Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I can buy a new advanced machine for $300,000, which will reduce my manufacturing cost by $30,000 per year in perpetuity (the savings is

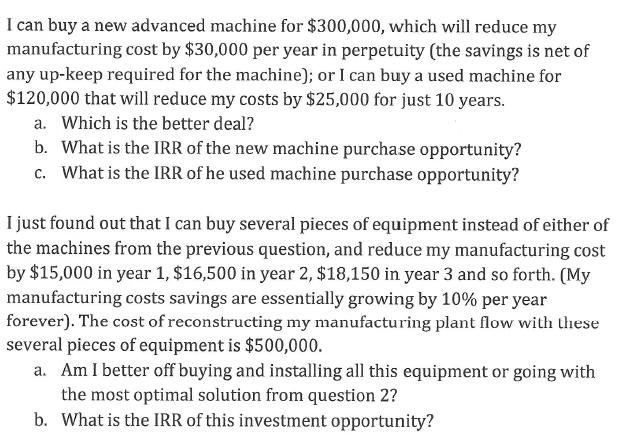

I can buy a new advanced machine for $300,000, which will reduce my manufacturing cost by $30,000 per year in perpetuity (the savings is net of any up-keep required for the machine); or I can buy a used machine for $120,000 that will reduce my costs by $25,000 for just 10 years. a. Which is the better deal? b. What is the IRR of the new machine purchase opportunity? c. What is the IRR of he used machine purchase opportunity? I just found out that I can buy several pieces of equipment instead of either of the machines from the previous question, and reduce my manufacturing cost by $15,000 in year 1, $16,500 in year 2, $18,150 in year 3 and so forth. (My manufacturing costs savings are essentially growing by 10% per year forever). The cost of reconstructing my manufacturing plant flow with these several pieces of equipment is $500,000. a. Am I better off buying and installing all this equipment or going with the most optimal solution from question 2? b. What is the IRR of this investment opportunity?

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A To compare two options we need to find the present value of each options cash flows The new machine costs 300000 and the annual savings is 30000 pay...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started