Question

Use this information to calculate interest rates and insurance information, and to assess their impact on the company's financial obligations. I want you to thoroughly

"Use this information to calculate interest rates and insurance information, and to assess their impact on the company's financial obligations. I want you to thoroughly check the work that I performed and ensure that the step by step work that I carried out is accurate. After you have read what I have done below, what should I with the quantitative information that I have below to respond to the expectation, where it is instructing me to "Use this information to calculate interest rates and insurance information, and to assess their impact on the company's financial obligations"?

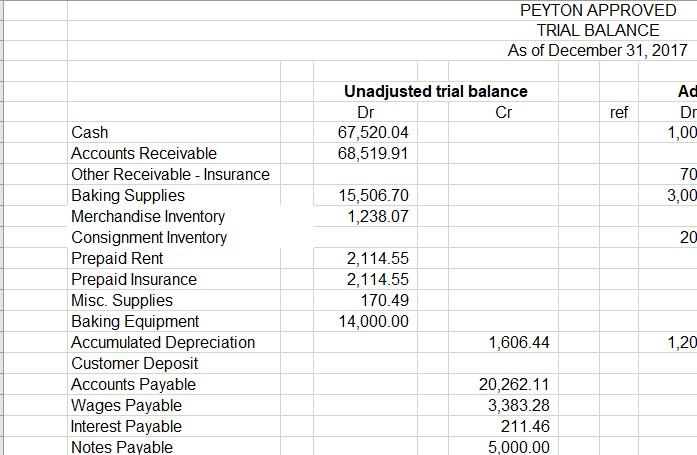

Reminder: $2,114.55 is the dollar amount associated with?Prepaid Insurance, and the $5,000 is the dollar amount is affiliated with?Notes Payable. Both?Prepaid Insurance?and?Notes Payable?is are located below in the Unadjusted Trial Balance for Peyton Approved.

?

?

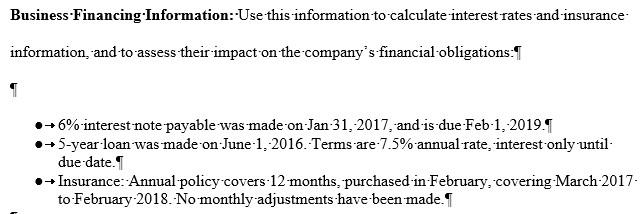

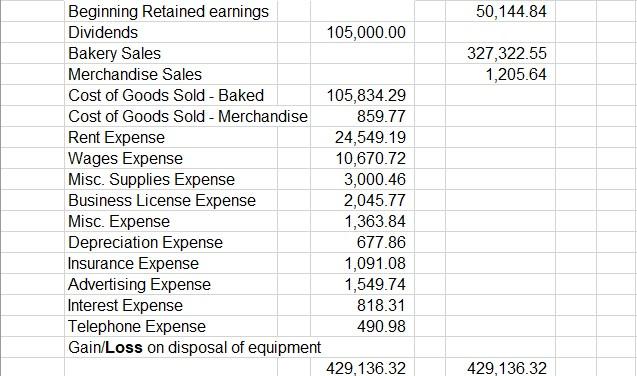

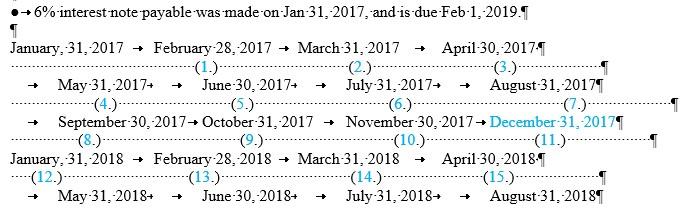

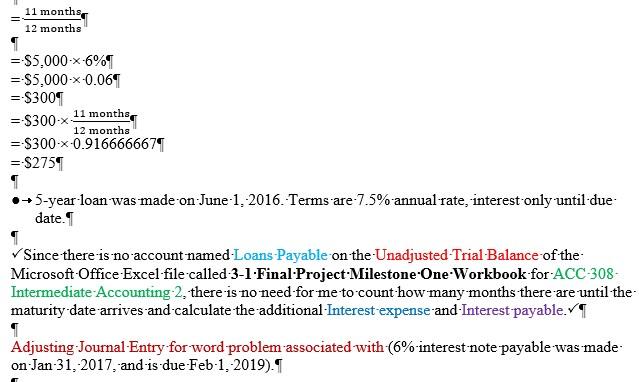

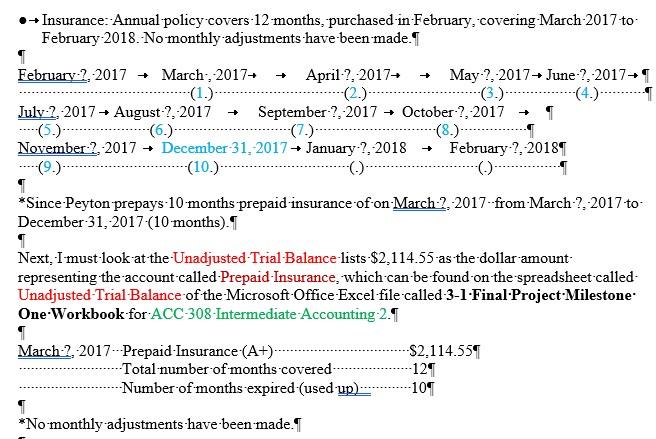

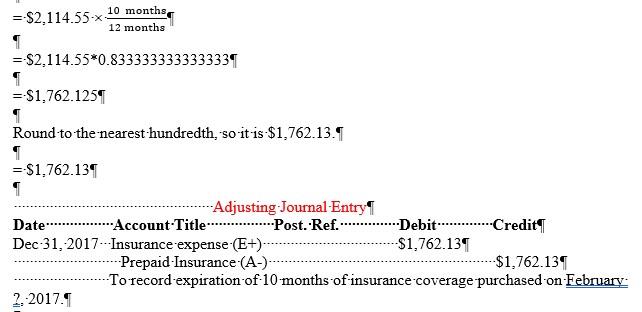

Business Financing Information: Use this information to calculate interest rates and insurance information, and to assess their impact on the company's financial obligations: 6% interest note payable was made on Jan 31, 2017, and is due Feb 1, 2019. 5-year loan was made on June 1, 2016. Terms are 7.5% annual rate, interest only until- due date. Insurance: Annual policy covers 12 months, purchased in February, covering March 2017- to February 2018. No monthly adjustments have been made.

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Peyton Approved Unadjusted Trial Balance As of December 31 2017 Accounts Debit Credit Cash 6000 Accounts Receivable 2000 Prepaid Insurance 2114 Suppli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started