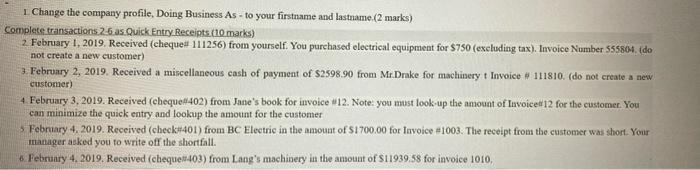

L. Change the company profile, Doing Business As - to your firstname and lastname.(2 marks) Complete transactions 2-6 as Quick Entry Receipts (10.marks) 2.

L. Change the company profile, Doing Business As - to your firstname and lastname.(2 marks) Complete transactions 2-6 as Quick Entry Receipts (10.marks) 2. February 1, 2019. Received (cheque# 111256) from yourself. You purchased electrical equipment for $750 (excluding tax). Invoice Number 555804. (do not create a new customer) 3. February 2, 2019. Received a miscellaneous cash of payment of $2598.90 from Mr.Drake for machinery t Invoice # 111810. (do not create a new customer) 4. February 3, 2019. Received (cheque#402) from Jane's book for invoice #12. Note: you must look up the amount of Invoice# 12 for the customer. You can minimize the quick entry and lookup the amount for the customer > February 4, 2019. Received (check#401) from BC Electric in the amount of $1700.00 for Invoice #1003. The receipt from the customer was short. Your manager asked you to write off the shortfall. 6 February 4, 2019. Received (chequen 403) from Lang's machinery in the amount of $11939.58 for invoice 1010,

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 John Doe is listed as the DBA Complete transactions 2...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started