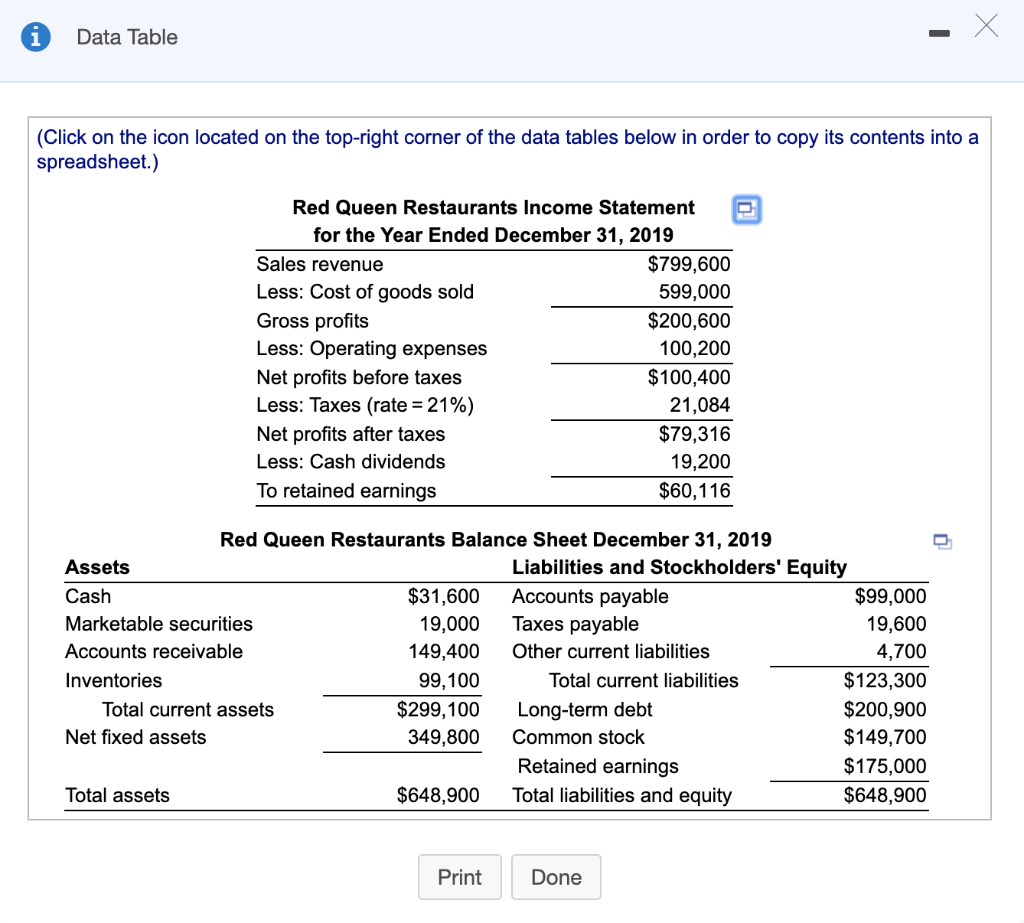

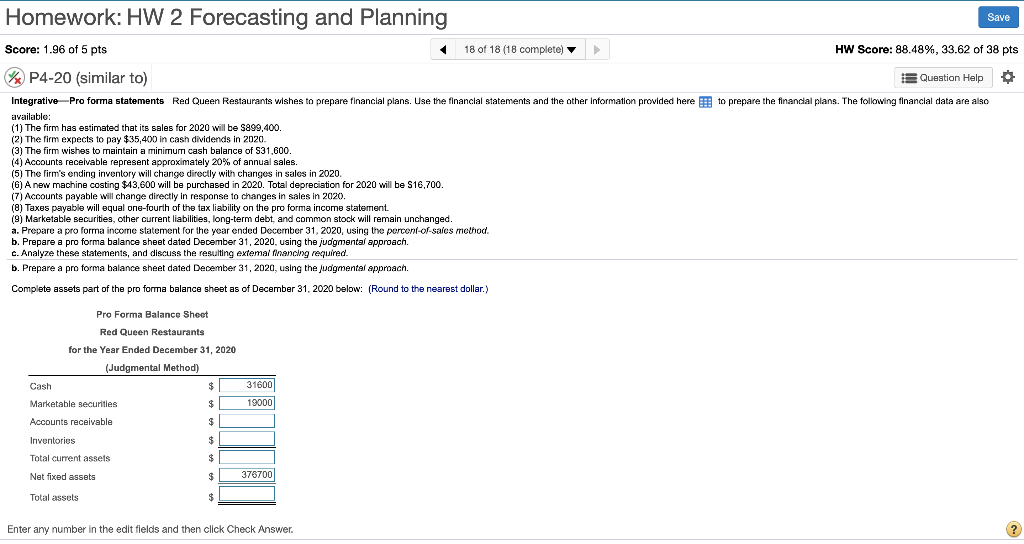

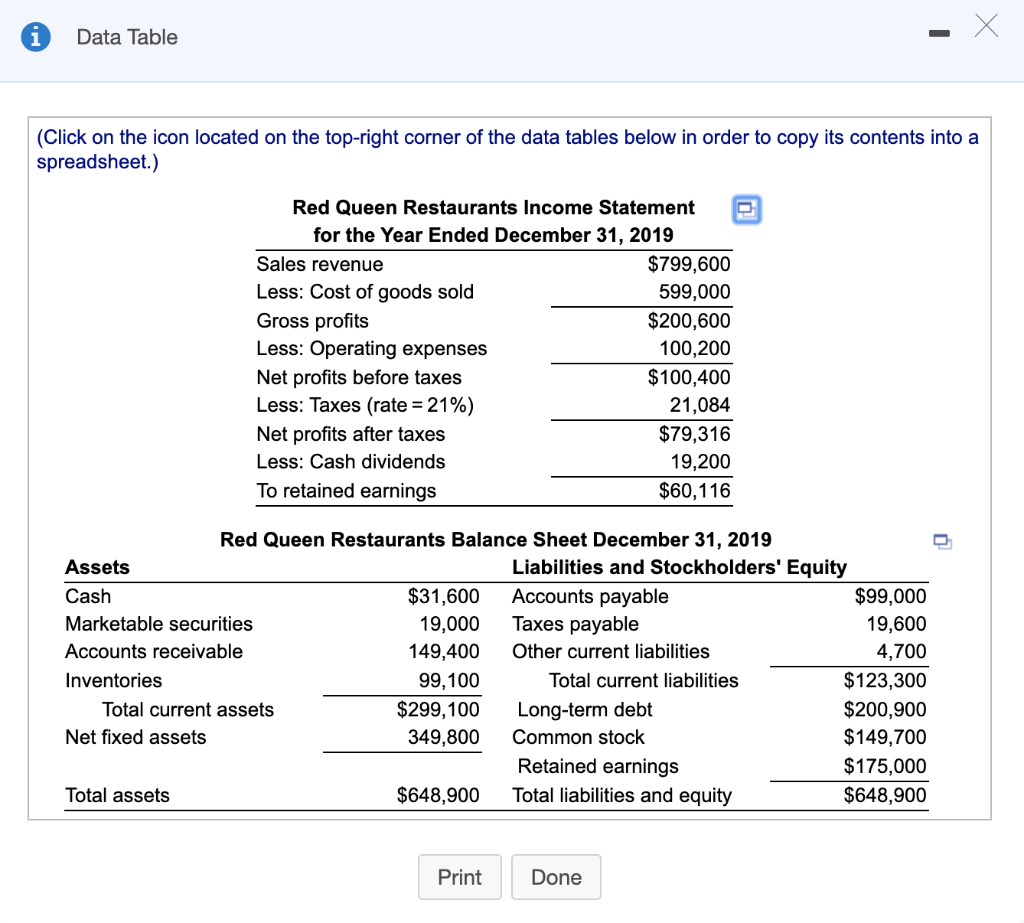

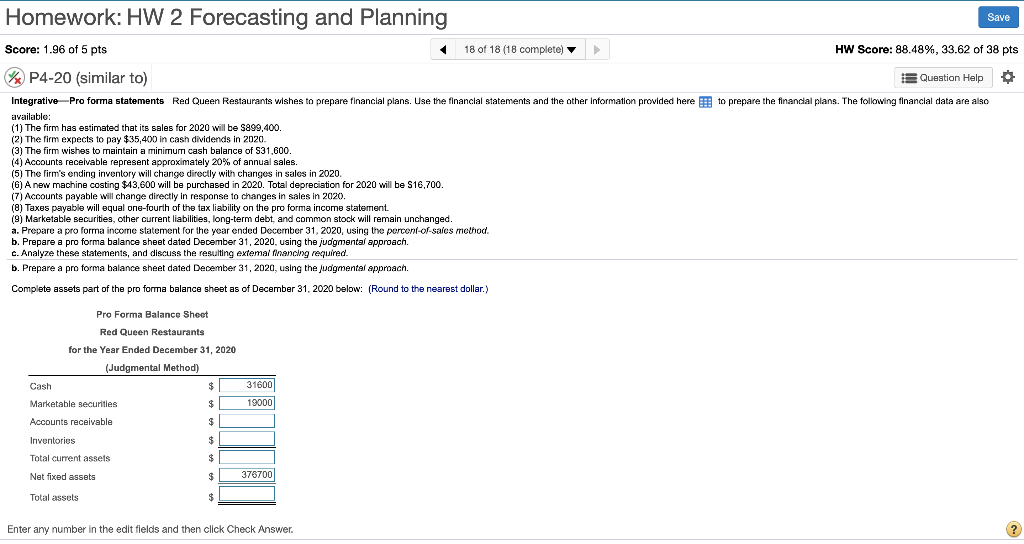

i Data Table (Click on the icon located on the top-right corner of the data tables below in order to copy its contents into a spreadsheet.) Red Queen Restaurants Income Statement for the Year Ended December 31, 2019 Sales revenue $799,600 Less: Cost of goods sold 599,000 Gross profits $200,600 Less: Operating expenses 100,200 Net profits before taxes $100,400 Less: Taxes (rate = 21%) 21,084 Net profits after taxes $79,316 Less: Cash dividends 19,200 To retained earnings $60,116 Red Queen Restaurants Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Cash $31,600 Accounts payable $99,000 Marketable securities 19,000 Taxes payable 19,600 Accounts receivable 149,400 Other current liabilities 4,700 Inventories 99,100 Total current liabilities $123,300 Total current assets $299,100 Long-term debt $200,900 Net fixed assets 349,800 Common stock $149,700 Retained earnings $175,000 Total assets $648,900 Total liabilities and equity $648,900 Print Done Homework: HW 2 Forecasting and Planning Save 18 of 18 (18 complete) HW Score: 88.48%, 33.62 of 38 pts Score: 1.96 of 5 pts P4-20 (similar to) Question Help to prepare the financial plans. The following financial data are also Integrative-Pro forma statements Red Queen Restaurants wishes to prepare financial plans. Use the financial statements and the other information provided here available: (1) The firm has estimated that its sales for 2020 will be $899,400. (2) The firm expects to pay $35,400 in cash dividends in 2020. (3) The firm wishes to maintain a minimum cash balance of S31,600. (4) Accounts receivable represent approximately 20% of annual sales. (5) The firm's ending inventory will change directly with changes in sales in 2020. (6) A new machine costing $43,600 will be purchased in 2020. Total depreciation for 2020 will be $16,700. (7) Accounts payable will change directly in response to changes in sales in 2020. (8) Taxes payable will equal one-fourth of the tax liability on the pro forma income statement. (9) Marketable securities, other current liabilities, long-term debt and common stock will remain unchanged. a. Prepare a pro forma income statement for the year ended December 31, 2020, using the percent-of-saics method. b. Prepare a pro forma balance sheet dated December 31, 2020, using the judgmental approach. c. Analyze these statements, and discuss the resulting extemal financing required. b. Prepare a pro forma balance sheet dated December 31, 2020, using the judgmental approach. Complete assets part of the pro forma balance sheet as of December 31, 2020 below: (Round to the nearest dollar.) Pro Forma Balance Sheet Red Queen Restaurants for the Year Ended December 31, 2020 (Judgmental Method) Cash 31600 19000 Marketable securities Accounts receivable A Inventories Total current assets Net fixed assets 376700 Total assets 5 Enter any number in the edit fields and then click Check