Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(i) Calculate the payback period for each project. (Round the figures to 2 decimal) (ii) Calculate the ARR for each project. (Round the figures to

(i) Calculate the payback period for each project. (Round the figures to 2 decimal)

(i) Calculate the payback period for each project. (Round the figures to 2 decimal)

(ii) Calculate the ARR for each project. (Round the figures to 2 decimal)

(iii) Calculate the NPV for each project. (Round the figures nearest to $- no decimal)

(iv) What will be Masons best project option? Justify your answer.

with formula pls

thank you so much

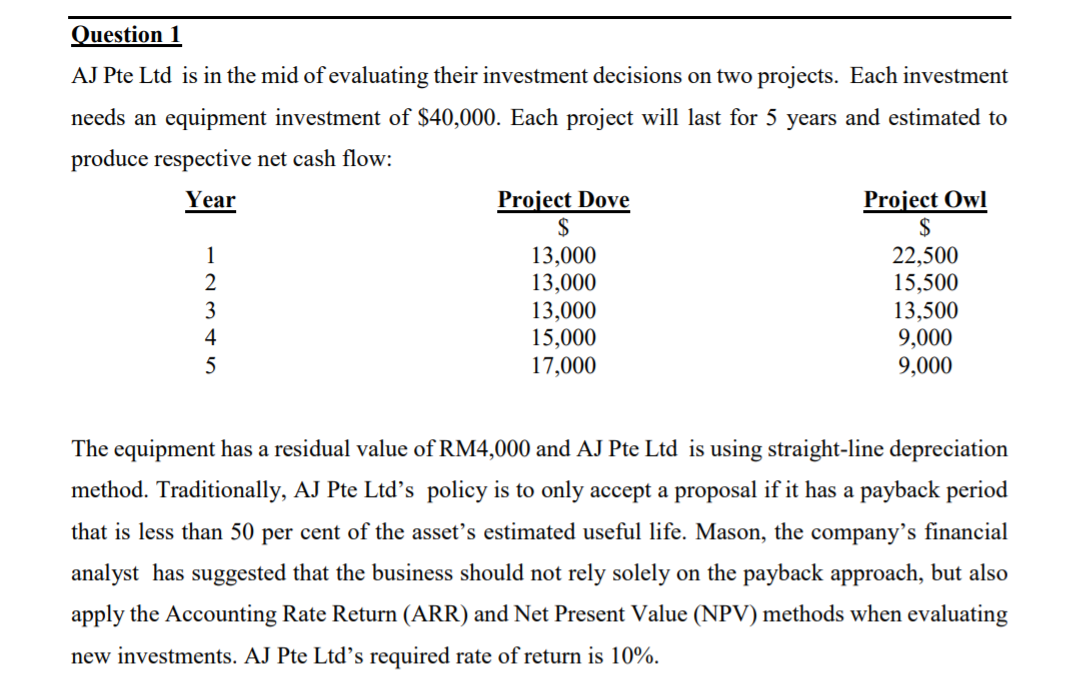

Question 1 AJ Pte Ltd is in the mid of evaluating their investment decisions on two projects. Each investment needs an equipment investment of $40,000. Each project will last for 5 years and estimated to produce respective net cash flow: Year Project Dove Project Owl $ $ 1 13,000 22,500 2 13,000 15,500 3 13,000 13,500 4 15,000 9,000 5 17,000 9,000 The equipment has a residual value of RM4,000 and AJ Pte Ltd is using straight-line depreciation method. Traditionally, AJ Pte Ltd's policy is to only accept a proposal if it has a payback period that is less than 50 per cent of the asset's estimated useful life. Mason, the company's financial analyst has suggested that the business should not rely solely on the payback approach, but also apply the Accounting Rate Return (ARR) and Net Present Value (NPV) methods when evaluating new investments. AJ Pte Ltd's required rate of return is 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started