Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i am trying to complete my financial projections in a business plan paper and need help with completing it. can someone help me do the

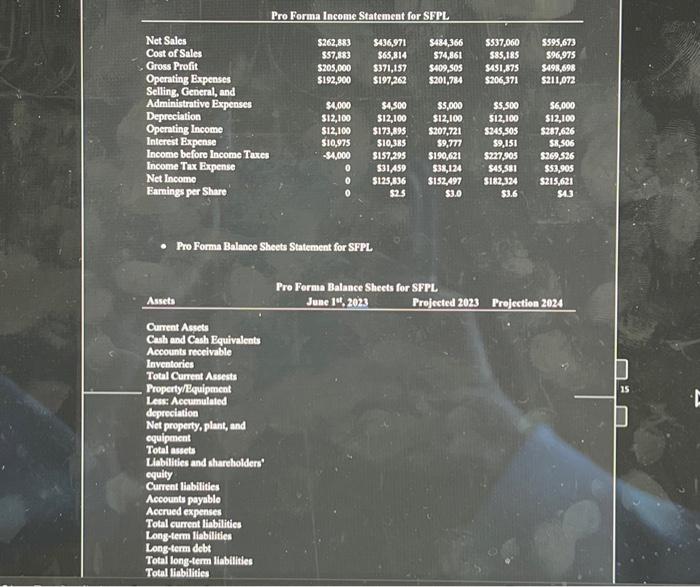

i am trying to complete my financial projections in a business plan paper and need help with completing it. can someone help me do the Pro Forma balance sheets and income cash flows? thank you in advance!

