I basically konw the answer but I also need explanations on why the answer is correct. If a question requires a numerical answer, provide a formula that helps to solve it.

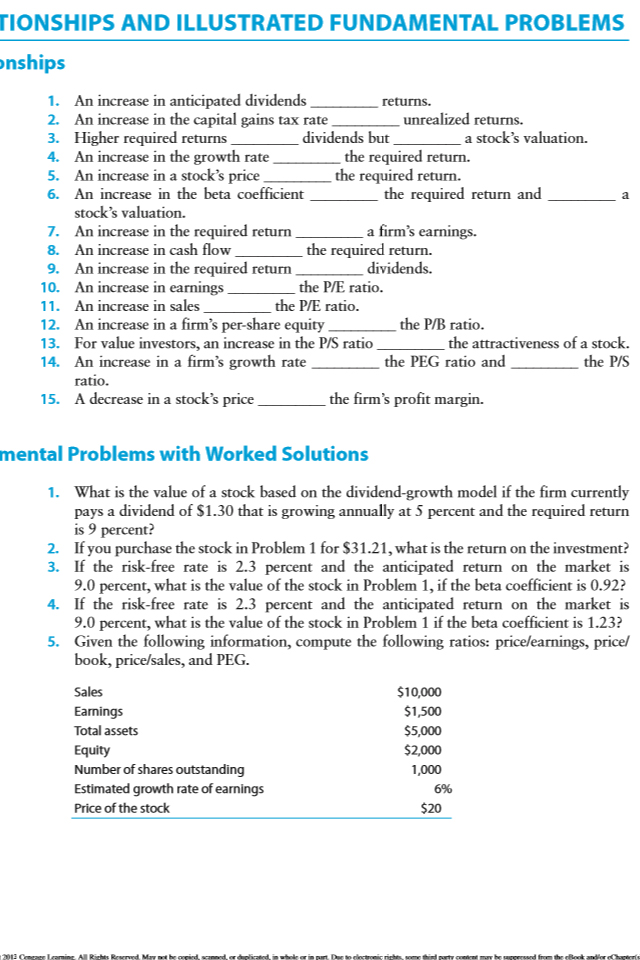

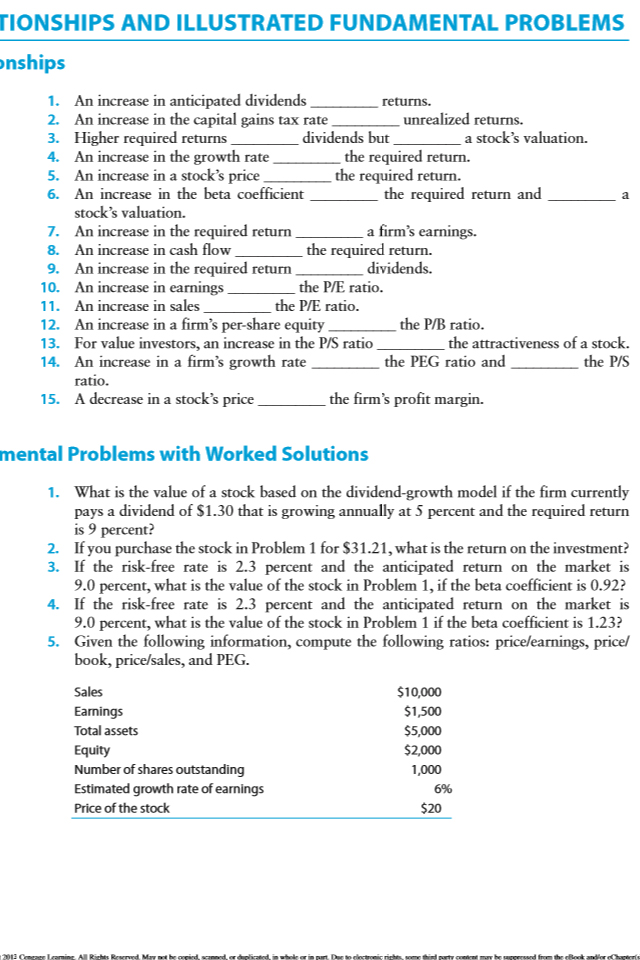

TIONSHIPS AND ILLUSTRATED FUNDAMENTAL PROBLEMS a onships 1. An increase in anticipated dividends returns. 2. An increase in the capital gains tax rate unrealized returns. 3. Higher required returns dividends but a stock's valuation. 4. An increase in the growth rate the required return. 5. An increase in a stock's price the required return. 6. An increase in the beta coefficient the required return and stock's valuation. 7. An increase in the required return a firm's earnings. 8. An increase in cash flow the required return. 9. An increase in the required return dividends. 10. An increase in earnings the P/E ratio. 11. An increase in sales the P/E ratio. 12. An increase in a firm's per-share equity the P/B ratio. 13. For value investors, an increase in the P/S ratio the attractiveness of a stock. 14. An increase in a firm's growth rate the PEG ratio and the P/S ratio. 15. A decrease in a stock's price the firm's profit margin. mental Problems with Worked Solutions 1. What is the value of a stock based on the dividend-growth model if the firm currently pays a dividend of $1.30 that is growing annually at 5 percent and the required return is 9 percent? 2. If you purchase the stock in Problem 1 for $31.21, what is the return on the investment? 3. If the risk-free rate is 2.3 percent and the anticipated return on the market is 9.0 percent, what is the value of the stock in Problem 1, if the beta coefficient is 0.922 4. If the risk-free rate is 2.3 percent and the anticipated return on the market is 9.0 percent, what is the value of the stock in Problem 1 if the beta coefficient is 1.232 5. Given the following information, compute the following ratios: pricelearnings, pricel book, price/sales, and PEG. Sales $10,000 Earnings $1,500 Total assets $5,000 Equity $2,000 Number of shares outstanding 1,000 Estimated growth rate of earnings 6% Price of the stock $20 2013 Caraming All Rights Rewd Mothecagend TIONSHIPS AND ILLUSTRATED FUNDAMENTAL PROBLEMS a onships 1. An increase in anticipated dividends returns. 