I completed some of it already but any help on any blanks would be appreciated. thank you

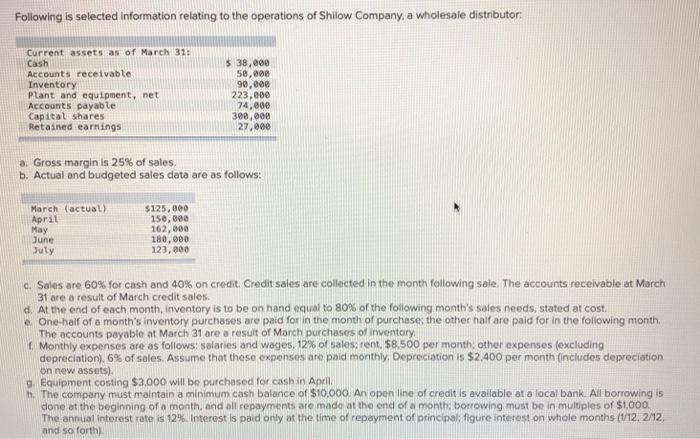

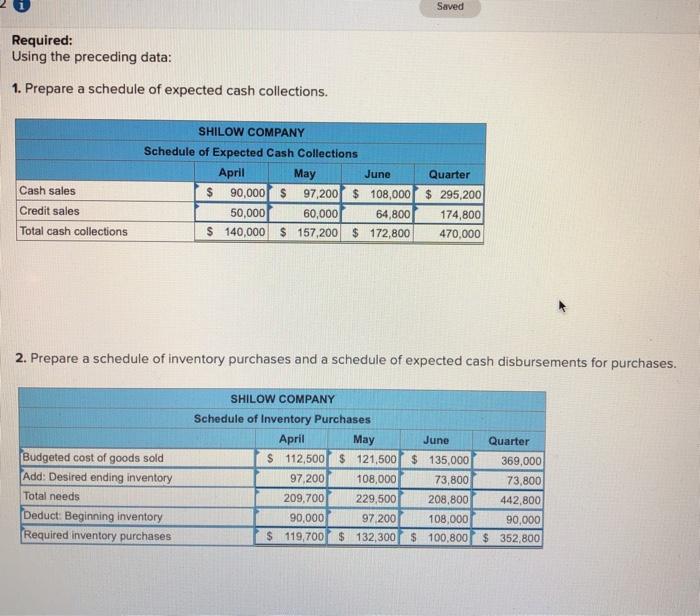

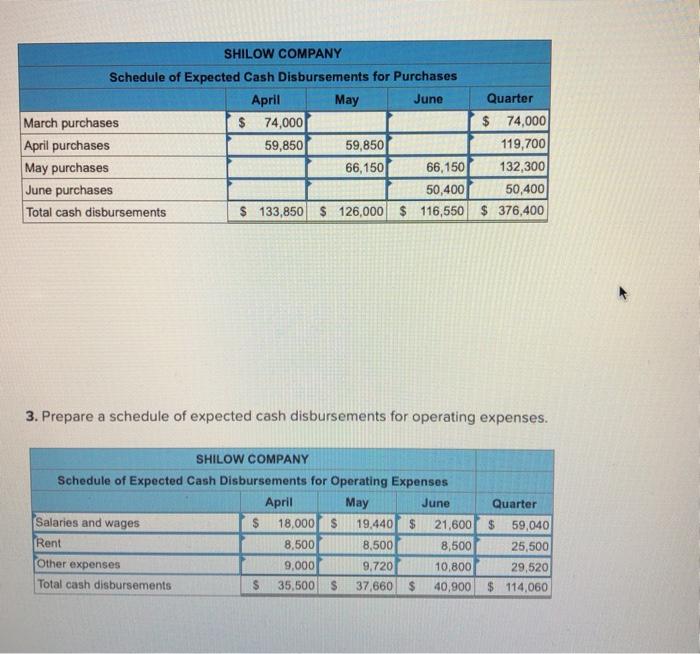

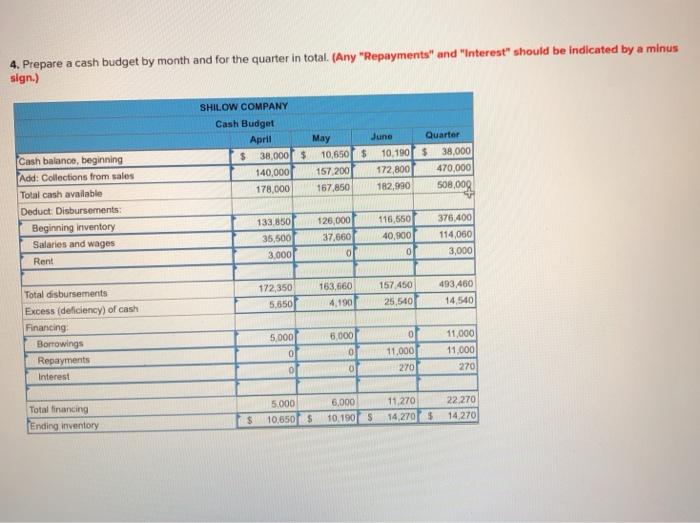

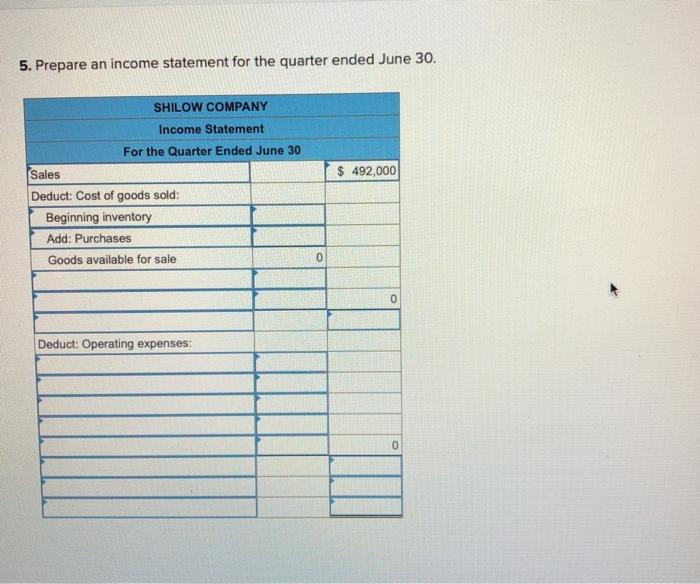

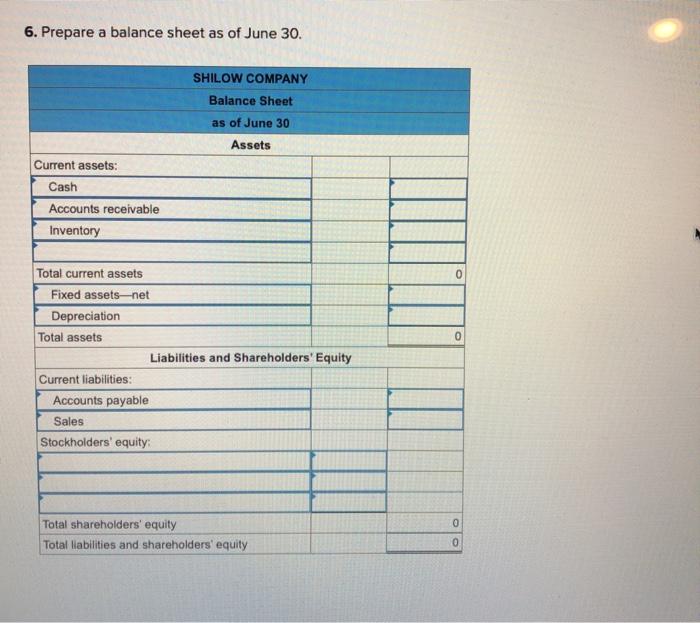

Following is selected information relating to the operations of Shilow Company, a wholesale distributor: Current assets as of March 31: Cash Accounts receivable Inventory Plant and equipment, net Accounts payable Capital shares Retained earnings $ 38,000 50.000 90,000 223,000 74,000 300,000 27.000 3. Gross margin is 25% of sales. b. Actual and budgeted sales data are as follows: March (actual) Aprit May June July $125,000 150,000 162,000 180,000 123,000 c. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales d. At the end of each month, Inventory is to be on hand equal to 80% of the following month's sales needs, stated at cost. e One-half of a month's inventory purchases are paid for in the month of purchase, the other half are paid for in the following month. The accounts payable at March 31 are a result of March purchases of inventory Monthly expenses are as follows: salaries and wages, 12% of sales rent, $8,500 per month other expenses (excluding depreciation), 6% of sales Assume that these expenses are paid monthly. Depreciation is $2,400 per month (includes depreciation on new assets) o Equipment costing $3,000 will be purchased for cash in April n. The company must maintain a minimum cash balance of $10.000. An open