Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am stuck on thia problem set, pls help! QUESTION 8 (CHAPTER 12) Please use the tables below to help you calculate tax liability for

I am stuck on thia problem set, pls help!

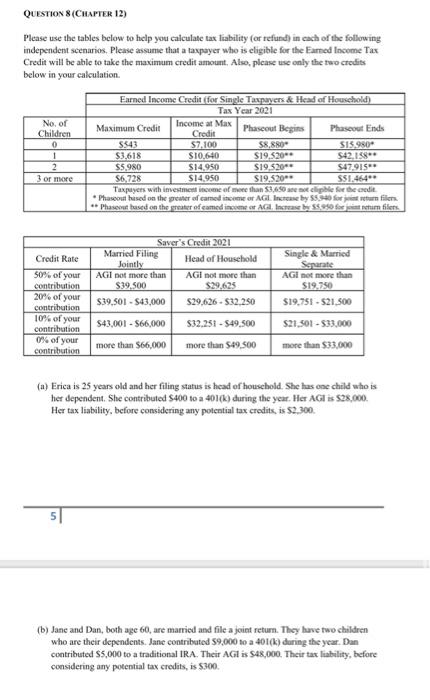

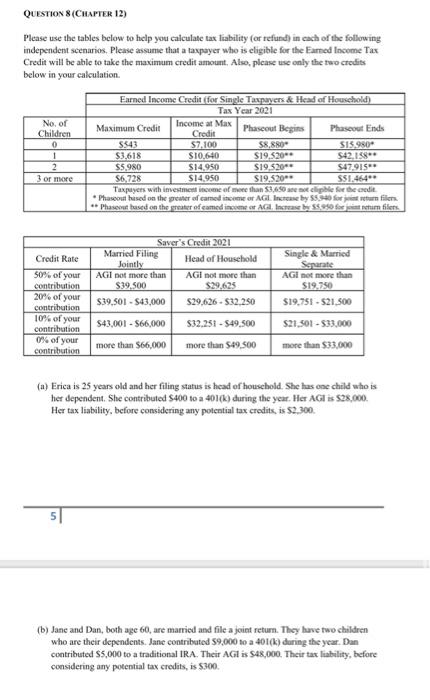

QUESTION 8 (CHAPTER 12) Please use the tables below to help you calculate tax liability for refund) in each of the following independent scenarios. Please assume that a taxpayer who is eligible for the Earned Income Tax Credit will be able to take the maximum credit amount. Also, please use only the two credits below in your calculation No. of Children 0 1 2 or more Earned Income Credit (For Single Taxpayers & Head of Houschold) Tax Year 2021 Income at Max Maximum Credit Credit Phaseout Begins Phascout Ends 5543 57.100 $8,880 SIS.980 $1.618 S10.640 S19,5204 S42.15 S5.90 $14.950 $19,5200 $47.915 S6,728 $14.950 $19.20 SS1.464 Taxpayers with investment income of me than 3.650 ble for the credit . Phascolhised on the greater of camede er AG Inte by 55.0 for return fillon ** Phascolused on the greater of camed income at AGB Increase by $5.00 Sortim files Credit Rate 50% of your contribution 20% of your contribution 10% of your contribution 0% of your contribution Saver's Credit 2021 Married Filing Head of Household Jointly AGI not more than AGI not more than $39.500 $29.625 $39.501 - 543,000 $29.626.532.250 Single & Married Separate AG not more than $19.750 $19,751 - $21.500 $32.251 - 549.500 S43,001 - 566,000 more than 566,000 $21.501 - 533,000 more than $33,000 more than $49.500 (a) Erica is 25 years old and her filing status is head of household. She has one child who is her dependent . She contributed S400 to a 401(k) during the year. Her AGB is $28,000. Her tax liability, before considering any potential tax credits, is $3,300. 5 (b) Jane and Dan, both age 60, are married and file a joint return. They have two children who are their dependents. Jane contributed 59,000 to a 401(k) during the year. Dan contributed $5,000 to a traditional IRA. Theit AG is S48,000. Their tax liability, before considering any potential tax credits, is $300 QUESTION 8 (CHAPTER 12) Please use the tables below to help you calculate tax liability for refund) in each of the following independent scenarios. Please assume that a taxpayer who is eligible for the Earned Income Tax Credit will be able to take the maximum credit amount. Also, please use only the two credits below in your calculation No. of Children 0 1 2 or more Earned Income Credit (For Single Taxpayers & Head of Houschold) Tax Year 2021 Income at Max Maximum Credit Credit Phaseout Begins Phascout Ends 5543 57.100 $8,880 SIS.980 $1.618 S10.640 S19,5204 S42.15 S5.90 $14.950 $19,5200 $47.915 S6,728 $14.950 $19.20 SS1.464 Taxpayers with investment income of me than 3.650 ble for the credit . Phascolhised on the greater of camede er AG Inte by 55.0 for return fillon ** Phascolused on the greater of camed income at AGB Increase by $5.00 Sortim files Credit Rate 50% of your contribution 20% of your contribution 10% of your contribution 0% of your contribution Saver's Credit 2021 Married Filing Head of Household Jointly AGI not more than AGI not more than $39.500 $29.625 $39.501 - 543,000 $29.626.532.250 Single & Married Separate AG not more than $19.750 $19,751 - $21.500 $32.251 - 549.500 S43,001 - 566,000 more than 566,000 $21.501 - 533,000 more than $33,000 more than $49.500 (a) Erica is 25 years old and her filing status is head of household. She has one child who is her dependent . She contributed S400 to a 401(k) during the year. Her AGB is $28,000. Her tax liability, before considering any potential tax credits, is $3,300. 5 (b) Jane and Dan, both age 60, are married and file a joint return. They have two children who are their dependents. Jane contributed 59,000 to a 401(k) during the year. Dan contributed $5,000 to a traditional IRA. Theit AG is S48,000. Their tax liability, before considering any potential tax credits, is $300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started