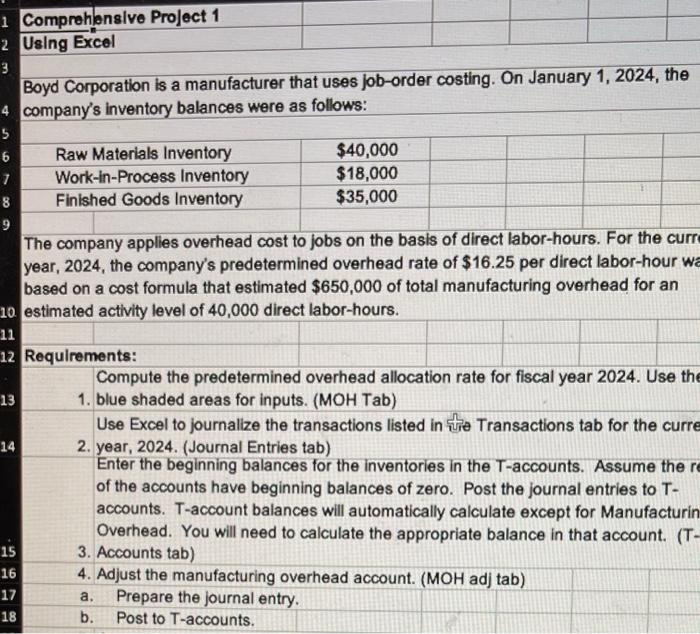

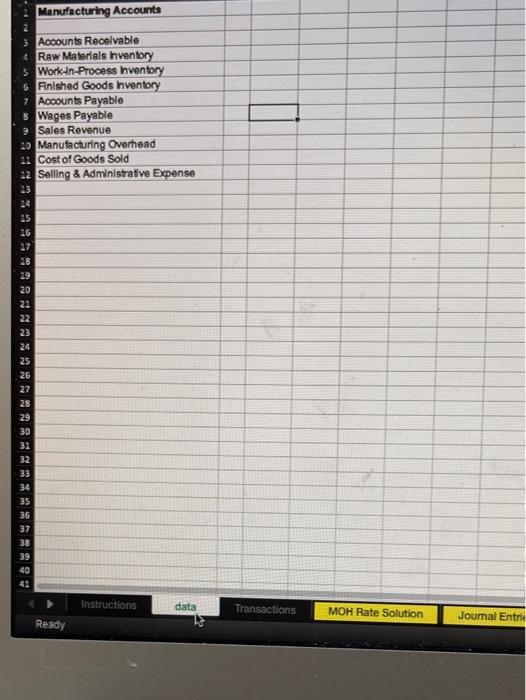

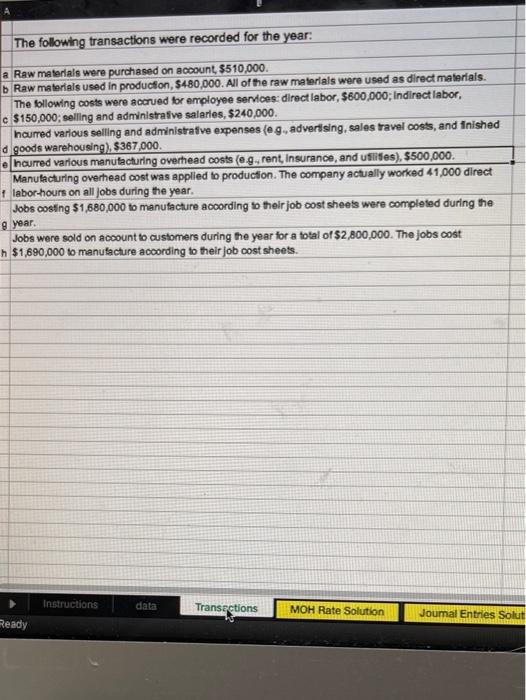

i Comprehensive Project 1 2 Using Excel 3 Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 2024, the 4 company's inventory balances were as follows: 5 6 Raw Materials Inventory $40,000 7 Work-in-Process Inventory $18,000 8 Finished Goods Inventory $35,000 9 The company applies overhead cost to jobs on the basis of direct labor-hours. For the curre year, 2024, the company's predetermined overhead rate of $16.25 per direct labor-hour wa based on a cost formula that estimated $650,000 of total manufacturing overhead for an 10 estimated activity level of 40,000 direct labor-hours. 11 12 Requirements: Compute the predetermined overhead allocation rate for fiscal year 2024. Use the 13 1. blue shaded areas for inputs. (MOH Tab) Use Excel to journalize the transactions listed in tie Transactions tab for the curre 14 2. year, 2024. (Journal Entries tab) Enter the beginning balances for the inventories in the T-accounts. Assume there of the accounts have beginning balances of zero. Post the journal entries to T- accounts. T-account balances will automatically calculate except for Manufacturin Overhead. You will need to calculate the appropriate balance in that account. (T- 15 3. Accounts tab) 4. Adjust the manufacturing overhead account. (MOH adj tab) 17 Prepare the journal entry. 18 b. Post to T-accounts. 16 a. Manufacturing Accounts 3 Accounts Recelvable 4 Raw Materials hventory 5 Work-In-Process hventory 6 Finished Goods hventory ; Accounts Payable 8 Wages Payable Sales Revenue 20 Manufacturing Overhead 2: Cost of Goods Sold 22 Selling & Administrative Expense 13 15 26 27 18 13 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 Instructions data Transactions MOH Rate Solution Journal Entri Ready The following transactions were recorded for the year: a Raw materials were purchased on account $510,000. b Raw materials used in production, $480,000. All of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, 5600,000; Indirect labor, c $150,000; selling and administrative salaries, $240,000 haurred various selling and administrative expenses (eg, advertising, sales travel costs, and Inished d goods warehousing), $367,000. e incurred various manufacturing overhead costs (eg.rent Insurance, and uflifes), $500,000. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct 1 labor-hours on all jobs during the year. Jobs costing $1,680,000 to manufacture according to their job cost sheets were completed during the 9 year. Jobs were sold on account to customers during the year for a total of $2,800,000. The jobs cost h $1,690,000 to manufacture according to their job cost sheets. Instructions data: Transections MOH Rate Solution Joumal Entries Solut Ready