Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I COMM210 company is establishing an allocation rule for indirect costs. The average indirect cost from the past 12 weeks is $543.31. It plans

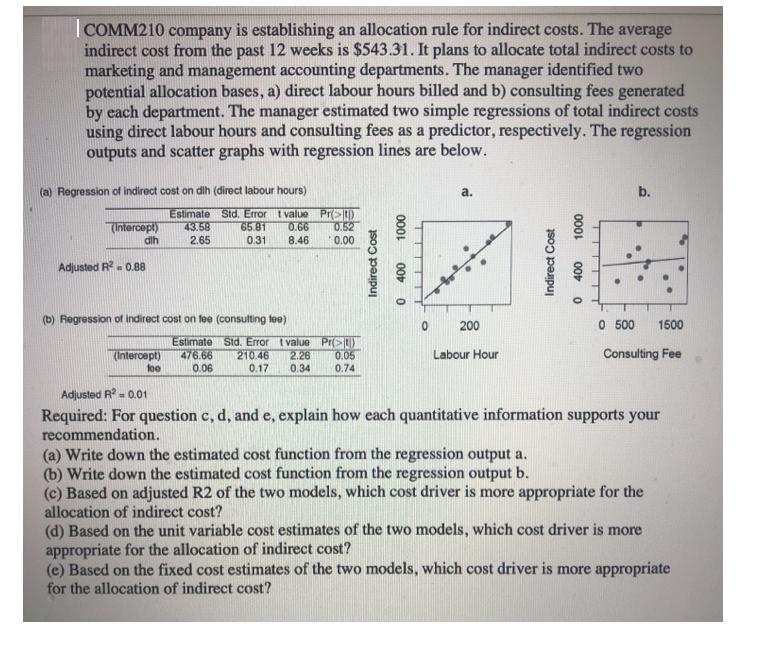

I COMM210 company is establishing an allocation rule for indirect costs. The average indirect cost from the past 12 weeks is $543.31. It plans to allocate total indirect costs to marketing and management accounting departments. The manager identified two potential allocation bases, a) direct labour hours billed and b) consulting fees generated by each department. The manager estimated two simple regressions of total indirect costs using direct labour hours and consulting fees as a predictor, respectively. The regression outputs and scatter graphs with regression lines are below. (a) Regression of indirect cost on dih (direct labour hours) a. b. Estimate Sid. Error t value Pr(>) 65.81 0.31 0.52 (intercept) dih 43.58 0.66 8.46 2.65 0.00 Adjusted R. 0.88 (b) Regression of indirect cost on fee (consulting tee) 200 O 500 1500 Estimate Std. Error I value Pr>) 210.46 0.17 476.66 Labour Hour Consulting Fee (intercept) foo 2.26 0.34 0.05 0.06 0.74 Adjusted R = 0.01 Required: For question c, d, and e, explain how each quantitative information supports your recommendation. (a) Write down the estimated cost function from the regression output a. (b) Write down the estimated cost function from the regression output b. (c) Based on adjusted R2 of the two models, which cost driver is more appropriate for the allocation of indirect cost? (d) Based on the unit variable cost estimates of the two models, which cost driver is more appropriate for the allocation of indirect cost? (e) Based on the fixed cost estimates of the two models, which cost driver is more appropriate for the allocation of indirect cost? 0001 Indirect Cost 000L 00 0 Indirect Cost

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a From the given information Indirect cost 4358 265 dlh b From the given information Indirect cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started