I cannot get the monthly payment right.

I cannot get the monthly payment right.

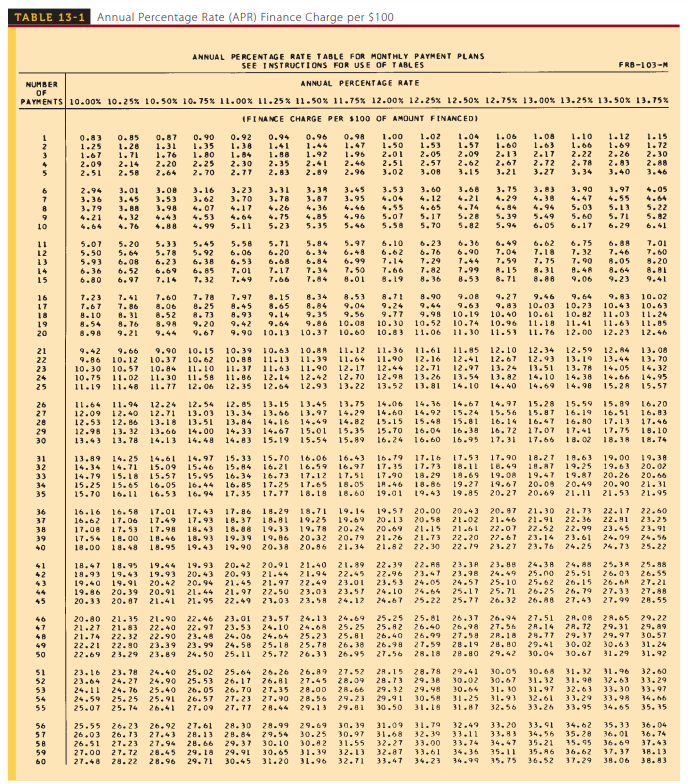

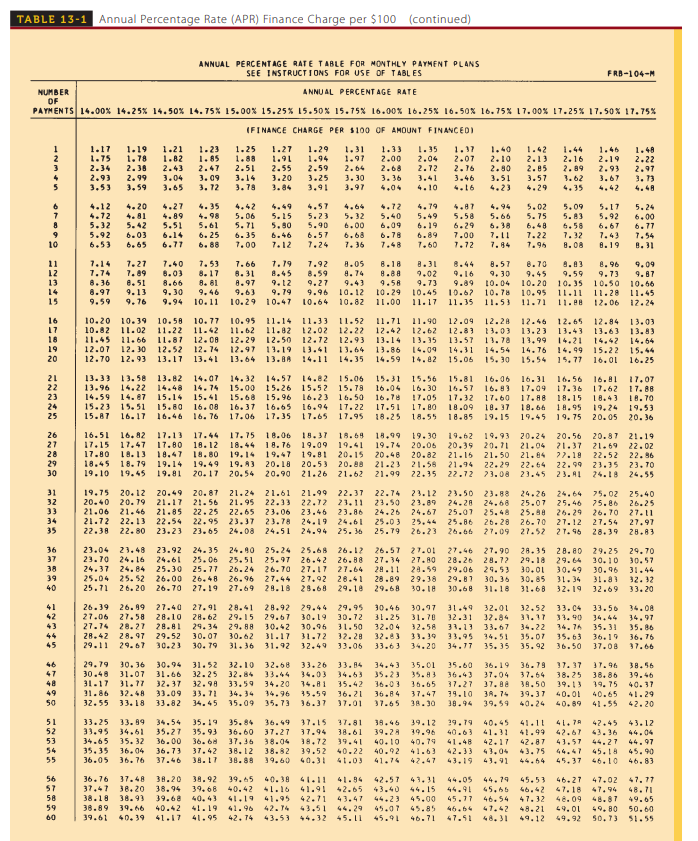

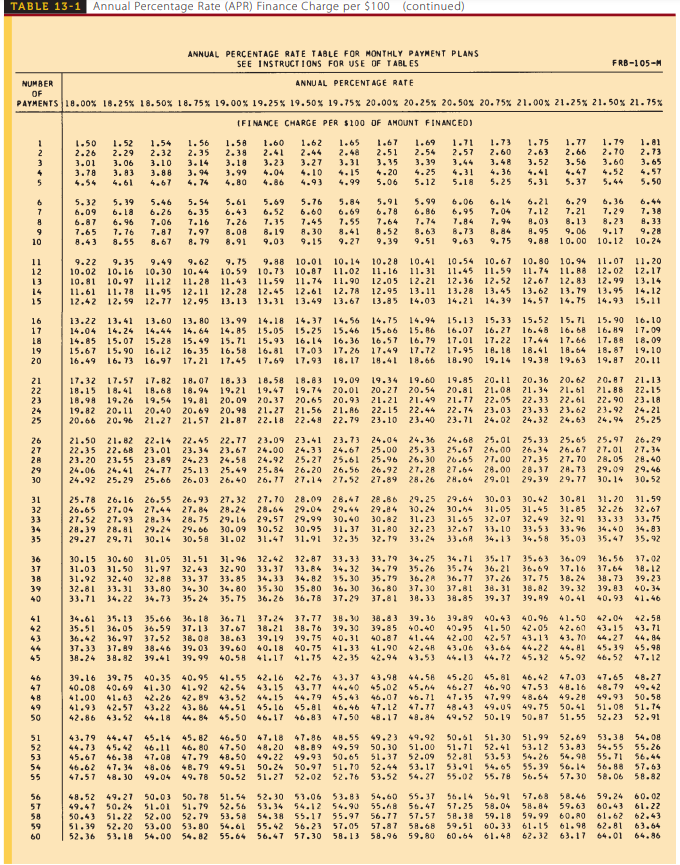

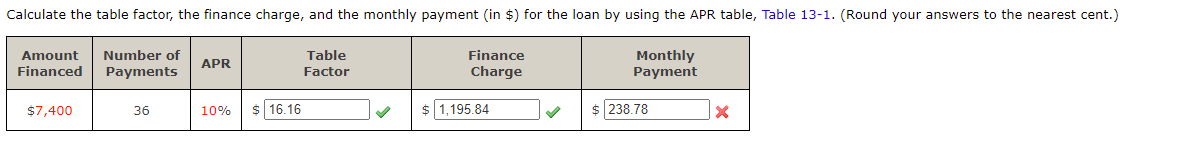

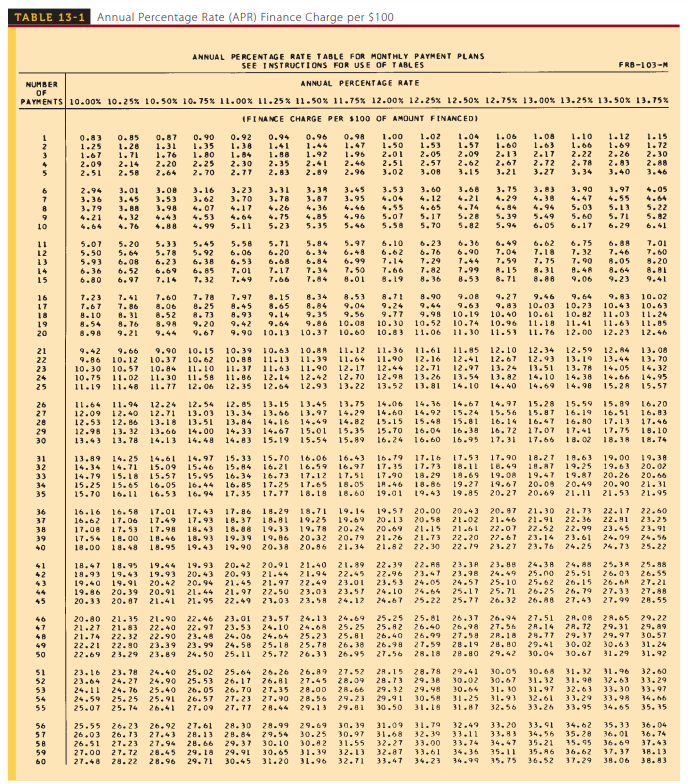

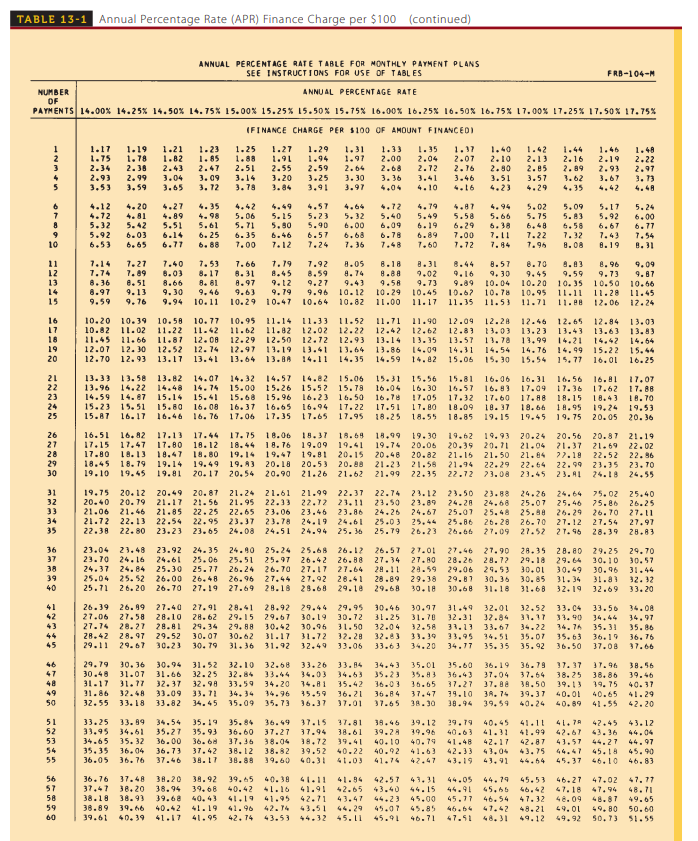

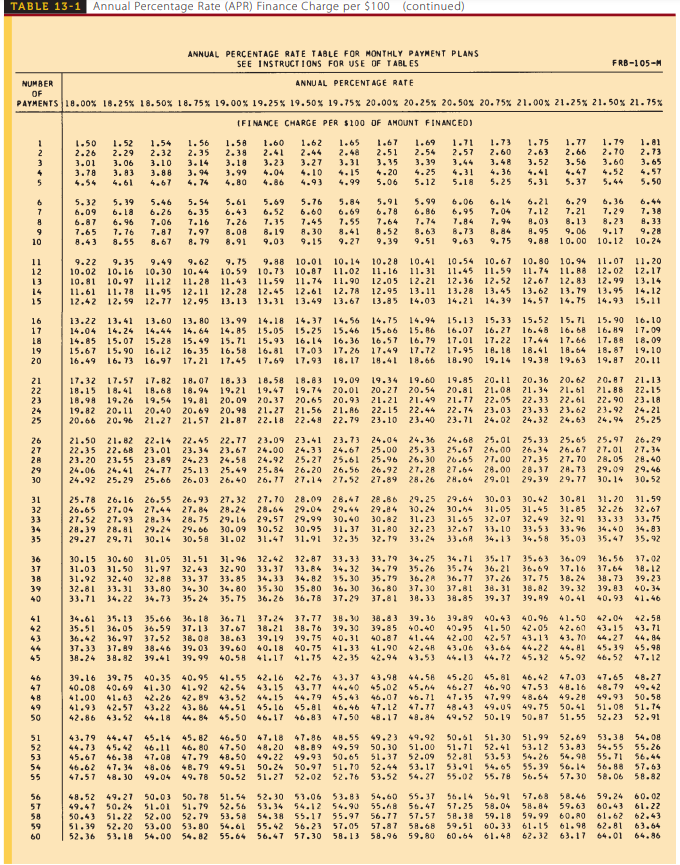

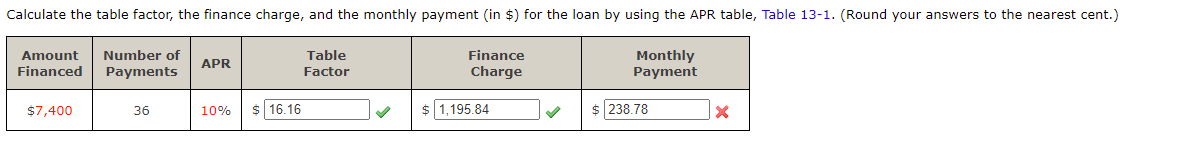

Calculate the table factor, the finance charge, and the monthly payment in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) Amount Financed Number of Payments APR Table Factor Finance Charge Monthly Payment $7,400 36 10% $ 16.16 $ 1,195.84 $ 238.78 x TABLE 13-1 Annual Percentage Rate (APR) Finance Charge per $100 5.92 8.71 9.04 ANNUAL PERCENTAGE RATE TABLE FOR MONTHLY PAYMENT PLANS SEE INSTRUCTIONS FOR USE OF TABLES FRB-103-N NUMBER ANNUAL PERCENTAGE RATE OF PAYMENTS 10.00% 10.25% 10.50% 10.75% 11.00% 11.25% 11.50% 11.75% 12.00% 12.25% 12.50% 12.75% 13.00% 13.25% 13.50% 13.75% (FINANCE CHARGE PER 3100 OF AMOUNT FINANCED) 0.83 0.85 0.87 0.90 0.92 0.94 0.96 0.98 1.00 1.02 1.04 1.06 1.08 1.10 1.12 1.15 1.25 1.28 1.31 1.35 1.38 1.41 1.44 1.47 1.50 1.53 1.57 1.60 1.63 1.66 1.69 1.72 1.67 1.71 1.76 1.80 1.64 1.80 1.92 1.95 2.01 2.05 2.09 2.13 2.17 2.22 2.26 2.30 2.09 2.14 2.20 2.25 2.30 2.35 2.41 2.46 2.51 2.57 2.62 2.67 2.72 2. 78 2.83 2.88 2.51 2.58 2.64 2. 70 2.77 2.83 2.89 2.96 3.02 3.08 3.15 3.21 3.27 3.34 3.40 3.46 2.94 3.01 3.00 3.16 3.23 3.31 3.38 3.45 3.60 3.68 3.75 3.83 3.90 3.97 4.05 3.36 3.53 3.62 3.70 3.78 3.87 3.95 4.04 4.12 4.21 4.29 4.55 3.79 3.88 3.98 4.07 4.17 4.26 4.36 4.55 4.65 4.74 5.03 5.13 5.22 4.21 4.32 4.53 4.75 4.85 5.07 5.17 5.28 5.39 5.49 5.60 5.71 5.82 10 4.76 4.88 4.99 5.11 5.23 5.35 5.46 5.58 5.70 5.82 5.95 6.05 6.17 6.29 6.41 11 5.07 5.20 5.33 5.45 5.58 5.71 5.97 6.10 0.23 0.36 6.49 6.62 6.75 7.01 5.50 5.64 5.78 6.06 6.20 6.48 6.62 6.76 6.90 7.04 7.18 7.32 7.46 7.00 5.93 6.08 6.23 6.38 6.53 6.68 0.84 6.99 7.14 7.29 7.44 7.59 7.75 7.90 8.05 8.20 14 6.36 6.52 6.69 6.85 7.01 7.17 7.34 7.50 7.66 7.82 7.99 8.15 8.31 8.48 8.64 8.81 15 6.80 6.97 7.14 7. 32 7.49 7.66 7.84 8.01 8.19 8.36 8.53 8.86 9.06 9.23 16 1.23 7.41 7.60 7.78 7.97 8.15 8.34 8.53 8.71 8.90 9.00 9.27 9.64 10.02 17 1.67 7.86 8.06 8.25 8.45 8.65 8.84 9.24 9.63 10.03 10.73 10.43 10.63 10 8.10 8.31 8.52 8.73 8.93 9.35 9.56 9.77 9.98 10.19 10.40 10.61 10.82 11.03 11.24 19 8.54 8. 