i completed the part a and all entries were correct

i just now need part b which is puting the ending balances on the t accounts. please make answers readable and please explain. thank you

please show work and make answers visble

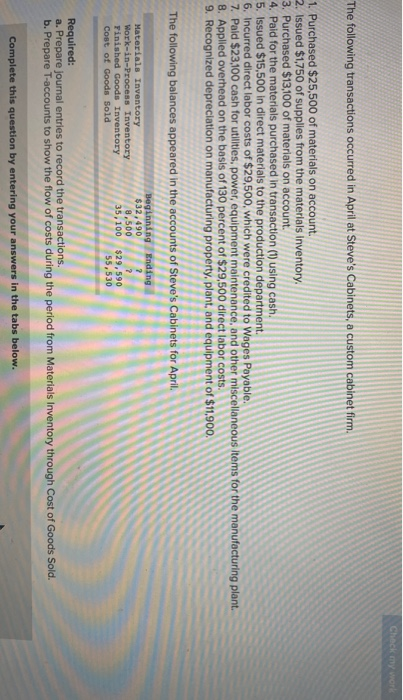

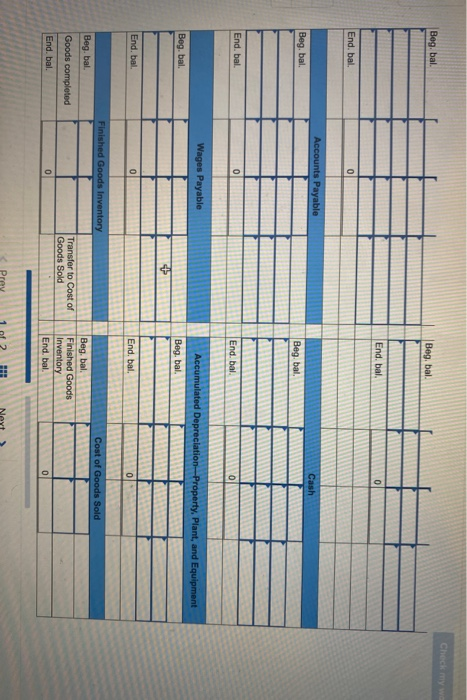

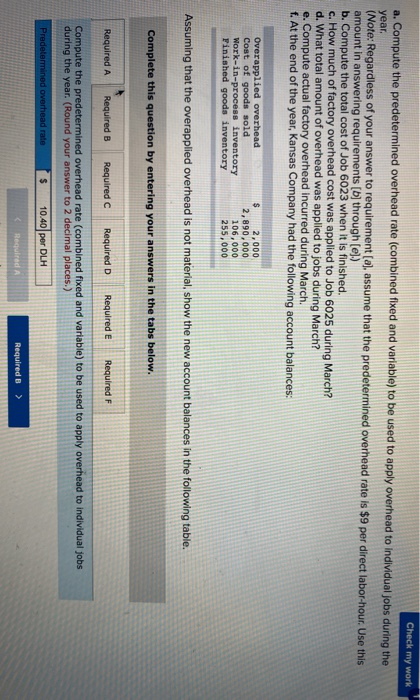

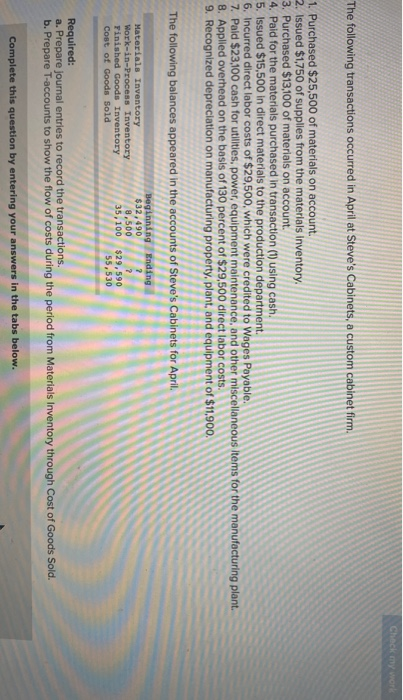

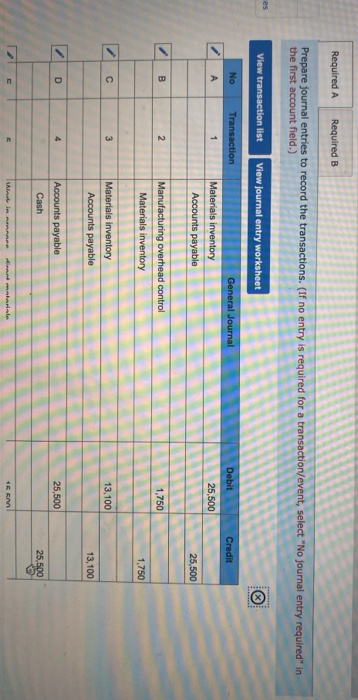

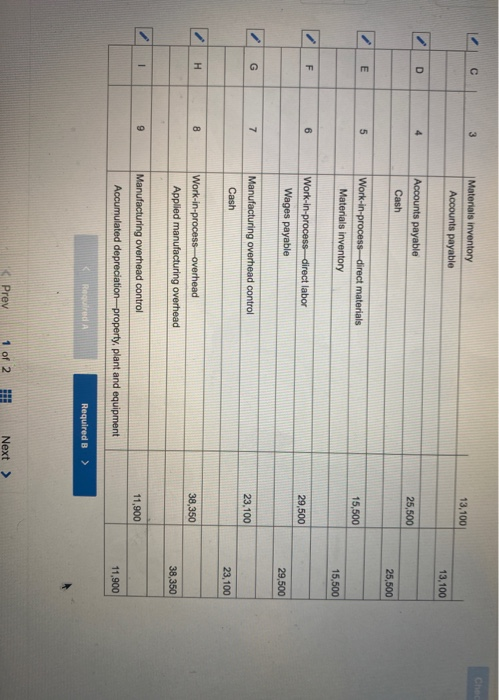

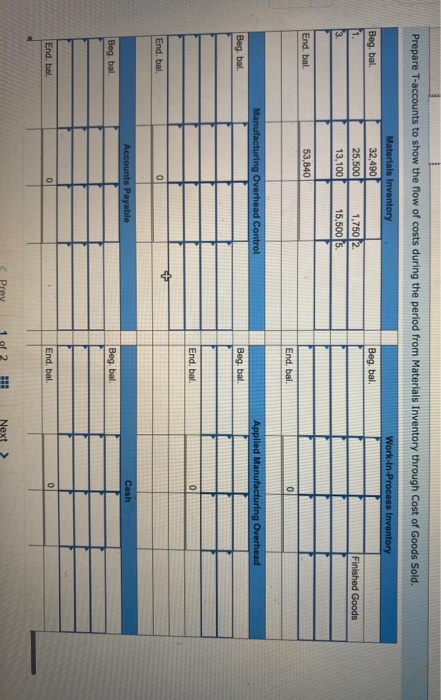

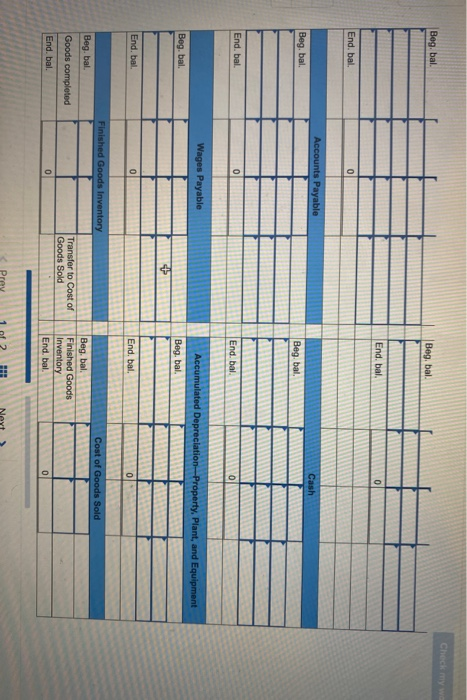

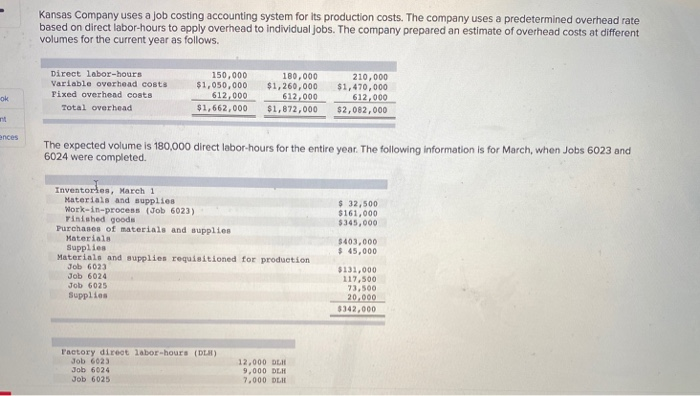

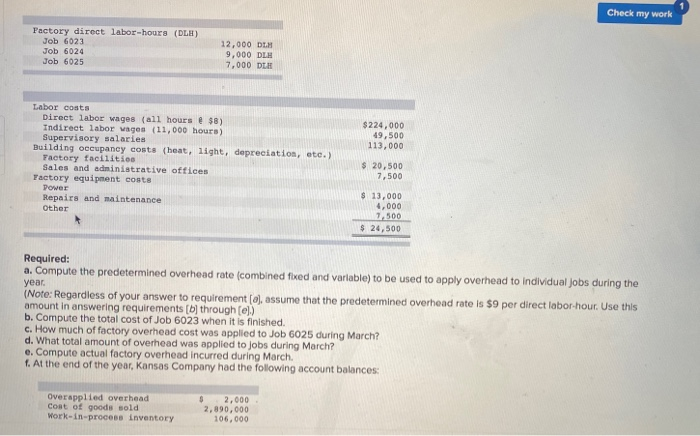

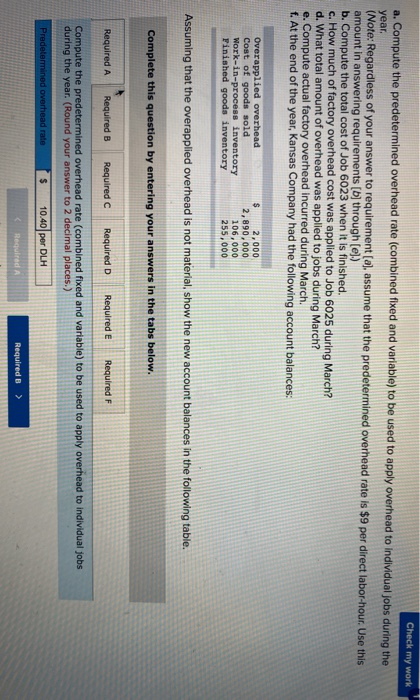

Check my work The following transactions occurred in April at Steve's Cabinets, a custom cabinet firm. 1. Purchased $25,500 of materials on account 2. Issued $1,750 of supplies from the materials inventory 3. Purchased $13,100 of materials on account. 4. Paid for the materials purchased in transaction (1) using cash. 5. Issued $15,500 in direct materials to the production department 6. Incurred direct labor costs of $29,500, which were credited to Wages Payable. 7. Pald $23,100 cash for utilities, power, equipment maintenance, and other miscellaneous Items for the manufacturing plant. 8. Applied overhead on the basis of 130 percent of $29,500 direct labor costs. 9. Recognized depreciation on manufacturing property, plant, and equipment of $11,900, The following balances appeared in the accounts of Steve's Cabinets for April Materials Inventory Work-in-Process Inventory Finished Goods Inventory Cost of Goods Sold Beginning Ending $32,490 8,500 35,100 $29,590 55,530 Required: a. Prepare journal entries to record the transactions. b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries to record the transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) es