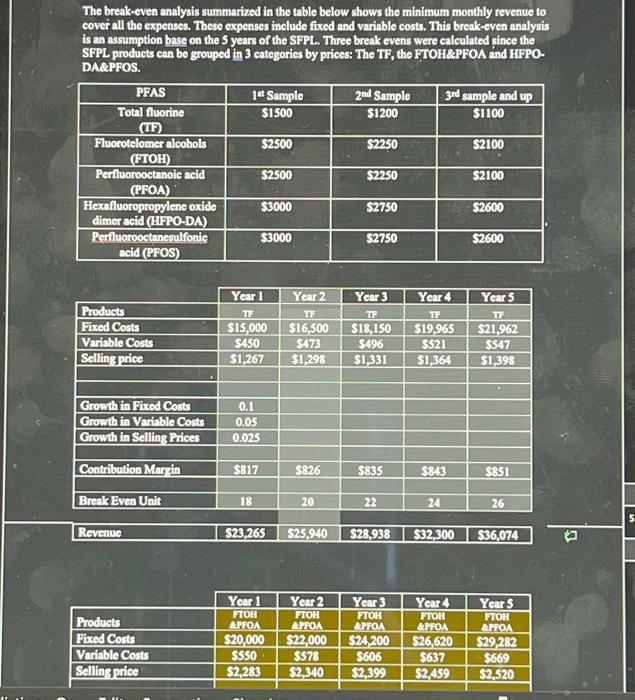

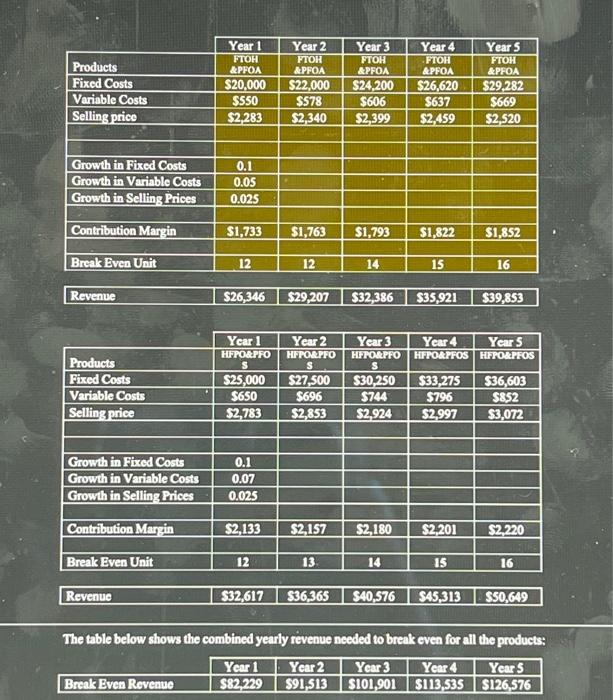

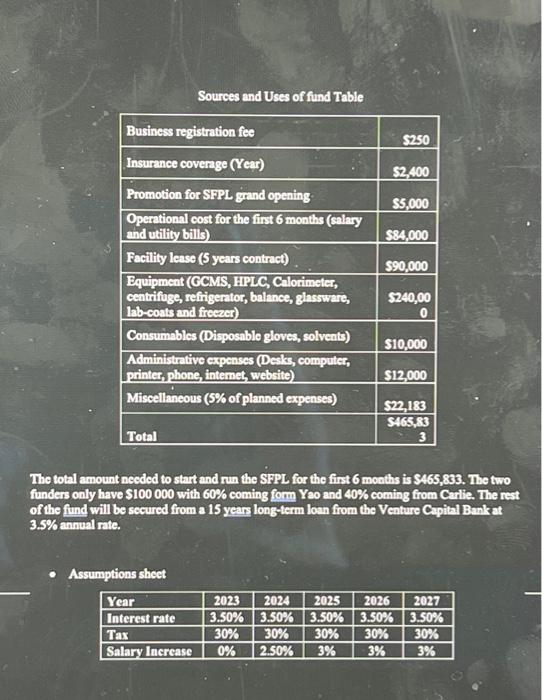

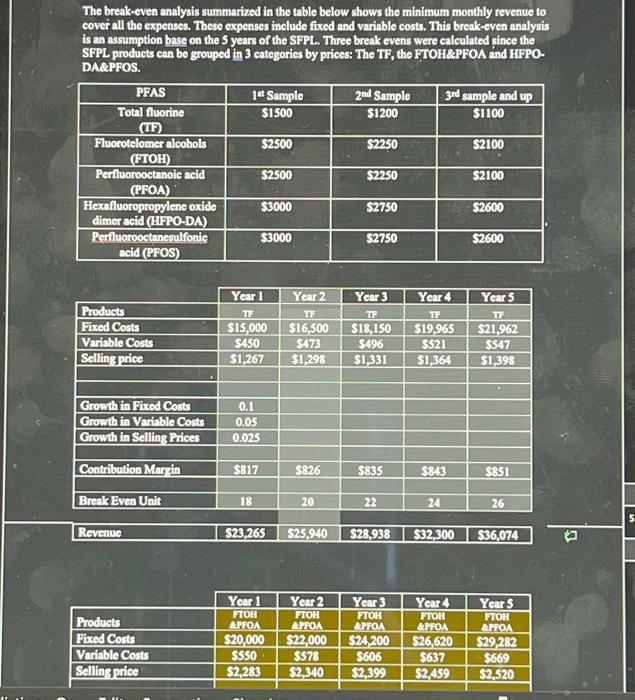

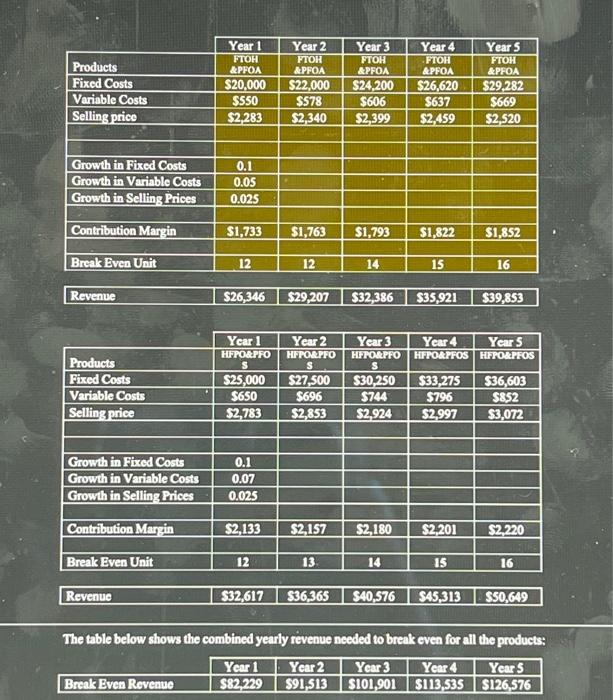

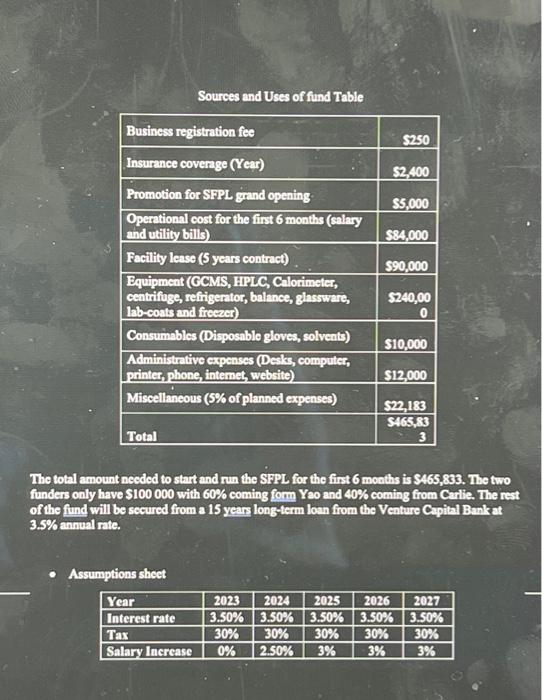

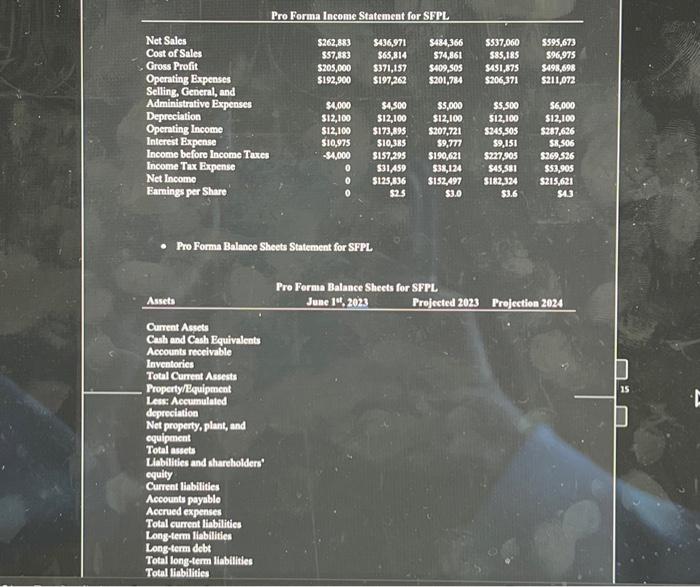

The break-even analysis summarized in the table below shows the minimum monthly revenue to cover all the expenses. These expenses include fixed and variablo costs. This breakeven analysis is an assumption base on the 5 years of the SFPL. Three break evens were calculated since the SFPL products can bo grouped in 3 categories by prices: The TF, the FIOH\&PFOA and HFPODA\&PFOS. \begin{tabular}{|l|l|l|l|l|l|} \hline Revenve & $26,346 & $29,207 & $32,386 & $35,921 & $39,853 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline Revenue & S32,617 & \$36,365 & S40,576 & S45,313 & S50,649 \\ \hline \end{tabular} The table below shows the combined yearly revenue needed to break even for all the products: \begin{tabular}{|l|c|c|c|c|c|} \cline { 2 - 6 } \multicolumn{1}{c|}{} & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 \\ \hline Break Even Rovenue & 582,229 & 591,513 & S101,901 & S113,535 & S126,576 \\ \hline \end{tabular} Sources and Uses of fund Table The total amount needed to start and run the SFPL for the first 6 moaths is S465, 833. The two funders only have $100000 with 60% coming form Yao and 40% coming from Carlie. The rest of the find will be secured from a 15 years longterm loan from the Venture Capital Bankat 3.5% annual rate. Pro Forma Balance Sheets Statement for SFPL The break-even analysis summarized in the table below shows the minimum monthly revenue to cover all the expenses. These expenses include fixed and variablo costs. This breakeven analysis is an assumption base on the 5 years of the SFPL. Three break evens were calculated since the SFPL products can bo grouped in 3 categories