Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I answered some but I'm not sure if I did them correctly. Could you please check? QUESTION 5 R=D+Peri-Pe PE Last year, you purchased a

I answered some but I'm not sure if I did them correctly.

I answered some but I'm not sure if I did them correctly.

Could you please check?

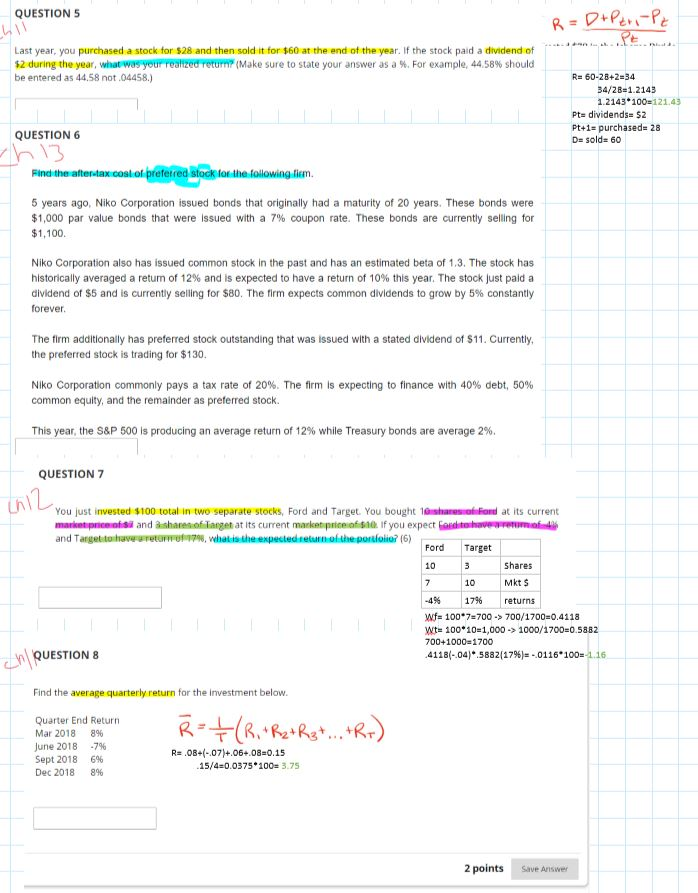

QUESTION 5 R=D+Peri-Pe PE Last year, you purchased a stock for $28 and then sold it for $60 at the end of the year. If the stock paid a dividend of $2 during the year, what was your realized returny (Make sure to state your answer as a %. For example 44.58% should be entered as 44.58 not 04458.) R= 60-28+2=34 34/28=1.2143 1.2143*100=121.43 Pt= dividends= 52 Pt+1= purchased= 28 D= sold= 60 QUESTION 6 Find the after tax cost of preferred stock for the following tim. 5 years ago, Niko Corporation issued bonds that originally had a maturity of 20 years. These bonds were $1,000 par value bonds that were issued with a 7% coupon rate. These bonds are currently selling for $1,100. Niko Corporation also has issued common stock in the past and has an estimated beta of 1.3. The stock has historically averaged a return of 12% and is expected to have a return of 10% this year. The stock Just palda dividend of $5 and is currently selling for $80. The firm expects common dividends to grow by 5% constantly forever The firm additionally has preferred stock outstanding that was issued with a stated dividend of S11. Currently, the preferred stock is trading for $130, Niko Corporation commonly pays a tax rate of 20%. The firm is expecting to finance with 40% debt, 50% common equity, and the remainder as preferred stock. This year, the S&P 500 is producing an average return of 12% while Treasury bonds are average 2%. QUESTION 7 (012, 3 You just invested $100 total in two separate stocks, Ford and Target. You bought sofon at its current market price and share of Target at its current market prices. If you expect for traverorenom and Target to have met 79, what is the expected return of the portfolio? (6) Ford Target 10 Shares Mkts 17% returns Wf= 100*7=700 -> 700/1700=0.4118 Wt= 100*10=1,000 -> 1000/1700=0.5862 700-1000-1700 QUESTION 8 41181-04)*.5882(17%)= - 0116*100=-116 7 10 -49 Find the average quarterly return for the Investment below. =+(R.+R2+3+...+R+) Quarter End Return Mar 2018 8% June 2018 -796 Sept 2018 6% Dec 2018 896 R= .08+/-07)+.06+08=0.15 15/4=0.0375*100= 3.75 2 points Save AriswerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started