I am stuck on how to file out the M-3 form, this is my first time doing one.

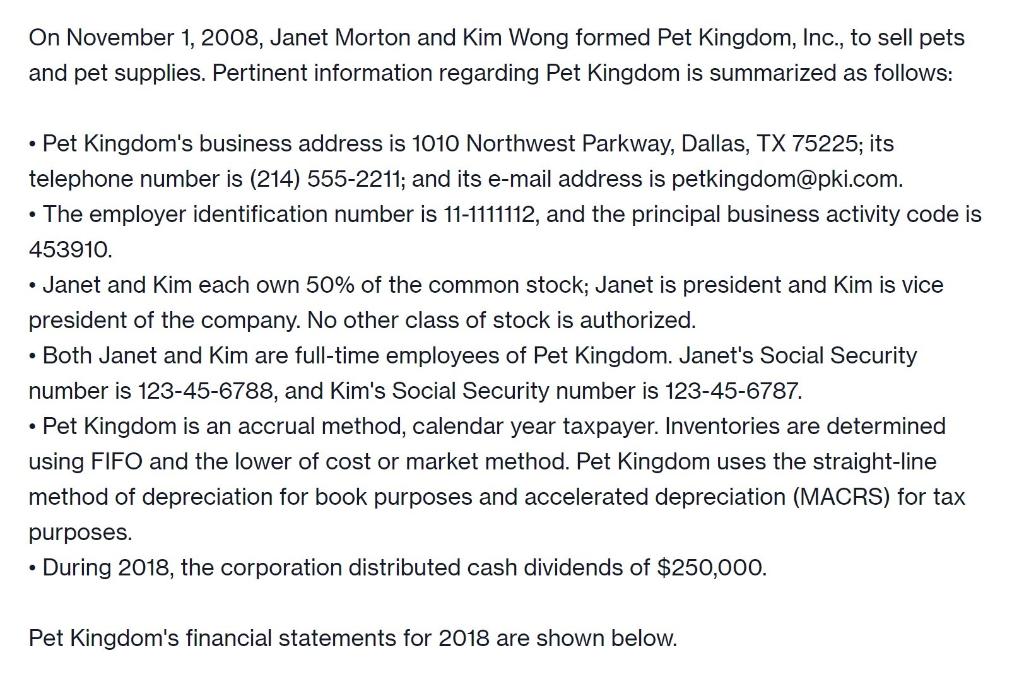

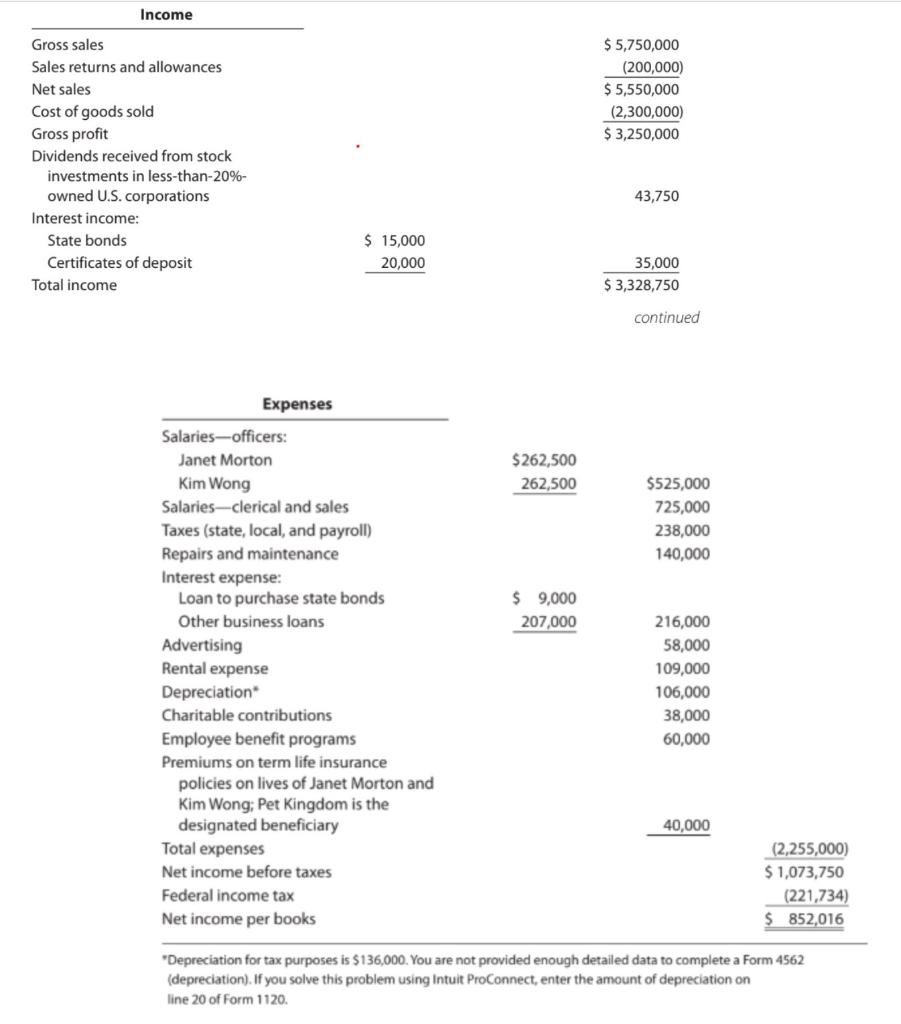

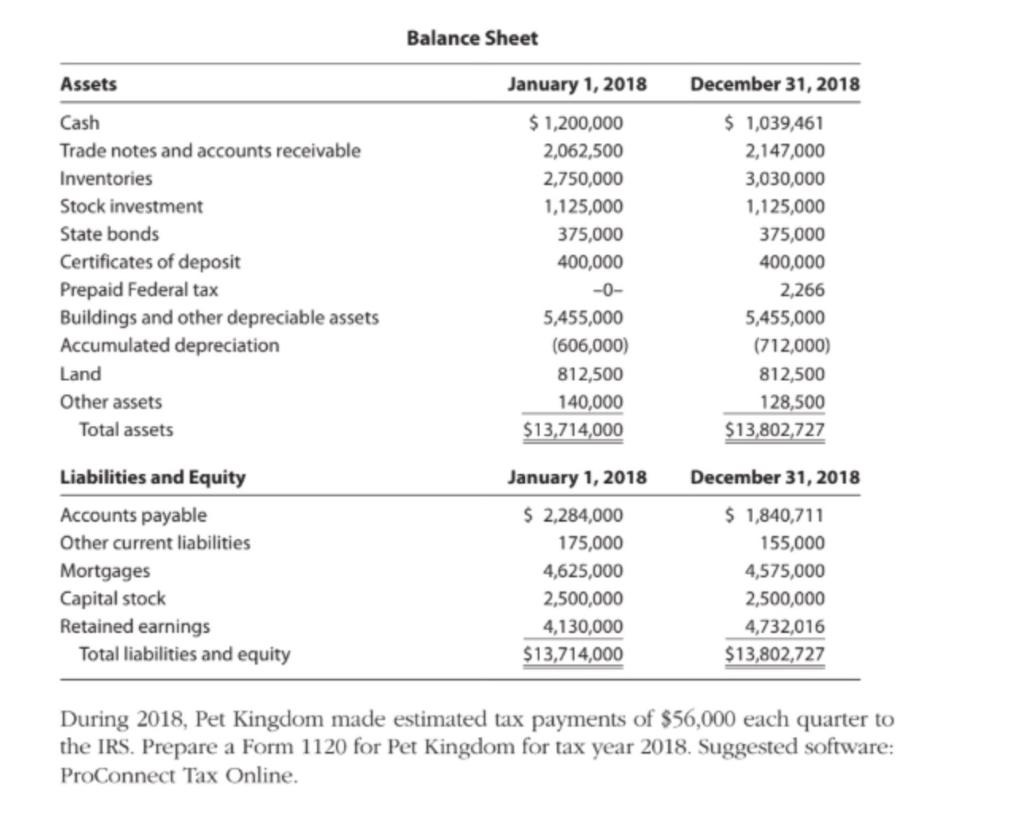

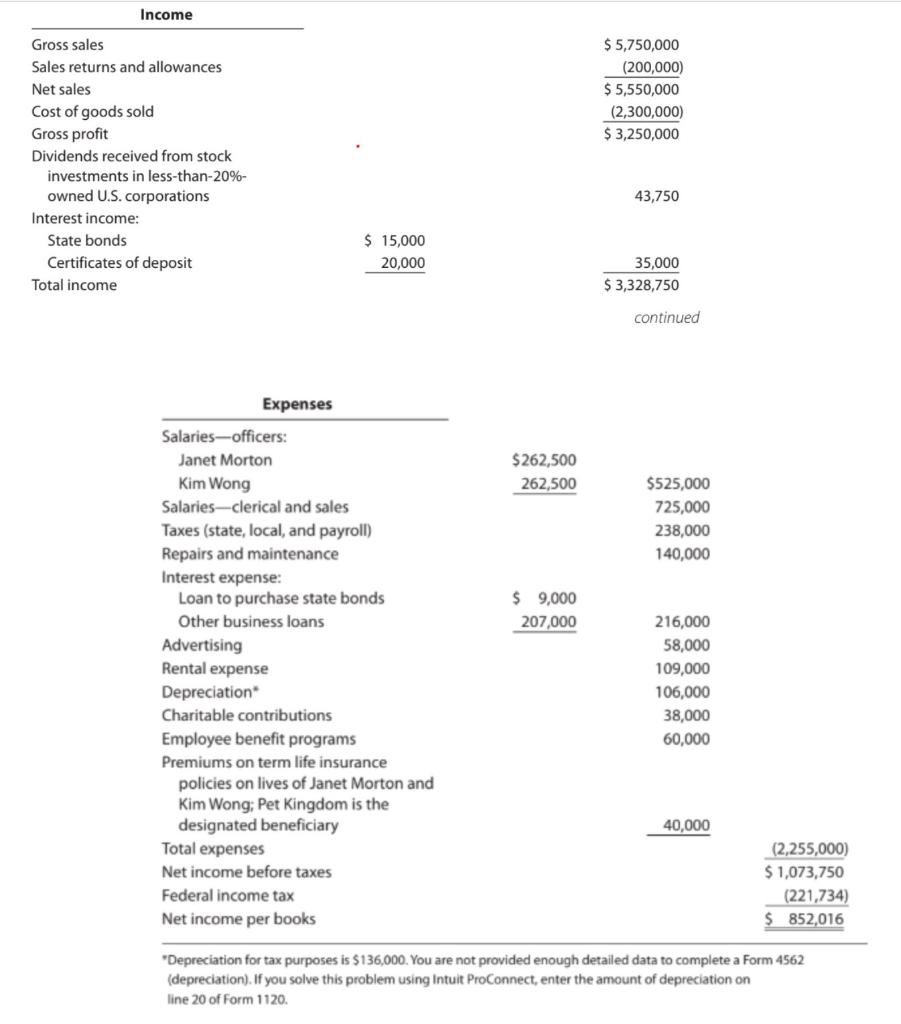

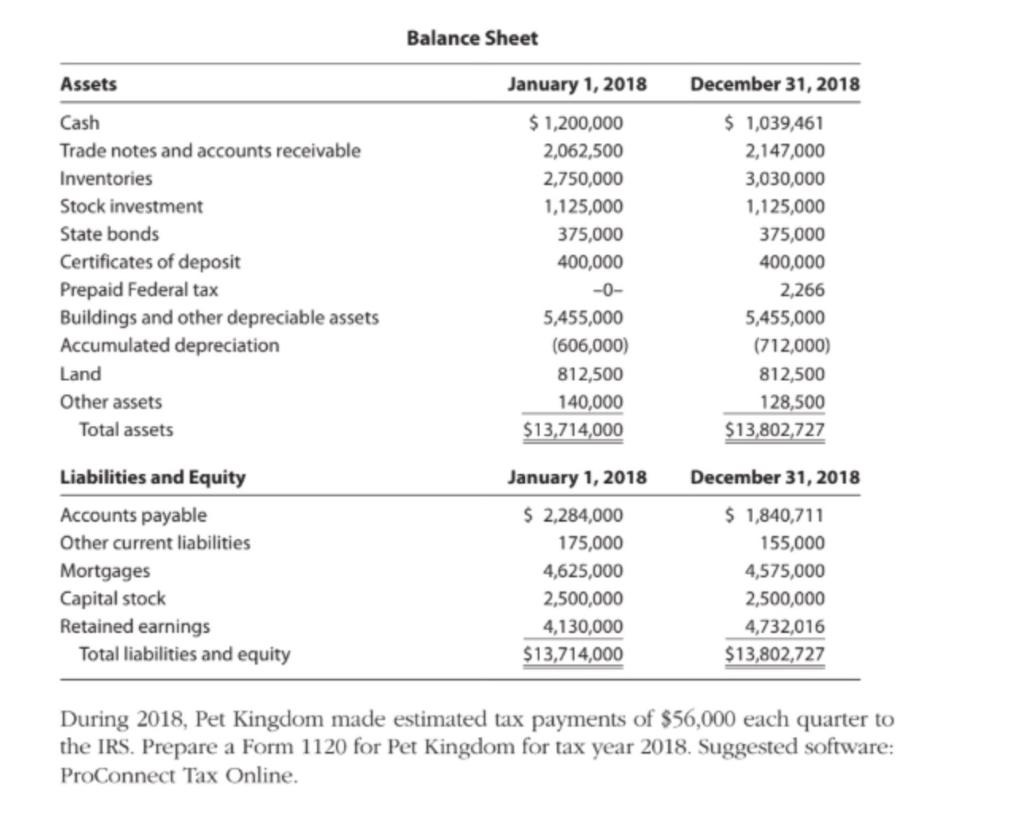

On November 1, 2008, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows: Pet Kingdom's business address is 1010 Northwest Parkway, Dallas, TX 75225; its telephone number is (214) 555-2211; and its e-mail address is petkingdom@pki.com. The employer identification number is 11-1111112, and the principal business activity code is 453910. Janet and Kim each own 50% of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized. Both Janet and Kim are full-time employees of Pet Kingdom. Janet's Social Security number is 123-45-6788, and Kim's Social Security