by prices: The TF, the FIOH\&PFOA and HFPODA\&PFOS. \begin{tabular}{|l|l|l|l|l|l|} \hline Revenve & $26,346 & $29,207 & $32,386 & $35,921 & $39,853 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline Revenue & S32,617 & \$36,365 & S40,576 & S45,313 & S50,649 \\ \hline \end{tabular} The table below shows the combined yearly revenue needed to break even for all the products: \begin{tabular}{|l|c|c|c|c|c|} \cline { 2 - 6 } \multicolumn{1}{c|}{} & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 \\ \hline Break Even Rovenue & 582,229 & 591,513 & S101,901 & S113,535 & S126,576 \\ \hline \end{tabular} Sources and Uses of fund Table The total amount needed to start and run the SFPL for the first 6 moaths is S465, 833. The two funders only have $100000 with 60% coming form Yao and 40% coming from Carlie. The rest of the find will be secured from a 15 years longterm loan from the Venture Capital Bankat 3.5% annual rate. Pro Forma Balance Sheets Statement for SFPL

The break-even analysis summarized in the table below shows the minimum monthly revenue to cover all the expenses. These expenses include fixed and variablo costs. This breakeven analysis is an assumption base on the 5 years of the SFPL. Three break evens were calculated since the SFPL products can bo grouped in 3 categories by prices: The TF, the FIOH\&PFOA and HFPODA\&PFOS. \begin{tabular}{|l|l|l|l|l|l|} \hline Revenve & $26,346 & $29,207 & $32,386 & $35,921 & $39,853 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline Revenue & S32,617 & \$36,365 & S40,576 & S45,313 & S50,649 \\ \hline \end{tabular} The table below shows the combined yearly revenue needed to break even for all the products: \begin{tabular}{|l|c|c|c|c|c|} \cline { 2 - 6 } \multicolumn{1}{c|}{} & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 \\ \hline Break Even Rovenue & 582,229 & 591,513 & S101,901 & S113,535 & S126,576 \\ \hline \end{tabular} Sources