View transaction list View journal entry worksheet No Transaction General Journal Debit Credit 1 25,500 Materials inventory Accounts payable 25,500 B 2 1,750 Manufacturing overhead control Materials inventory 1,750 C 3 13,100 Materials inventory Accounts payable 13,100 D 4 25,500 Accounts payable Cash Min Hitmateriale nn Choo 3 Materials inventory Accounts payable 13,100 13,100 D 4 Accounts payable Cash 25,500 25,500 E 5 Work-in-process direct materials Materials inventory 15,500 15,500 F 6 Work-in-process-direct labor Wages payable 29,500 29,500 G 7 Manufacturing overhead control Cash 23.100 23,100 H 8 38,350 Work-in-process overhead Applied manufacturing overhead 38,350 1 9 11,900 Manufacturing overhead control Accumulated depreciation property, plant and equipment 11,900 Reguld Required B > Prev 1 of 2 Next > Prepare T-accounts to show the flow of costs during the period from Materials Inventory through cost of Goods Sold. Work-In-Process Inventory Beg. bal. Materials Inventory 32,490 25,500 1.750 2. 13,100 15,500 5 Beg. bal Finished Goods 1. 3. End. bal. 53,840 End. bal. 0 Manufacturing Overhead Control Applied Manufacturing Overhead Bog. bal. Beg. bal. End. bal. 0 End. bal. 0 Accounts Payable Cash Beg. bal. Beg bal. End, bal. End. bal. 0 Prey HE Next Next > Bog, bal Bog, bal End, bal. End, bal 0 Accounts Payable Cash Beg. bal. Beg bal End, bal 0 End. bal 0 Wages Payable Accumulated Depreciation Property. Plant, and Equipment Bog. bal Beg. bal. End, bal 0 End, bal 0 Finished Goods Inventory Cost of Goods Sold Beg. bal Goods completed Transfer to Cost of Goods Sold Beg, bal Finished Goods Inventory End. bal. End, bal. 0 Pres Kansas Company uses a job costing accounting system for its production costs. The company uses a predetermined overhead rate based on direct labor-hours to apply overhead to individual