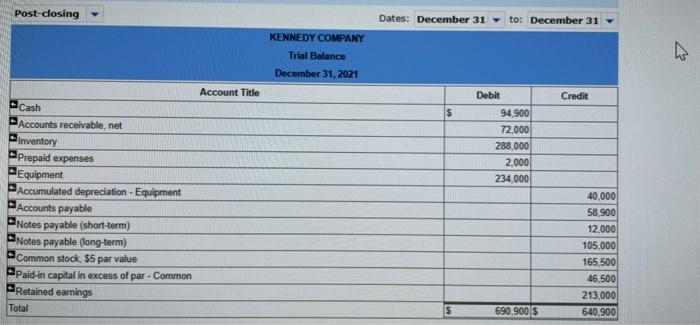

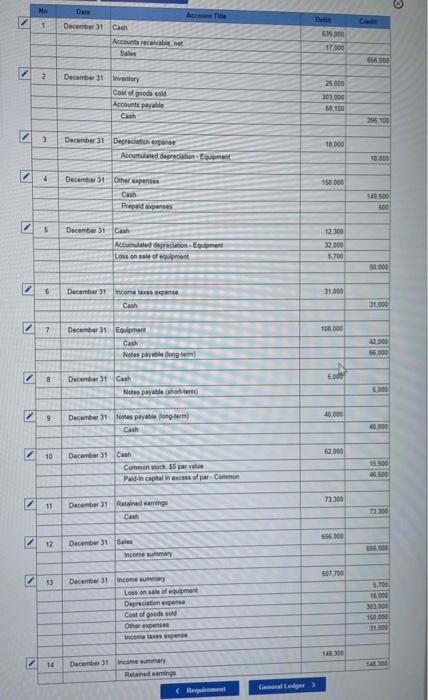

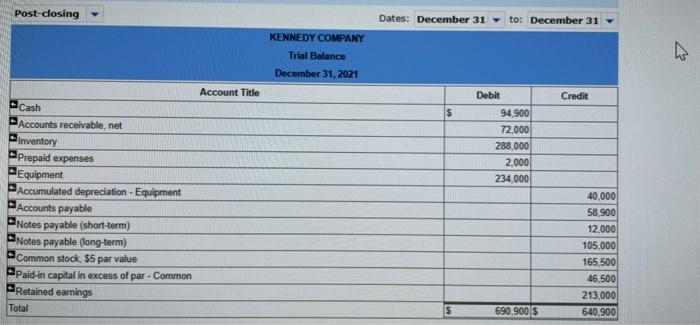

I cant find the discrepency causing my balance sheet to be off by 50,000. Just a point in the right direction.

