Answered step by step

Verified Expert Solution

Question

1 Approved Answer

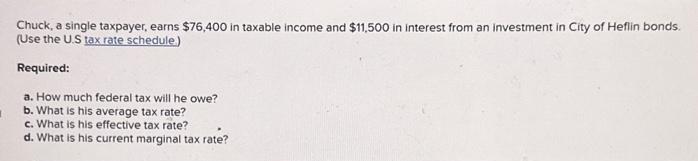

I Chuck, a single taxpayer, earns $76,400 in taxable income and $11,500 in interest from an investment in City of Heflin bonds. (Use the

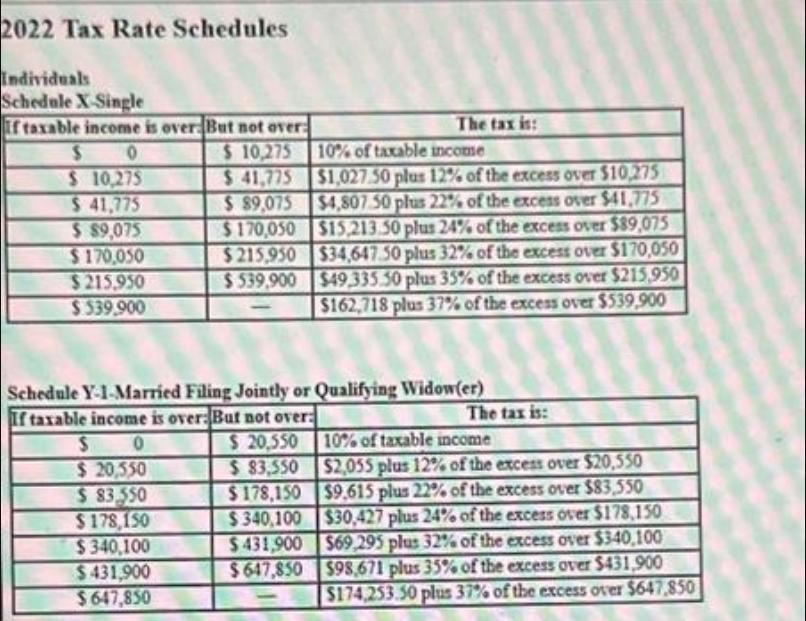

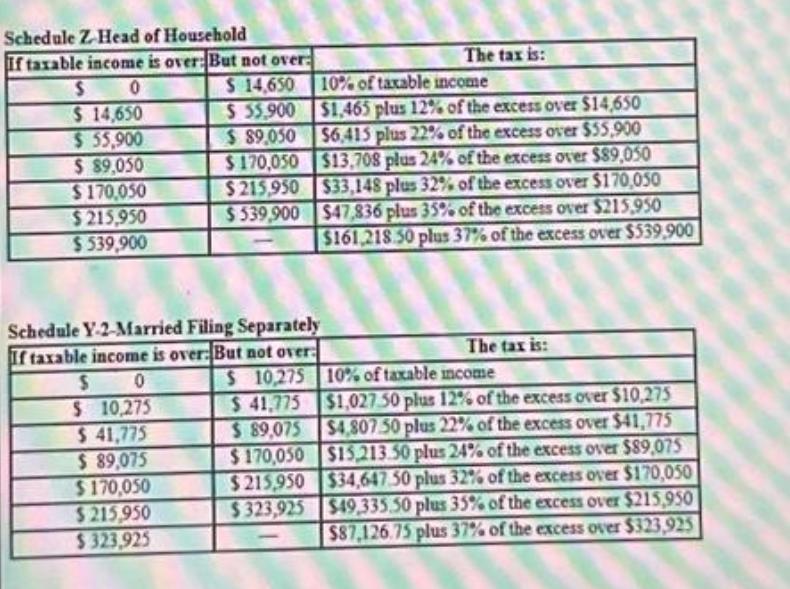

I Chuck, a single taxpayer, earns $76,400 in taxable income and $11,500 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? 2022 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over But not over: S 0 $ 10,275 $ 41,775 $ 89,075 $170,050 $215,950 $.$39.900 The tax is: $83.550 $178,150 $340,100 $431,900 $647,850 $ 10,275 10% of taxable income $41,775 $1,027.50 plus 12% of the excess over $10,275 $4,807 50 plus 22% of the excess over $41,775 $15,213.50 plus 24% of the excess over $89,075 $34,647.50 plus 32% of the excess over $170,050 $539,900 $49,335.50 plus 35% of the excess over $215,950 $162,718 plus 37% of the excess over $539,900 $ 89,075 $170,050 $215,950 EXCELL Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: S 0 $ 20,550 10% of taxable income $ 20,550 $ 83,550 $178,150 $2,055 plus 12% of the excess over $20,550 $9.615 plus 22% of the excess over $83,550 $30,427 plus 24% of the excess over $178,150 $431,900 $69,295 plus 32% of the excess over $340,100 $647,850 $98,671 plus 35% of the excess over $431,900 $340,100 $174,253.50 plus 37% of the excess over $647,850 The tax is: Schedule Z Head of Household If taxable income is over: But not over S 0 $ 14,650 $55,900 $ 89,050 $170,050 $215,950 $539,900 $ 14,650 $ 55,900 $ 89,050 $170,050 $215,950 $539,900 S 0 $ 10,275 $ 41,775 $ 89,075 $170,050 $215,950 $323,925 Schedule Y-2-Married Filing Separately If taxable income is over: But not over $ 10,275 $ 41,775 $89,075 $170,050 The tax is: 10% of taxable income $1,465 plus 12% of the excess over $14,650 $6,415 plus 22% of the excess over $55,900 $13,708 plus 24% of the excess over $89,050 $33,148 plus 32% of the excess over $170,050 $47,836 plus 35% of the excess over $215,950 $161,218.50 plus 37% of the excess over $539,900 The tax is: 10% of taxable income $1,027.50 plus 12% of the excess over $10,275 $4,807.50 plus 22% of the excess over $41,775 $15,213.50 plus 24% of the excess over $89,075 $215,950 $34,647.50 plus 32% of the excess over $170,050 $323,925 $49,335.50 plus 35% of the excess over $215,950 $87,126.75 plus 37% of the excess over $323,925 I Chuck, a single taxpayer, earns $76,400 in taxable income and $11,500 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? 