jobs. The company prepared an estimate of overhead costs at different volumes for the current year as follows. Direct labor-hours Variable overhead costs Fixed overhead costs Total overhead 150,000 $1,050,000 612,000 $1,662,000 180,000 $1,260,000 612,000 $1,672,000 210,000 $1,470,000 612,000 $2,082,000 ok ences The expected volume is 180,000 direct labor hours for the entire year. The following information is for March, when Jobs 6023 and 6024 were completed Inventories, March 1 Materials and supplies Work-in-process (Job 6023) Tinished goods Purchases of materials and supplies Materials Supplies Materials and supplies requisitioned for production Job 6023 Job 6024 Job 6025 Supplies $ 32,500 $161.000 $345,000 $403,000 $ 45,000 $131,000 117,500 73,500 20.000 $342,000 Factory direct labor-hours (DLR) Job 6023 Job 6024 Job 6025 12,000 DI 9,000 DLR 7.000 DLK Check my work Factory direct labor-hours (DLE) Job 6023 Job 6024 Job 6025 12,000 DLH 9,000 DL 7,000 DLH $ 224,000 49,500 113,000 Labor costs Direct labor wages (all hours $8) Indirect labor wages (11,000 hours) Supervisory salaries Building occupancy costs (heat, light, depreciation, etc.) Factory facilities Sales and administrative offices Factory equipment costs Power Repairs and maintenance Other $ 20,500 7,500 $ 13,000 4,000 7,500 $ 24,500 Required: a. Compute the predetermined overhead rate (combined fixed and variable) to be used to apply overhead to individual jobs during the year (Note: Regardless of your answer to requirement (a), assume that the predetermined overhead rate is $9 per direct labor hour. Use this amount in answering requirements [b] through(e)) b. Compute the total cost of Job 6023 when it is finished. c. How much of factory overhead cost was applied to Job 6025 during March? d. What total amount of overhead was applied to jobs during March? e. Compute actual