I cannot figure this problem out to save my life. I am especially confused as to how the revenues and expenses work, there is no formula that works and my teacher did not teach me how to do this.

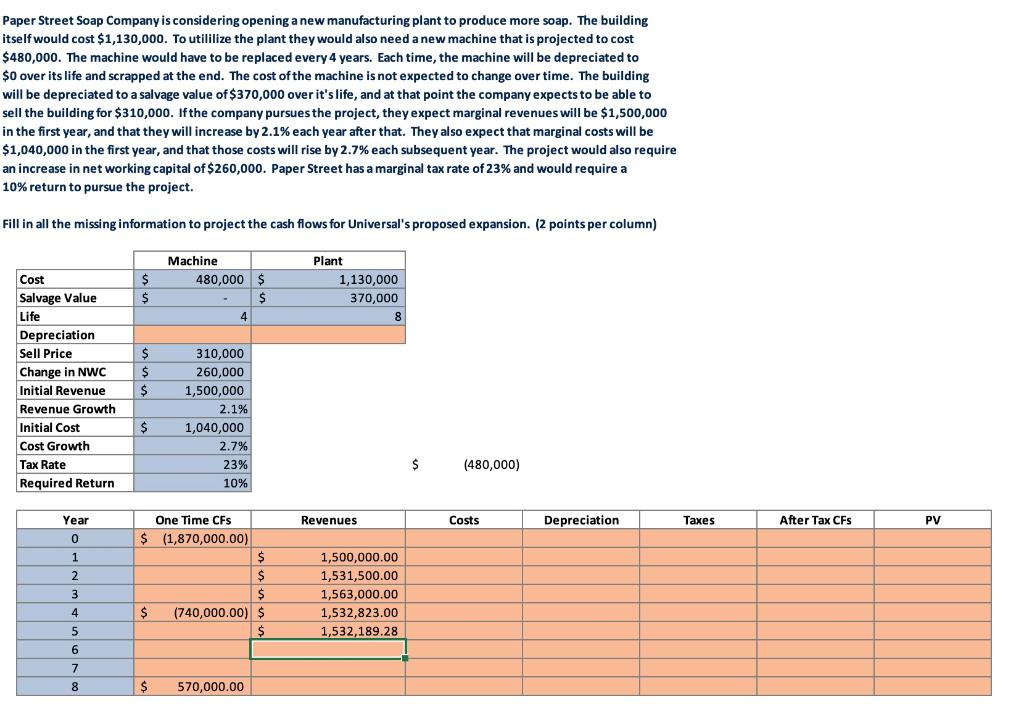

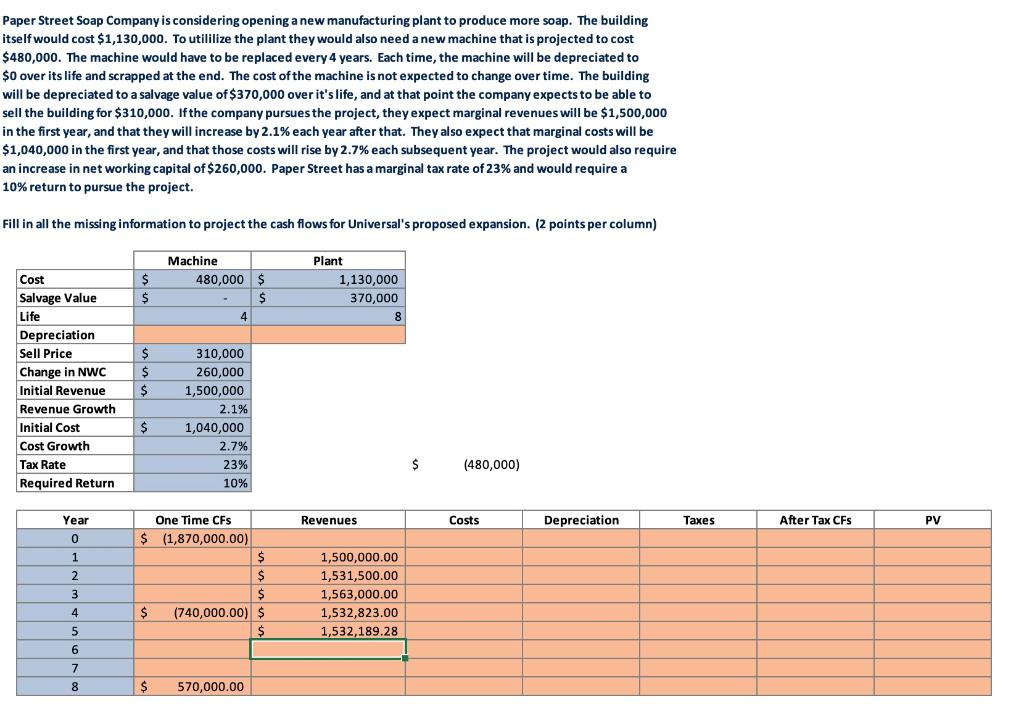

Paper Street Soap Company is considering opening a new manufacturing plant to produce more soap. The building itself would cost $1,130,000. To utililize the plant they would also need a new machine that is projected to cost $480,000. The machine would have to be replaced every 4 years. Each time, the machine will be depreciated to $0 over its life and scrapped at the end. The cost of the machine is not expected to change over time. The building will be depreciated to a salvage value of $370,000 over it's life, and at that point the company expects to be able to sell the building for $310,000. If the company pursues the project, they expect marginal revenues will be $1,500,000 in the first year, and that they will increase by 2.1% each year after that. They also expect that marginal costs will be $1,040,000 in the first year, and that those costs will rise by 2.7% each subsequent year. The project would also require an increase in net working capital of $260,000. Paper Street has a marginal tax rate of 23% and would require a 10% return to pursue the project. Fill in all the missing information to project the cash flows for Universal's proposed expansion. (2 points per column) Paper Street Soap Company is considering opening a new manufacturing plant to produce more soap. The building itself would cost $1,130,000. To utililize the plant they would also need a new machine that is projected to cost $480,000. The machine would have to be replaced every 4 years. Each time, the machine will be depreciated to $0 over its life and scrapped at the end. The cost of the machine is not expected to change over time. The building will be depreciated to a salvage value of $370,000 over it's life, and at that point the company expects to be able to sell the building for $310,000. If the company pursues the project, they expect marginal revenues will be $1,500,000 in the first year, and that they will increase by 2.1% each year after that. They also expect that marginal costs will be $1,040,000 in the first year, and that those costs will rise by 2.7% each subsequent year. The project would also require an increase in net working capital of $260,000. Paper Street has a marginal tax rate of 23% and would require a 10% return to pursue the project. Fill in all the missing information to project the cash flows for Universal's proposed expansion. (2 points per column)