76 8.98 9.20 9.42 9.64 9.86 10.08 10.30 10.52 10.74 10.96 11.19 11.41 11.63 11.85 20 8.98 9.21 9.67 9.90 10.13 10.37 10.60 10.89 11.06 11.30 11.53 11.76 12.00 12.23 12.46 21 9.42 9.66 9.90 10.15 10.39 10.63 10.8 11.12 11.36 11.61 11.85 12.10 12.34 12.59 12.14 13.08 22 9.86 10.12 10.37 10.62 10.88 11.13 11.39 11.64 11.90 12.16 12.41 12.67 12.93 13.19 13.44 13.70 23 10.30 10. 57 10.84 11.10 11.31 11.6311.90 12.17 12.44 12.71 12.97 13.24 13.51 13.78 14.05 14.32 24 10.75 11.02 11.30 11.58 11.86 12.14 12.212.70 12.98 13.26 13.54 13.82 14.10 14.38 14.06 14.95 25 11.19 11.40 11.77 12.06 12.35 12.64 12.93 13.22 13.52 13.81 14.10 14.40 14.69 14.90 15.28 15.57 26 11.64 11.94 12.24 12.54 12.85 13.15 13.45 3.75 14.06 14.36 14.67 14.97 15.28 15.59 15.89 27 16.20 12.09 12.40 12.71 13.03 13.34 13.50 13.97 14.29 14.60 14.92 15.24 15.56 15.81 16.19 16.51 28 16.83 12.53 12.B6 13.1 13.51 13.84 14.16 14.49 14.82 15.15 15.48 15.81 16.14 16.47 16.80 17.13 17.46 29 12.98 13.12 13.66 14.00 14.33 14.67 15.01 15.35 15.70 16.04 16.30 16.72 27.07 17.41 17.75 18.10 30 13.43 13.78 14.13 14.40 14.83 15.19 15.54 15.89 16.24 16.00 15.95 17.31 17.66 18.02 18.18 18.74 31 13.89 14.25 14.61 14.97 15.33 15.70 16.06 16.43 16.79 17.15 17.53 17.90 18.27 18.63 19.00 19.30 32 14.34 14.71 15.09 15.46 15.84 16.21 16.59 16.91 17.15 17.73 18.11 16.49 18.87 19.25 19.03 20.02 33 14.79 15.18 15.57 15.95 16.34 16.73 17.12 17.51 17.90 18.29 18.69 19.08 19.47 19.87 20.26 20.06 34 15.25 15.65 16.05 16.44 16.85 17.25 11.65 18.05 18.46 18.86 19.27 19.67 20.08 20.49 20.90 21.31 35 15.70 16.11 16.53 16. 94 17.35 17.77 18.19 18.60 19.01 19.43 19.85 20.27 20.69 21.11 21.53 21.95 36 16.16 16.58 17.01 17.43 17.86 18.29 18.71 19.14 19.57 20.00 20.43 20.87 21.30 21.73 22.17 22.60 37 16.62 17.06 17.49 17.93 18.37 18.81 19.25 19.69 20.13 20.58 21.02 21.46 21.91 22.36 22.91 23.25 38 17.08 17.53 17.9918.43 18.88 19.33 19.78 20.24 20.69 21.15 21.61 22.07 22.52 22.99 23.45 23.91 39 17.54 18.00 18.46 18.93 19.39 19.86 20.32 20.79 21.26 21.73 22.20 27.67 23.14 23.61 24.09 24.56 40 18.00 18.48 18.95 19.43 19.90 20.38 20.86 21.34 21.82 22.30 22.79 23.27 23.76 24.25 74.73 25.22 41 18.47 18.95 19.44 19.93 20.12 20.91 21.40 21.89 