Question

I can't wait to rate!!!!! A basic arbitrary example of 10 individuals from a specific populace has a mean age of 27. Would we be

I can't wait to rate!!!!!

A basic arbitrary example of 10 individuals from a specific populace has a mean age of 27. Would we be able to reason that the mean age of the populace isn't 30? The change is 20. Test at the 0.05 level. Is this a couple of tail test?

For a similar set up as above, would we be able to reason that the mean age of the populace is under 30? Is this a one or a two followed test?

A place of business utilizes lights that have a mean existence of 900 hours. Another producer guarantees that his lights last more than 900 hours. They request you to direct a test to decide the legitimacy from their case. You take an example of 64 bulbs and compute a mean of 920 hours with a standard deviation of 80 hours. Test this at .05 level.

An eatery tells its clients that the normal expense of a supper there is $52 with a standard deviation of $4.50. A gathering of concerned clients feels that the normal expense is higher. To test the eateries guarantee, 100 clients buy a supper at the store and track down the mean cost is $52.80. Play out a speculation test at .05 importance level and express the choice.

Play out a similar test as above, however accept just 15 clients bought supper. The wide range of various boundaries are something very similar. How does this influence the aftereffects of the test?

An example of 40 deals receipts from a gadgets store has mean $137 and a standard deviation of $30.2. Utilize the worth to test whether the mean deals at the hardware store are not the same as $150. Test at the .01 level.

On the off chance that you get a p-worth of .001, do you dismiss the invalid speculation at the 0.05 level? The 0.01 level?

You accept that a populace mean is equivalent to 6.2. To test this conviction, you do a theory test at the .05 level dependent on an example of information that you gathered:

a. Mean = 5.9

b. Standard deviation is 4.1

c. Test size =42

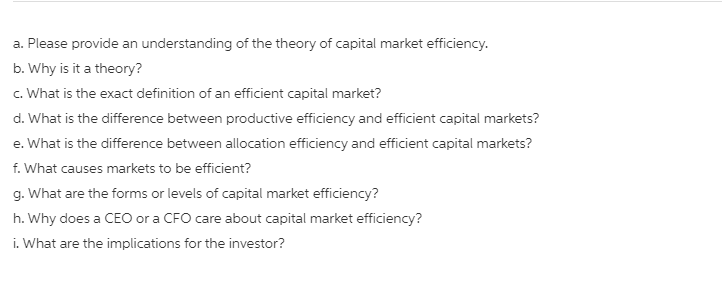

a. Please provide an understanding of the theory of capital market efficiency. b. Why is it a theory? c. What is the exact definition of an efficient capital market? d. What is the difference between productive efficiency and efficient capital markets? e. What is the difference between allocation efficiency and efficient capital markets? f. What causes markets to be efficient? g. What are the forms or levels of capital market efficiency? h. Why does a CEO or a CFO care about capital market efficiency? i. What are the implications for the investor?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started