Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I cannot post another question for part 2a and 2b as they are a follow-up on question 1. I would appreciate it if you could

I cannot post another question for part 2a and 2b as they are a follow-up on question 1. I would appreciate it if you could solve them all. Thank you

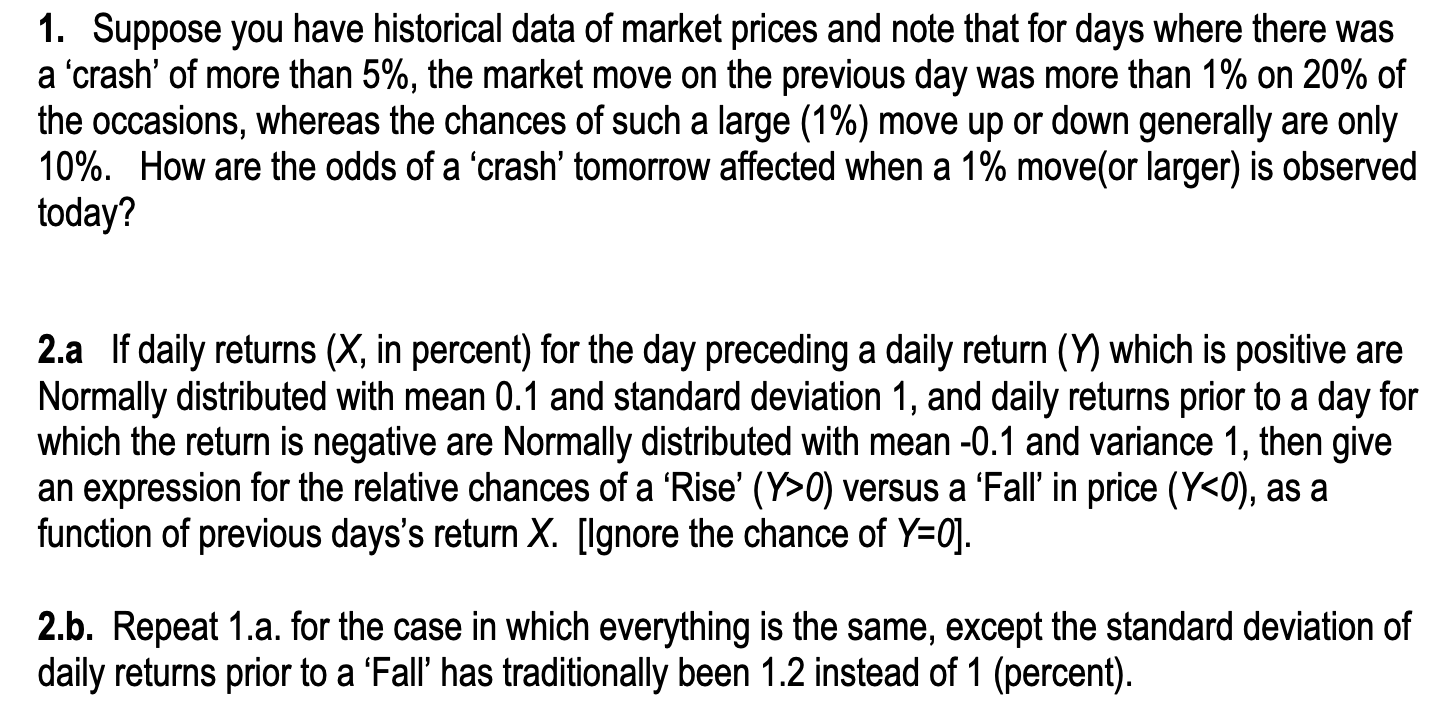

1. Suppose you have historical data of market prices and note that for days where there was a 'crash' of more than 5%, the market move on the previous day was more than 1% on 20% of the occasions, whereas the chances of such a large (1%) move up or down generally are only 10%. How are the odds of a 'crash' tomorrow affected when a 1% move(or larger) is observed today? 2.a If daily returns (X, in percent) for the day preceding a daily return (Y) which is positive are Normally distributed with mean 0.1 and standard deviation 1, and daily returns prior to a day for which the return is negative are Normally distributed with mean -0.1 and variance 1, then give an expression for the relative chances of a 'Rise' (Y>0) versus a 'Fall in price (Y0) versus a 'Fall in price (YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started