Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i attached the format of the analysis 2. Elliot is the one-year-old son of Andrew and Diana Wilson. Elliot starred in several television commercials this

i attached the format of the analysis

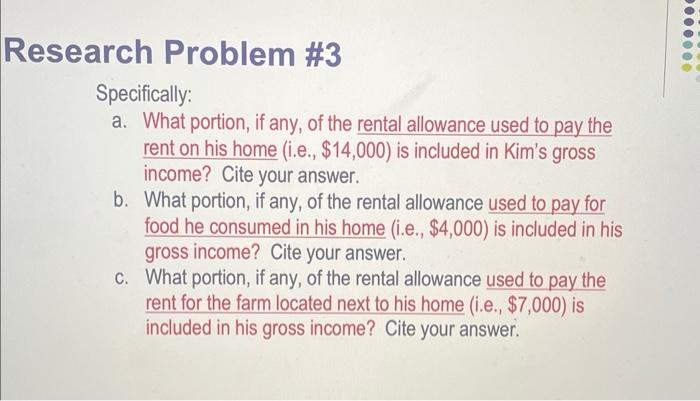

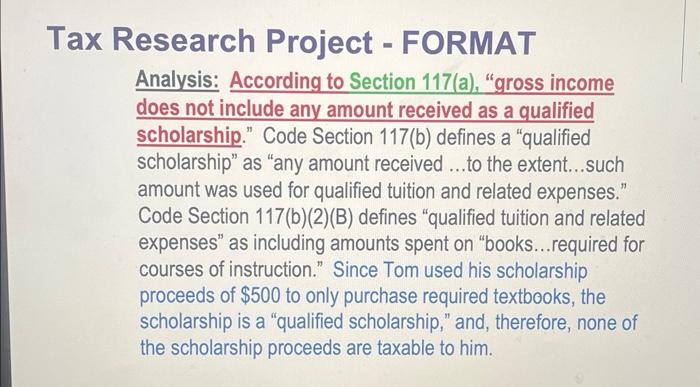

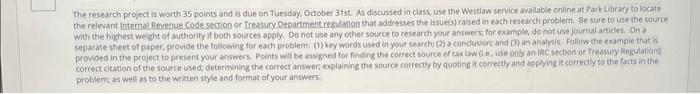

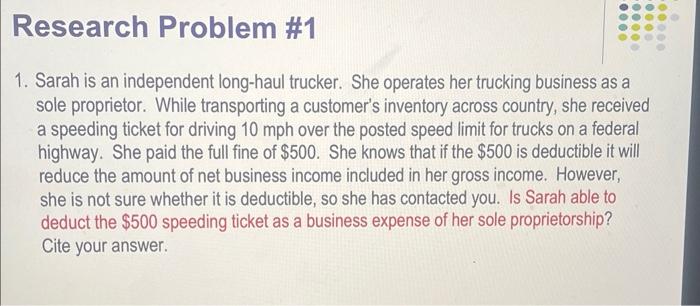

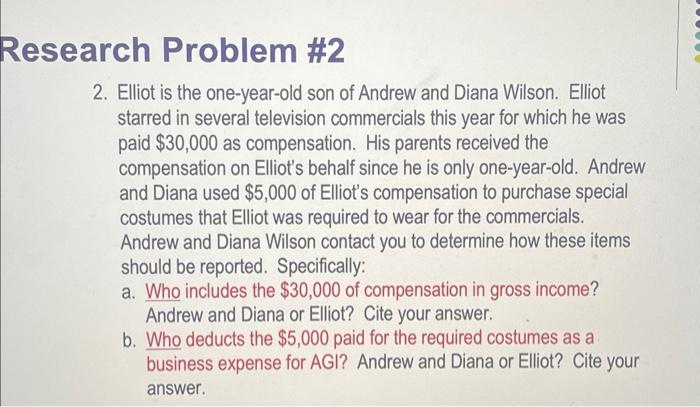

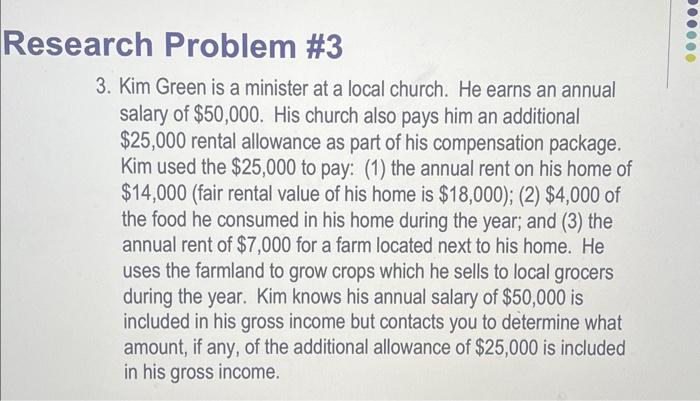

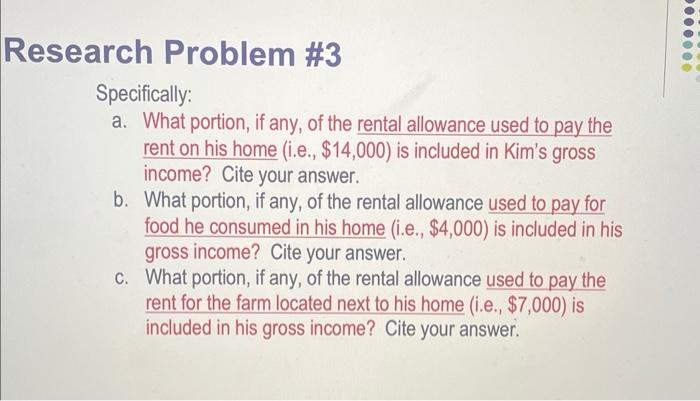

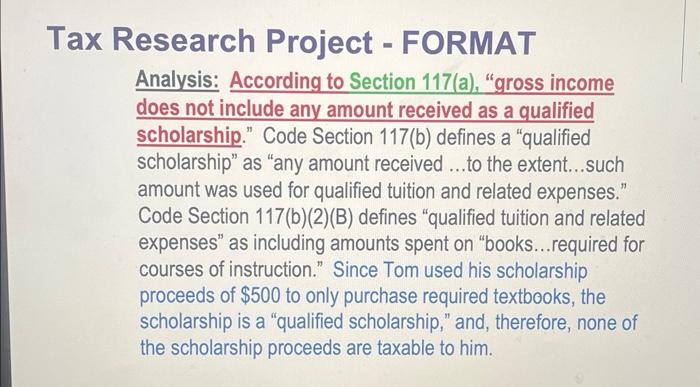

2. Elliot is the one-year-old son of Andrew and Diana Wilson. Elliot starred in several television commercials this year for which he was paid $30,000 as compensation. His parents received the compensation on Elliot's behalf since he is only one-year-old. Andrew and Diana used $5,000 of Elliot's compensation to purchase special costumes that Elliot was required to wear for the commercials. Andrew and Diana Wilson contact you to determine how these items should be reported. Specifically: a. Who includes the $30,000 of compensation in gross income? Andrew and Diana or Elliot? Cite your answer. b. Who deducts the $5,000 paid for the required costumes as a business expense for AGI? Andrew and Diana or Elliot? Cite your answer. 1. Sarah is an independent long-haul trucker. She operates her trucking business as a sole proprietor. While transporting a customer's inventory across country, she received a speeding ticket for driving 10mph over the posted speed limit for trucks on a federal highway. She paid the full fine of $500. She knows that if the $500 is deductible it will reduce the amount of net business income included in her gross income. However, she is not sure whether it is deductible, so she has contacted you. Is Sarah able to deduct the $500 speeding ticket as a business expense of her sole proprietorship? Cite your answer. search Problem \#3 Specifically: a. What portion, if any, of the rental allowance used to pay the rent on his home (i.e., \$14,000) is included in Kim's gross income? Cite your answer. b. What portion, if any, of the rental allowance used to pay for food he consumed in his home (i.e., $4,000 ) is included in his gross income? Cite your answer. c. What portion, if