line of credit is available at a local bank. All borrowing is done at the beginning of a month, and all repayments are made at the end of a month borrowing must be in multiples of $1.000 The annual interest rate is 12% Interest is paid only at the time of repayment of principal: figure interest on whole months (112. 2/12, and so forthi Saved Required: Using the preceding data: 1. Prepare a schedule of expected cash collections. SHILOW COMPANY Schedule of Expected Cash Collections April May June Quarter $ 90,000 $ 97,200 $ 108,000 $ 295,200 50,000 60,000 64,800 174,800 140,000 $ 157,200 $ 172,800 470,000 Cash sales Credit sales Total cash collectio 2. Prepare a schedule of inventory purchases and a schedule of expected cash disbursements for purchases. May Budgeted cost of goods sold Add: Desired ending inventory Total needs Deduct: Beginning inventory Required inventory purchases SHILOW COMPANY Schedule of Inventory Purchases April $ 112,500 $ 121,500 97,200 108,000 209.700 229,500 90,000 97 200 $ 119,700 $ 132,300 June Quarter $ 135,000 369,000 73,800 73,800 208,800 442,800 108,000 90,000 $ 100,800 $ 352,800 SHILOW COMPANY Schedule of Expected Cash Disbursements for Purchases April May June Quarter March purchases $ 74,000 $ 74,000 April purchases 59,850 59,850 119,700 May purchases 66,150 66,150 132,300 June purchases 50,400 50,400 Total cash disbursements $ 133,850 $ 126,000 $ 116,550 $ 376,400 3. Prepare a schedule of expected cash disbursements for operating expenses. SHILOW COMPANY Schedule of Expected Cash Disbursements for Operating Expenses April May June