Answered step by step

Verified Expert Solution

Question

1 Approved Answer

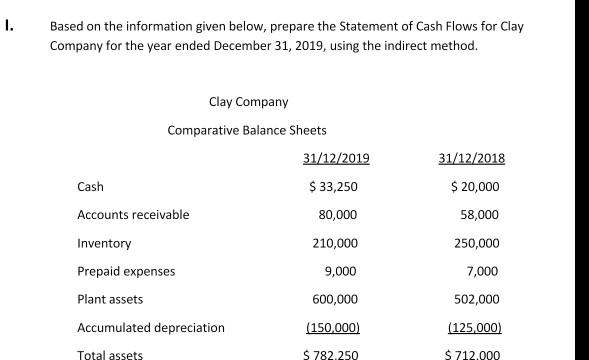

I. Based on the information given below, prepare the Statement of Cash Flows for Clay Company for the year ended December 31, 2019, using the

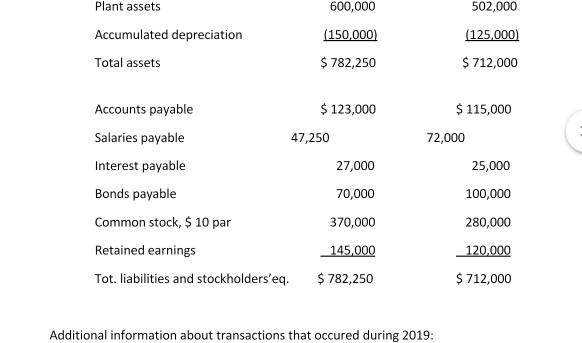

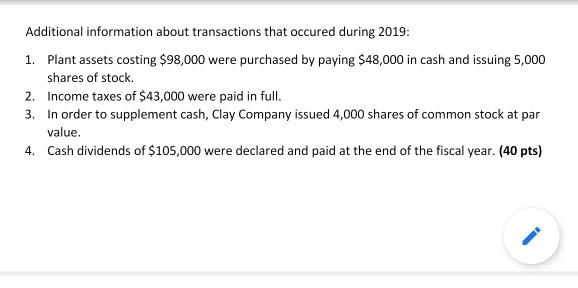

I. Based on the information given below, prepare the Statement of Cash Flows for Clay Company for the year ended December 31, 2019, using the indirect method. Clay Company Comparative Balance Sheets 31/12/2019 31/12/2018 Cash $ 33,250 $ 20,000 Accounts receivable 80,000 58,000 Inventory 210,000 250,000 Prepaid expenses 9,000 7,000 Plant assets 600,000 502,000 Accumulated depreciation (150.000) (125,000) Total assets S 782.250 $ 712.000 Plant assets 600,000 502,000 Accumulated depreciation (150,000) (125,000) Total assets $782,250 $ 712,000 $ 115,000 72,000 25,000 Accounts payable $ 123,000 Salaries payable 47,250 Interest payable 27,000 Bonds payable 70,000 Common stock, $ 10 par 370,000 Retained earnings 145,000 Tot. liabilities and stockholders'eq. $ 782,250 100,000 280,000 120,000 $ 712,000 Additional information about transactions that occured during 2019: Additional information about transactions that occured during 2019: 1. Plant assets costing $98,000 were purchased by paying $48,000 in cash and issuing 5,000 shares of stock. 2. Income taxes of $43,000 were paid in full. 3. In order to supplement cash, Clay Company issued 4,000 shares of common stock at par value. 4. Cash dividends of $105,000 were declared and paid at the end of the fiscal year. (40 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started