and Uses of fund Table The total amount needed to start and run the SFPL for the first 6 moaths is S465, 833. The two funders only have $100000 with 60% coming form Yao and 40% coming from Carlie. The rest of the find will be secured from a 15 years longterm loan from the Venture Capital Bankat 3.5% annual rate. Pro Forma Balance Sheets Statement for SFPL The break-even analysis summarized in the table below shows the minimum monthly revenue to cover all the expenses. These expenses include fixed and variablo costs. This breakeven analysis is an assumption base on the 5 years of the SFPL. Three break evens were calculated since the SFPL products can bo grouped in 3 categories by prices: The TF, the FIOH\&PFOA and HFPODA\&PFOS. \begin{tabular}{|l|l|l|l|l|l|} \hline Revenve & $26,346 & $29,207 & $32,386 & $35,921 & $39,853 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline Revenue & S32,617 & \$36,365 & S40,576 & S45,313 & S50,649 \\ \hline \end{tabular} The table below shows the combined yearly revenue needed to break even for all the products: \begin{tabular}{|l|c|c|c|c|c|} \cline { 2 - 6 } \multicolumn{1}{c|}{} & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 \\ \hline Break Even Rovenue & 582,229 & 591,513 & S101,901 & S113,535 & S126,576 \\ \hline \end{tabular} Sources and Uses of fund Table The total amount needed to start and run the SFPL for the first 6 moaths is S465, 833. The two funders only have $100000 with 60% coming form Yao and 40% coming from Carlie. The rest of the find will be secured from a 15 years longterm loan from the Venture Capital Bankat 3.5% annual rate. Pro Forma Balance Sheets Statement for SFPL

i am trying to complete my financial projections in a business plan paper and need help with completing it. can someone help me do the Pro Forma balance sheets and income cash flows? thank you in advance!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started