I CANNOT ADD THE FINANCIALS, IT WOULD MAKE THE QUESTION TOO LONG. I CAN SEND IT TO WHOMEVER CAN HELP ME WITH THE QUESTION

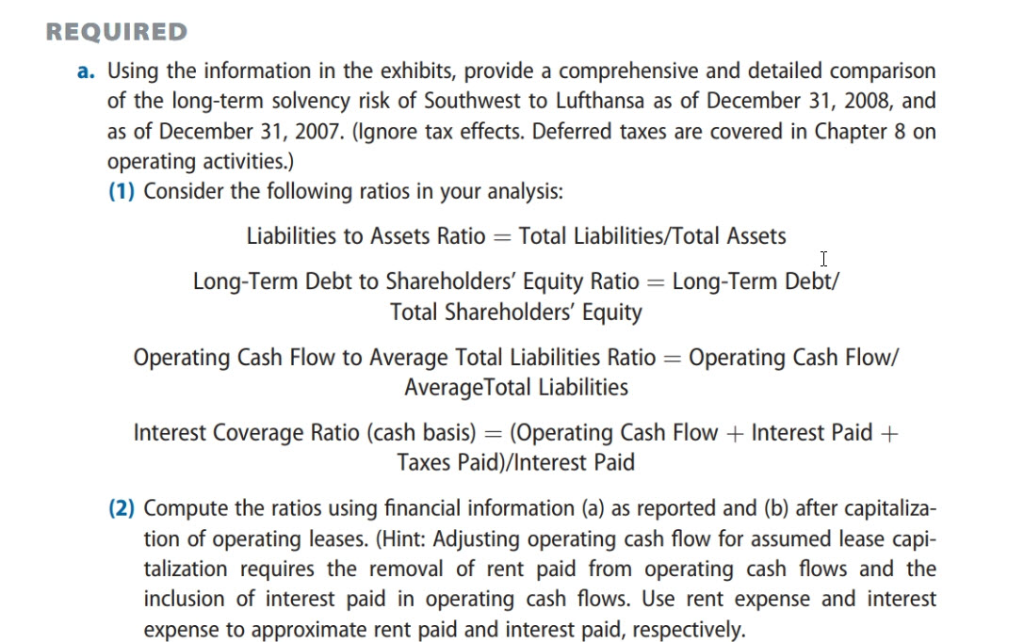

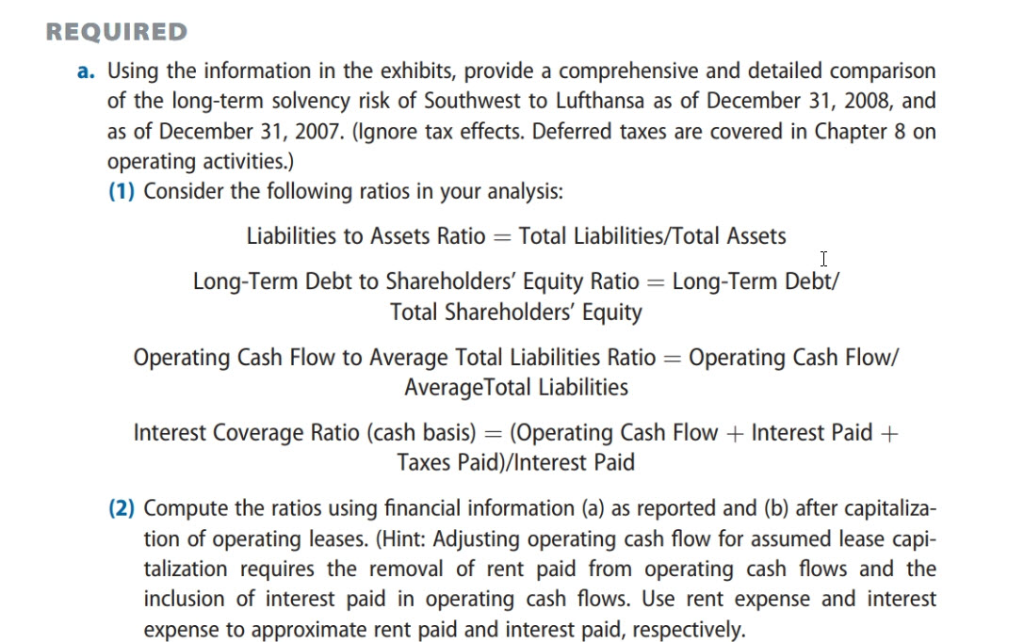

REQUIRED a. Using the information in the exhibits, provide a comprehensive and detailed comparison of the long-term solvency risk of Southwest to Lufthansa as of December 31, 2008, and as of December 31, 2007. (lgnore tax effects. Deferred taxes are covered in Chapter 8 on operating activities.) (1) Consider the following ratios in your analysis: Liabilities to Assets Ratio Total Liabilities/Total Assets Long-Term Debt to Shareholders' Equity Ratio Long-Term Debt/ Total Shareholders' Equity Operating Cash Flow to Average Total Liabilities Ratio Operating Cash Flow/ AverageTotal Liabilities Interest Coverage Ratio (cash basis) (Operating Cash Flow +Interest Paid + Taxes Paid)/Interest Paid (2) Compute the ratios using financial information (a) as reported and (b) after capitaliza tion of operating leases. (Hint: Adjusting operating cash flow for assumed lease capi- talization requires the removal of rent paid from operating cash flows and the inclusion of interest paid in operating cash flows. Use rent expense and interest expense to approximate rent paid and interest paid, respectively. REQUIRED a. Using the information in the exhibits, provide a comprehensive and detailed comparison of the long-term solvency risk of Southwest to Lufthansa as of December 31, 2008, and as of December 31, 2007. (lgnore tax effects. Deferred taxes are covered in Chapter 8 on operating activities.) (1) Consider the following ratios in your analysis: Liabilities to Assets Ratio Total Liabilities/Total Assets Long-Term Debt to Shareholders' Equity Ratio Long-Term Debt/ Total Shareholders' Equity Operating Cash Flow to Average Total Liabilities Ratio Operating Cash Flow/ AverageTotal Liabilities Interest Coverage Ratio (cash basis) (Operating Cash Flow +Interest Paid + Taxes Paid)/Interest Paid (2) Compute the ratios using financial information (a) as reported and (b) after capitaliza tion of operating leases. (Hint: Adjusting operating cash flow for assumed lease capi- talization requires the removal of rent paid from operating cash flows and the inclusion of interest paid in operating cash flows. Use rent expense and interest expense to approximate rent paid and interest paid, respectively