22.39 22.AB 23.3 23.88 24.38 24.88 25.34 25.88 42 18.93 19.43 19.93 20.43 20.93 21.44 21.94 22.45 22.96 23.47 23.98 24.49 25.00 25.51 26.03 26.55 19.40 19.91 20.42 20.94 21.45 21.97 22.49 23.01 23.53 24.05 24.57 25.10 25.62 26.15 26. A 27.21 19.86 20.39 20.91 21.44 21.91 22.50 23.03 23.57 24.10 24.64 25.17 25.71 26.25 26.79 27.33 27.88 45 20.33 20.87 21.41 21.95 22.49 23.03 23.58 24.12 24.67 25.22 25.77 26.32 26.88 27.43 27.99 28.55 20.80 21.35 21.90 22.46 23.01 23.57 24.13 24.69 25.25 25.81 26.37 26.94 27.51 21.08 47 28.65 29.22 21.27 21.83 22.40 22.97 23.53 24.10 24.68 25.25 25.82 26.40 26.98 27.56 2A.14 28. 12 29.31 29.89 21.74 22.32 22.90 23.48 24.06 24.64 25.23 25.81 26.40 26.99 27.5 28.18 28.77 29. 37 29.97 30.57 49 22.21 22.30 23.39 23.99 24.58 25.18 25.78 26.38 26.98 21.59 28.19 28.80 29.41 30.02 30.63 31.24 50 22.69 23.29 23.89 24.50 25.11 25.72 26.31 26.95 27.56 28.18 28.80 29.42 30.04 30.67 31.29 31.92 51 23.16 23. 78 24.40 25.02 25.64 26.26 26.89 27.52 28.15 28.75 29.41 30.05 30.68 31.32 31.96 32.60 52 23.64 24.27 24.90 25.53 26.17 26.81 27.45 28.09 28.73 29.38 30.02 30.67 31.32 31.98 32.63 33.29 53 24.11 24.76 25.40 26.05 26. TO 21,35 28.00 28.66 29.32 29.48 30.64 31.40 31.97 32.63 33.30 33.97 54 24.59 25.25 25.91 26.57 27.23 27.90 28.56 29.23 29.91 30.58 31.25 31.93 32.61 33.29 33.98 34.66 55 25.07 25. 74 26.41 27.09 27.77 28.44 29.13 29.01 30.50 31.16 31.87 32.56 33.26 33.95 34.65 35. 35 56 25.55 26.23 26.92 27.61 28.30 28.99 29.69 30.39 31.09 31.79 32.49 33.20 33.91 34.62 35.33 36.04 57 26.03 26.73 27.43 28.13 28.84 29.54 30.25 30.97 31.58 32.39 33.11 33.3 34.56 35.28 36.01 36.74 58 26.51 27.23 27.94 28.66 29. 37 30.10 30.42 31.55 32.27 33.00 33.74 34.47 35.21 15.95 36.69 37.43 59 27.00 27.72 28.45 29. ta 29.91 30.65 31.39 32.13 32.87 33.61 34, 35 75.11 35. A6 36.62 37.37 38.13 60 27.48 28.22 28.96 29.71 30.45 31.20 31.96 32.71 33.47 34.23 34.99 35.75 36.52 37.29 38.06 38.83 TABLE 13-1 Annual Percentage Rate (APR) Finance Charge per $100 (continued) . 0 .I . : . : . 70 . 1 R: 5.24 00 10. . . 0 8 8 :5 8 . 