Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am working on this problem but I think i am doing something wrong. Can someone help me fill out this table properly? Thanks! (If

I am working on this problem but I think i am doing something wrong. Can someone help me fill out this table properly? Thanks! (If you cannot see the image clearly please right click and select "open in a new tab)

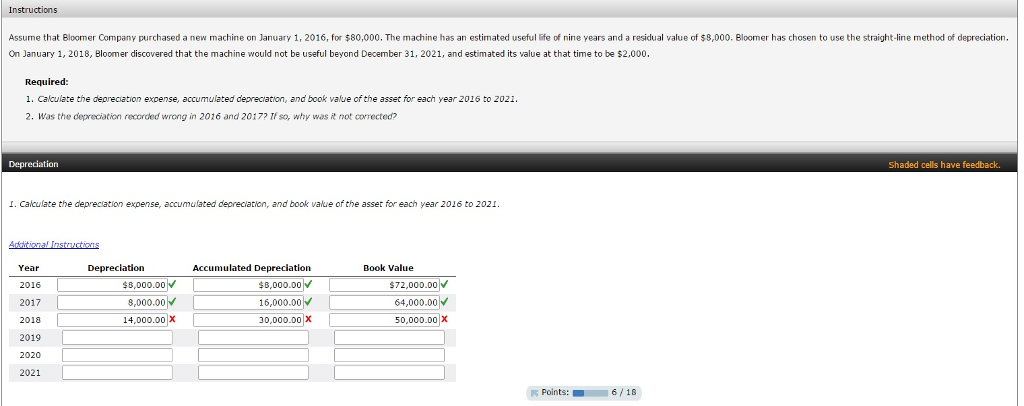

Instructions Assume that Bloomer Company purchased a new machine on January 1, 2016, for $80,000, The machine has an estimated useful life of nine years and a residual value of $8,000, Bloomer has chosen to use the straigh ne method of depreciation. On January 1, 2018, Bloomer discovered that the machine would not be useful beyond December 31, 2021, and estimated its value at that time to be $2,000. Required 1. Calculate the depreciation expense, accumulated depreciation, and book value of the asset for each year 2016 to 2021. 2. Was the depreciation recorded wrong in 2016 and 2017? Tf so, why was it not comected? Depreciation Shaded cells have feedback. I. Calculate the deprecation expense, accumulated depreciation, and book value of the asset for each year 2016 to 2021 Depreciation Accumulated Depreciation Book Value Yea $8,000.00 v $8,000.00 $72,000.00 016 8.000.00 16,000.00 v 64,000.00 2017 14,000.00 X 30,000.00 X 50,000.00 X 018 2019 2020 2021 Points: 6/18Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started