i did all the work just do not understand top parr

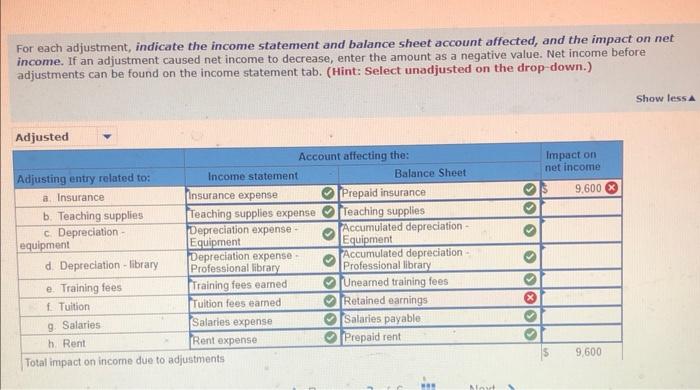

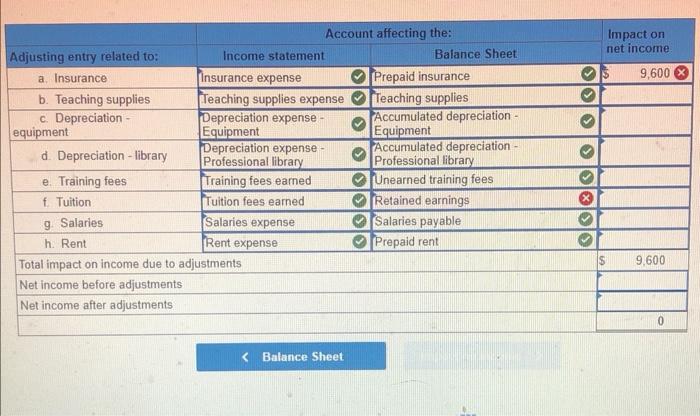

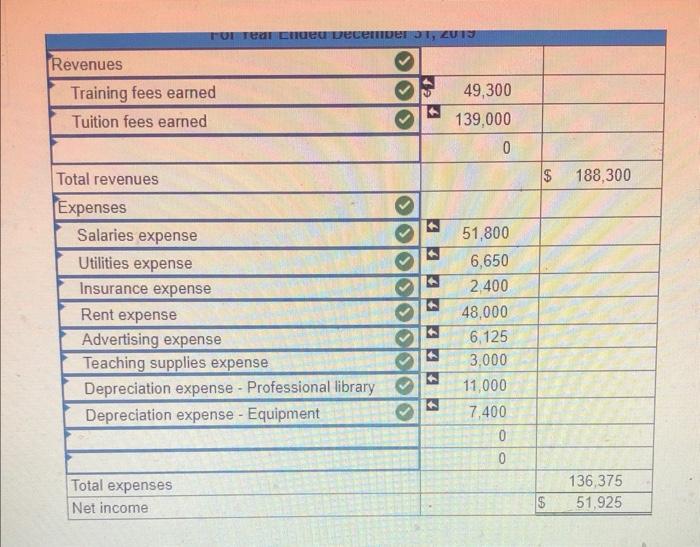

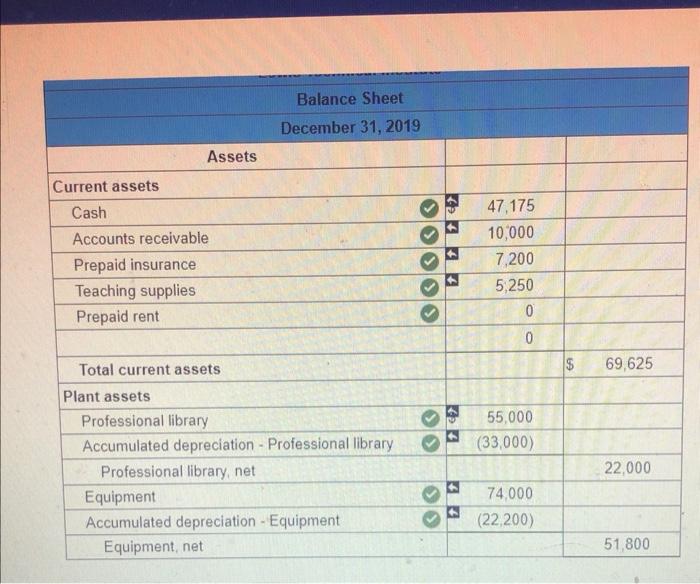

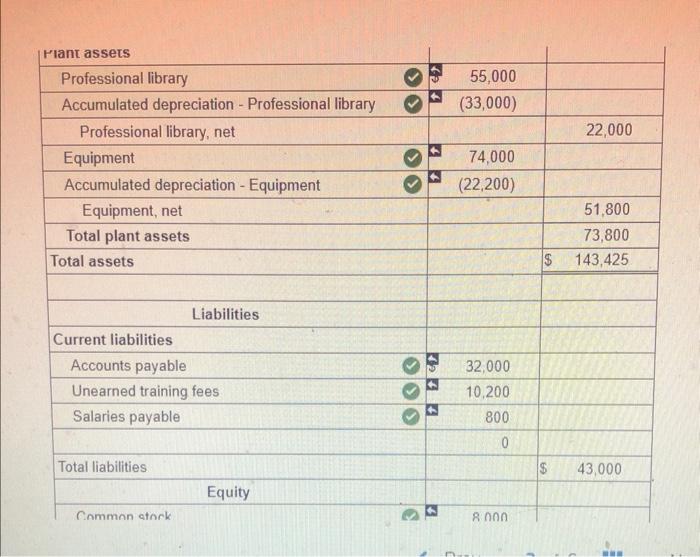

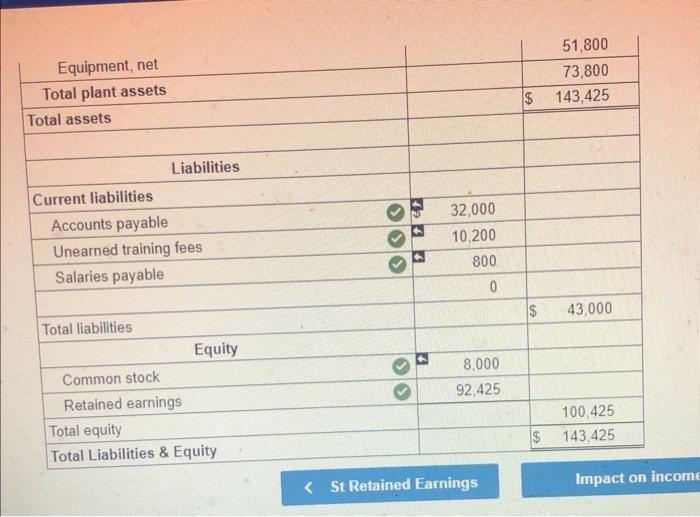

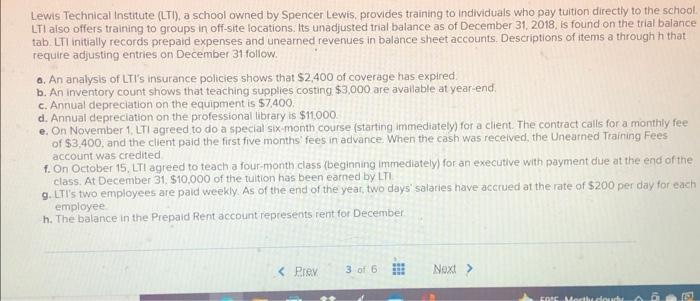

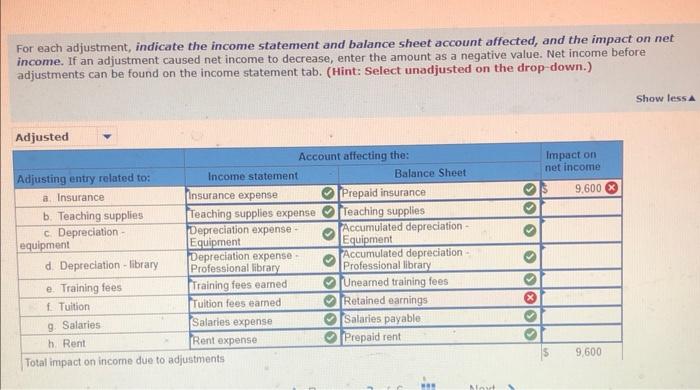

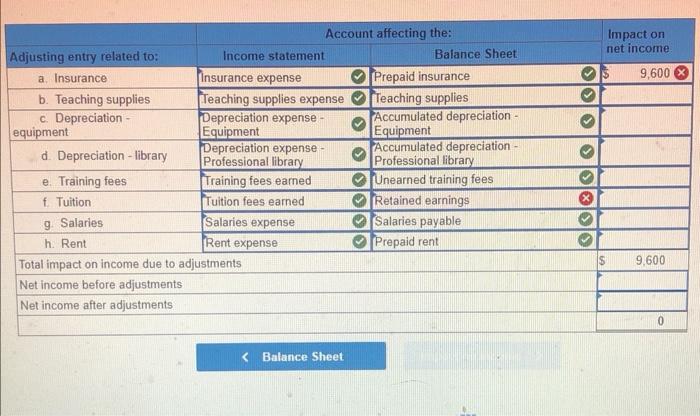

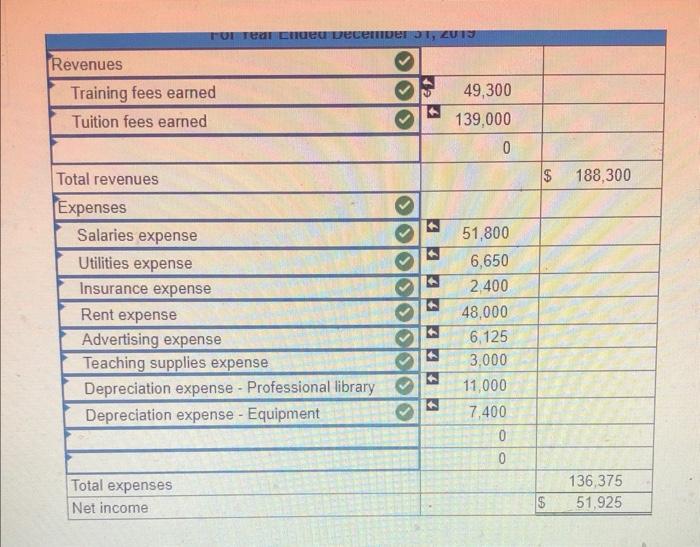

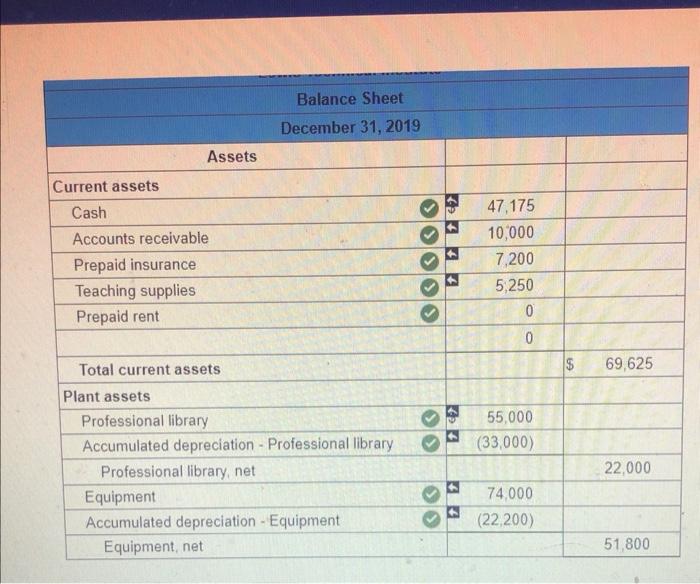

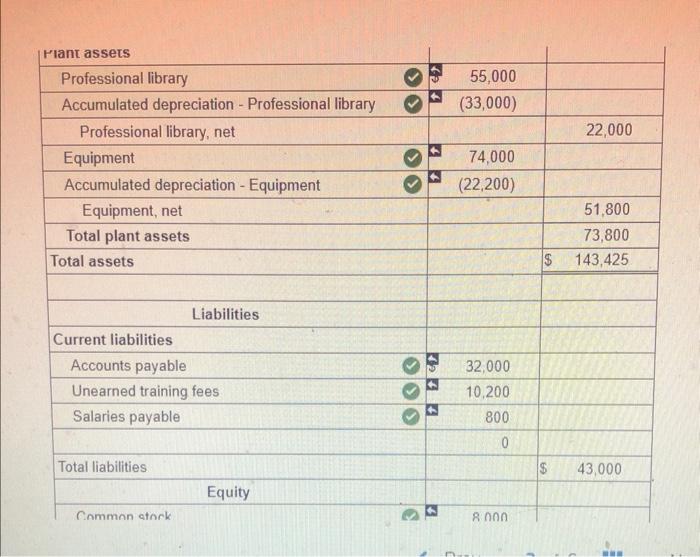

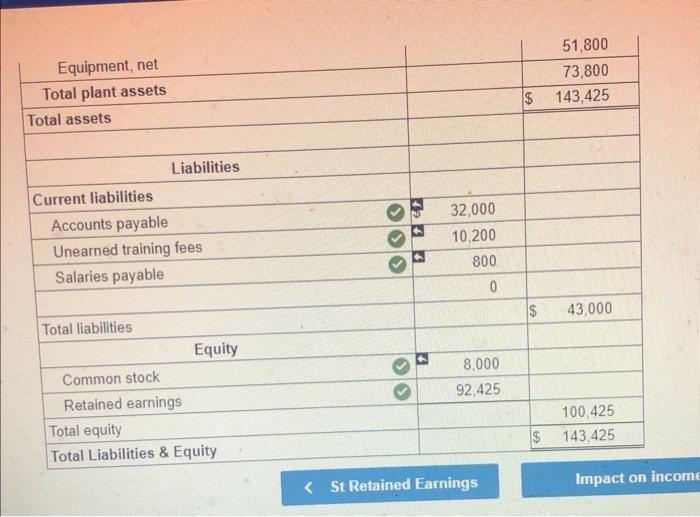

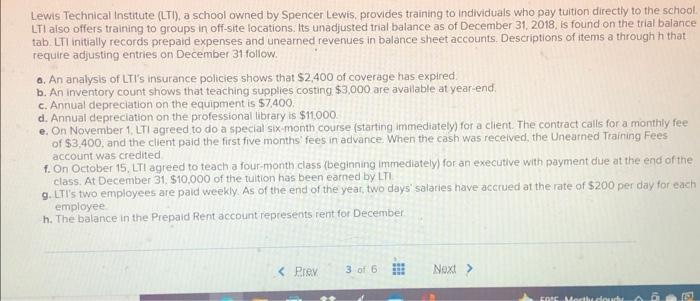

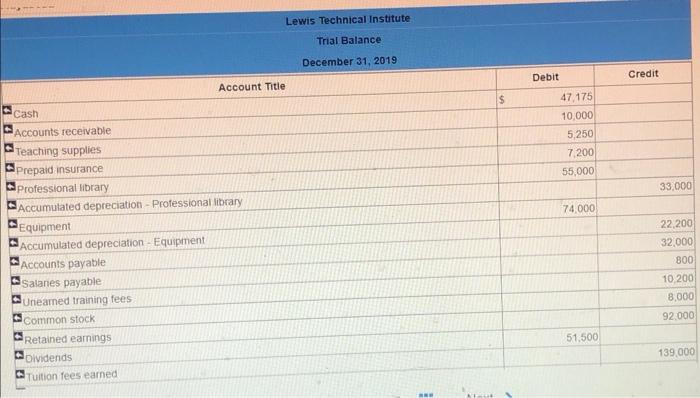

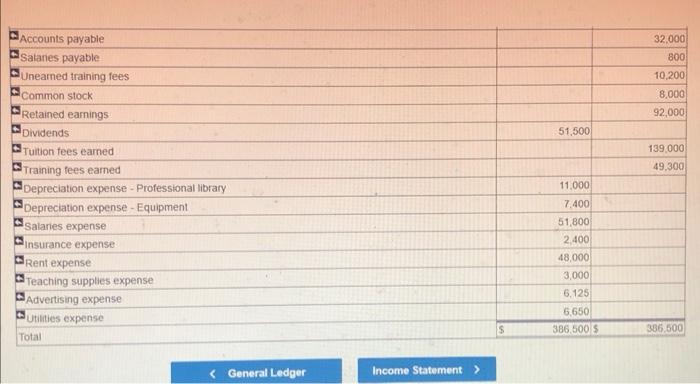