0 ANNUAL PERCENTAGE RATE TABLE FOR MONTHLY PAYMENT PLANS SEE INSTRUCTIONS FOR USE OF TABLES PRH-104-M NUMBER ANNUAL PERCENTAGE RATE OF PAYMENTS 14.00% 14.25% 14.50% 14.75% 15.00% 15.25% 15.50% 15.75% 16.00% 16.25% 16.50% 16.75% 17.00% 17.25% 17.50% 17.75% (FINANCE CHARGE PER $100 OF AMOUNT FINANCED) 1 1.17 1.19 1.21 1.23 1.25 1.27 1.31 1.33 1.35 1.37 1.48 2 1.78 1.82 1.88 1.94 1.91 2.00 2.04 2.07 2.10 2.13 2.16 2.19 2.22 3 2.34 2.38 2.43 2.47 2.51 2.55 2.59 2.64 2.68 2.72 2.16 2.80 2.85 2.89 2.93 2.97 2.93 2.99 3.04 3.09 3.14 3.20 3.25 3.30 3.36 3.41 3.46 3.51 3.57 3.62 3.67 3.13 5 3.53 3.59 3.65 3.72 3.78 3.84 3.91 3.97 4.04 4.29 6 4.57 5.02 5.09 5.17 7 4.81 4.89 4.98 5.06 5.15 5.23 5.32 5.40 5.49 5.58 5.66 5.75 5.83 5.92 6.00 9 5.32 5.42 5.51 5.61 5.71 5.80 5.90 6.19 6.29 6.38 6.48 6.58 6.67 6.77 9 5.92 6.03 6.14 6.25 6.35 6.57 6 . 64 6.78 6.89 7.00 7.11 7.22 7.32 7.54 10 6.53 6.65 6.88 7.00 7.24 7. 36 7.48 7.60 1.72 7.84 7.95 8.19 11 7.14 7.27 7.40 7.53 7.66 1.79 7.92 8.05 8.18 8.31 8.57 8. 73 9. 89 856 9.09 12 7.74 7.89 8.17 8.31 8.59 8.74 _H . H 9.02 9.16 9.30 9.45 9.59 13 9.73 9.87 8.36 e. 51 8.66 8. 81 8.97 9.27 9.58 9.73 9.89 10.04 10.20 10.35 10.50 10.66 14 8.97 9.13 9.30 9.46 9.63 9.79 9.96 10.12 10.45 10.67 10.78 11.28 11.45 15 10.95 11.11 9.59 9.76 10.11 10.29 10.47 10.64 10.82 11.00 11.17 11.35 11.53 11.71 11.08 12.06 12.24 16 10.20 10.39 10.58 10.77 10.95 11.14 11.33 11.52 11.71 11.90 12.09 12.28 17 12.46 12.65 12.84 13.03 10.82 11.02 11.22 11.42 11.62 11.82 12.02 12.22 12.42 12.62 12.81 13.03 13.23 13.43 13.63 13.83 18 11.45 11.66 11.81 12.08 12.29 12.50 12.72 12.93 13.14 13.35 13.57 13.78 13.99 14.21 14.42 14.64 19 12.07 12.30 12.52 12.74 12.97 13.19 13.41 13.64 13.86 14.04 14.31 14.54 20 14.76 14.49 15.22 15.44 12.70 12.93 13.17 13.41 13.64 13.88 14.11 14.35 14.59 14.82 15.06 15.30 15.54 19.77 16.01 16.25 21 13.33 13.58 13.82 14.07 14.32 14.57 14.82 15.06 15.31 15.56 15.81 16.06 16.31 16.56 16.81 17.07 22 13.96 14.22 14.48 14.74 15.00 15.26 15.52 15.78 16.04 16. 30 16.57 16.93 17.04 17.36 17.62 17.88 23 14.59 14.87 15.14 15.41 15.68 15.96 16.23 16.50 16.78 17.05 17.32 17.60 11.88 18.15 18.43 18.70 15.23 15.51 15.80 16.08 16.31 16.65 16.94 17.22 17.51 17.00 18.09 10.37 18.66 19.95 25 19.24 19.53 15.87 10.11 16.46 16.76 17.06 17.35 17.65 17.95 18.25 18.55 18.85 19.15 19.45 19.75 20.05 20.36 26 16.5L 16.82 17.13 17.44 17.75 1800 18.37 18.69 18.99 19.30 19.62 19.93 20.24 20.56 20.87 21.19 27 17.15 17.47 17.80 18.12 18.76 19.09 19.41 19.74 20.06 20.39 21.04 21.37 21.69 22.02 28 17.80 18.13 