Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I can't understand highlited part. In the problem, there are two choices, pay $10 per week or buy a case today. In step1, to get

I can't understand highlited part. In the problem, there are two choices, pay $10 per week or buy a case today.

In step1, to get interest rate, I think $108 = $10/r*(1-1/((1+r)^12)) is the right solution. Because he buys a case 'today'.

Can you explain why the solution goes like that? If the solution is wrong, please teach me the right method!

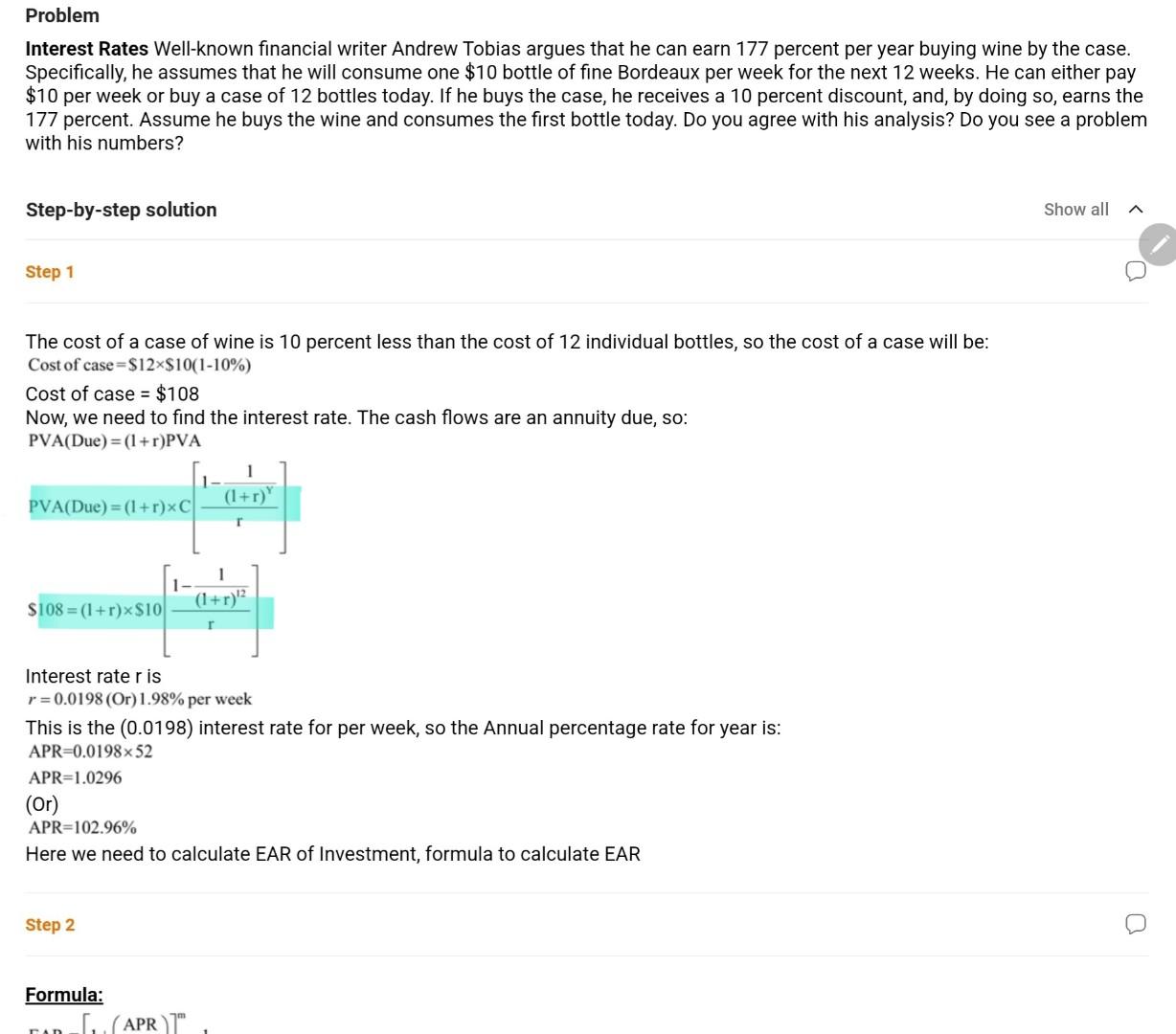

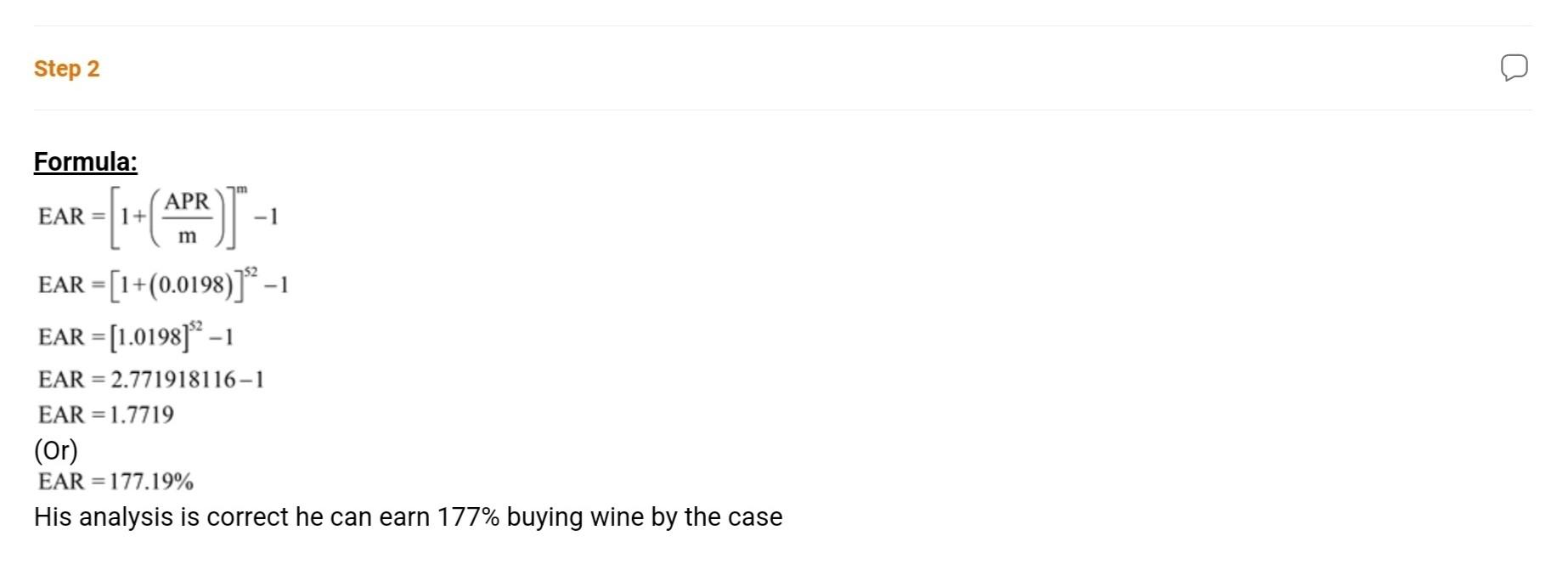

Problem Interest Rates Well-known financial writer Andrew Tobias argues that he can earn 177 percent per year buying wine by the case. Specifically, he assumes that he will consume one $10 bottle of fine Bordeaux per week for the next 12 weeks. He can either pay $10 per week or buy a case of 12 bottles today. If he buys the case, he receives a 10 percent discount, and, by doing so, earns the 177 percent. Assume he buys the wine and consumes the first bottle today. Do you agree with his analysis? Do you see a problem with his numbers? Step-by-step solution Show all ^ Step 1 The cost of a case of wine is 10 percent less than the cost of 12 individual bottles, so the cost of a case will be: Cost of case=$12x$10(1-10%) Cost of case = $108 Now, we need to find the interest rate. The cash flows are an annuity due, so: PVA(Due)=(1+r)PVA 1 PVA(Due) =(1+r)C (1+r)' 1 (1+r)" $108 = (1+r)x $10 Interest rater is r=0.0198 (Or) 1.98% per week This is the (0.0198) interest rate for per week, so the Annual percentage rate for year is: APR=0.0198 x 52 APR=1.0296 (Or) APR=102.96% Here we need to calculate EAR of Investment, formula to calculate EAR Step 2 Formula: 5. APRT AD Step 2 Formula: APR EAR = R=[-(4) -1 m EAR = [1+(0.0198)] EAR = [1.0198]"? - 1 EAR = 2.771918116-1 EAR = 1.7719 (Or) EAR = 177.19% His analysis is correct he can earn 177% buying wine by the caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started