any, of the rental allowance used to pay the rent for the farm located next to his home (i.e., $7,000 ) is included in his gross income? Cite your answer. The research project is worth 35 points and is due on Tuesdsy, October 31 st. As discussed in class, use the Westaw service avallable online at Park Loracy to locate With the highest weight of authority if both sources apply. Do not use any other source to research your answers for cxample, do not use journal articles. On a provided in the project to present your answers. Points wil be assigned for finding the correct source of tax Law (I.e. ise onb an IRC sectoon of Treasury Regulation. correct citation of the source used, deternining the correct answer, explaining the source correctly by qupting it comrectly and applying it correctly to the facts in the problemy as welf as to the written style and format of your answers. 3. Kim Green is a minister at a local church. He earns an annual salary of $50,000. His church also pays him an additional $25,000 rental allowance as part of his compensation package. Kim used the $25,000 to pay: (1) the annual rent on his home of $14,000 (fair rental value of his home is $18,000 ); (2) $4,000 of the food he consumed in his home during the year; and (3) the annual rent of $7,000 for a farm located next to his home. He uses the farmland to grow crops which he sells to local grocers during the year. Kim knows his annual salary of $50,000 is included in his gross income but contacts you to determine what amount, if any, of the additional allowance of $25,000 is included in his gross income. Analysis: According to Section 117(a), "gross income does not include any amount received as a qualified scholarship." Code Section 117(b) defines a "qualified scholarship" as "any amount received ...to the extent...such amount was used for qualified tuition and related expenses." Code Section 117(b)(2)(B) defines "qualified tuition and related expenses" as including amounts spent on "books...required for courses of instruction." Since Tom used his scholarship proceeds of $500 to only purchase required textbooks, the scholarship is a "qualified scholarship," and, therefore, none of the scholarship proceeds are taxable to him

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started