18.47 18.80 19.14 19.47 19.81 20.15 20.48 20.82 21.15 21.50 21.84 22.1922.52 22.36 18.45 18.79 19.14 19.49 19.43 20.18 20.53 20.88 21.23 21.58 21.94 22.29 22.64 22.99 23.35 23.70 30 19.10 19.45 19.8120.17 20.54 20.90 21.26 21.62 21.99 22.35 22.72 23.08 23.45 23.AL 24.18 24.55 31 19.75 20.12 20.49 20.87 21.24 21.61 21.99 22.37 22.74 23.12 23.50 23 : B8 75.02 25.40 32 20.40 20.79 21.17 21.56 21.95 22.13 23.11 23.50 23.89 24.28 24, 68 25.07 35. 46 33 75.86 26.25 21.06 21.46 21.85 22.25 22.65 23.06 23.46 23.86 24.26 24.67 25.07 25.48 25.88 25.29 26.70 27.11 21.72 22.13 22.54 22.95 23.37 23.78 25.03 29.44 25.86 25.28 26.70 27.12 27.54 27.97 22.38 22.80 23.23 23.65 24.08 24.51 25.36 25.79 26.23 27.09 27.52 21.96 28.39 28.83 36 23.04 23.48 23.92 24.35 24.90 25.24 25.68 26.12 26.57 27.01 27.90 28.35 28.80 29.25 29.70 37 23.70 24.16 24.61 25.06 25.51 25.97 2 6 .42_26. B8_8 7 . 3 4 27.80 28.26 28.72 29.18 ;9. 64 30.10 38 30.57 24.37 24.84 25.30 25.77 26.24 26.70 27.17 27.64 29.11 28.59 P 5 53 39 30.01 30.49 20.96 31.44 25.04 25.52 26.48 28.89 29.38 29.87 30.36 30.85 31.34 40 31.8 32.32 25.71 z 6. 20 26.70 27.19 27.69 29.18 29.68 29.18 30.68 31.18 31.68 2.19 32.69 33.20 41 26.39 26.99 27.40 27.91 28.41 28.92 29.44 29.95 30.45 30.97 31.49 32.01 32.52 33.04 33.56 36.00 27.58 28.10 28.62 29.15 29.67 30.19 30.72 31.25 31.70 32.31 32.84 1.17 33.90 34.97 43 27.74 28.27 29.34 29.88 30.2 30.96 31.50 32.04 32.58 31.13 33.67 34.22 35.31 35.86 28.42 28.97 29.52 30.07 30.62 31.17 31.72 32.28 32.83 33.95 94.51 35.07 35.63 45 36.19 36.76 29.11 29.67 30.23 30.79 31.36 31.92 32.49 13.06 33.63 34.20 35.35 35.92 36.50 37.08 37.66 29.79 30.36 30.94 31.52 32.10 32.68 33.26 33.84 34.43 35.01 35.60 36.19 36.79 37.37 4 B .'6 47 30.48 31.07 31.66 32.25 32.84 33.44 34.03 34.63 35.23 36.43 27.04 37.64 38.25 38.86 39.46 48 31.17 31.77 32. 37 32.98 33.59 34.20 74.81 35.42 36.03 36.65 37.27 37.88 39.50 39.13 99.75 40.37 49 11.88 32.48 33.09 33.71 14.96 45.59 36.21 36.84 39.10 3.74 39.37 40.01 50 40.65 32.55 33.18 33.82 34.45 35.09 35.73 36.37 37.01 37.65 38.30 38.94 39.59 40.24 40.89 42.20 51 33.25 33.99 34.54 35.19 35.84 36.49 37.15 47.81 39.46 39.12 37 . 