Answered step by step

Verified Expert Solution

Question

1 Approved Answer

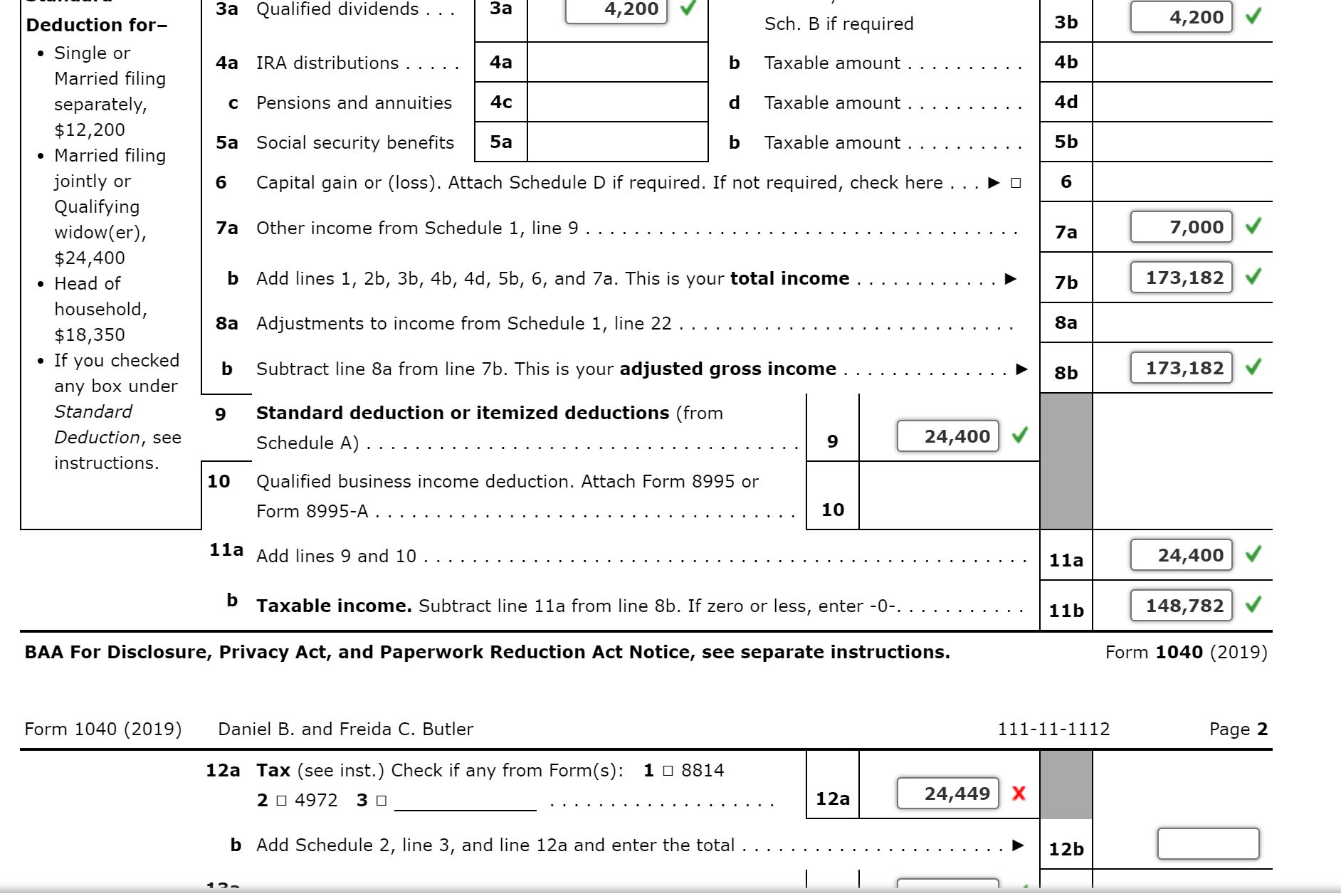

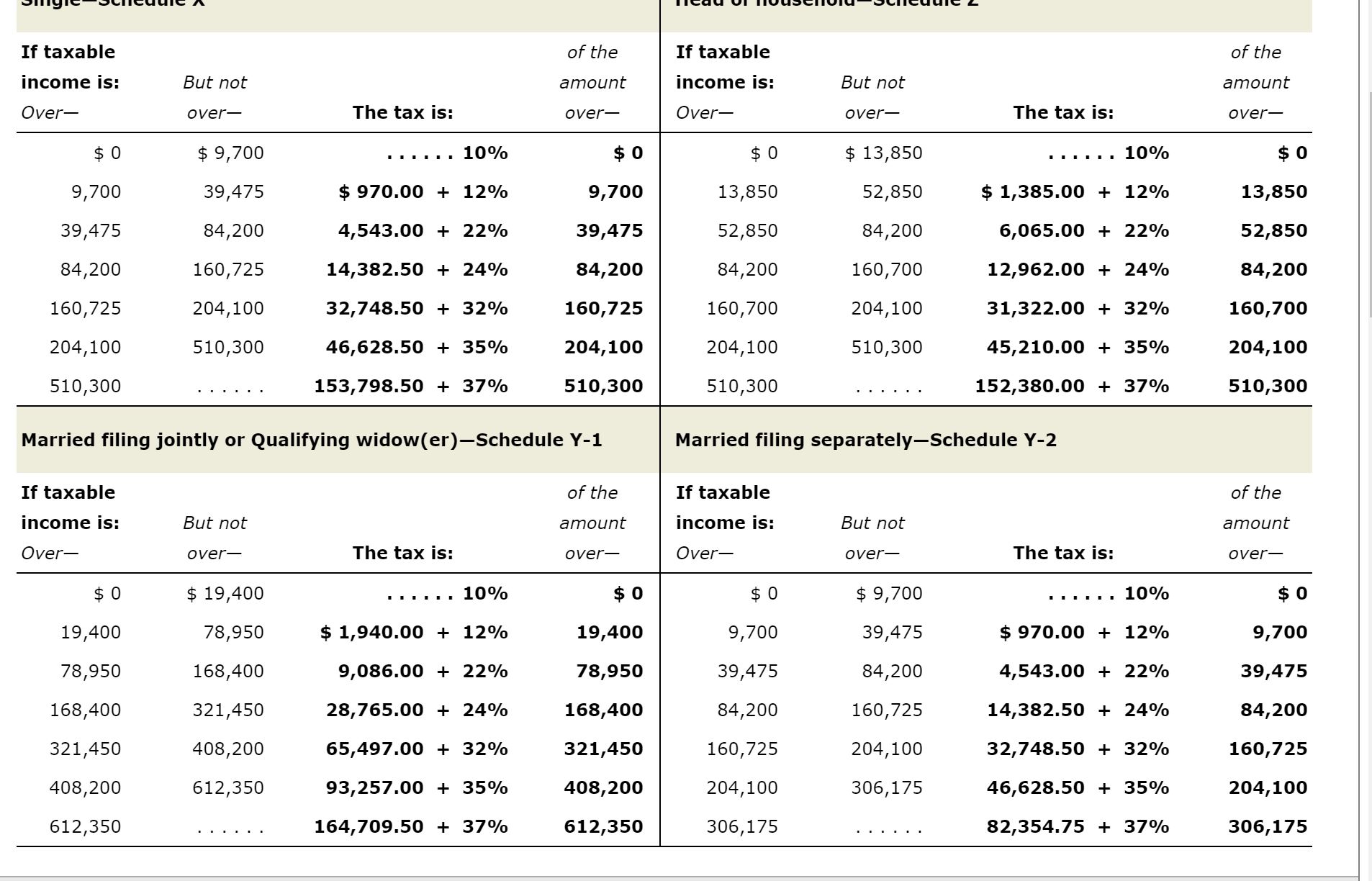

I am trying to evaluate tax using tax rate schedules for 2019 for Daniel B. and Frieda C. Butler. My taxable income is $148,782, and

I am trying to evaluate tax using tax rate schedules for 2019 for Daniel B. and Frieda C. Butler. My taxable income is $148,782, and I computed my tax to be $24,449 using the computation ((148,782-78,950)*.22)+9,086 to receive my answer, but the system says it is wrong. I need help to see what I am doing wrong. Thank you in advance.

Deduction for- Single or Married filing separately, $12,200 Married filing jointly or Qualifying widow(er), $24,400 Head of household, $18,350 If you checked any box under Standard Deduction, see instructions. 3a Qualified dividends. Form 1040 (2019) 4a IRA distributions Sch. B if required b Taxable amount. Pensions and annuities d Taxable amount. 5a Social security benefits b Taxable amount. 6 Capital gain or (loss). Attach Schedule D if required. If not required, check here 7a Other income from Schedule 1, line 9 10 11a 3a b Add lines 1, 2b, 3b, 4b, 4d, 5b, 6, and 7a. This is your total income 8a Adjustments to income from Schedule 1, line 22. b Subtract line 8a from line 7b. This is your adjusted gross income 9 Standard deduction or itemized deductions (from Schedule A). Add lines 9 and 10 4a Daniel B. and Freida C. Butler 4c 12- 4,200 5a Qualified business income deduction. Attach Form 8995 or Form 8995-A. b Taxable income. Subtract line 11a from line 8b. If zero or less, enter -0-. . . BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 12a Tax (see inst.) Check if any from Form(s): 1 8814 2 4972 30 b Add Schedule 2, line 3, and line 12a and enter the total . 9 10 24,400 12a 3b 24,449 X 4b 4d 5b 6 7a 7b 8a 8b 11a 11b 111-11-1112 12b 4,200 7,000 173,182 173,182 24,400 148,782 Form 1040 (2019) Page 2

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through the tax calculation stepbystep 1 For a married filing jointly return in 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started