number is 123-45-6787 Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Pet Kingdom uses the straight-lin method of depreciation for book purposes and accelerated depreciation (MACRS) for tax purposes. During 2018, the corporation distributed cash dividends of $250,000. Pet Kingdom's financial statements for 2018 are shown below. Income $ 5,750,000 (200,000) $ 5,550,000 (2,300,000) $3,250,000 Gross sales Sales returns and allowances Net sales Cost of goods sold Gross profit Dividends received from stock investments in less-than-20%- owned U.S. corporations Interest income: State bonds Certificates of deposit Total income 43,750 $ 15,000 20,000 35,000 $ 3,328,750 continued Expenses $ 262,500 262,500 $525,000 725,000 238,000 140,000 $ 9,000 207,000 Salaries-officers: Janet Morton Kim Wong Salaries-clerical and sales Taxes (state, local, and payroll) Repairs and maintenance Interest expense: Loan to purchase state bonds Other business loans Advertising Rental expense Depreciation Charitable contributions Employee benefit programs Premiums on term life insurance policies on lives of Janet Morton and Kim Wong, Pet Kingdom is the designated beneficiary Total expenses Net income before taxes Federal income tax Net income per books 216,000 58,000 109,000 106,000 38,000 60,000 40,000 (2,255,000) $ 1,073,750 (221,734) $ 852,016 "Depreciation for tax purposes is $136,000. You are not provided enough detailed data to complete a Form 4562 (depreciation). If you solve this problem using Intuit ProConnect, enter the amount of depreciation on line 20 of Form 1120. Balance Sheet Assets January 1, 2018 December 31, 2018 Cash Trade notes and accounts receivable Inventories Stock investment State bonds Certificates of deposit Prepaid Federal tax Buildings and other depreciable assets Accumulated depreciation Land Other assets Total assets $ 1,200,000 2,062,500 2,750,000 1,125,000 375,000 400,000 -0- 5,455,000 (606,000) 812,500 140,000 $13,714,000 $ 1,039,461 2,147,000 3,030,000 1,125,000 375,000 400,000 2,266 5,455,000 (712,000) 812,500 128,500 $13,802,727 January 1, 2018 Liabilities and Equity Accounts payable Other current liabilities Mortgages Capital stock Retained earnings Total liabilities and equity $ 2,284,000 175,000 4,625,000 2,500,000 4,130,000 $13,714,000 December 31, 2018 $ 1,840,711 155,000 4,575,000 2,500,000 4,732,016 $13,802,727 During 2018, Pet Kingdom made estimated tax payments of $56,000 each quarter to the IRS. Prepare a Form 1120 for Pet Kingdom for tax year 2018. Suggested software: ProConnect Tax Online