17 40.45 43.12 52 33.95 34.51 35.27 35.93 36.60 37.27 37.94 38.61 39.28 39.96 40.63 41.31 42 .57 53 34.65 35.32 36.00 37.35 28.04 38.72 40.10 40.79 42.81 41.57 35.35 36.04 36.73 37 , 42 38.12 38.82 39.52 40.22 40.92 42.33 43.04 43.75 45.18 55 36.05 36.76 37.40 38.17 38.88 39.60 * L .3 3 43.19 43,91 45. 37 56 36.76 37.48 38.20 38.92 39.65 40.39 41.11 41.94 45.53 57 37.47 38.20 38.94 39.68 40.42 41.9142.65 45.45 47.18 58 38.18 48.71 39.68 40.43 45.00 ;5 ,17 47.32 48.69 48.87 49.65 59 38.89 39.66 40.42 41.19 43.51 ' 48.21 50.60 60 39.61 41.17 43.53 44.32 45.11 45.91 47.51 & 8. 31 49.12 50.73 51.55 ,18 20 . 26 . 2 4.5 P : ;) :* $ 00 26 8 :[: & ; ,27 9 ,26 # # % B 1 Ad 27.06 14 PHH # ? . . 34 t 8 .17 4 8 3 ? 47 . 41 B ? | . 11: 94 . 14 . . 3 | 33 8. 1 2 27. :1 0 .5 89 .t | . 9 . 6 q 4 4 6 17 . NE 7 4 54: . 66 . 38 16 .1 7 .3 : 1' ;;. 1 | 3 .61 . 29 . : 3 3 . 54 .6 55 . ! 71 . |0 . $$ TABLE 13-1 Annual Percentage Rate (APR) Finance Charge per $100 (continued) ANNUAL PERCENTAGE RATE TABLE FOR MONTHLY PAYMENT PLANS SEE INSTRUCTIONS FOR USE OF TABLES FRB-105-M NUMBER ANNUAL PERCENTAGE RATE OF PAYMENTS 19.00% 18.25% 18.50% 18.75% 19.00% 19.25% 19.50% 19.75% 20.00% 20.25% 20.50% 20.75% 21.00% 21.25% 21.50% 21.75% (FINANCE CHARGE PER $100 OF AMOUNT FINANCED) 1.79 2.70 2 3 1.50 2.26 3.01 3.78 1.52 2.29 3.06 3.83 4.61 1.54 2.32 3.10 3.88 4.67 1.56 2.35 3.14 3.94 4.74 1.58 2.38 3.18 3.99 4.80 1.60 2.41 3.23 4.04 4.86 1.62 2.44 3.27 4.10 4.93 1.65 2.48 3.31 4.15 1.67 2.51 3.35 4.20 5.06 1.69 2.54 3.39 4.25 5.12 1.71 2.57 3,44 4.31 5.18 1.73 2.60 3.48 4.36 5.25 1.75 2.63 3.52 4.41 5.31 1.77 2.66 3.56 4.47 5.37 3.60 1.81 2.73 3.65 4.57 5.50 4.52 5.44 5 4.99 5.84 6 7 8 9 10 5,32 6.09 6.87 7.65 8.43 5. 39 b.la 6.96 7.76 8.55 5.46 6.26 7.06 7.87 8.67 5.54 6.35 7.16 7.97 5.61 6.43 7.26 8.08 8.91 5.69 6.52 7.35 8.19 9.03 5.76 6.00 7.45 8.30 9.15 5.91 6.79 7.64 8.52 9.39 5.99 6.86 7.74 1.55 8.41 9.27 6.06 6.95 7.84 8.73 9.03 6.14 7.04 7.94 8.84 9.75 6.21 7.12 8.03 8.95 9.88 6.29 6.36 7.21 7.29 8.13 8.23 9.06 9.17 10.00 10.12 7.38 8.33 9.28 10.24 8.79 9.51 9.49 9.75 11 12 13 15 9.22 9.35 9.62 9.88 10.0110.14 10.28 10.41 10.54 10.67 10.80 10.94 11.07 11.20 10.02 10.16 10.30 10.44 10.59 10.73 10.87 11.02 11.16 11.31 11.45 11.59 11.74 11.88 12.02 12.17 10.81 10.97 11.12 11.28 11.43 11.59 11.74 11.90 12.05 12.21 12.36 12.52 12.67 12.83 12.99 13.14 11.61 11.78 11.95 12.11 12.28 12.45 12.61 12.78 12.95 13.11 13.28 13.45 13.62 13.79 13.95 14.12 12.42 12.59 12.77 12.95 13.13 13.31 13.49 13.67 13.85 14.03 14.21 14.39 14.57 14.75 14.93 15.11 13.22 13.41 13.60 13. 