Answered step by step

Verified Expert Solution

Question

1 Approved Answer

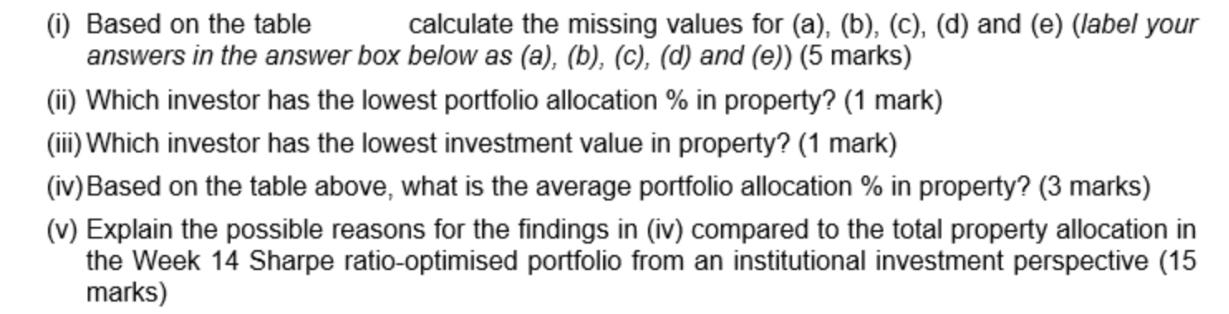

(i) Based on the table calculate the missing values for (a), (b), (c), (d) and (e) (label your answers in the answer box below

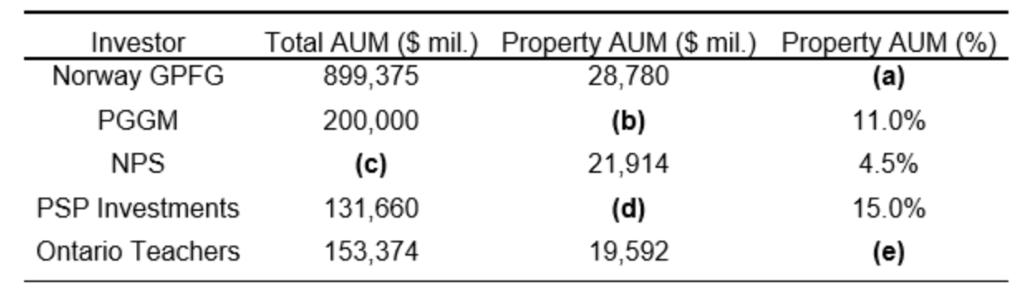

(i) Based on the table calculate the missing values for (a), (b), (c), (d) and (e) (label your answers in the answer box below as (a), (b), (c), (d) and (e)) (5 marks) (ii) Which investor has the lowest portfolio allocation % in property? (1 mark) (iii) Which investor has the lowest investment value in property? (1 mark) (iv) Based on the table above, what is the average portfolio allocation % in property? (3 marks) (v) Explain the possible reasons for the findings in (iv) compared to the total property allocation in the Week 14 Sharpe ratio-optimised portfolio from an institutional investment perspective (15 marks) 899,375 Investor Norway GPFG Total AUM ($ mil.) Property AUM ($ mil.) Property AUM (%) 28,780 (a) PGGM 200,000 (b) 11.0% NPS (c) 21,914 4.5% PSP Investments 131,660 (d) 15.0% Ontario Teachers 153,374 19,592 (e)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started