Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I can't calculate the net capital loss carryover and it keeps me marking wrong. What is the loss? Ordinary taxable income Other items not included

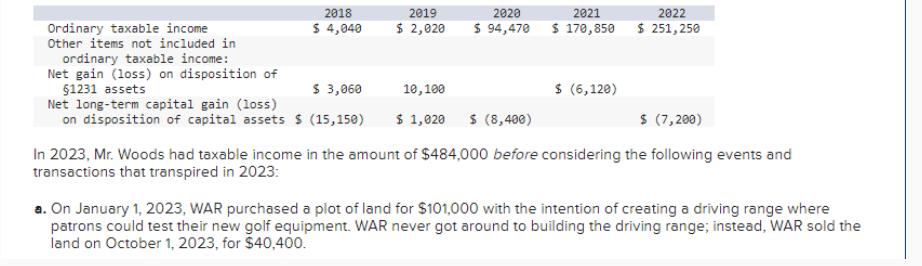

I can't calculate the net capital loss carryover and it keeps me marking wrong. What is the loss?

Ordinary taxable income Other items not included in ordinary taxable income: 2018 2019 $ 4,040 $ 2,020 2020 2021 2022 $ 94,470 $ 170,850 $ 251,250 Net gain (loss) on disposition of 1231 assets $ 3,060 10,100 $ (6,120) Net long-term capital gain (loss) on disposition of capital assets $ (15,150) $ 1,020 $ (8,400) $ (7,200) In 2023, Mr. Woods had taxable income in the amount of $484,000 before considering the following events and transactions that transpired in 2023: a. On January 1, 2023, WAR purchased a plot of land for $101,000 with the intention of creating a driving range where patrons could test their new golf equipment. WAR never got around to building the driving range; instead, WAR sold the land on October 1, 2023, for $40,400.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the net capital loss carryover we need to determin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started