I attached answer to q1 can i get answer to q3

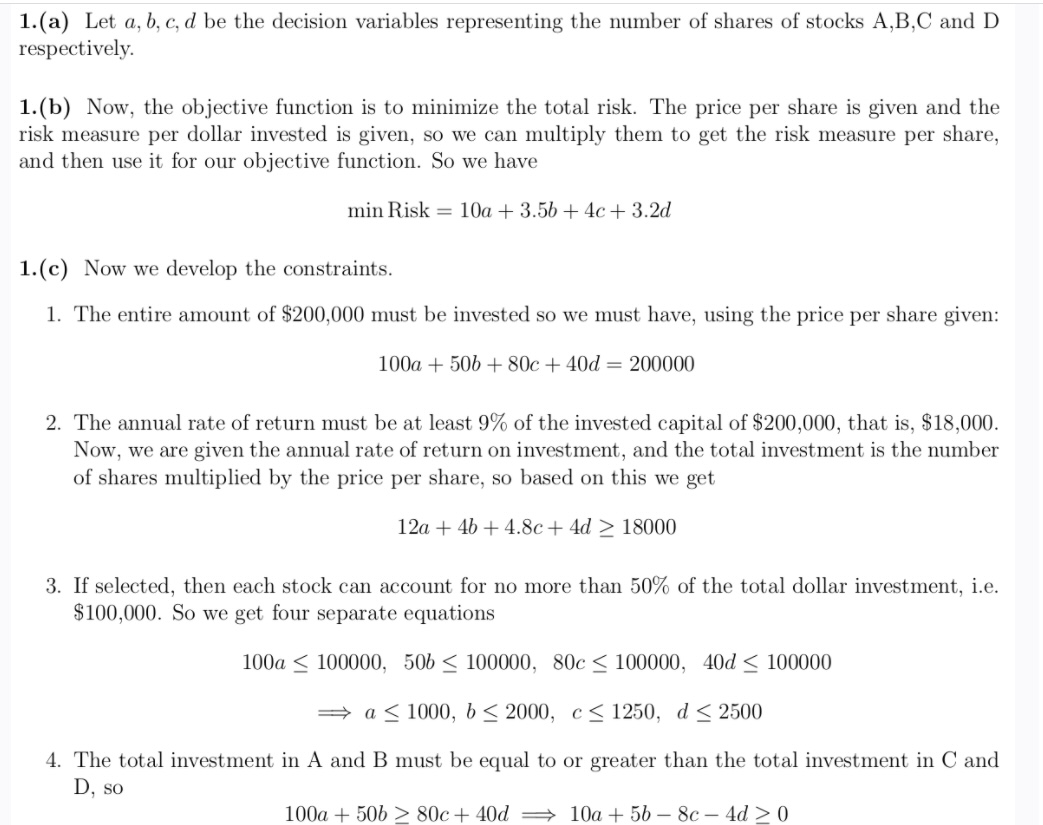

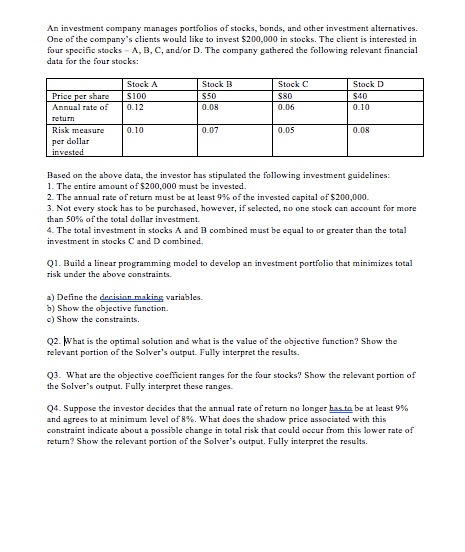

1.(a) Let a, b, c, d be the decision variables representing the number of shares of stocks A,B,C and D respectively. 1.(b) Now, the objective function is to minimize the total risk. The price per share is given and the risk mesSure per dollar invested is given, so we can multiply them to get the risk measure per share, and then use it for our objective function. So we have minRisk = 100 + 3.55 + 48+ 3% 1.(c) Now we develop the constraints. 1. The entire amount of $200,000 must be invested so we must have, using the price per share given: 100:} + 50b + 806 + 40d. = 200000 2. The annual rate of return must be at least 9% of the invested capital of $200,000, that is, $18,000. Now, we are given the annual rate of return on investment, and the total investment is the number of shares multiplied by the price per share. so based on this we get 120. + 4b + 4.80 + 4d 2 18000 3. If selected, then each stock can account for no more than 50% of the total dollar investment, i.e. $100,000. So we get four separate equations 100a E 100000, 50.5 E 100000, 80c E 100000, 40d 5 100000 =:~ a s 1000, b s 2000, c 5 1250, d s 2500 4. The total investment in A and B must be equal to or greater than the total investment in C and D1 so 100a+50l32806+40d => 10a+5b864d20 An investment company manages portfolios of stocks, bonds, and other investment alternatives. One of the company's clients would like to invest $200,000 in stocks. The client is interested in four specific stocks - A, B, C, and/or D. The company gathered the following relevant financial data for the four stocks: Stock A Stock B Stock C Stock D Price per share $100 $50 $40 Annual rate of 0.12 0.08 0.06 0.10 return Risk measure 0.10 0.07 0.05 0.08 per dollar invested Based on the above data, the investor has stipulated the following investment guidelines: 1. The entire amount of $200,000 must be invested 2. The annual rate of return must be at least 9%% of the invested capital of $200,000. 3. Not every stock has to be purchased, however, if selected, no one stock can account for more than 50% of the total dollar investment 4. The total investment in stocks A and B combined must be equal to or greater than the total investment in stocks C and D combined. Q1. Build a linear programming model to develop an investment portfolio that minimizes total risk under the above constraints. 1) Define the decision making variables. b) Show the objective function. ") Show the constraints. 02. What is the optimal solution and what is the value of the objective function? Show the relevant portion of the Solver's output. Fully interpret the results. Q3. What are the objective coefficient ranges for the four stocks? Show the relevant portion of the Solver's output. Fully interpret these ranges. Q4. Suppose the investor decides that the annual rate of return no longer has to be at least 9% and agrees to at minimum level of 8%%. What does the shadow price associated with this constraint indicate about a possible change in total risk that could occur from this lower rate of return? Show the relevant portion of the Solver's output. Fully interpret the results