factory overhead incurred during March 1. At the end of the year, Kansas Company had the following account balances: Overapplied overhead Cost of goods sold Work-in-procese inventory $ 2,000 2,890,000 106,000 Check my work a. Compute the predetermined overhead rate (combined fixed and variable) to be used to apply overhead to individual jobs during the year (Note: Regardless of your answer to requirement (a), assume that the predetermined overhead rate is $9 per direct labor-hour. Use this amount in answering requirements [b] through (e)) b. Compute the total cost of Job 6023 when it is finished. c. How much of factory overhead cost was applied to Job 6025 during March? d. What total amount of overhead was applied to jobs during March? e. Compute actual factory overhead incurred during March. f. At the end of the year, Kansas Company had the following account balances: Overapplied overhead Cost of goods sold Work-in-process inventory Finished goods inventory $ 2,000 2,890,000 106,000 255,000 Assuming that the overapplied overhead is not material, show the new account balances in the following table. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F Compute the predetermined overhead rate (combined fixed and variable) to be used to apply overhead to individual jobs during the year. (Round your answer to 2 decimal places.) Predetermined overhead rate $ 10.40 per DLH

i completed the part a and all entries were correct

i completed the part a and all entries were correct

i just now need part b which is puting the ending balances on the t accounts. please make answers readable and please explain. thank you

i just now need part b which is puting the ending balances on the t accounts. please make answers readable and please explain. thank you

please show work and make answers visble

please show work and make answers visble