2. An increase in the capital gains tax rate unrealized returns. 3. Higher required returns dividends but a stock's valuation. 4. An increase in the growth rate the required return. 5. An increase in a stock's price the required return. 6. An increase in the beta coefficient the required return and stock's valuation. 7. An increase in the required return a firm's earnings. 8. An increase in cash flow the required return. 9. An increase in the required return dividends. 10. An increase in earnings the P/E ratio. 11. An increase in sales the P/E ratio. 12. An increase in a firm's per-share equity the P/B ratio. 13. For value investors, an increase in the P/S ratio the attractiveness of a stock. 14. An increase in a firm's growth rate the PEG ratio and the P/S ratio. 15. A decrease in a stock's price the firm's profit margin. mental Problems with Worked Solutions 1. What is the value of a stock based on the dividend-growth model if the firm currently pays a dividend of $1.30 that is growing annually at 5 percent and the required return is 9 percent? 2. If you purchase the stock in Problem 1 for $31.21, what is the return on the investment? 3. If the risk-free rate is 2.3 percent and the anticipated return on the market is 9.0 percent, what is the value of the stock in Problem 1, if the beta coefficient is 0.922 4. If the risk-free rate is 2.3 percent and the anticipated return on the market is 9.0 percent, what is the value of the stock in Problem 1 if the beta coefficient is 1.232 5. Given the following information, compute the following ratios: pricelearnings, pricel book, price/sales, and PEG. Sales $10,000 Earnings $1,500 Total assets $5,000 Equity $2,000 Number of shares outstanding 1,000 Estimated growth rate of earnings 6% Price of the stock $20 2013 Caraming All Rights Rewd Mothecagend