Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am working on the last few problems of this worksheet, I am learning about Compounding interest. 4. The goal of this problem is to

I am working on the last few problems of this worksheet, I am learning about Compounding interest.

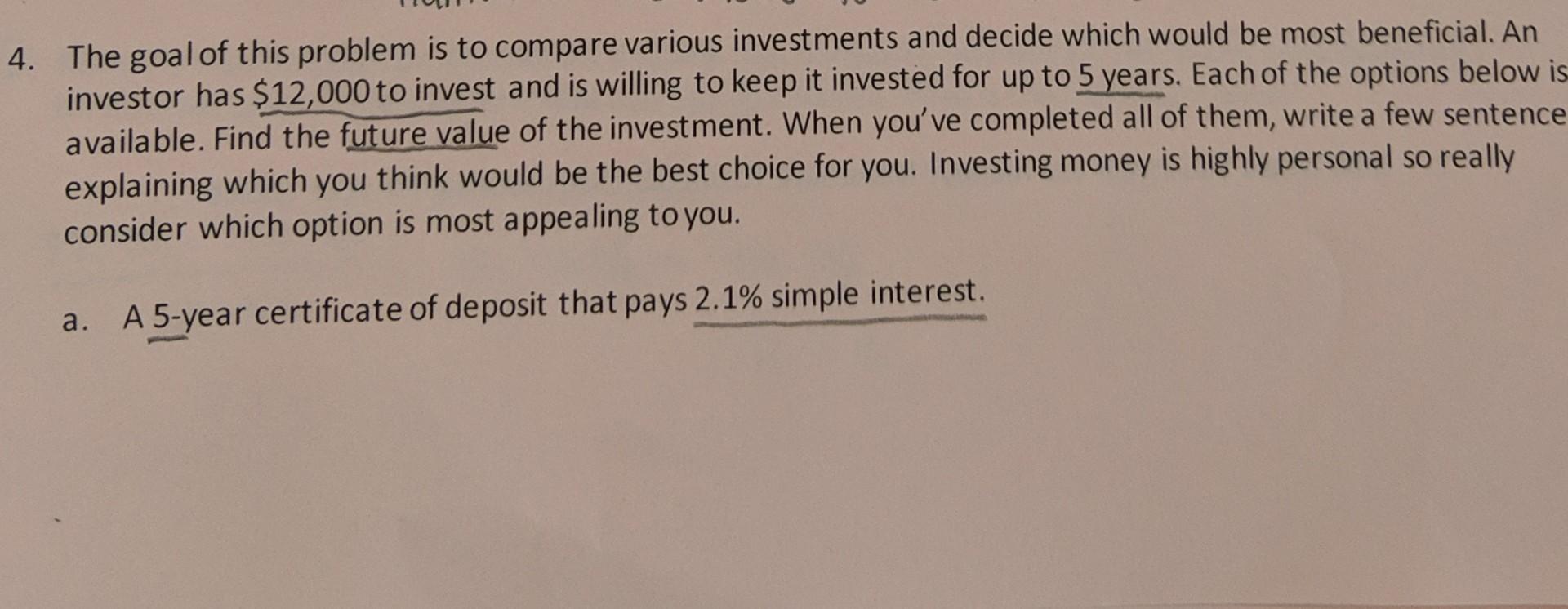

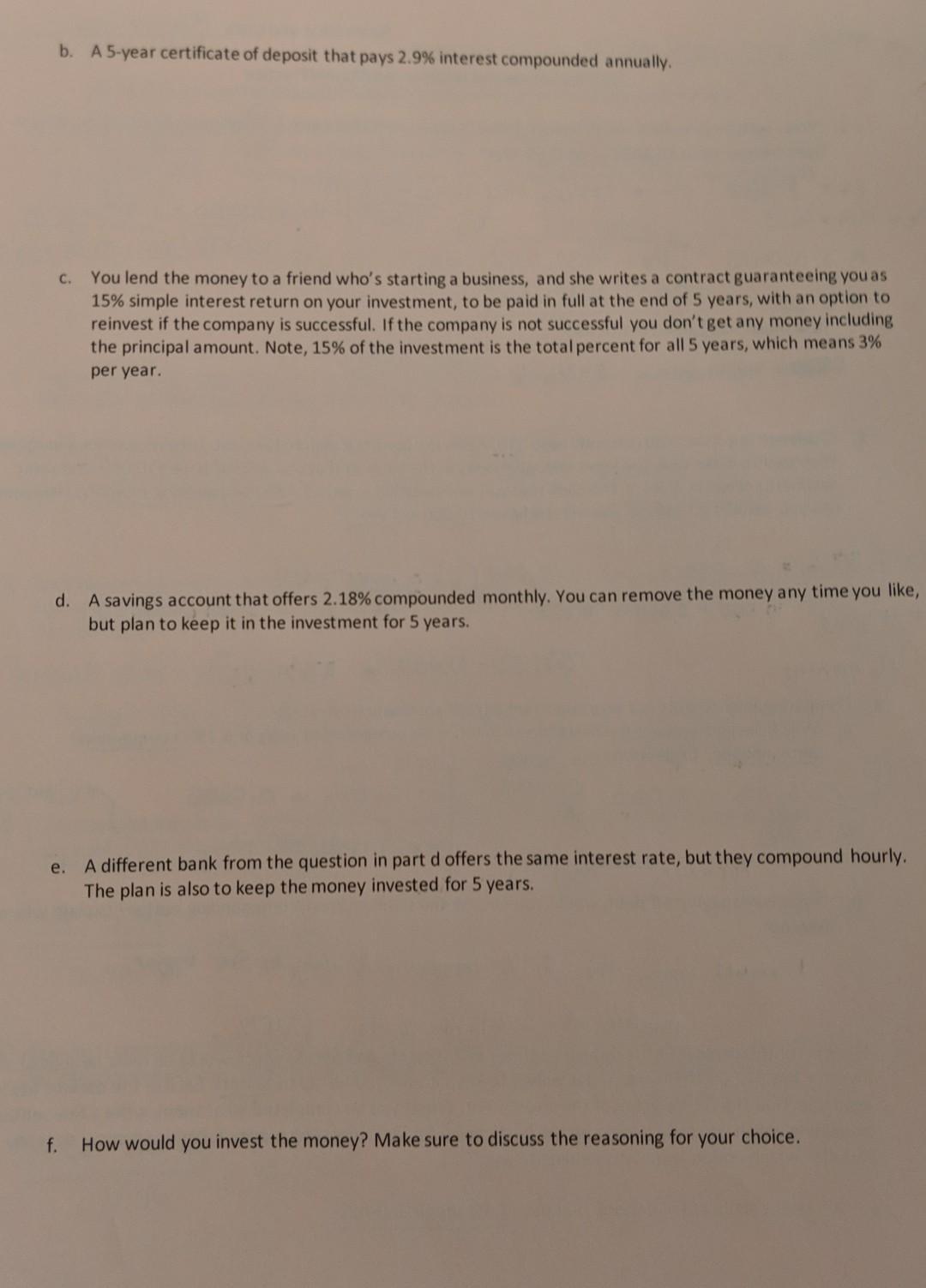

4. The goal of this problem is to compare various investments and decide which would be most beneficial. An investor has $12,000 to invest and is willing to keep it invested for up to 5 years. Each of the options below is available. Find the future value of the investment. When you've completed all of them, write a few sentence explaining which you think would be the best choice for you. Investing money is highly personal so really consider which option is most appealing to you. a. A 5-year certificate of deposit that pays 2.1% simple interest. b. A 5-year certificate of deposit that pays 2.9% interest compounded annually. c. You lend the money to a friend who's starting a business, and she writes a contract guaranteeing you as 15% simple interest return on your investment, to be paid in full at the end of 5 years, with an option to reinvest if the company is successful. If the company is not successful you don't get any money including the principal amount. Note, 15% of the investment is the total percent for all 5 years, which means 3% per year. d. A savings account that offers 2.18% compounded monthly. You can remove the money any time you like, but plan to keep it in the investment for 5 years. e. A different bank from the question in part d offers the same interest rate, but they compound hourly. The plan is also to keep the money invested for 5 years. f. How would you invest the money? Make sure to discuss the reasoning for your choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started