it damages sensitive fishing grounds. If the Fish and Wildlife Service spent $110 million in year 0 and $50 million in years 1 and 2 to mini- mize environmental damage from one particular oil spill, what is the benefit-to-cost ratio provided the efforts resulted in saving 3000 jobs valued at a total of $175 million per year? Assume disbenefits associated with oyster deaths amounted to $30 mil- lion in year 0. Use a 5-year study period and an interest rate of 8% per year. On-site granular ferric hydroxide (GFH) systems can be used to remove arsenic from water when daily flow rates are relatively low. If the operating cost is $600,000 per year and the public health benefits are assumed to be $800,000 per year, what initial investment in the GFH system is necessary to guarantee a modified B/C ratio of at least 1.0? Assume that the equipment life is 10 years and the interest rate is 6% per year.Based on company records of similar equipment, a consulting acrospace engineer at Acrospatiale esti- mated AW values for a presently owned, highly accurate steel rivet inserter. If Retained This AW Valua, Number of Years S per Year -62,000 -$1,000 -49,000 WA w -$3,000 -70,000 A challenger has ESL = 2 years and AWc = $-48,000 per year. (a) If the consultant must rec- commend a replace/retain decision today, should the company keep the defender or purchase the challenger? Why? The MARR is 15% per year. (b) When should the next replacement evaluation take place? In planning a plant expansion, MedImmune has an economic decision to make-upgrade the existing controlled-environment rooms or purchase new ones. The presently owned ones were purchased 4 years ago for $250,000. They have a current "quick sale" value of $20,000, but for an investment of $100,000 now, they would be adequate for another 4 years, after which they would be sold for $40,000. Alternatively, new controlled-environment rooms could be purchased at a cost of $270,000. They are expected to have a 10-year life with a $50,000 sal- vage value at that time. Determine whether the company should upgrade or replace. Use a MARR of 20% per year.An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates he obtained from the vendor and company records. Retention AW Value. Period, Years $ per Year - 92,000 -81,000 -87,000 -89 000 -95,000 A challenger has an economic service life of 7 years with an AW of $-86,000 per year. Assume that used machines like the one presently owned will always be available and that the MARK is 12% per year. If all future costs remain as esti- mated for the analysis, the company should pur- chase the challenger: (a) Now (b) After 2 years (c) After 3 years (d) NeverFor the density function of Exercise 3.18, find F(x), and use it to evaluate P(3 s X