For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the drop-down.) Show less Impact on net income 9,600 OI Adjusted Account affecting the: Adjusting entry related to: Income statement Balance Sheet a Insurance Insurance expense Prepaid insurance b. Teaching supplies Teaching supplies expense Teaching supplies c. Depreciation - Depreciation expense - Accumulated depreciation - equipment Equipment Equipment Depreciation expense Accumulated depreciation d Depreciation - library Professional library Professional library e. Training fees Training fees earned Uneamed training fees Tuition Tuition fees eamed Retained earnings 9. Salaries Salaries expense Salaries payable h Rent Rent expense Prepaid rent Total impact on income due to adjustments ololo 9,600 Impact on net income 9,600 Account affecting the: Adjusting entry related to: Income statement Balance Sheet a Insurance Insurance expense Prepaid insurance b. Teaching supplies Teaching supplies expense Teaching supplies c. Depreciation - Depreciation expense- Accumulated depreciation - equipment Equipment Equipment Depreciation expense- Accumulated depreciation - d. Depreciation - library Professional library Professional library e Training fees Training fees earned Unearned training fees f. Tuition Tuition fees earned Retained earnings Salaries expense Salaries payable h. Rent Rent expense Prepaid rent Total impact on income due to adjustments Net income before adjustments Net income after adjustments OOOO g. Salaries IS 9,600 0 > 32,000 10,200 800 0 Total liabilities $ 43,000 Equity Common stock A non Equipment, net Total plant assets Total assets 51,800 73,800 143,425 $ Liabilities Current liabilities Accounts payable Unearned training fees Salaries payable 32,000 10,200 800 0 $ 43,000 Total liabilities Equity Common stock Retained earnings Total equity Total Liabilities & Equity 8,000 92,425 100,425 143,425 $ to od Lewis Technical Institute Trial Balance December 31, 2019 Debit Credit Account Title $ 47,175 10,000 5,250 7200 55,000 33,000 74.000 Cash Accounts receivable Teaching supplies Prepaid insurance Professional library Accumulated depreciation - Professional library Equipment Accumulated depreciation - Equipment Accounts payable Salanes payable Unearned training fees Common stock Retained earnings Dividends Tuition fees earned 22 200 32,000 800 10.200 8.000 92 000 51,500 139.000 11 32.000 800 10,200 8.000 92,000 14 51,500 139,000 49.300 Accounts payable Satares payable Unearned training fees Common stock Retained eamings Dividends Tuition fees earned Training fees earned Depreciation expense - Professional library Depreciation expense - Equipment Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense Total 11.000 2020 7.400 51,800 2.400 48,000 3,000 6.125 6,650 386,500 5 S 336.500