2022 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over But not over: S 0 $ 10,275 $ 41,775 $ 89,075 $170,050 $215,950 $.$39.900 The tax is: $83.550 $178,150 $340,100 $431,900 $647,850 $ 10,275 10% of taxable income $41,775 $1,027.50 plus 12% of the excess over $10,275 $4,807 50 plus 22% of the excess over $41,775 $15,213.50 plus 24% of the excess over $89,075 $34,647.50 plus 32% of the excess over $170,050 $539,900 $49,335.50 plus 35% of the excess over $215,950 $162,718 plus 37% of the excess over $539,900 $ 89,075 $170,050 $215,950 EXCELL Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: S 0 $ 20,550 10% of taxable income $ 20,550 $ 83,550 $178,150 $2,055 plus 12% of the excess over $20,550 $9.615 plus 22% of the excess over $83,550 $30,427 plus 24% of the excess over $178,150 $431,900 $69,295 plus 32% of the excess over $340,100 $647,850 $98,671 plus 35% of the excess over $431,900 $340,100 $174,253.50 plus 37% of the excess over $647,850 The tax is: Schedule Z Head of Household If taxable income is over: But not over S 0 $ 14,650 $55,900 $ 89,050 $170,050 $215,950 $539,900 $ 14,650 $ 55,900 $ 89,050 $170,050 $215,950 $539,900 S 0 $ 10,275 $ 41,775 $ 89,075 $170,050 $215,950 $323,925 Schedule Y-2-Married Filing Separately If taxable income is over: But not over $ 10,275 $ 41,775 $89,075 $170,050 The tax is: 10% of taxable income $1,465 plus 12% of the excess over $14,650 $6,415 plus 22% of the excess over $55,900 $13,708 plus 24% of the excess over $89,050 $33,148 plus 32% of the excess over $170,050 $47,836 plus 35% of the excess over $215,950 $161,218.50 plus 37% of the excess over $539,900 The tax is: 10% of taxable income $1,027.50 plus 12% of the excess over $10,275 $4,807.50 plus 22% of the excess over $41,775 $15,213.50 plus 24% of the excess over $89,075 $215,950 $34,647.50 plus 32% of the excess over $170,050 $323,925 $49,335.50 plus 35% of the excess over $215,950 $87,126.75 plus 37% of the excess over $323,925

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started