80 13.99 14.18 14.37 14.56 14.75 14.94 15.13 15.33 15.52 15.71 15.90 16.10 14.04 14.24 14.44 14.64 14.85 15.05 15.25 15.46 15.66 15.86 16.07 16.27 16.48 16.68 16.89 17.09 14.85 15.07 15.28 15.49 15.71 15.93 16.14 16:36 16.57 16.79 17.01 17.22 17.44 17.66 17.88 18.09 15.67 15.90 16.12 16.35 16.58 16.81 17.03 17.26 17.49 17.72 17.95 18.16 18.41 18.64 18.87 19.10 16.49 16.73 16.97 17.21.17.45 17.69 17.93 16.17 18.4118.66 18.90 19.14 19.38 19.63 19.87 20.11 16 17 18 19 20 21 22 23 24 25 17.32 17.57 17.82 18.07 18.33 18.58 18.83 19.09 19.34 19.60 18.15 18.4 18.68 18.94 19.2119.47 19.74 20.01 20.21 20.54 18.99 19.26 19.54 19.81 20.09 20.37 20.65 20.93 21.21 21.49 19.82 20.11 20.40 20.69 20.98 21.27 21.56 21.26 22.15 22.44 20.66 20.96 21.27 21.57 21.87 22.18 22.48 22.79 23.10 23.40 19.85 20.11 20.81 21.08 21.77 22.05 22.74 23.03 23.71 24.02 20.36 20.62 21.34 21.61 22.33 22.61 23.33 23.62 24.32 24.63 20.87 21.88 22.90 23.92 24.94 21.13 22.15 23.18 24.21 25.25 26 27 28 29 30 21.50 22.35 23.20 24.06 24.92 21.82 22.14 22.68 23.01 23.55 23.69 24.41 24.77 25.29 25.66 22.45 22.77 23.09 23.41 23.73 23.34 23.67 24.00 24.33 24.67 24.23 24.58 24.92 25.27 25.61 25.13 25.49 25.84 26.20 26.56 26.03 26.40 26.77 27.14 27.52 24.04 24.36 25.00 25.33 25.96 26.30 26.92 27.28 27.89 28.26 24.68 25.01 25.67 26.00 26.65 27.00 27.64 28.00 24.64 29.01 25.33 25.65 25.97 26.34 26.67 27.01 27.35 27.70 28.05 28.37 29.73 29.09 29.39 29.77 30.14 26.29 27.34 28.40 29.46 30.52 31 32 33 34 35 25.78 26.16 26.55 26.65 27.04 27.44 27.52 27.93 28.34 28.39 28.91 29.24 29.27 29.71 30.14 26.93 27.84 28.75 29.06 30.58 27.32 27.70 28.09 28.24 28.64 29.04 29.16 29.57 29.99 30.09 30.52 30.95 31.02 31.47 31.91 28.47 29.44 30.40 31. 37 32.35 28.86 29.84 30.82 31.80 32.19 29.25 30.24 31.23 32.23 33.24 29.64 30.06 31.65 32.67 33. 30.03 31.05 32.07 33.10 34.13 30.42 30.81 31.20 31.45 31.85 32.26 32.49 32.91 33.33 33.53 33.96 34.40 34.58 35.03 35.47 31.59 32.67 33.75 34.83 35.92 36 37 30.15 30.60 31.05 31.03 31.50 31.97 31.92 32.40 32.88 32.81 33.31 33.80 33.71 34.22 34.73 31.51 32.43 33.37 34.30 35.24 31.96 32.90 33.85 34.80 35.75 32.42 32.87 33.37 33.84 34.33 34.82 35.30 35.80 36.26 36.78 33.33 34.32 