Salaries and wages $ 18,000 19.440 $ 21,600 Rent 8,500 8.500 8,500 Other expenses 9,000 9,720 10,800 Total cash disbursements $ 35,500 $ 37,660 $ 40,900 Quarter $ 59,040 25,500 29,520 $ 114,060 4. Prepare a cash budget by month and for the quarter in total. (Any "Repayments" and "Interest" should be indicated by a minus sign.) SHILOW COMPANY Cash Budget April May $ 38.000 $ 10,650 $ 140,000 157 200 178,000 167,850 June Quarter 10.190 $ 38.000 172,800 470,000 182.990 508,009 Cash balance, beginning Add: Collections from sales Total cash available Deduct: Disbursements: Beginning inventory Salaries and wages Rent 133,850 35,500 3.000 126,000 37,660 116,650 40,900 376.400 114,060 3,000 0 0 163,660 172,350 5,650 157 450 25,540 493 460 14,540 4.190 Total disbursements Excess (deficiency) of cash Financing Borrowings Repayments Interest 0 5,000 0 6.000 0 11,000 270 11,000 11.000 270 0 Total financing Ending inventory 5.000 10.650 $ 6,000 10,1905 11,270 14 270 5 22.270 14 270 $ 5. Prepare an income statement for the quarter ended June 30. SHILOW COMPANY Income Statement For the Quarter Ended June 30 $ 492,000 Sales Deduct: Cost of goods sold: Beginning inventory Add: Purchases Goods available for sale 0 Deduct: Operating expenses 0 6. Prepare a balance sheet as of June 30. SHILOW COMPANY Balance Sheet as of June 30 Assets Current assets: Cash Accounts receivable Inventory 0 0 Total current assets Fixed assets-net Depreciation Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Sales Stockholders' equity: 0 Total shareholders' equity Total liabilities and shareholders' equity 0