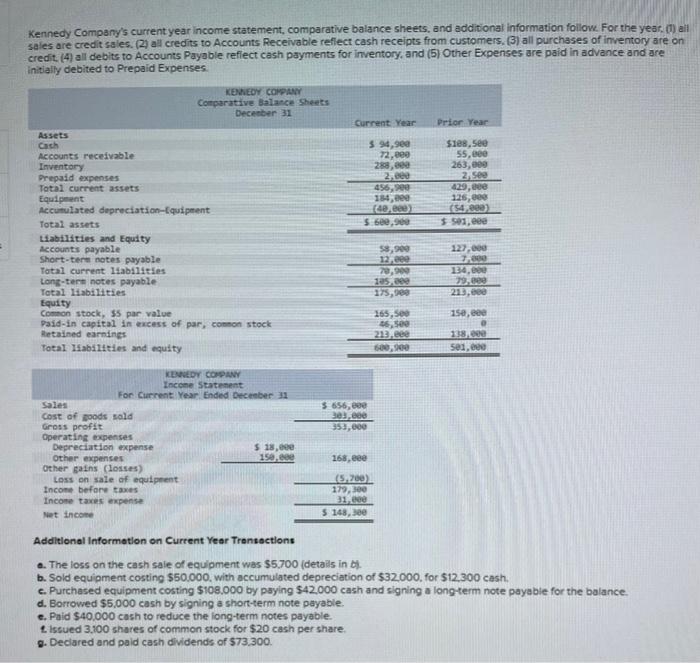

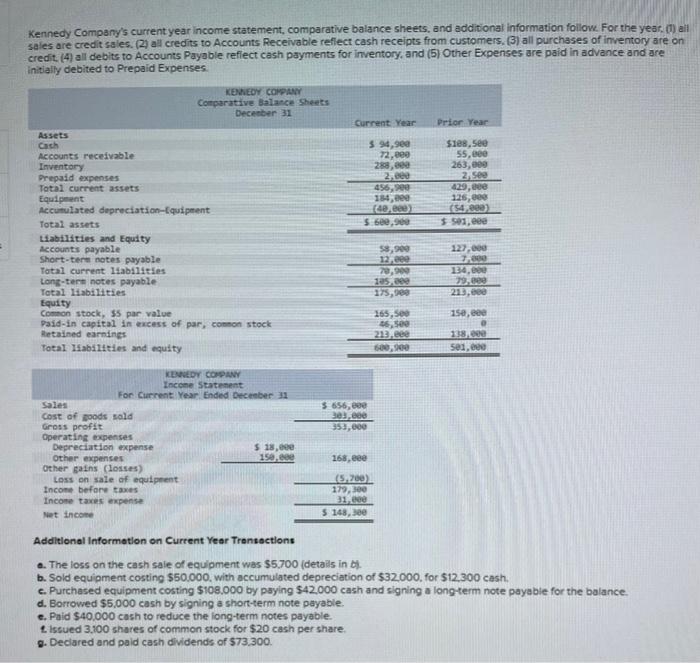

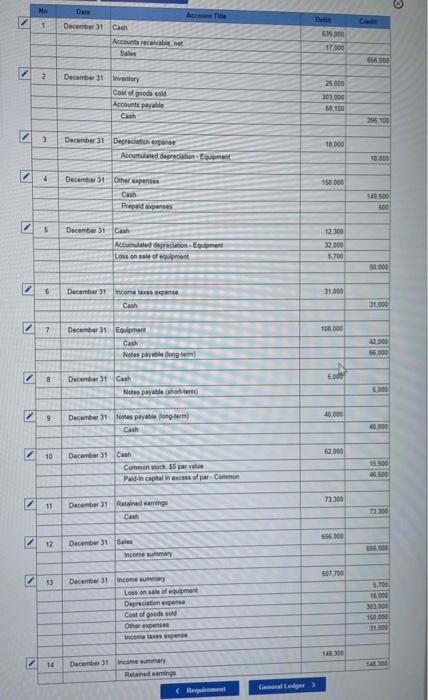

Kennedy Company's current year income statement, comparative balance sheets, and additional information follow. For the year. (1) all sales are credit sales. (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit. (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses KENNEDY COMPANY Comparative Balance Sheets December 31 Current Year Prior Year $ 94,9ee 72.ee 288, 456, 184, (de eee 5 6.900 $108,5ee 55,000 263,000 2.50 429,00 126,000 (54,800) $50, eee Assets Cach Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation Equipment Total assets Liabilities and Equity Accounts payable Short-term notes payable Total current liabilities Long-term notes payable Total liabilities Equity Comon stock, 35 par value Paid-in capital in excess of par, common stock Retained earnings Total Isabilities and equity 127,000 58,900 12.ee 20,900 125,00 175,000 34,00 29.ee 213, 150, 165,500 16,500 213.ee 118.00 ses. $ 656,000 303,00 353,000 KENNEDY COMPANY Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $ 18, Other expenses 150. Other gains (losses) Loss on sale of equipment Income before taxes Income taxes expense Net Income 168, eee (5,200) 179,00 31, ce $ 148,300 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $5.700 (details in dj. b. Sold equipment costing 550.000. with accumulated depreciation of $32.000. for $12.300 cash. c. Purchased equipment costing $108.000 by paying $42.000 cash and signing a long-term note payable for the balance. d. Borrowed $5,000 cash by signing a short-term note payable. e. Paid $40,000 cash to reduce the long-term notes payable. tissued 3.100 shares of common stock for $20 cash per share, g. Declared and paid cash dividends of $73.300. No De December 31 1 At title Cash Accounts receivable.net Sales 100 17 000 666000 IN 2 25000 December 31 wory Cost of goods sold Accounts payable Cash 300.000 50.00 1996.100 IN 3 December 31 Deprecationen Accumulated depreciation Equipment 10.000 18.000 150 000 December 31 Other expenses Cash Prepaid 149 50 500 2 5 12.300 December 31 Cash Accumulated predation Equipment Los on sale of woment 22.000 5.700 DOO 28 31000 December incon Cash 30.000 27 130.000 December 31 Equipment Cash Notes payable ongem 2.000 56.000 so 8 December 31 Cash Notes payati honum 5 000 2 9 10.000 December 31 Notes payable fogtam Cash 40.000 2 2.000 10 December Cash Common ok. 55 para Paldin capital in excess of par.Com 1500 600 72.300 11 December 31 Ruined caringe ch 7100 65600 17 December 31 400 Income 557.100 13 TO December 31 income su Loss on sale of equipment Depreciation expense Cost of goods sold Our expenses Income pense 303.000 150.000 3000 1300 14 December 31 Income way Renderings (Region Com Lady> Post-closing Dates: December 31 to: December 31 KENNEDY COMPANY Trial Balance December 31, 2021 Account Title Debit Credit $ 94.900 72.000 288,000 2,000 234.000 Cash Accounts receivable, net Inventory Prepaid expenses Equipment Accumulated depreciation - Equipment Accounts payable Notes payable (short-term) Notes payable (long-term) Common stock, $5 par value Pald-in capital in excess of par - Common Retained earnings Total 40,000 58.900 12,000 105,000 165,500 46,500 213,000 640.900 s 690,900 S