35.30 36.30 37.29 33.79 34.79 35.79 36.80 37.81 34.25 35.26 36.2 37.30 38.33 34.71 35.17 35.74 36.21 36.77 37.26 37.81 38.31 38.85 39.37 95.63 36.09 36.69 37.16 37.75 38.24 38.2 39.32 39.9 40.41 36.56 37.64 38.73 39.83 40.93 37.02 38.12 39.23 40.34 41.46 39 40 42 34.61 35.13 35.66 35.51 36.05 36.59 36.42 36.97 37.52 37.33 37.99 38.46 38.24 38.82 39.41 36.18 37.13 38.08 39.03 39.99 36.71 37.24 37.77 38.10 38.83 39.36 37.67 38.21 38.76 39.30 39.85 40.40 38.63 39.19 39.75 40.31 40.87 41.44 39.60 40.18 40.75 41.33 41.90 42.48 40.58 41.17 41.75 42.35 42.94 43.53 39.89 40.95 42.00 40.43 41.50 42.57 43.64 44.72 40.96 41.50 42.04 42.05 42.60 43.15 43.13 43.70 44.27 44.22 44.81 45.39 45.32 45.92 46.52 42.58 43.71 44.84 45.98 47.12 44.13 46 47 48 49 50 39.16 39.75 40.35 40.08 40.69 41.30 41.00 41.63 42.26 41.93 42.57 43.22 42.86 43.52 44.18 40.95 41.55 42.16 42.76 41.92 42.54 43.15 43.77 42.89 43.52 44.15 44.79 43.86 44.51 45.16 45.81 44. 84 45.50 46.17 46.83 43.37 44.40 45.43 46.46 47.50 43.98 44.58 45.02 45.14 46.07 46.71 47.12 47.77 48.17 48.84 45.20 46.27 41.35 48.43 49.52 45.81 46.90 47.99 49.09 50.19 46.42 47.03 47.65 47.53 48.16 48.79 48.64 49.28 49.93 49.75 50.41 51.08 50.87 51.55 52.23 48.27 49.42 50.58 51.74 52.91 51 52 53 54 55 43.79 44.47 44.73 45.42 45.67 46.38 46.62 47. 34 47.57 48.30 45.14 46.11 47.08 48.06 49.04 45.82 46.80 47.79 48,79 49, 78 46.50 47.18 47.86 48.55 49.23 49.92 50.61 51.30 47.50 48.20 48.89 49.59 50.30 51.00 51.71 52.41 48.50 49.22 49.93 50.65 51.37 52.09 52.31 53.53 49.51 50.24 50.97 51.70 52.44 53.17 53.91 54.65 50.52 51.27 52.02 52.76 53.52 54.27 55.02 55.78 51.99 52.69 53.38 54.00 53.12 53.83 54.55 55.26 54.26 54.98 55.71 56.44 55.39 56.14 56.88 57.63 56.54 57.30 58.06 58.82 56 57 58 59 60 48.52 49.27 50.03 49.47 50.24 51.01 50.43 51.22 52.00 51.39 52.20 53.00 52.36 53.18 54.00 50.78 51.54 52.30 53.06 53.83 54.60 55.37 51.79 52.56 53.34 54.12 54.90 55.68 56.47 52.79 53.58 54.38 55.17 55.97 56.77 57.57 53.80 54.61 55.42 56.23 57.05 57.87 58.68 54.82 55.64 56.47 57.30 58.13 58.96 59.80 56.14 57.25 58.38 59.51 60.54 56.91 58.04 59.18 60.33 61.4 57.68 58.84 59.99 61.15 62.32 58.46 59.24 59.63 60.43 60.80 61.62 61.98 62.81 63.17 64.01 60.02 61.22 62.43 63.54 64.86

I cannot get the monthly payment right.

I cannot get the monthly payment right.